To market to market to buy a fat pig. "Them who must not be named", A.K.A. Viceroy, were the centre of attention again yesterday. We now know that they weren't writing a report about Aspen or the Resilient group of companies but on the darling of the JSE, Capitec. If you haven't already seen the report, you can find it here: Capitec: A wolf in sheep's clothing

It is amazing how quickly this report circulated, and its immediate impact on the Capitec and PSG share price. Capitec plummeted, sending it into a volatility auction, it then recovered to be briefly in the green for the day, followed by a slide to R700 a share (it opened at R939). When the day came to an end, they were 'only' down 3%. The investment company PSG, who have more than 50% of their NAV in Capitec, also got walloped. They closed down 8% for the day.

At the other end of the spectrum was Aspen, closing up 6%. It seems that some people were still holding off buying the company due to the very remote chance that Viceroy were in fact writing about Aspen. I think it is worth showing Byron's tweet from the midst of the Aspen storm.

The same logic applies now to Capitec, the advantage this time is that you can actually read the report and make up your own mind. We don't own Capitec for clients, making us neutral onlookers. As neutral onlookers, I was very impressed with how Capitec's management has responded. They released three SENS announcements, one being a detailed reply to the Viceroy concerns, and had an investor call which you can listen to here - investor relations. Naspers management could take a few notes?

Organisations write positive and negative reports about companies all the time. Thanks to Steinhoff, Viceroy has this allure of having a 'Midas touch' or more aptly the touch of death. Steinhoff is what made their name, yet we are still not sure if the Viceroy version of events is accurate. Only time will tell how much is fact and how much is fiction, where fortunes will be made and lost in the bull and bear camps.

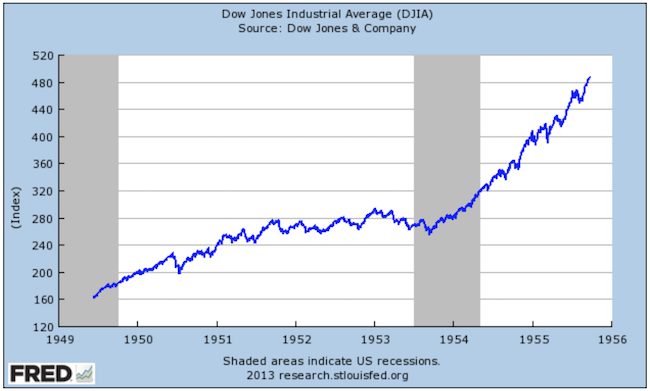

Market Scorecard. I woke up this morning to my phone telling me that the US market had its worst day yesterday since May last year. The Dow was down 1.37%, the S&P 500 was down 1.09%, the Nasdaq was down 0.86%, and the All-share was down 2.07%. Whatever the reason for a down day, remember that markets dropping 1% or 2% is normal.

Company Corner

Byron's Beats

Since Netflix released their Q4 results on the 22nd of January the share is up nearly 30%. Wow. And that is off a share price that was up 70% last year. The market cap of the business now sits at $120bn, a similar size to Naspers.

Streaming revenue grew by 36% (in other news they still rent DVDs) for the full year. They added a whopping 24 million new memberships in 2017 to bring the total close to 118 million subscribers. How many people out there could be potential Netflix subscribers? They need access to good internet and be able to afford $11 per month (I suppose those two come hand in hand). I would say at least 1 billion today and growing.

Guidance for this year was again positive. They expect to add another 6.35 million subscribers this quarter. At that rate you would expect at least 30 million new subscribers for 2018. 150 million subscribers paying $11 a month would bring in close to $20bn in revenues. For 2017, revenues came in at $11bn. You can see how quickly this can grow. Another growth avenue would be price increases (which they did do in 2017). Paul thinks the product is far too cheap. I tend to agree. Compare that to DSTV who charge up to R1 000 per month for the premium service.

Content is king!

My favourite show at the moment is The Crown, a show that follows the life of Queen Elizabeth. Like most great companies, clients are their best salesmen. People talking about "must watch series" will convince others to sign up. And it really is so easy. Most TV's these days link to the internet, all you need is to add your Credit Card details on the easy to navigate website.

The hard part for Netflix is creating world-class content. They plan on spending $8bn on content in 2018. This is a great outcome for that industry! As long as they keep churning out great series and movies, they will continue to do well.

The industry is very competitive. The potential Disney Fox tie-up could create another streaming behemoth. Amazon Prime is gaining traction with quality content, and Apple is also jumping on board. But if you signed up for all these services at the same time, you would still pay less than the old school satellite and cable providers. In the future you will have 3-4 streaming services which will also cover sport. That is my prediction.

This is a high flyer and can be volatile. We like it as a small allocation amongst a diversified portfolio.

Linkfest, lap it up

One thing, from Paul

One of the world's richest persons just died. Ingvar Kamprad was the founder of Swedish DIY furniture giant IKEA.. He checked out with a personal fortune of $59 billion, according to the Bloomberg Billionaires Index, but was known for buying his clothes from flea markets.

This tidy Quartz article has a list of nine intriguing facts about him. My favourite is that IKEA consumes 1% of the world's wood supply - Nine intriguing facts about Ingvar Kamprad and his IKEA empire

Michael's Musings

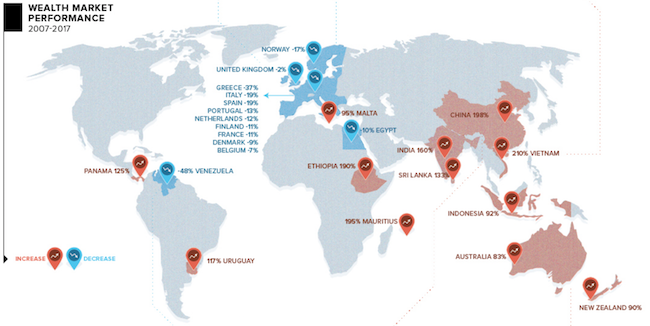

I found this very interesting article on the Vanderbalts and preserving generational wealth - The Best Way to Lose $5 Billion Dollars. There are many articles about how much wealth the top 1% have, and how that gap is growing. What isn't pointed out though is the high turnover of people and families in that category. So don't worry too much about the gap, generations two and three will use their inherited wealth to stimulate the local economy.

What makes the below information more amazing, is that 100 years before the family reunion they were worth more than the US Treasury.

"When 120 of the Commodore's descendants gathered at Vanderbilt University in 1973 for the first family reunion, there was not a millionaire among them."

Bright's Banter

This is such a great infographic as it shows where game developers are focusing all their energy to building new games. The graph is also quite relevant to us here at Vestact because Tencent (one of our indirect investments through Naspers) dominates both PC Gaming and Mobile Gaming in Asia. For example, their game Honour of Kings is still the top game in Asia and League of Legends attracts an eye-popping 24% of all the gaming audience in the world. Much wow! It's good to see that PC is still by far the favoured platform by developers and mobile isn't far behind.

You will find more statistics at Statista

You will find more statistics at Statista

Vestact in the Media

Paul chatted to 702 about Capitec and the Viceroy report - Vestact fund manager Paul Theron says Viceroy's Capitec report is irresponsible.

Home again, home again, jiggety-jog. The EU had GDP growth of 2.5% for 2017, best in a decade, and then later today they release their inflation number and unemployment figures. Moving across the pond, Janet Yellen announces if the fed is raising rates or not, at around 21:00 our time.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063