"Twitter themselves have the easiest explanation of what the platform is supposed to be for their users: "the best and fastest place to see what's happening and what people are talking about all around the world. From breaking news and entertainment to sports and politics, from big events to everyday interests. If it's happening anywhere, it's happening first on Twitter." (That is a lot more than 140 characters)"

To market to market to buy a fat pig Thanks to the hawkish statements from Janet Yellen, the markets closed at all time highs, she indicated that March is "live", i.e. The Federal Reserve could raise interest rates at the next FOMC meeting of the year, being March. So why would that make markets go up, surely the opposite would have happened? For one thing, this is very supportive for financial stocks. Whilst March is not a "done deal", June would be a definite, at least in the eyes of Mr. Market.

By session end stocks have rallied again, financials added six-tenths of a percent, Goldman and Wells Fargo closed at all time highs, Apple also traded at an all time high. The market cap of the company that makes wonderful things now stands at 714 billion Dollars, a long, long way off from where pundits can cross another milestone off their list, the first company to one trillion Dollars. Perhaps it may be a Chinese business, Alibaba or TenCent have the growth trajectory to make a real rush and grab of the first. Remembering that nobody remembers that Michael Collins watched Neil Armstrong and Buzz Aldrin descend to the moon, let alone Eugene Cernan, the last man to step off the moon. Cernan recently passed away, mid January. Ah, stock records are made to be broken.

Session end the Dow Jones Industrial average had added 92 points, which is 0.45 percent these days, to top 20 thousand and five hundred points. That was a fairly quick 500 points, I suppose as the index swelled in size, the milestones are reached quicker, the percentage is smaller. You get it .... The broader market S&P 500 added four-tenths of a percent to close at 2337, whilst the nerds of NASDAQ added just shy of one-third of a percent to close at a record 5782. I don't think that Mr. Market is complacent, I suspect that there could be a huge leg up from here, another five odd percent if a concrete tax plan was shovelled through in the coming weeks and months. There are loads of businesses with lots of cash abroad (outside of the US), that could be brought back "home". For share buybacks? Retire debt? Possibly.

I had a look back at the ten year performance of some financial stocks, Wells Fargo, Goldman Sachs, JP Morgan and Bank of America Merrill Lynch. And then I threw in Citi because I "felt bad" that they were not amongst that grouping. The relative performances will astound you, so hold on to your seat here for a second, the ten year performances of the respective financial heavyweights in the US are as follows - WFC +63.96%, GS +16.87%, JPM +77.56%, BAC -54.75% and C -88.79%. The S&P 500? That is up 62.54 percent over the last ten years. Wells and JP Morgan have outperformed the market over ten years, remembering that the highs, before the sub-prime mortgage implosion was October 2007. When we have, towards the end of this year, a ten year comparative time frame, "things" will start to look more interesting, historically speaking.

Locally we were hamstrung (stocks were) by the strengthening Rand. This is a good thing, when the Rand strengthens, this is a good thing for all of us you see, as it bites into inflation in a good way. The less we have to pay for imports the better. Equally, with strengthening commodity prices, that is better for our exports. Not so good for our stocks that report Dollar revenue that converts back to Rand terms. There was an unemployment number which Michael looked at in detail, the number of folks with a school leavers certificate is bleak, I tell you. It should be much, much higher than the current levels. Having said that, school is not necessarily for everyone. Skills learnt cannot be taken away, the more people with skills, the better for everyone.

The All Share index sank over nine-tenths of a percent, industrials were the biggest losers, down over a percent and a half on the day. Kumba was at the top of the losers board (not a place you want to be), down nearly six and a half percent. The volatility has been nothing short of heart stopping in recent days, with Chinese numbers and SARS settlements, Iron Ore prices rocketing ahead (the company thinks that they are too high) and then the company forgoing a dividend. It has been a wild ride in Kumba in recent years. Other stocks to take pain as a result of the strengthening Rand included Naspers, British America Tobacco and Steinhoff, all these companies have listings elsewhere. Those benefitting from a firmer Rand, unsurprisingly were the banks and retailers, the prospects of a better inflation outlook could mean lower rates down the line. Nedbank, RMB and FirstRand all found themselves near the top of the winners leaderboard.

There was a NAV update from Brait, which at first caught the market off guard, the stock sank over five percent before calm was restored and the stock gained just over a percent and one-third on the day. We have certainly been wrong on this one, as a result of a number of factors, including an ill timed UK purchase of a retailer that is now "struggling", New Look is roaring ahead in China, their base is still the UK. Brexit helped like a hole in the head, the weakening UK currency and the weaker outlook has meant lower Rand profits and equally downgraded expectations for the UK economy. Brexit, who saw that coming? What is likely to transpire with the negotiations, your guess is as good as mine. We will have a more detailed look in the coming days, tomorrow is the likely publish date.

Company corner

Twitter is a great platform for staying in touch with each others thoughts, be they not well thought through or on point. The fact that the platform is completely live, all of the time, no matter where in the world you happen to be, counts for a lot. I recall hearing about the poor soul who was taken by a shark in the Cape via Twitter, that was in the early days. People are addicted to their phones and are addicted to news-flow. The platform is a little more school-ground bully and less sunshine and lollipops than say for instance Facebook, where there are more roses. You may think you know the people on Twitter, heck, you do not even know your friends on Facebook!

The investment thus far has been a disaster. You would have expected a company with multiple eyeballs and streaming customised news to attract a lot more revenue from advertisers, yet they have stumbled. Trump tweets about his daughter during a White House brief (or there abouts), people pick it up and crazily retweet. Trump tweets attract an enormous amount of attention. Twitter themselves have the easiest explanation of what the platform is supposed to be for their users: "the best and fastest place to see what's happening and what people are talking about all around the world. From breaking news and entertainment to sports and politics, from big events to everyday interests. If it's happening anywhere, it's happening first on Twitter." (That is a lot more than 140 characters)

So why then is the business struggling to grow? Monthly active users in the last quarter is 319 million, flat at 67 million in the US. The cost per ad is falling across all platforms, Twitter experienced a 60 percent fall in the last quarter. Revenues were basically flat, the fourth quarter clocked revenues of 717 million Dollars, when measured against the corresponding quarter from 2016. In the US, advertising revenues fell from Q4 2016 (down 7 percent), international revenues picked up the slack marginally. Added to that, the business suffered a 167 million Dollar loss, or 23 cents per share. For the full year the company recorded revenues of 2.5 billion with a loss of 457 million Dollars. What irks most people is the stock based compensation, which was 24 percent of revenues in 2016. WHAT? And 31 percent last year. They have roughly, in the last two years, dolled out half of revenues in stock based compensation.

That is enough to get your blood boiling. Why would the staffers at Twitter be remunerated in that fashion when clearly, from a subscribers and revenue point of view and definitely from a profitability point of view, you are not getting the returns you deserve? The outlook for 2017 and the next quarter is average at best, it looks a little anaemic. In the end, shareholders only have themselves to blame for having the business dish out so much lolly to the staff. Of course this would not have been such an "issue" if the company had struck pay dirt immediately and grown revenues sharply, and the advertisers had rushed in order to be front and centre of their platform.

I do not think that it is binary from here. Twitter as a product has incredible uses. Believe it or not, they still have a fair share of what is going to become an increasingly big part of the social media platforms, the streaming market. They (Twitter have around ten percent), YouTube and Facebook (unsurprisingly) dominate here. Is it a good invest though? The short answer is not in the very short term, the company is expected to see revenue go backwards this year before it slowly starts to stabilise. Heck, the investment community only expects the company to make a marginal profit in 2019 and to break even in 2018. I guess that means that whilst the platform is exciting and that there is plenty of engagement with the pretty loyal community, the chances for shareholders to be upbeat in the short term are few. If you own them, be patient. It is a shaky hold at best.

Linkfest, lap it up

My word. After having read this admittedly one sided piece, it becomes clear that marketing is very important, as is the supply of diamonds in creating the allure that there is this huge demand for something that is very rare. Neither of which is really true, industry can manufacture (at a cost), diamonds. You cannot make gold or platinum. Read this and let me know what you really think - 6M Americans may get engaged today with a diamond that costs $5K (avg.) including a huge premium for false scarcity. Whoa, this is the first time that I have seen this angle.

The holy grail for those living in the tropics and in danger of being infected with Malaria, scientists believe that they are a little closer to solving the mystery that could help hundreds of millions of people around the globe - New insight into malaria could boost the search for a vaccine.

In an age of political incorrectness, that seems to have reared its ugly head, it is good to see that someone got fired for being insensitive and acting in a manner unbecoming of any generation. YouTube's biggest subscriber base has been pulled for anti-Semitic remarks and content. Do you think that they have gone far enough though? Read here and see - PewDiePie Show Canceled by Google's YouTube. Disney have gone one step further and completely cut the fellow off - Disney Drops PewDiePie and YouTube Distances Itself After Reports of Anti-Semitic Videos. In so much that math and accounting (and economics) are important, history is very important too. Kjellberg has apologised, is it enough though?

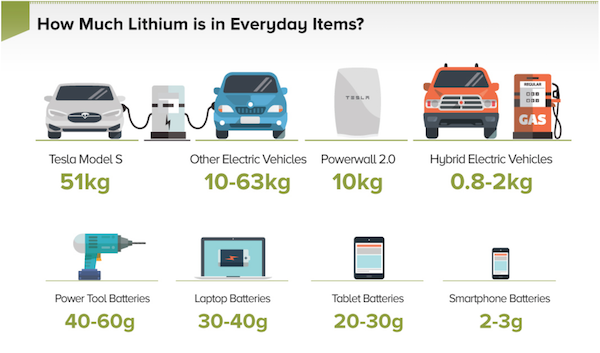

Glencore just upped their stake in two Cobalt mines, a key component of the modern battery. A bigger component is lithium, visual capitalist has a great break down on lithium - Lithium: The Fuel of the Green Revolution

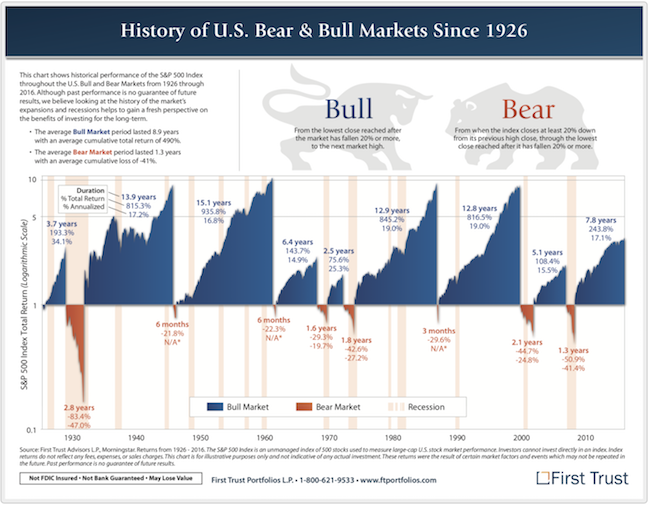

When we talk about having a long term view on equities, here is what we mean - History of US Bear & Bull Markets Since 1926. What a great graph! Note how big the drawdowns are and how long they last for. 30% - 40% pull backs ARE going to happen, this is par for the course when investing in equities.

Home again, home again, jiggety-jog. Stocks across Asia are higher mostly, both the Japanese and Hong Kong markets are much stronger. US futures are up a smidgen. It is that time of the year that the asset managers release their 13F filings, Berkshire Hathaway said that they had increased their Apple stake to 57.4 million shares, up from 15.2 million shares earlier. That is more than 1 percent of Apple. That happened quickly. Berkshire also sold all their Walmart shares. When are they going to own a few Amazon?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment