"Innovation remains a large part of the company. Any runner will tell you that their running shoes over a few decades (they would have to be in their late forties, early fifties) have changed drastically over time. In the old days you had to "run your shoes in". In the Pegasus range, Nike have sold over 50 million pairs since the shoe was introduced."

To market to market to buy a fat pig Stocks slipped here in Jozi after a decent enough start, we were higher to begin with and then that all fell away during the course of the day. In the end we closed at exactly 50900 points on the Jozi all share, down 1.13 percent on the day. Resources were the hardest hit, down nearly two percent on the day, most stocks amongst the majors ended in the red. In fact, most stocks ended in the red, Capitec with results managed to buck the trend, they are adding around 100 thousand customers a month, in the last half. How is that possible, three thousand customers a day? And judging by the size of their loan book, relative to the "big four", they may be scratching the surface. The market rates them at double (and more) the rating of some of the older banks in South Africa. Thus far the company has never delivered short which resulted in an earnings stumble. They continue to prove their naysayers wrong, they continue to attract customers, they continue to innovate and give customers products that they need and want. Credit cards and home loans will be a big push, I am pretty sure that they will get that right.

In the losing column near the top was MTN again, allegations from the Nigerian Senate Floor that the company has illegally repatriated 13.92 billion Dollars over a ten year period. What? As far as I understood it, the Nigerian Central Bank facilitates all of the ins and outs, right? They would know all the flows. The company this morning has suggested that the comments are completely unfounded and without any merit. Yech. More noise that detracts from the core business trying to empower ordinary citizens to get access to the internet. The more investment in the networks, the better and cheaper the internet will get for their users. Data in the developed world, where I am sorry to say this next part, is more business friendly, is more like a utility. And cheaper. So you use more of it across your devices and empower yourself. The better for ordinary citizens. The more you stifle business, the less they will invest. Yech, we watch it.

The other big news on the local front is that Steinhoff have announced that they are issuing shares to a number of parties in order to raise a whole lot of money, in order to shore up cash reserves. The logistics are easy enough to understand, just lean in a little closer to understand the different legs. Firstly, Upington Investment Holdings (a business controlled by the trust of Christo Wiese, who is the biggest shareholder of Steinhoff) will subscribe for 162 million new shares at 5.055 Euros per share (higher than where the stock price traded yesterday). Total proceeds of that, 819 million Euros. Next up, an empowerment deal for 60 million shares with a vehicle called Lancaster 101, facilitated by The Public Investment Corporation (the PIC). That will raise 303 million Euros, same price of 5.055 Euros per share, I am sure there will be more detail in due course.

Next, an "upsize facility" (you thought that was only available at McDonald's, right?) of 110 million shares offered to institutional shareholders via an accelerated bookbuild, price determined via the process. More details on that during the next day or so, I guess. In addition to the 162 million shares that Upington is paying for, the same vehicle is buying another 152 million shares currently classified by the company as Treasury shares (the ones that the company holds). In total, should the full placement of the "upsize facility" take place, the company may raise up to 2.447 billion Euros. Wow. That represents, as part of the closing value last evening, 12.5 percent of the market capitalisation. This is pretty big for the company, and again a sign that Christo Wiese continues to back this team in a significant way. The stock is up over two and a half percent at the get go, the stock has certainly been under the pump lately too!

Over the seas and far away, in New York, New York, stocks rose across the board. The Dow Jones industrial average added nearly three-quarters of a percent, the broader market S&P 500 added nearly two-thirds of a percent. The nerds of NASDAQ performed better than both, 0.92 percent better on the day. Energy was the only real loser on the day, oil prices down as there was no deal reached in Algiers. Yeah, well done chaps, the higher the price goes (the oil price) the more the commercial frackers will produce. Dominance is gone. And, if Clinton has her way, solar energy and alternatives will be a bigger part of the US landscape. The markets seem to suggest that Clinton won the debate, the biggest recipient of flows was the Mexican Peso, which rallied sharply after some recent weakness.

Company corner

Nike no friends. After regular market hours, that is. The biggest sports apparel and sports shoes manufacturer in the western world, and one of the most recognisable brands across the globe, reported numbers last evening for the first quarter of their financial year 2017. At face value they actually look quite good, revenues up 8 percent to 9.1 billion, in constant currencies sales were up 10 percent. Diluted earnings per share clocked 73 cents, up 9 percent when compared to the prior financial year. Here is the reason for Mr. Market being disappointed however, future orders worldwide were only up 5 percent, 7 percent in constant currencies. Here is the thing, Nike touts themselves as a growth company, and whilst I firmly believe that to be true, the company needs to deliver growth in the low to mid teens if they are going to continue to attract a premium multiple to the market.

There is no mistaking that they are a premium brand in athletic wear. There is no doubting that there is a huge push from broader society to get healthier and to get more active. I ran my first half marathon in 1997 I think, I ran my first ultra marathon in 2000. In those days there were a few hundred people in the field. There were very few races in South Africa that you had to enter a month or so before. Comrades, that you could submit your entry around 8 weeks before, there were no caps. Only in 2000 I think there was a cap, then the numbers subsided again. Nowadays, if you don't enter months and months ahead, you are not going to get in. I mean, Two Oceans entires are open already. Nuts!!! They are around halfway through the cap of 11 thousand entrants. I feel tempted .....

Enough about my amateur hap-hazard training regime and running aspirations, Paul is the real revelation around here. He is on a running streak of at least one mile a day for the last two and one quarter years. By my math, that is more than 800 days of running at least one mile a day. At Vestact these exercise regimes are serious business. And I am very sure that we are definitely not alone in this regard, companies are ditching the old ways for encouraging their employees into getting active. As such, all the apparel and shoe businesses globally will benefit from higher sales of athletic wear. This is a global theme. Equally, casual wear has morphed into athletic apparel, the so called "athleisure" category. It is not uncommon to see folks walking around in what looks like athletic clothes, comfortable is the new cool.

CEO Mark Parker had this to say about the general category on the conference call - "The active-wear market continues to outpace the overall apparel and footwear market, which itself continues to outpace global GDP growth." He is equally right here too, in the opening statements of the results release he makes some more good points about the whole sector. It is not just about making the shirts, the pants, the socks, the shoes and so on, the technology associated with the manufacturing process and the experience that the end users get when using the products are just as important nowadays:

"Q1 also showed how we're amplifying every category through sports style innovation, transforming retail by connecting the digital and physical experience and ushering in a new Era of Personalized Performance - through product, consumer connections and our supply chain. NIKE's strategic investments in these growth opportunities continue to deliver long-term value to our shareholders."

Indeed, they just announced a fairly *nice* partnership with Apple Watch, the Nike only version for runners. What is quite important to note is that the company is not everything to all sports, they saw the decline in golf across North America (participation) and decided enough was enough there. The word golf appears once there.

Other sports and athletes sponsored by Nike had a great time during the last financial quarter to August 31, a first ever all Nike affair in the Euro championship (France vs Portugal), Serena tying the Steffi Graf record of 22 grand slam singles at Wimbledon, 1500 Olympians from 60 countries were sponsored by Nike, winning 189 medals. And of course Neymar kicked the penalty that won Brazil to their first football Olympic gold medal. Mo Farah rocked it, defending both his Olympic titles. Of the 24 members of the Team USA basketball teams at the Olympics (both men and woman USA teams won), 21 wore Nike or Jordan shoes. Make no mistake, Nike (and their peers) make wonderful apparel and shoes.

Innovation remains a large part of the company. Any runner will tell you that their running shoes over a few decades (they would have to be in their late forties, early fifties) have changed drastically over time. In the old days you had to "run your shoes in". In the Pegasus range, Nike have sold over 50 million pairs since the shoe was introduced. That is pretty astonishing, considering that a Nike Air Zoom Pegasus 33 (full name) costs 1799.95 Rand on the online website. Look, running shoes will always be expensive. A single shoe weighs 306 grams, according to the website. For comparisons sake, Nike of course owns Converse (since 2003), and according to Wikipedia, Chuck Taylor All-Stars have sold over 600 million pairs. Surely that must be the best selling shoe of all time? And not the Bata Toughie people ....

So, innovation and pushing the boundaries, more personalisation (you can make your own shoes on the website) will lead to wider margins in time. We continue to see the company as a market leader. That is all very well, that is the company. We can see that it is in good hands, in a good space and has good growth prospects. The stock price on the other hand is at the same level pre-market that it was last June. That is 15 months on and we are basically at the same level. The new buyback program of 12 billion Dollars from last year November has proceeded slowly, the company has bought back only 2.2 billion of the 12 billion Dollar program. Approaching the lows of the last 52 weeks (pre-market indicated 53.89 Dollars versus 12 month low of 51.47 Dollars) means the company may get busy. The market cap is currently around 91 billion Dollars, buying back and retiring around 11-12 percent of the shares in issue has big long term implications.

The market is pricing the stock on 20 times forward earnings for the next financial year. Whilst that is not dirt cheap and equally you are not being handsomely rewarded by way of yield (1.16 percent at current levels), you are still buying a growth business. One should continue to accumulate what is a really quality business at a lower price, you will be well rewarded in the years to come, as will all their competitors no doubt. We maintain our conviction buy recommendation.

Linkfest, lap it up

New technology is helping us discover more about our past. Having the ability to read old scrolls that previously we couldn't because they were too fragile to handle is a huge step forward - Archeologists are virtually unraveling ancient hidden texts that could rewrite biblical history.

Having access to financial products will help the poor. Being able to access credit at a reasonable rate to fund a business with lumpy cash flows is one example. Another is simply just getting interest on money saved, keeping money under the mattress has risks involved and zero interest - Developing nations would be $3.7 trillion richer if more people could handle their finances from their mobile phones. The amount of time that I have saved by using the banking app on my phone is significant.

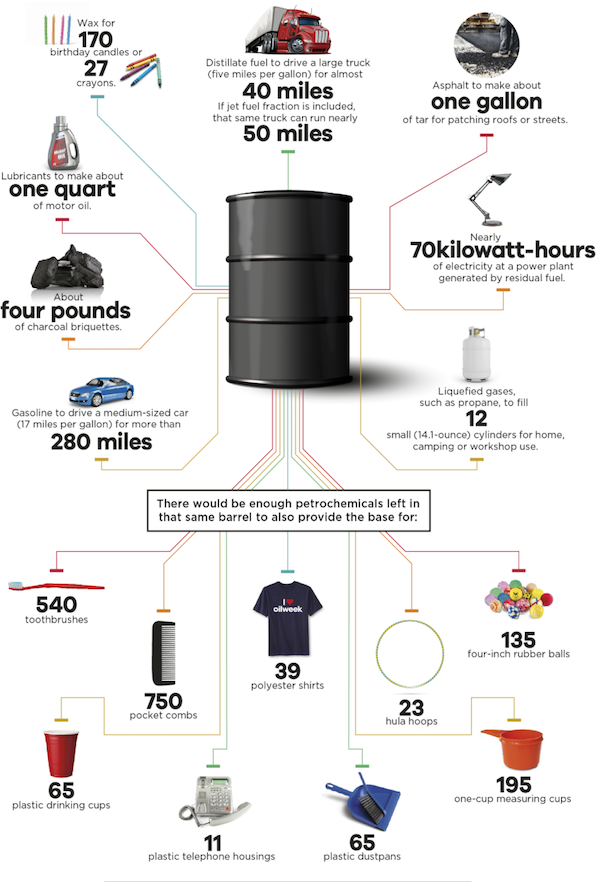

I know that we produce just short of 100 million barrels of oil a day, I have never thought about what can be produced from it- What Can Be Made from One Barrel of Oil?.

Home again, home again, jiggety-jog. Stocks are higher to begin with across the Mzansi landscape, some more than others. Marginally better across Europe in a follow through of the US session. Yeah, we need this, it has been more than a little jittery lately.

Here is a little insight from a friend of the newsletter, into Mexico City, just so you can feel a little better about where you live, or better that it is same-same in other places:

"Greetings from the former Aztec capital. All is well here in that f'ed up, developing-nation way that I suspect a conscientious South African would understand. Violent episodes fill the "penny horrible" newspapers; the Peso is falling; the President is accused of idiocy; they bought Chinese gasoline and that's why the pollution is so bad lately.. etc, etc, etc. In the meantime, friends celebrate birthdays and anniversaries; the mariachi bands keep playing and the mangoes are uniformly excellent. This is a great and ancient city, and don't underestimate the solace that good produce can provide."

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment