"A poor January in Abu Dhabi, those are the Al Noor assets, which are going to be rebranded in due course, they will take a 140 million AED, or 500 million Rand charge in the rebranding process, a non cash event. Expectations are for full year revenues from the middle east operations to be 3 to 3.2 billion AED or nearly 11.5 billion Rand at the top end of the range, EBITDA margins of 10 to 11 percent."

To market to market to buy a fat pig That was about the busiest day in terms of news-flow that I have seen on the local exchange in a long, long time. There were results from Anglo American, BHP Billiton, Shoprite-Checkers, Imperial and then there were trading updates from the likes of Tiger Brands and Mediclinic. As well as Pioneer Foods. We will do our best to cover the ones that are most relevant to our clients, both today and in the coming days. Of course there are Discovery results tomorrow. There are rumours swirling that Telkom could make a go for Cell C, remembering that the shareholders from Saudi, Oger, may well be getting really tired after all these years in what is a saturated market from a subscriber point of view.

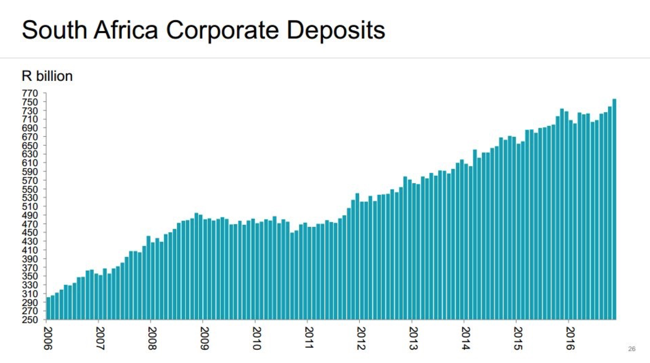

Session end in the city founded on gold, stocks managed a meagre 0.05 percent gain. Resources were nearly half a percent to the good. Financials were down around one-quarter of a percent, I am guessing that the budget speech will be a big day for all South Africans, it is widely expected that there will be tax hikes across the board. Revenue may seemingly be easy to "get" but has a massive knock on effect on the economy, with lower confidence leading to lower spend. On the Twitter thingie, I found a graph via Kevin Lings and Stanlib, I think that this is pretty self explanatory and tells you that any sort of confidence shift could lead to a big boost in the economy:

Makes you think, doesn't it? And makes you wonder whether or not these funds would be smartly deployed. Confidence is key to almost everything. Byron said on the box this morning, "confidence is the cheapest form of stimulus". Makes sense. If you want to read a *nice* view of the mining stocks currently, here goes - Mining Companies Are Back in the Black.

Another day for Wall Street where the confidence continues to flow, stocks all reaching another new bunch of highs. The Dow Jones Industrial Average added nearly six-tenths of a percent, the S&P 500 added exactly that. The nerds of NASDAQ added just shy of half a percent by the time all was said and done. Walmart had numbers that at face value looked average, and the guidance was average. What people liked about the results was that Walmart online sales grew quite quickly, accounting for 7.8 percent of all online sales in the US, second to Amazon, which is at 33 percent. Those online sales for Walmart grew by 29 percent, we have always maintained that they will be able to compete in this way. For the likes of Macy's, the department store, is that going to be easy? Are they going to be able to differentiate? By session end Walmart had tacked on three percent.

Other big news was Carl Icahn taking a stake in Bristol-Myers Squibb. Must be grossly undervalued you know, perhaps a letter to the board is in order. Ha ha. And perhaps make it known and very public to everyone, that is a great style and it works. Remember that public spat between Icahn and Ackman around Herbalife, looks like Icahn is winning that one. See an old one - Waiters At New York City's Restaurants Know Never To Seat Bill Ackman Next To Carl Icahn. Egos and investing, it normally doesn't go well.

Company corner

Mediclinic had a trading update yesterday, their results are not until May, this was more of a look at their Middle East business. The first line is OK - "During the year we have seen a good trading performance from our two largest platforms in Switzerland and Southern Africa in line with full year expectations for the full year 2016/17."

And then the next seven paragraphs point out how "things" in the Middle East are sucking wind. A reminder, from the last set of numbers - Mediclinic half year numbers - not going so well in UAE: "Switzerland stands head and shoulders above them all, as you would imagine, being a 51.8 percent contributor and saw good growth (currency translations - yes) of 18 percent. The South African business contributed 34 percent to EBIDTA and the Middle East business was the balance, 15.45 percent."

A poor January in Abu Dhabi, those are the Al Noor assets, which are going to be rebranded in due course, they will take a 140 million AED, or 500 million Rand charge in the rebranding process, a non cash event. Expectations are for full year revenues from the middle east operations to be 3 to 3.2 billion AED or nearly 11.5 billion Rand at the top end of the range, EBITDA margins of 10 to 11 percent. Perhaps we should change those to Pound Sterling, of course that is the currency that they (Mediclinic) now report in. 650 to 700 million Pounds revenue. 65 to 77 million Pounds EBITDA, from their Middle East operations. Which is more than double at the half year stage (306 million revenues at H1, 34 million EBIDTA at H1).

I suspect that whilst integration is not going according to plan, government budgets under pressure (and the subsequent raising of the co-payments by the national health provider in the UAE) is not something Mediclinic can help in any way. The oil price has been rallying and I suspect that will definitely help matters. I think that the market possibly overreacted, sending the Mediclinic share price down nearly 6 percent in London and 4.6 percent here.

The market expects better, the stock trades at an elevated level for the stodgy numbers that they have delivered thus far, and it has been punished accordingly. It happens. The business is a really good one, with a great anchor shareholder that will definitely help if other opportunities come along for a deal. They need to "bed" (excuse the pun) down the Middle East, the reason for the London listing remember was access to cheaper capital, hence the acquiring of Al Noor for that purpose. We like the business, like the trends that will continue to appear for healthcare. Be patient, acquire on weakness will continue to be the message.

The other business of interest to us here at Vestact that had a trading statement, was Tiger Brands. I had oats this morning, I know it is not all Banting, sorry about that you purist cave people. I should have had wooly mammoth and washed it down with Yak milk, something like that, right? At face value the trading update may have looked weird, the company has a September year end, so their interim numbers would be after March. This trading update coincided with the AGM though, and it is not unusual for a business to give an update.

Turnover for the four months to end January, relative to the prior year, increased by 12 percent. One would argue in an economy where moral is a little low as a result of economic activity being average at best, this is a fair result. Exports and their international business were impacted by (drum roll), the strong Rand, which makes for a good change. The company has decided to exit their East African Haco business, selling their half (plus one) to their partner. This comes on top of their sale in Ethiopia. As they point out, with the sale of Taco, it is not really material.

Things locally are still tough out there: "The trading environment remains difficult. The focus will continue to be on optimising margins without sacrificing market share. This will be achieved through targeted investment in marketing and route to market activities, as well as through ongoing cost-saving initiatives."

Expect results on the 25th of May. Good day that, my wedding anniversary, I will be married for a decade and a half, that is a good achievement, right? Yes. As Charlie Munger always says, take the very best person who will have you! Ha ha. The stock lost around 0.9 percent on the day, hardly here or there by the end I guess. We remain holders and accumulators of Tiger Brands, excellent enduring brands. And in case you hadn't noticed, food is more addictive than anything else.

Linkfest, lap it up

Facebook have lately been called copycats of Snapchat. They have been on many of their platforms trying to counteract the prominence of Snapchat. Here is some more news - WhatsApp Launches Snapchat-Like Status Feature. We remain long Facebook.

Wow. Just when you thought there was no more chance of a straw changing shape or size or suction - McDonald's Just Innovated The Hell Out Of Straws. Is that really what straw stands for? Suction Tube for Reverse Axial Withdrawal?

There are some handy tips in here, also via PC Mag - 8 Uses for Your Old Smartphone. For people who use some applications a lot, freeing up some "screen time" for a dedicated Skype screen is probably the best idea.

You can give up folks, if you were thinking about this. Air Force doctor wins NASA "Space Poop Challenge". 15 thousand bucks for the winner! Seems too little to solve a complicated problem?

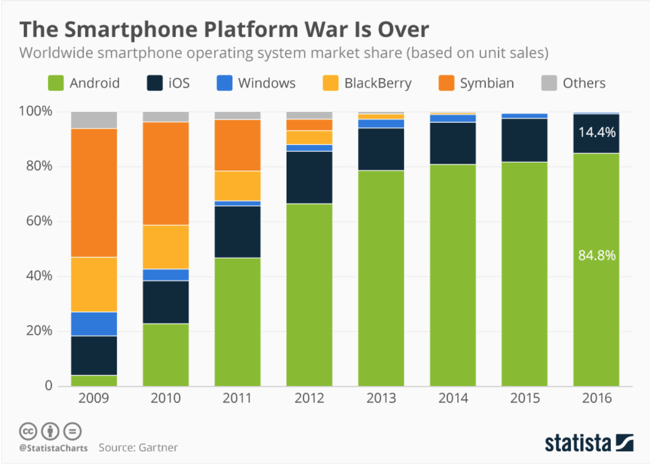

No ways! Seeing is believing. Two links essentially about the same thing. The Smartphone Platform War Is Over, and the associated graph, courtesy of Statista. This article (with associated graph from Statista too) tells you all you need to know about what used to be - BlackBerry's fall from grace, in one chart.

Home again, home again, jiggety-jog. Chinese stocks are up, Hong Kong more than Shanghai. Japanese stocks are completely flat.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment