To market to market to buy a fat pig. When Viceroy's short of Capitec and Steinhoff came to market, it was the first time that many investors had heard of the concept of 'short selling'. The initial reaction for many people was some form of outrage; the thought that someone can benefit when others lose money didn't sit well with them.

Short selling is more common than many people think. Most companies that you own have what is called a short interest in them. For example Tesla currently has around 169 million shares in issue, 30 million of those have been shorted. Having 17% short interest is much higher than most companies have. Because investors in Tesla have such polar views on the company, it has attracted many short sellers. If you were short Tesla over the last 2-years, you have watched the stock more than double. Ouch!

Short sellers take their chances just like everyone else, their job is actually harder than most. On average stocks go up more than they go down, short sellers are betting against that trend. No for me thanks!

If you have Netflix, you might have seen the documentary Betting on Zero. Bill Ackman shorting Herbalife, is probably the most public short position of the last couple years. Ackman put $1 billion on the line, as he pushed for Herbalife to go to zero because his research pointed to the company being a pyramid scheme that preyed on poor people. After being in the position for 5-years, and fighting the rising tide Ackman celled it quits on Herbalife.

I think short sellers have a role to play in the market. They help keep management honest and help keep a lid on inflated share prices. Maybe we should think of them with less disdain, and remember not all short sellers make money.

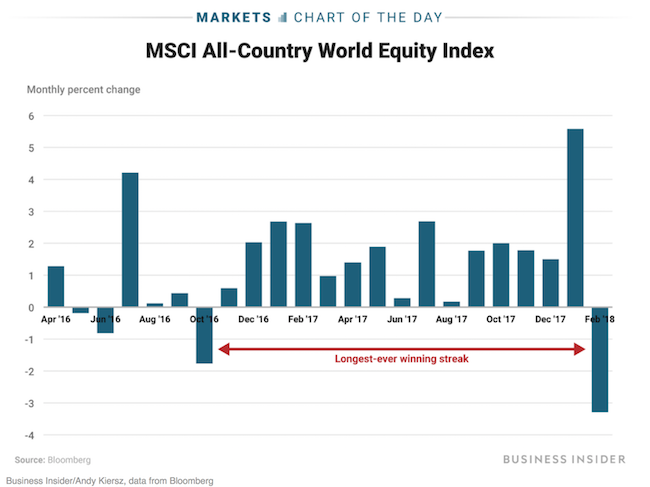

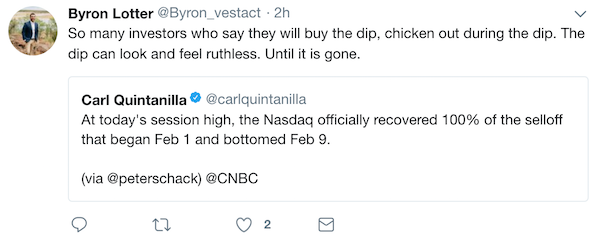

Market Scorecard: Last night the All-share closed up 0.29%, the Dow closed up 1.37%, the S&P 500 closed up 1.10%, and the Nasdaq closed up 1.00%. Yesterday Tencent announced that their WeChat platform now has more than a billion users. The news has pushed the stock up 3% this morning.

Linkfest, lap it up

One thing, from Paul

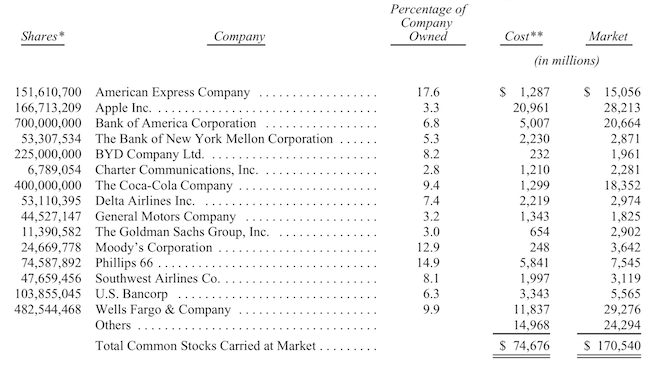

JP Morgan Chase is another core holding in the Vestact (New York) portfolio. It's the largest US bank and operates across retail and commercial banking, investment advisory and financial trading. Our basic theory is that rising interest rates and lowered costs (from greater use of fintech) will fatten up their margins.

The company recently announced that they would rebuild their headquarters, at 270 Park Avenue, in midtown Manhattan, New York City. The current building was erected in 1961, has 52 floors and was previously known as the Union Carbide Building. It's between East 47th and 48th Streets.

Interestingly, that building was heavily renovated in 2011, at considerable cost, to the US Green Building Council's highest environmental rating, LEED Platinum. Now, just six years later they will demolish the building and start again. It currently has about 6,000 employees crammed into a space that was built for 3,500.

During the demolition and construction process the banks bigwigs will be accommodated in nearby buildings — 237, 245 and 277 Park Avenue, as well as 390 Madison Avenue.

The new building will be a 70-storey world headquarters for 15,000 employees.

Out With the Old Building, in With the New for JPMorgan Chase

Michael's Musings

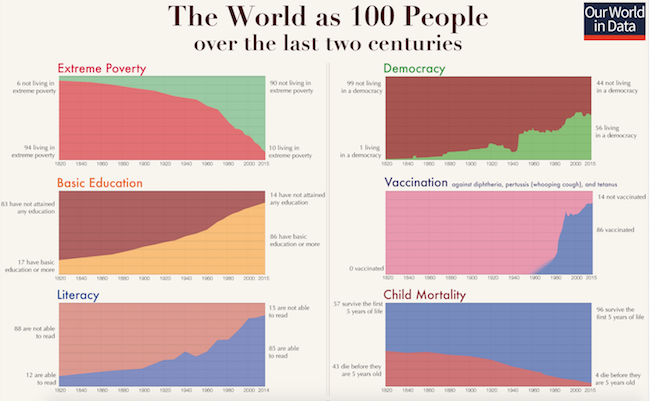

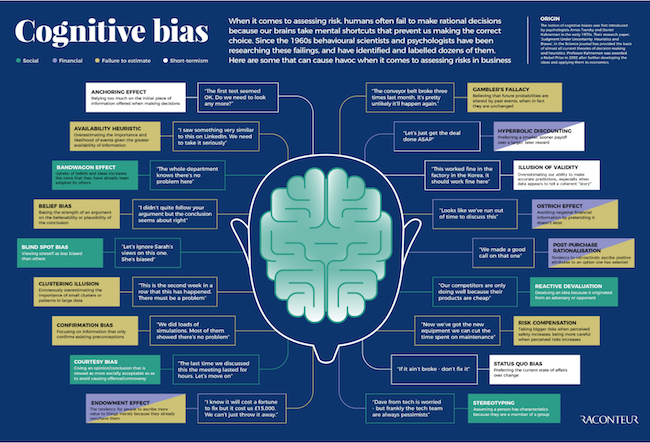

The skills needed to survive living in caves and running away from lions, are very different from the survival skills needed to survive modern living and investing. Here are some of the mental biases that served us well when we were cave men but are not so great when it comes to the stock market - 18 Cognitive Bias Examples. It is interesting to note, research has shown even being well versed in these cognitive bias doesn't prevent us from being directed by them.

Click on the link to get a full screen, clear picture.

Vestact in the Media

Bright gets a nice mention in this Business Insider piece - Why Tiger Brands' CEO couldn't say sorry

As you can imagine, Tiger Brands was big news yesterday. Michael gets a mention in this Reuters article - Tiger Brands, RCL Foods lost R5.7 billion in one day.

Home again, home again, jiggety-jog. Our market has kicked off into the green this morning, thanks to Naspers being up 3%. The only major data out today is RSA 4Q GDP. The data only covers to the end of December 2017, so we won't see much impact from renewed confidence, we will have to wait another three months to see that.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063