To market to market to buy a fat pig. You know that it was a tough day out when CNBC showed the top 5 'gainers' of the S&P 500 for yesterday, as stocks who lost the least! Not even cryptocurrencies have survived the current market sell-off, Bitcoin is down 24% to $6 200 a coin, ouch!

Market Scorecard. After the carnage on the market yesterday, US indexes are now red for the year. The Dow was down 4.60%, the S&P 500 was down 4.10%, the Nasdaq was down 3.78%, and the All-share was down 2.63%. Having a look at Asian markets this morning, our market is going to open very deep in the red! Tencent in Hong Kong is down 6%, which means Naspers will be down a similar amount too. If that happens Naspers will be trading around R2 900 a share, a far cry from the R4 000 plus a share in November last year.

Why is it so 'easy' for the market to fall 4% in a day, but it is almost unheard of for it to gain 4% in a day? You can blame our cave-dwelling ancestors for the irrational thought process of Loss aversion. In simple terms, a loss hurts more than the pleasure you get out of a gain. Roughly speaking, to balance out the potential of a 5% loss, the other side of the equation needs to be the potential to gain 10%.

Added to that, our minds are generally lazy, so they latch onto the stories that are easiest to imagine. What is more natural to imagine, the stock market dropping to levels it has been at before or it pushing higher into uncharted territory? When people talk about stock market history, the landmarks are usually the periods of stock market crashes, not the periods of record highs. As such, after a small drop in stocks, it is not hard to jump directly to the 'this is a crash' scenario.

Add those two mental tendencies together and 'Sell first, ask questions later' becomes our go-to strategy.

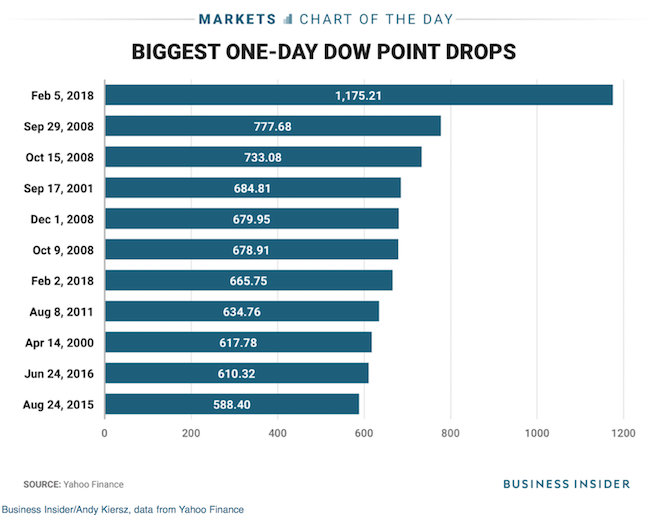

The following graphs from mainstream media don't help the situation either! (Here are the biggest one-day point drops in the Dow's history)

As Paul points out below, when ranking yesterdays drop in percentage terms, it would be lower than Bafana Bafana on FIFA's global ranking.

One thing, from Paul

Well, last night was a tough trading session on Wall Street. As you will have read above, the Dow saw it's biggest points decline (1175 points) in history. However, at 4.6% off, it was only the 108th worst percentage drop of all time. So there were lots of days that were worse.

According to Josh Brown, the last time we had a Dow drawdown this big in a single day was in August 2011. He notes that the Dow was at 10,700 points then and today it closed at 24,345. That puts things into perspective.

The intraday slump was even worse, almost 1,600 points before a slight rally into the close. Again, big numbers (the rally of the last eight years) begets big numbers (the slump in nominal terms).

If you feel bad about all this, I wonder how poor Jay Powell is feeling? It was his first day on the job as Federal Reserve chair. Mind you, one of the reasons advanced to explain the sell off was that strong US employment numbers on Friday last week might lead the Fed to hike rates too fast this year. Well, that's easy to fix! No inflation, no need to hike rates aggressively, right?

So the market went lower because people think that the global economy is too strong? We shall see what happens next, but I 'd rather that we were complaining about a strong economy, than one which was too weak.

The right thing for you to do at this time is nothing. Ride it out! Equity markets do this sort of thing from time to time. Its part of the deal. I have been in this business for most of my adult life, and I've lived through many similar dramas. If you jump ship now you lock in poor exit prices and are out of the market when the rally comes. If you feel like being brave, it can be a good idea to buy these dips.

Company Corner

Bright's Banter

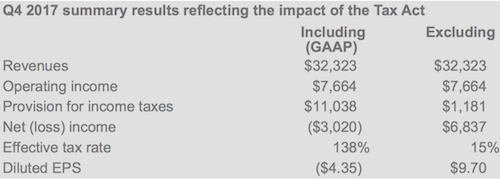

On the 1st of February, Alphabet/Google blessed us with financials for the last quarter of the year, as well as the full-year numbers for the year ending on 31 December 2017. The company missed earnings expectations, with $9.70 per share coming in just under the $9.98 forecast. Shares were down 5% in after-hours trading when those numbers came out.

The amazing and not so new Ruth Porat, CFO of Alphabet, opened by saying the following on the earnings call:

"Our business is driving great growth, with 2017 revenues of $110.9 billion, up 23% year on year, and fourth quarter revenues of $32.3 billion, up 24% year on year. Our full year operating income growth continues to underscore our core strength, and on top of this, we continue to make substantial investments for the long-term in exciting new businesses,"

Now in English, "The business is growing from strength to strength. 2017 was our record year and record quarter, and we will continue to seek out more complimentary opportunities to continue to grow our business."

This amazing one-trick pony posted an all-time record for advertising sales which is now 85% of revenues. These ads are the ones we see on our smartphones and at the beginning of a YouTube video. The only problem with the smartphone ads is that they bring home less bacon than the traditional desktop/laptop ads. This will change over time as engagement increases on mobile due to larger screens. Google's cost-per-click, what advertisers pay each time someone clicks on an ad, declined 14% for the quarter, this will stabilise over time.

However, Alphabet posted a net loss of $3 billion for the quarter due to a $9.9 billion once off charge tied to changes in the US tax system. This is not a surprise at all as we have seen banks reporting similar tax charges. Thank you Trump?

Google is still the largest, most dominant search-engine by miles thanks to its positioning as the default search engine on Chrome and on mobile phones. Sometimes Google has to pay the likes of Apple to be the default search engine on their Safari browser and this payment is referred to as traffic-acquisition costs or TAC. TAC was 24% of Google's advertising revenues, which was up 33% year-on-year. According to the lovely Ruth Porat, Mobile Search and something called "Programmatic advertising" carry the highest TAC.

"Other revenues" which include sales from Google's Cloud Business, The Pixel Phone, YouTube Red, Google's Smart Speaker, Google Play Music etc. came to $4.7 billion for the 4th quarter, up 37% year-on-year and was 15% of Google's overall revenues thanks to the strong holiday sales.

Alphabet's "other bets" which include their self-driving car business Waymo, smart-home hardware provider Nest, and their fibre-to-home business Fiber, are still loss-making businesses.

Alphabet's shares were up just over 30% for the year of 2017, they're up 6.5% year-to-date at time of writing, valuing the company at $775 Billion. The company continues to buy back more shares, the board has authorised to buy-back a further $8.6 billion worth of its Class C shares. If you strip out the once-off tax item, the historic price-to-earnings ratio of 35 and a forward price-to-earnings ratio of around 29 is still relatively cheap for a high-growth technology company.

Linkfest, lap it up

Michael's Musings

Putting the market crashing aside. Today humans get one step closer to going to Mars, Elon Musk's Falcon Heavy rocket is scheduled to launch this evening - SpaceX has received permission from the US government to launch Elon Musk's car toward Mars.

Home again, home again, jiggety-jog. Our market is down 3% this morning on the open. The morning after Brexit is the last time I can remember such a poor start to the day. Later today, is the South African business confidence number; given all the positive chatter around I expect it to be smartly up.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment