"I remember when I was young, my father had proudly acquired a set of encyclopaedias and tasked me to go look it up when I asked a question about something. Search nowadays is a far easier task than before, my daughters teacher told us that her class of nine year olds all researched their speeches and topics on the internet without help. So my dad telling me to go look it up in the dictionary and encyclopaedia really are days gone by."

To market to market to buy a fat pig Stocks in Jozi rallied nearly four-tenths of a percent, mainly led by industrials and a fresh all time high for Naspers shares, that stock closed at 2860 Rand, up nearly two percent on the day. The top performing stock on the day was Woolies, over two percent to the good. Still, over three months Woolies is down 12 percent, since the surprise rate cut last week, the stock has rallied on the basis that richer customers are likely to have smaller debts to pay and therefore will have more disposable income.

In the down column were some currency impacted stocks, those ones with a Pound Sterling bias. Since last Tuesday the Rand has gained around 60 cents to the Pound Sterling, and we see a number with a 16 in front of it again. You will recall that when the Barmy Army was here and Ben Stokes was flaying a Proteas attack to all parts of Newlands, that the Rand was at 24 to the Pound. We are now 16.84 (or thereabouts).

There was a trading update from AVI that the market didn't seem to like that much, the stock was sent lower and then recovered some of that - Voluntary Trading Update. Group revenues rose by a little over 8 percent, there is a once off after-tax impairment of 108 million Rand on Green Cross, the shoes business. They make decent shoes, it is a pretty crowded space, however.

The stock had been priced for perfection at 97 Rand a share, with a heavy dividend underpin, I would say that the stock may trade down to a five odd percent yield. I would suggest that the price would sag back to around the mid eighties. Hey, what do I know about share price movements? Very little and trying to predict where that is likely to go is tricky at best. Nonetheless, the AVI release is telling you what you know already, it is tough out there. The stock is up marginally this morning! See, what do I know!

Stocks in New York, New York steadied after an initial sell off, the nerds of NASDAQ rallied to an all time high, up over one-third of a percent on the session. Both the Dow Jones and the the broader market S&P 500 sank, the Dow by just under one-third of a percent, whilst the broader market gave up just over one-tenth of a percent. GE stock continues to slide, the stock is down nearly 20 percent year-to-date. The results were iffy at best and unfortunately the outlook is pretty muted, the full year multiple is around sixteen and a half, and I would hardly suggest that enters the realms of dirt cheap. In their favour is that the dividend yield is around 3.8 percent, that yield underpin is probably likely to see the price not fall much more. Unless of course if rates go up a little quicker than you think, although the market is telling you otherwise.

This is a big earnings week, continuing through to Apple results next week Tuesday, remembering that there are unlikely to be any clues with regards to the new phone, Apple are notoriously cagey with regards to the secrecy around their projects. There is some talk of the new iPhone cycle being in time for the Holidays this year, it may be a little later than usual as not all the tweaks on the handset are perfect. That is the understanding. Facebook stock traded at an all time high last evening, closing at 166 Dollars a share exactly. On a 41 multiple, remember how the company was supposed to be not really profitable until round about now.

Company Corner

Alphabet. Alphabet is recently named as the holding company for Google, and their other businesses. Indicating that the company wants to increase their relative market shares in things outside of search. Search of course is synonymous with Google, you never hear anyone say, go Bing it or go Yahoo! it. Or for the older crowd amongst us, you never hear anyone say go Ask Jeeves it. Nor did you hear it in the days gone by, when web pages were flat html text, ah yes, the good old days!

I remember when I was young, my father had proudly acquired a set of encyclopaedias and tasked me to go look it up when I asked a question about something. Search nowadays is a far easier task than before, my daughters teacher told us that her class of nine year olds all researched their speeches and topics on the internet without help. So my dad telling me to go look it up in the dictionary and encyclopaedia really are days gone by. Young kids all use Google to search. And of course YouTube, they (and adults) use that a lot too. Adults, they use this functionality a lot more, of that I am sure.

Alphabet reported their second quarter earnings last evening, you will read loads of headlines of how the EU fine has put a lid on the profits, understandably. Talking adults for a second here, Ruth Porat, the CFO brought across from Wall Street, made the financial statements and use of resources internally less frivolous and more grown up. With no disrespect to the people running the business before, I am pretty sure that this is exactly what the folks who started the business wanted. Along with Sundar Pichai, the company has managed to seamlessly pass onto professional managers who take the business of Alphabet as seriously as the founders and controlling shareholders (Page and Brin).

At a headline level, both the earnings per share number and revenue number was a comfortable beat, quarterly revenues clocked a little over 26 billion Dollars (an increase of 21 percent year over year) and EPS for the quarter was 5.01 Dollars, without the impact of the 2.74 billion Dollar fine levied, it would have been 8.90 Dollars. This time last year, Q2 2016 EPS numbers were 7 Dollars a share exactly. I was pretty surprised to see a massive ramp up in staff, obviously I have not been paying as close attention, the business now employs over 75 thousand folks, happy Googlers (1614 people employed during the quarter). Or are they Alphabetters? The current quarter is where the usual ramp up in staff comes, new graduates enter the workplace.

The business is still dominated by Google revenues, 25.762 billion compared to a mere 248 million Dollars from "other bets". Other bets made a slightly narrower loss, still clocking 772 million Dollars however. Cash on hand swelled to 94.7 billion Dollars (a radio frequency here on the highveld), 61 percent of which is held offshore. Cash to market cap is 14 percent. Far lower than is the case with Apple. The business still does not pay a dividend, perhaps they anticipate a far stronger Capex cycle over the coming years, I suspect that in time they may consider this. The dirty D word (dividend for a growth company) wasn't mentioned once in the conference call.

Sundar Pichai made a few interesting points on the earnings conference call that are worth sharing. Firstly, Youtube has taken a long time to grow to a more important level as a contributor, 1.5 billion monthly viewers watching on average 60 minutes a day. Now before you shout, what the hell are those people doing wasting their time watching Youtube, what are you doing watching an hour of GOT on a Monday night and 90 minutes of football and 80 minutes of rugby on the weekend? It is all entertainment, just of a different kind. Adding to yesterday's Visa piece (and fodder for Amazon), Pichai made an interesting observation yesterday, 90 percent of all transactions still happen offline, i.e. brick and mortar stores. Google needs to help these people in advertising their space.

Alphabet is a phenomenal business. Forget "other bets" and focus on the "one trick pony". The seamless transition to mobile means that they are more in your face, the average cell phone user checks their mobile around 76 times a day. High users are around 130 times, there are a whole lot of separate events. It is great to be the leader in search, on more than one platform, i.e. the internet and Youtube. The biggest reason for the fall in the share price post the market is that the cost of acquiring users to click through on the adverts has risen, in other words, what Google will pay the likes of Apple to get their iPhone users to click through. Forget the fine, cash on hand actually increased by a lot more than that 2.7 billion Dollars.

Alphabet still looks cheap relative to their growth prospects, trading at roughly 25 times next years (2018) earnings, with earnings growing of around 20 percent, that puts the PEG ratio a little above 1. This is a great business, I suspect that we are looking back on a company that will continue to define the next industrialisation phase and be pleased for continuing to own it. Continue to own this one, like Visa, this is a bottom drawer stock.

Linkfest, lap it up!

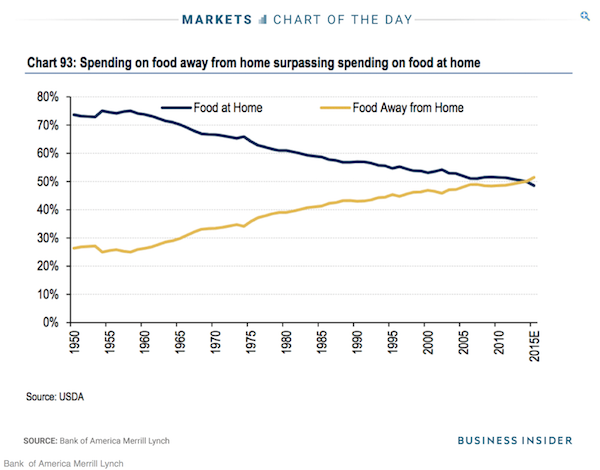

This is not only an American trend it is a global trend - This chart shows a major shift in the way Americans eat. Good news for the likes of Famous Brands.

Amazing to see how these whales sleep - 'Tail-Standing' Sperm Whales Snooze in Stunning Photo. Given how exposed they are when they sleep it makes sense that they only sleep 7% of their time.

The problem of slums is something that most cities around the world are dealing with. Slums pop up due to the proximity to jobs, so even giving better housing away from the city doesn't help much. The inner-city of Johannesburg currently has that problem, where reclaiming down trodden areas has resulted in poor families being pushed out due to price and higher income families moving in. No doubt a good thing for the city over the long run, not great for the families that used to live there though - There's a simple reason why Indians return to the slums after they've been given better housing.

Home again, home again, jiggety-jog. Tencent is around one-third of a percent higher in Hong Kong trade, stocks on balance are down in Hong Kong and Japan. We have started better for now, mostly a broad based rally here at the get go. Watch out for interesting results coming your way!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment