"The Zurich listed price, since the clamp down on "gifting" in China, has "gone nowhere" for nearly 50 months. In Rand terms, over 50 months, we are up 46 percent. That is not to say that the Richemont share price has gone up and down in-between, and reached different levels (it has). I am making an observation about the Rand price of an asset being protected by a weakening currency."

To market to market to buy a fat pig The Rand sank to a 7 week low, which really does not sound that bad at face value. It did boost the market, many of the Rand hedge stocks, the companies with a large portion of non-Rand earnings, and primary listings elsewhere (be it Frankfurt, London or Zurich) were given a shot in the arm. It feels in a way "false", stocks went up as a weaker Rand boosted their cause, it is what it is.

In order to grow and protect capital, many of these businesses have established a listing elsewhere. It gives these businesses an opportunity to operate in deeper and more liquid markets. An offshore listing with access to said capital markets gives businesses an opportunity to raise capital in a cheaper interest rate environment. Equally, if you have businesses offshore (like Naspers and Aspen) and you do NOT have a listing elsewhere, you can get financing from financial institutions and investors in those environments.

For instance, as per their last set of financials, Aspen has (had) 35.6 billion Rand worth of debt, of which 30 percent of it was here in South Africa. 63 percent was in their international business (mostly Europe), and the rest in Asia Pacific (7 percent). The blended interest rates that they are paying currently are as follows, 8.9 percent in South Africa, 4.1 percent in Australia and 2.1 percent in Europe. For the most part, debt has been raised in order to acquire businesses, most recently thrombosis and anaesthetic related therapies. So much so, that they (Aspen) are now a serious operator in this space worldwide. You can imagine if the debt was issued in Rands, it would have been prohibitively expensive, relative to having access to those markets.

As a separate and an aside to this discussion around Rand hedge businesses, the CEO was in the news recently (finally for the right reasons) saying that they would focus more on emerging markets, rather than developed markets. They are studying a recent (Monday afternoon) ruling from the Italian courts and are perhaps going to appeal the 5.2 million Euro fine. What I find "interesting" is that the Italian company selling the generic to what Aspen bought and hiked the price, sell that one (the generic) for double. Think about that for a moment, the Italian authorities okayed the generic pricing at double the existing (and hiked) price of the Aspen therapy. European regulations are somewhat bizarre and all over the show.

OK, more to the point, if a listed business is more exposed to a weakening Rand, then this has a positive impact on the share price. Either if the share price is listed in say, Zurich (like Richemont is) or if the revenues are sensitive to the currency (like Sasol for instance). The Richemont share price in Rands yesterday was up 0.95 percent, trading at 110 Rand. Meanwhile, in their major market and primary listing in Zurich, the stock was down 0.13 percent yesterday. On paper your Rands are worth more, actually in Swiss Francs, you are down a smidgen. That has made my point.

The Zurich listed price, since the clamp down on "gifting" in China, has "gone nowhere" for nearly 50 months. In Rand terms, over 50 months, we are up 46 percent. That is not to say that the Richemont share price has gone up and down in-between, and reached different levels (it has). I am making an observation about the Rand price of an asset being protected by a weakening currency.

At the end of the session the ALSI had rallied around four-fifths of a percent to close at nearly 52 and a half thousand points. There were new 12 month (and in this specific case, an all time) highs for the likes of Bidcorp (up four and a half percent), the food services business that we hold widely for clients. At the other end, there were 12 month lows for the likes of Sun International, and Sygnia (the asset manager down in Cape Town with the outspoken CEO), perhaps a sign of the times.

Across the seas and oceans, stocks in New York, New York were mixed by the close. The nerds of NASDAQ bounced back (up two-thirds of a percent), the Dow ended a smidgen down and the broader market S&P 500 was in-between, up 0.15 percent by the close of business. The top winners included the likes of Alphabet, Amazon and Microsoft, I seem to sound like a stuck record when talking about these share prices, they are either on side B (selling off collectively) or on side A (going up collective).

In the news and getting pasted overnight was Tesla, down over 7 percent as Goldman Sachs struggled to see them being able to meet production goals. It really is the same old, same old actually. At the same time, Guggenheim securities upped their price target. I guess, without knowing how it works too much, this may well be a case of Goldman 1 - 0 Guggenheim, in the short term. Tesla stock is always going to be a very, very wild ride, what I am certain of is that Elon Musk is working really hard to achieve his goals and has in principle delivered at a better rate than almost anyone else. See how he is changing the perception of the public, in the links below.

Those of you who have never flipped a record, a LP record, you actually have to turn it over on the turntable. I tried this in the office, and asked a few of the people whether or not they had actually laid a record on a turntable. One fellow, doing a few days interning (during the varsity holidays) had never seen a turntable or a record (LP). Can you imagine that, if you are over the age of 50 (40?), you would definitely remember this, provided that you were brought up in a middle class house.

Linkfest, lap it up!

So it has begun, Volvo has announced that from 2019 they wont have any combustion-only vehicles, they will either be hybrid or pure electric - Geely's Volvo to go all electric with new models from 2019

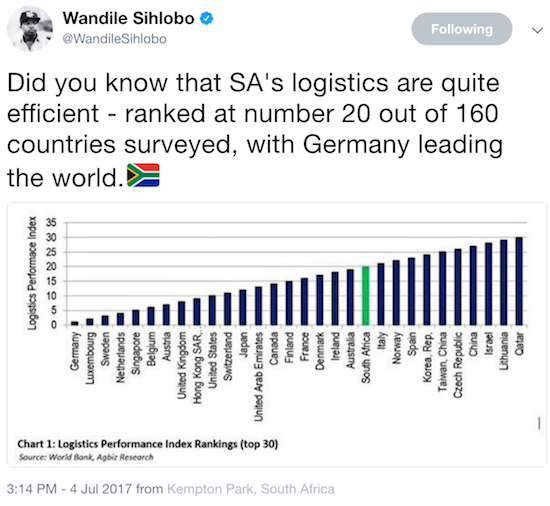

Found this great stat on Twitter yesterday. It is a big feather in the cap of South Africa's private sector.

Great to see Discovery and Vitality making waves globally. The Forbes article is about their innovations they are bringing to healthcare and to fintech - Get Paid To Lose Weight, And Other Ways Fintech Wants To Make You Healthier

If my bank account/ Visa card has fraudulent activity on it the bank will return my money, nice extra peace of mind. I'm not sure what happens to these customers who have lost their Bitcoins? (One of the world's biggest bitcoin exchanges has been hacked) Is Bitcoin a currency, investment or commodity? Do the people buying it even know why they are buying it?

As people get busier and costs of healthcare increase, outsourcing general GP visits seems like the logical next step. In the UK you can now consult with a doctor using an app on your phone - Push Doctor.

Home again, home again, jiggety-jog. Stocks are marginally higher here again, to start with. Dean Elgar and his troops start the "real cricket" today, let us hope that their stock ends sharply in the green by the close.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment