"Quarterly revenues of 78.4 billion Dollars bested the markets expectations, and unit sales of the newer iPhone clocked 78.29 million. Again, above expectations, which were in the region of 76 million."

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig Stocks rose marginally in the city founded on gold, financials rebounded by two-thirds of a percent, the overall market added one quarter of a percent by the time the bell clanged for closing time. Kumba and AngloGold Ashanti found their stock prices at the top of the "winners" column, in the losers was Bidvest and South32, as well as Mediclinic and Steinhoff. Brexit .... yech, the timelines may well be closer than we think. We shall see, there is little price in trying to second guess what the outcomes of French elections, or Dutch elections are likely to be. Seeing as we are in the midst of a very heavy earnings season, we will focus on that. It is, using Quality Street as an example and in dipping into the box, my favourite favourite.

Stocks across the oceans and seas in New York, New York, were mixed, the Dow Jones down over 100 points on the session (just over half a percent these days), the S&P 500 closed down nearly one-tenth of a percent and the nerds of NASDAQ just squeaked into the green. Healthcare stocks added nearly a percent and one-third, a meeting with the president revealed little over the pricing of the products, in the end these businesses spend hundreds of billions of Dollars on Research and Development. UPS whiffed on earnings, the stock sank nearly 7 percent. Under Armour was caned, we will review that one in a bit.

Time. You have it, I have it, we all have it. It does not matter whether you are Warren Buffet, Charlie Munger or Big Jo (Person on the street Jo), there are 24 hours in a day and you can choose to use them any way you want. There is no way that I will be able to buy more time, Buffett says in this interview with Charlie Rose. He is joined again by Bill Gates, this follows from a few days ago at Columbia University - Bill Gates and Warren Buffett. I urge you to watch what is nearly an hour long interview. Meryl Streep, that over-rated actress with 400 plus nominations from the industry, says that life without Charlie Rose (the interviewer) is not worth living.

Some highlights include when Charlie asks Warren about 2 percent economic growth. He answers something like this "The goose (the US) will keep laying golden eggs. 2 percent is good. 19 thousand per capita, which is greater than a whole lot of countries is what will be added in a generation." Buffett arrives at a number of nearly 80 thousand Dollars of "stuff" being contributed per capita in a generation's time, that seems like a great outcome to him. I agree.

The greatest satisfaction is in appreciating and having good health. Buffett says that he enjoys running Berkshire, it is one of his great pleasures. "I own the brush and canvas, which is unlimited, and I get to do it with people I like". He says that it is important to like those people. I don't have to answer to Wall Street, and I do not have to worry about what they think of my quarterly filings. Business is easier than philanthropy, says Buffett. The most important teaching job, says Buffett, is to teach your kids. Get good at that, you will be just fine, in terms of your mental well being. And .... as he says many times over, I have never had a fight with my business partner, Charlie Munger in all the years they have known one another, that extends to 57 years.

Bill Gates - Still on a steep learning curve, the same as when he was at Microsoft. He worries, like Warren Buffett about nuclear war, both of them make reference to the Einstein-Szilard Letter. A few years later, they agree, and the Nazis may have reached nuclear capability first. That may have changed the course of history. This is why they (Gates and Buffett) fear a nuclear war. Strangely, and a little out there, Gates suggests that if nuclear power was refined to be cheaper and safer, that may be a more viable option for power generation. At some distance I agree with him, the waste disposal and safety concerns have forced people away from this idea.

Carl Richards, the Behaviour Gap guy, had a brilliant piece (republished in the NYT) a few weeks back titled - Free Time? Not Likely, for Time Is Anything but Free, in which he (Carl) says that time is a non-renewable and therefore very valuable resource. True. His last line is a predictable, spend your time wisely. Lessons from Gates and Buffett are always wildly useful. Time well spent!

Company Corner

Apple, the biggest company in the world by market cap, reported numbers for the "holiday" (their 1st of their new financial year) quarter last evening after the market had closed "regular" hours. The headline pretty much sums it up - iPhone, Services, Mac and Apple Watch Set All-Time Records. iPads, not so much! My feeling on the iPad is that more businesses will be drawn to it in time. Quarterly revenues of 78.4 billion Dollars bested the markets expectations, and unit sales of the newer iPhone clocked 78.29 million. Again, above expectations, which were in the region of 76 million.

China was the only geography with a significant fall in revenues, the quarter on quarter growth in that region was huge (up 85 percent). Perhaps waiting for the year of the Rooster? The services business (music, apps) continues to impress, growing revenues by 18 percent. That is now a 7 billion Dollars a quarter business. Cash and cash equivalents topped 246 billion Dollars. An eye popping number, one that always needs a little bit of context. There is a very, very short list of stocks with a greater market capitalisation than the cash that Apple has. It is worth "printing", Apple (obviously), Alphabet, Microsoft, Berkshire Hathaway, Amazon, Facebook, Exxon Mobil, JNJ, JP Morgan, Wells Fargo, GE, AT&T, TenCent and Alibaba. Those are the only ones that have market capitalisations of greater than 246 billion Dollars. No other companies. Apple has more cash than the market cap of Nestle. More cash than the market cap individually of Procter & Gamble, Bank of America and Royal Dutch Shell. Context sometimes throws some crazy numbers at you.

The market cap is 636 billion Dollars, the cash represents 38.6 percent of the value of business. Of course in the context of a US domiciled company, if the business were to repatriate that cash, they would have tax issues. Even though the company has paid tax in places that they have sold their products (the EU says that it is too low), in terms of US laws, they have to pay tax on it again if they decide to repatriate it. That is still ongoing, expectations are for the Trump administration to announce something on overseas cash for US businesses. Apple, just by the way, missed a deadline to pay the European Union 13 billion Euros, for "enjoying" illegal tax concessions. Ireland clearly does not see it that way. Ireland seemingly at loggerheads with their EU brothers, they don't want it. That is ongoing.

Earnings per share crept up marginally, 3.36 Dollars per share, a "beat" of 14 cents on earnings (and 1 billion on revenue). Dividends, remember those have increased from 52 to 57 cents per quarter, it is payable at the end of next week. Shares in issue over the last year have decreased to 5,298,661 from 5,558,930 this time last year. That is fairly significant. This is part of the capital return program (dividends and buybacks) of 200 billion Dollars thus far. Since it started, that is, in the post Steve Jobs era, where dividends and buybacks were part of the norm. The long term impact of retiring shares and by extension juicing up earnings per share is felt in later years.

That is all very nice, what are we to think of the future? Guidance for Q2 is as follows: "revenue between $51.5 billion and $53.5 billion, gross margin between 38 percent and 39 percent, tax rate of 26 percent." Whilst people suggest that the trajectory of the phone sales may be slowing, the mix upwards to the better camera (the iPhone 7 plus) means that this caught the company a little off guard, their supply balance only came back in January. You can read the opening statement of the conference call here - Tim Cook's Opening Statement, in which he says: "iPhone 7 Plus has earned rave reviews for its advanced new features, especially the dual camera system which produces stunning portraits and high quality zoom. This is a uniquely Apple feature that is surprising and delighting our users."

I think that statement is at the core of the DNA of the business. They continue to make awesome products that delight their customer base. As long as this continues to be the case, be it artificial intelligence (an Alexa/Echo competitor), augmented reality (a Snap/Google glass competitor) or inserts into vehicle parts (competing with all the self drive folks), Apple will produce wonderful products that their customers want. AirPods shake things up, from a wireless point of view. There is a case to be made that once customers are inside of the ecosystem, they rarely, if ever, leave the ecosystem.

We continue to accumulate and own what is a tremendous company. It is a compelling investment too, the growth rates may have slowed, I suspect that there will continue to be innovative products that will drive growth, and products that create a better experience, be they the watch or the earphones. The stock is cheap (cheaper when you strip out the cash) and will deliver great products. More to the point, the next generation phone, the ten year anniversary is highly anticipated. Called the 10 or the 8 or even the x, no doubt the new form will be beautiful.

Yesterday the rumours were floating that Nando's was planning on listing on the London Stock Exchange (LSE). The company quickly squashed those rumours though. During the hype, we had a look at some of the fun facts about the company (most of them can be found here - Nando's Statistics)

The company currently has 1 094 stores globally in 24 countries, with their biggest presence in the UK with 339 restaurants, followed by Australia with 264 and South Africa with 259. Not bad considering that the first restaurant opened in 1987.

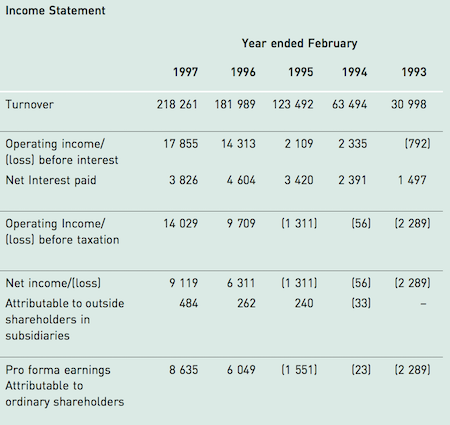

Many of you will remember that Nando's used to be listed on the JSE. It was a brief 6 year stint between 1997 and 2003, when it was delisted because management increased their stake and left the free float of the shares too low. It listed at R1, spiked to R1.80 on the first day and then closed the day out at R1.25. When delisting came around, the shares price was at 70c, not a great return if you got in on day one. Look how phenomenal their growth was leading up to the listing.

The only reason to list is if you want to raise capital or if a major shareholder wants to realise some of their value. Maybe one of the founders is thinking of slowing down and enjoying more of their hard earned money? I think though that if you listed and then de-listed, you are not in a rush to return to the regulatory burden of being listed again.

Linkfest, lap it up

Two posts yesterday, talking about the impact of smoking on society. The first article sites research which puts the negative impact of smoking on society at $1.4 trillion - Smoking costs $1.4 trillion in health care, labour loss: study.

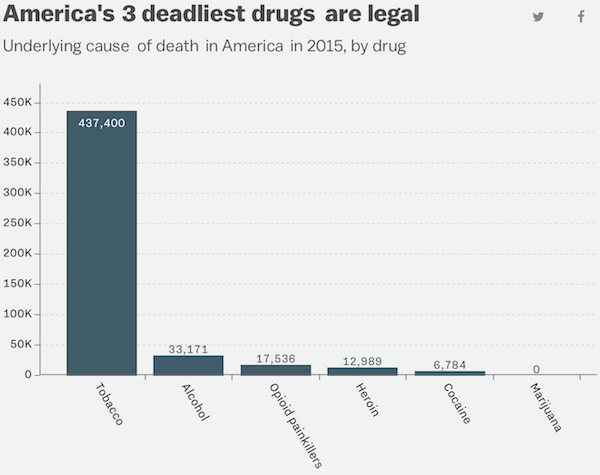

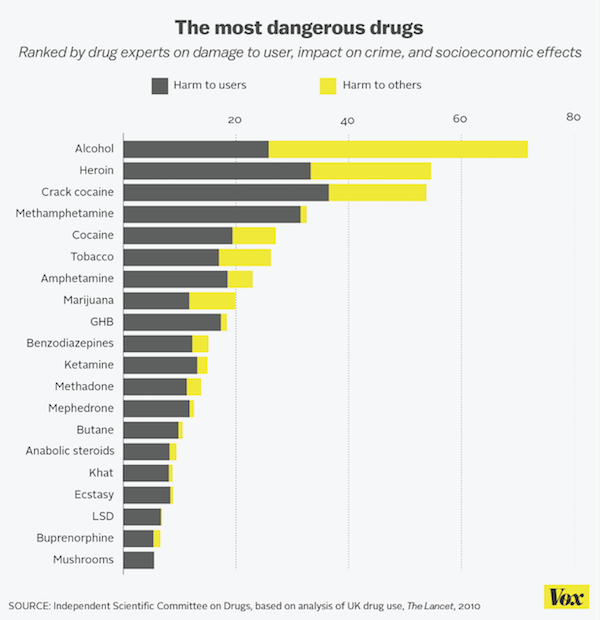

The second article points to legal substances which kills many people a year - The 3 deadliest drugs in America are legal.

The studies have many, many assumptions in them but there is no doubt that alcohol and cigarettes have a negative impact on society. If governments are paying for healthcare expect them to go after these sectors even harder going forward.

I have wondered how it works and done some low level research on the "matter" - Animation: How Solar Panels Work, this answers it.

Home again, home again, jiggety-jog. Hey, the Fed decide that they will do nothing today. Stocks across Asia look marginally better!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment