Hello and welcome back, this is 2018!

This is my 15th annual Vestact client message. I left it late this year, to be sure that all of you would be concentrating properly by the time this hits your mailbox.

We keep doing things the same way here at Vestact. We manage long-term "family" money for individuals. We only invest in equity markets. We try to select and hold the best quality companies in the most favourable sectors (currently technology, healthcare and consumer). Every client portfolio is customised and personalised. Our fees are low and we try to keep portfolio turnover low. We offer this service for accounts in Rands here in Johannesburg, and in US Dollars in New York.

All in all, 2017 was a good year for investment returns

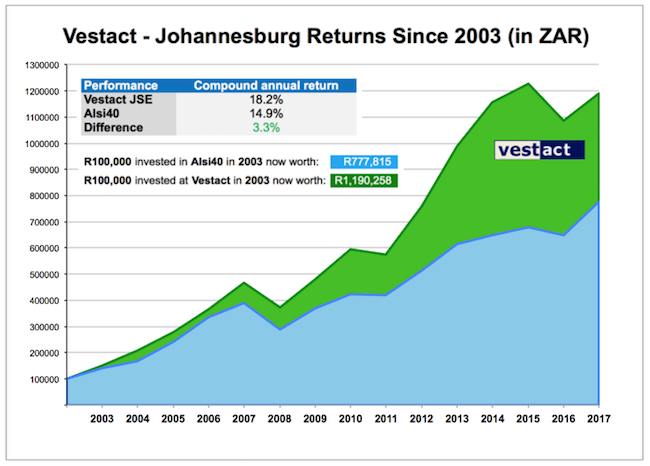

Our Rand-denominated Johannesburg model portfolio was up 9.6% for 2017 after all costs, compared to the JSE Alsi-40 which was up 19.7% for the year. Since we started managing money in 2003, our average annual (compound) gains, after all costs, are 18.2% per annum. That is better than the Alsi-40 which rose by 14.9% each year over the same 15 year period. Take a look at the chart below, the part in green reflects that outperformance.

Strong portfolio performers this year were Naspers, Discovery and MTN. The laggards were Steinhoff, Brait, Mediclinic and Woolworths.

Vestact's assets under management here in Johannesburg are now R1,265 billion.

New: AdvTech was added to the list of recommended stocks. State run education in South Africa is not improving, but that is an opportunity for private providers.

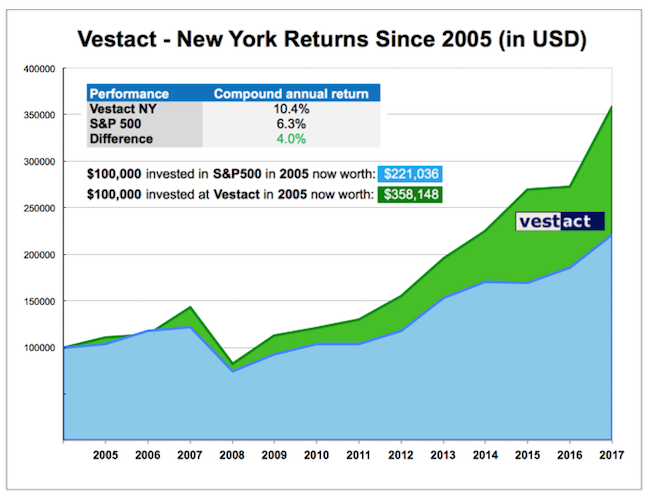

Our US Dollar-denominated New York model portfolio was up 31.6% for 2017 after all costs compared to the S&P500 which was up 19.4% for the year.

Our returns for clients in US portfolios have been excellent for quite a while. Since inception in 2005 we are up on average, and after all costs, by 10.4% per annum. in US Dollars. We are easily outpacing the S&P 500 index, which is up only 6.3% per annum. See the picture below. Again, the part in green shows how we are pulling ahead.

Our preferred shares all did well this year. The best of the lot were Amazon, Visa, Facebook, Nike and Amgen. To paraphrase Peter Lynch: "always be fully invested. Its great to be caught with your pants up."

New: JP Morgan, Priceline and Nvidia were added to the model portfolio.

Vestact's assets under management in New York are now over $150 million.

We buy and hold, but do sell stocks sometimes. We sold out of General Electric in 2016, and we switched out of Wells Fargo into JP Morgan during 2017. In hindsight, we would have done better if we had sold some under-performing local stocks. Like Steinhoff. Ugh, what a mess!

We are very proud to have delivered long-term index beating returns (this is rather rare in the investment industry). I think that our superior returns are due to a sound investment process and low costs. We charge low advice fees of 1 percent of your account value per year, plus Vat, with no performance charges. This is cheap by the standards of our industry. As I mentioned in previous emails like this one, asset management is a product where offering it for a lower price makes it much, much better.

Global outlook remains positive

We are optimistic about equities. The global economy is doing well. Big companies are getting bigger. South Africa looks a bit messy, as usual, but Cyril Ramaphosa is a good guy!

What you need to do now

Save more. This is more important than returns in determining how much money you have when you retire. Send your free cash to Vestact.

If you can, use your discretionary allowance to take out up to R1 million per adult, and invest it offshore in US Dollars with us in New York. Email or call us to get the ball rolling.

Vestact is a small "family office" asset manager. We are not a big institution. We know who you are. We would like to serve you and your family for decades, and over many generations to come. We work hard to maintain high service levels. We look forward to hearing from you.

Best wishes

Paul Theron

CEO, Vestact

078 533 1063

No comments:

Post a Comment