"It will take around a year to close, these things are not necessarily quick. They (AB InBev) have had a long time to think about what they want to sell, the SABMiller deal took nearly a year to close, they would have known which assets to sell and which one's to keep."

To market to market to buy a fat pig Locally in Jozi, the city founded on gold and the city that has been unbearably hot lately, stocks were red too. Which is lower, down as a collective just over one-third of a percent by the time the closing bell rang. It was a pretty broad based sell off, gold stocks were the exception, rallying over a percent. Amongst the majors AngloGold Ashanti and Woolies rallied sharply (relative), Amplats and Kumba were the big losers on the day. Globally stocks were lower, across Europe most indices were down around one-quarter to one-third of a percent. In that sort of range.

There was however some pretty big news on the local front, just after 8am local time (before the sun got up in Europe), AB InBev continued to waste little time in dispensing of assets they see as non-core to their operations. This time it was selling their stake in the Coca-Cola beverages Africa business that they inherited from SAB Miller. They will sell their 54.5 percent stake in a business that was only pieced together in the middle of last year, for 3.15 billion Dollars. That is a really big number. Western Europe, Eastern Europe and now African soda operations are all being shipped out by AB InBev. Like I said to a journalist yesterday: "As per their announcement this morning, they will sell all assets that they deem to be non-core to their bigger picture. You must remember that they paid a serious premium for a business that traded at the top end of a long term average multiple. So, they are entitled to bash this out as quickly as possible."

In Typical AB InBev style, the release is short and sweet, they don't need to tell you why, you own the stock so that the management can steer the ship - The Coca-Cola Company and Anheuser-Busch InBev Reach Agreement Regarding Coca-Cola Beverages Africa. It will take around a year to close, these things are not necessarily quick. They (AB InBev) have had a long time to think about what they want to sell, the SABMiller deal took nearly a year to close, they would have known which assets to sell and which one's to keep.

The stock in New York rallied just shy of two-thirds of a percent, year-to-date BUD stock is down 17 percent in Dollar terms. Coke sank a little, the stock is of course one of two down in the Dow this year. Nike being the other. In Jozi, where the Rands matter, that is the currency that we spend and invest with locally, AB InBev added over half a percent on the day. 3 billion Dollars sounds like a lot of money, and it really is a lot of a money. Relative to the BUD market cap though ..... BUD is 177 billion, Coke is 179 billion Dollars. Three and a bit billion is not going to move the needle materially for either company.

Stocks across the oceans and far away were lower, Dow 20 thousand is going to become a thing, until it happens. Energy stocks and non-cyclical consumer goods stocks rose, healthcare was the biggest laggard. I see that Trump wants to appoint Carl Icahn as a special advisor on regulation, "Advisor on Regulatory Overhaul". I must admit, as much as I don't like the guy (and Icahn is hardly the most likable either), he does seem to have a very business friendly agenda. Which is good for us as equity investors.

At the bell, the Dow had fallen 30 odd points or 0.16 percent. The S&P 500 and the nerds of NASDAQ fell around one-quarter of a percent. Accenture had results earlier in the session, it was a miss I am afraid, the stock sank five percent. My neighbour works for them, I didn't have the heart to tell him yesterday, he will find out. Nike results were well received, the stock was up nearly a percent on the session. Friday! That is my mark for Dow 20 thousand. The futures market is pointing lower, I am hoping for one last Santa hurrah by Friday. And Dow 20 thousand, that is all I want for Christmas.

Linkfest, lap it up

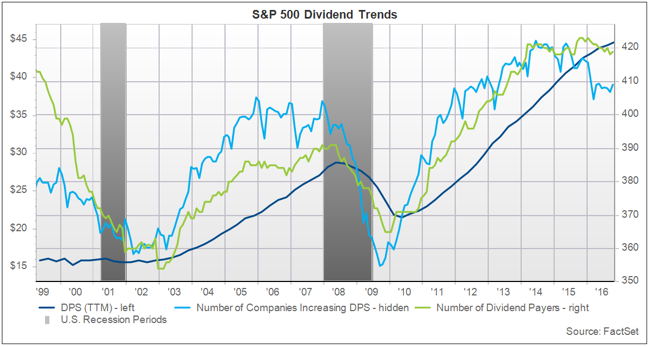

This is an interesting article for many different reasons. Firstly, the cash never lies, right? Secondly, many companies have been able to borrow at historically low rates in order to meet their obligations. In the end, for many investors (not all), the cash is what matters, and by that I mean the dividends from the businesses you own. If you were a skeptic about the recent half a decade plus stock rally, perhaps this will put your mind at rest, even though the headline looks like it wouldn't do that - Dividend Per Share Growth Slows for Fourth Consecutive Period. Courtesy Factset:

The largest social media (and single biggest platform that connects humanity) Facebook, could build your own artificial intelligence robot. For your house, only. How many hours do the most productive people have in a day? turns out, many more than you or I. A lovely piece about the Zuck and his AI bot, Jarvis - At Home With Mark Zuckerberg And Jarvis, The AI Assistant He Built For His Family.

Coffee nerds, stop the clock. Everyone thinks that they are the people who have the secret sauce when it comes to the fine art. Are we over complicating these things? I think so, and so does C|Net - Forget the freezer, this is how you should be storing your coffee. The main thing seems to be, no sunlight, cool and dry. Like almost any grain or bean, right?

This is a very contentious article that is very close to home: Tossed aside in the 'white gold' rush. We all need more batteries. Without capital to mine the assets (not like a factory that can have a chosen site), would the locals be able to raise the funds? I guess not, both parties need each other. It seems that the locals are benefitting, it could be more. Once the mine is gone, the key to the legacy will be the sustainability of the local communities. Education is critical in breaking any poverty cycle that exists right now.

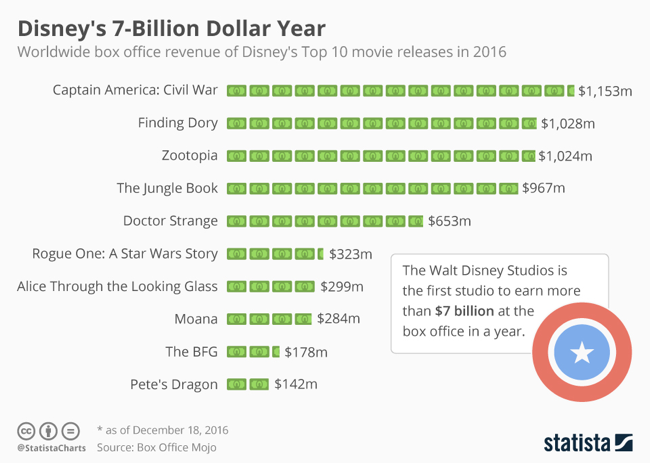

If you are a Star Wars fan, you possibly have seen Rogue One already. It may well turn out to be the best movie in a while for Disney, they have had the best year ever in global box office sales, having passed 7 billion Dollars. Here it is, a whole host of remakes, what have we become!!?? Disney's 7-Billion Dollar Year. Courtesy Statista:

I recall when speaking to a man who is long retired in this industry (he was a stockbroker his whole life) what one of his rookie mistakes were. He suggested to a man in his late eighties that he ought to buy this gold mine for the "long term", when pressed for a single idea. The really old guy suggested he didn't have time, he wanted a "right now" idea. If you do have the "time", you should always be looking to invest over the same sort of period you would own a property - Why Investors Need to Focus on the Long-Term.

My youngest daughter once told me that she was never leaving home, I guess that is a natural reaction at her age. Well, if we lived in the US, she would definitely not be alone, when she reaches this age of course - Percentage of Young Americans Living With Parents Rises to 75-Year High. It could be a product of the financial crisis, more young people being more cautious on ownership of houses, or more stringent credit scoring. Or both. Secretly I think both parties are happy, parents get to see their kids longer, kids get to have home cooked meals and laundry "done".

Home again, home again, jiggety-jog. Stocks across Asia are lower, it may well be another marginal selling day here in Jozi, volumes are light and holidays are now in full swing. Sun and beach, remember to slap on the sunscreen sportslovers.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063