To market to market to buy a fat pig. Phew, we survived super earnings Thursday. Given their huge growth rates, coupled with high expectations, tech stocks are always the most exciting earning events. It has been known to happen where a tech stock, particularly those belonging to 'FANG', can rocket 20% or slump 20% after reporting. Here is how they did compared to analyst expectations:

- Apple beat on revenue and on earnings, stock is up 3.4%

- Alphabet beat on revenue, but missed on earnings, stock is down 2.2%

- Amazon beat on revenue and a strong beat on earnings, stock is up 6.3%

- Amgen missed on revenue and on earnings, stock is down 1.7%

- Alibaba beat on revenue but missed on earnings, stock is down 6%

- Visa beat on revenue and on earnings, stock is down 1.1% (sometimes you can 'beat' and still disappoint the market)

Over the last few weeks, there have been concerns about the number of iPhone X's sold. I read a comment where one user was asking if they are going to stop producing the phone because of weak sales. I think this tweet sums up the iPhone X and Apple in general.

Market Scorecard. It was a red day for most markets yesterday and an even worse day for Bitcoin. Byron joked in the office saying that the 2% drop in Bidcorp, is out of sympathy for the 15% drop in the Bitcoin price. The Dow was up 0.14%, the S&P 500 was down 0.06%, the Nasdaq was down 0.35%, and the All-share was down 0.42%

Company Corner

Byron's Beats

I get the hype around Bitcoin and blockchain technology. The notion of an unregulated, fee free, community-based network sounds great. The problem is people will always misbehave. It is human nature. Even more importantly, governments need to track payments so that they can gather taxes. No one likes paying taxes, but they are very necessary. Yesterday India expressed a will to regulate cryptocurrencies. Can you blame them? They have been working exceptionally hard to eradicate a cash based society in order to track payments and raise taxes. If Bitcoin went mainstream with no regulation, then that would have been in vain.

Visa reported earnings last night which looked fantastic. In a way, Visa aims to achieve the same goals as cryptocurrencies. They provide an easy, trustworthy and efficient medium of exchange. Of course they do not do it for free. But why should they? They are offering an exceptionally useful product. The difference here is that regulators love Visa! Swiping plastic can be tracked through the banks. Tax evasion is bad for economies and most notably, the vulnerable people in society. Governments ability to track payments is a good thing.

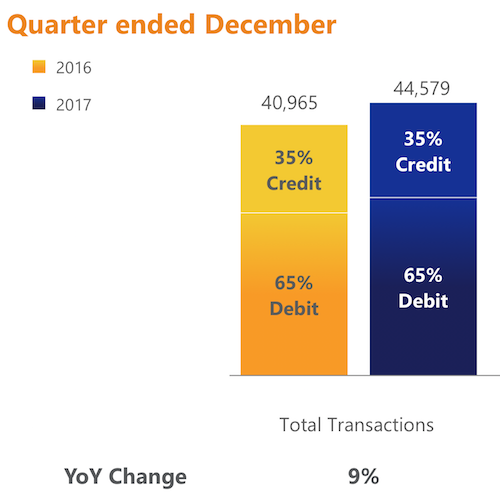

Ok, let's look at the Q1 numbers. Net revenues grew 9% driven by strong international revenue. Total payment volume increased 12.4% in constant currencies to a whopping $2.030 trillion. International (outside the US) grew volumes by 15.2%. This is good news as the developing markets start adopting plastic transactions. The picture below shows how many transactions took place using Visa cards and with what cards.

Earnings came in at $1.08, well ahead of expectations. The company expects earnings for the full year to increase by more than 20%, helped by a $7.5bn share buyback program. Earnings for the full year are expected to come in at $4.40. The stock trades at 28 times earnings which may sound expensive but remember they have operating margins of 68% and are growing earnings north of 20% per annum.

There are so many tailwinds for this business. I already mentioned the regulatory environment but consider the changes in the way we consume. Uber, online retail, app-based rewards programs, music streaming services, video streaming. They all support credit card payments. We continue to add to Visa as a core Vestact holding.

Michael's Musings

Last week, Johnson & Johnson released their 4Q and FY numbers, beating market expectations. One of the reasons why I love the company as an investment is because it is basically three companies in one. Investment bankers have been licking their lips at the prospect of breaking the company up, arguing it unlocks value for the shareholder. A breakup probably will add value in the short term, over time though I think having a strong brand and some diversification across sectors is more important. Here is a breakdown of the company:

Reading through all of their brands and the therapies that they own, you realise how huge this company is. Unlike something like Alphabet, where over 90% of profits come from one product, JnJ has many products in different life stages. For example their diabetes division had 16% lower sales due to increased competition, but the electrophysiology and atrial fibrillation divisions registered growth of 20% and 13%, respectively.

Diversity is what you want in a healthcare company. One day you could wake up to find that your drug does more harm than good, not good if you are a 'one trick pony'. Due to JnJ's size and diversity, the stock is not going to shoot the lights out. Over the last 10-years the stock is 'only' up 120%, Amazon is up by more in less than 2-years. With that size and diversity comes strong cash flows. JnJ boasts a record of increasing their dividend every year for 55-years! We think this is a great anchor stock for your portfolio.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: What really happened at Steinhoff, China spying in Africa, airlines have had it with your "emotional support" animal, and Volkswagen hit by Dieselgate 2. - Blunders - Episode 86

Vestact in the Media

Michael chatted to The Eusebius McKaiser Show on 702 about Capitec - [LISTEN] 'More research needs to be done into allegations against Capitec'.

Home again, home again, jiggety-jog. Not so highly anticipated non-farm payrolls are released this evening, US unemployment is expected to stay at 4.1%. During the financial crisis, this data was huge. It indicated how bad things were, and then how quickly things were recovering. Enjoy the weekend, hopefully the Proteas can return to winning ways at Centurion on Sunday.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment