"It seems pretty easy, at the end of the day it all boils down to trust. The cardholder and the merchant have to trust that Visa will be able to switch their transaction. And that is for all points, everywhere in the world. The network is capable of handling 65 thousand transaction messages a second. Quite simply, they make your life a whole lot easier, whether you are using your debit or credit card to complete the transaction, either at the physical location (the merchant) or online."

To market to market to buy a fat pig Our market had a strong start to Friday trading, taking momentum from the surprise drop in interest rates the day before. But with the opening of the US market and the initial drop there, our market followed suit. When all was said and done the all share was down 0.23% come the five o'clock closing bell. The big news for Friday was the rumour that Government will consider selling their stake in Telkom to cover the cost of the SAA bailout, Telkom closed down 2.7% but more interesting was that Vodacom closed up 4.2%.

The best explanation we could come up with (I don't think it is a very good one) on why Vodacom was up so much was the expectation that government will interfere less in the telecoms space. More spectrum with less strings attached is good news for the telecom providers. Less strings means less costs which filter down to the consumer as lower internet prices. Given how important access to internet is and how emotive data prices are, I don't see much changing on the regulation front.

Government currently owns 39.7% of Telkom which is worth around R13.7 billion at the close on Friday. So far government has written a cheque of R2.2 billion on behalf of SAA and the way I understand it, there will be another cheque of R13.5 billion in the next 12 months. Ouch! We have already covered SAA as an investment here (Keeping SAA aloft), so lets focus of Telkom.

The company went through a tough patch where they suspended the dividend in 2011 but thanks to new focus and streamlining the business (Telkom employee numbers: 1991 to 2015) the company re-instated the dividend in 2015 and the share price is up around 400% since the lows of 2013. A more important number though is the dividend that Telkom pays, last year that number came in at around R883 million for the Governments share. As a tax payer I would much rather own a profitable dividend paying organisation than a loss making one, cutting the roses and watering the weeds ends badly every time!

New York, New York The Nasdaq's 10 day streak of gains was broken, finishing the day down a smidgen at 0.04%. The S&P 500 was also down 0.04% and the Dow down a bit more at 0.15%, being driven lower by GE dropping 2.9% on worse than expected earnings. The focal point for the week is what the FED will do on Wednesday, the expectation is for them to do nothing. What will move markets this week though is a number of large players reporting numbers, we have Alphabet (Google) tonight, Apple tomorrow and Amazon on Thursday. Not to mention Amgen, Starbucks, Cerner and Stryker also reporting this week.

Company corner

Visa inc. reported their third quarter results for the period to end 30 June. It was a beat by most metrics, the business reported net income of 2.1 billion Dollars, or 86 US cents per share off revenues of 4.6 billion Dollars. Remember that Visa Europe is now fully integrated into group, payments volumes increased a whopping 38 percent to 1.9 trillion Dollars. 28.5 billion transactions in total. During the quarter, the group also returned 2.1 billion Dollars to their shareholders, by way of dividends and share buybacks (59.2 million shares bought back at an average of 86.82 for the last nine months). There is still 5.5 billion Dollars available for repurchases inside of the current program, or roughly two and a half percent of the current market capitalisation.

This is a pretty incredible business. Their model is simple, yet the technology is always evolving too. Every electronic payment needs to be processed, to make sure that the relationship between the cardholder, the issuing bank, the merchant and the acquiring bank (of the merchant) is honoured, all seamlessly. It seems pretty easy, at the end of the day it all boils down to trust. The cardholder and the merchant have to trust that Visa will be able to switch their transaction. And that is for all points, everywhere in the world. The network is capable of handling 65 thousand transaction messages a second. Quite simply, they make your life a whole lot easier, whether you are using your debit or credit card to complete the transaction, either at the physical location (the merchant) or online.

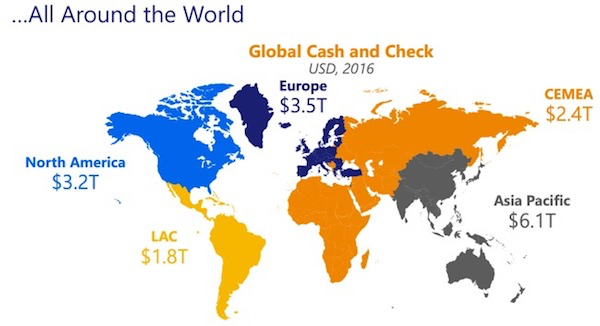

The stock always trades on a pretty lofty multiple, that is as a result of continually growing their revenues and earnings at a fearsome click, the company expects revenues to grow by 20 percent for the full year. Earnings per share are expected to be around 3.40 to 3.50 Dollars a share. At the record close on Friday evening (99.60 Dollars), the stock trades on 28 times expected 2017 earnings. Not cheap by any measure, a growth business with lofty expectations. I suspect that they will continue to meet and surpass expectations, there is likely to be less and less cash in circulation, businesses like Visa will take care of the elimination of physical notes and coins. There is still around 17 trillion Dollars in cash and checks that will in time convert to electronic payments. See the image below to reflect that this is a global phenomenon.

I suspect that the company has a very bright future. Governments want trails for transactions. Businesses and consumers want easier payment methods that eliminate physical cards (think of all the cell phone payment methods). The shift to digital (online) from physical (at the store) benefits Visa above their competitors, as a result of having built the wider net from a technology point of view. With the current share price of close to 100 Dollars, there may be little wriggle room for the next half a year or so, this really is a business that you can stick in your back pocket and hold on a "forever" basis.

Linkfest, lap it up

Making vaccines more user friendly will be huge for areas of the world where immunisation levels are low, especially if storage can be done at room temperature - Beyond The Nasty Needle: Trying To Make Vaccines More Comfy And Convenient.

This is great, Google now allows you to explore the International Space Station - Google Maps, International Space Station. I'm not sure I could spend months up there.

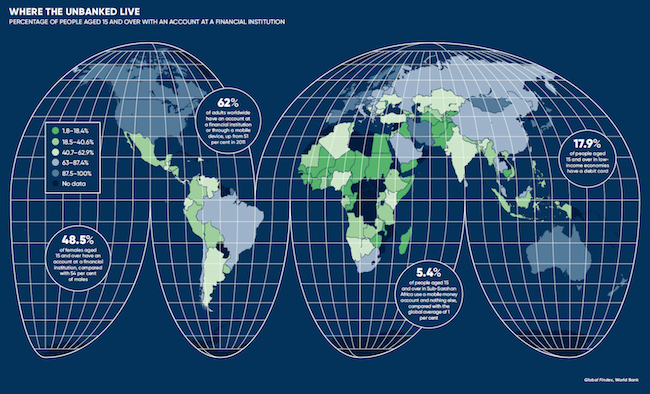

Having access to a bank goes along way to providing financial stability - Banking the Unbanked is a $380B Opportunity.

Home again, home again, jiggety-jog. Our market is in the green this morning along with Naspers which is trading at an all time high. The Rand is below the phycological $/R 13.00 level and Pound/R 17.00 level, steady as we go.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment