"I am getting to a point. In a world where there is more and more passive investing, index investing, who is going to set the prices of the individual stocks? Just the natural flows from monthly buying and selling (redemptions and additions), or will money managers and individuals set the bulk of the prices?"

To market to market to buy a fat pig Friday was jobs day, the most important day because it is, at least for global markets. The health of the US jobs markets is of importance for the rest of the globe, the old adage of the US sneezing and the rest of the world catching a cold still holds true. Perhaps not as much as before, with the rise of some significant other economies across the globe, still, the US is the biggest and most important. So, until that changes (many years from now) expect us to maintain the fixation with all things economic from the US. To check out the Friday number follow here - Employment Situation Summary.

The employment rate ticked up a little, to 5 percent, revisions were marginally lower for the two prior months by 7 thousand and overall the last three month run-rate was 192 thousand per month. The trend of where jobs being added is pretty interesting, restaurants (food services and drinking places) have added around 300 thousand people over the last year. Healthcare has added 445 thousand jobs over the last 12 months. The one sector that has beaten all others has been the professional and business services employment area, accountants, bookkeepers, architects, lawyers, consultants, scientific research, advertising, engineers, and so on. That sounds like a good thing, no? These people tend to earn more than the average Joe and work longer hours. I guess it goes without saying.

There is so much data to pick and choose from that I am sure you could come to multiple conclusions from the same numbers. The trend seems just fine. That crazy Joe Kernan suggested that the department of Labor were likely to fudge next month, ahead of the election. No need to worry Joe, your call in once upon a time (there was a segment called "Trump Tuesday") is doing all he can for you. Talking Trump, the debate for the record finished around 04:40 our time, this morning. Unless you are an insomniac, early bird or debate nerd, I am guessing that down here at the Southern tip of Africa, you will have to watch re-runs. That fellow is everything and more, I guess the fact that he still has huge amount of support means that I am missing something. Something about humanity.

Michael found a statistic about Saturday Night Live and the skits there (pretty good), and depending on which side of the fence you sat, your candidate won and theirs lost. i.e. Saturday Night Live nailed it. I guess we will learn through the coming days how the audiences found it. It really doesn't matter what I think, unless you can cast a vote in the upcoming elections, that is all that matters really.

Back to Markets and Friday, stocks closed off their best and worst levels for the day, comfortably off the worst though, mid afternoon. The broader market S&P 500 ended the day down one-third of a percent, the worst of the three majors, led lower by energy, materials and industrials. Strangely, the Dow Jones Industrial Average shed only 0.15 percent, whilst the nerds of NASDAQ sank just over one-quarter of a percent on the session.

Alcoa reports after the market closes tomorrow, that used to be the traditional kick off to earnings season back in the day when the company was part of the Dow 30. Share code AA now only has a market cap of 13.58 billion Dollars, that is smaller than Twitter. What is quite remarkable is that Alcoa was only dropped from the iconic index back in September 2013, three years ago. At that time HP and Bank of America were ejected too, Visa, Nike and Goldman Sachs were added. That took a while, wouldn't you say? Nike and Visa in for HP and Alcoa, as more representative of industrial America. The last change was in March 2015 when AT&T was ejected for Apple. That took a while too, wouldn't you say?

As per the S&P Dow Jones indices website "the DJIA today serves the same purpose for which it was created - to provide a clear, straightforward view of the stock market and, by extension, the U.S. economy." I think that the people putting it together want to be sure that the components have longevity. They want to be sure that you have the right "mix". The broader market S&P 500 is clearer, the biggest US companies by market capitalisation. In other words the only thinking taking place inside of the component sizes of the S&P 500 (i.e. the market capitalisations) are the investment community itself.

Which then leads me to a very important question, which may not be answerable by now. If you are investing for your retirement and do not care for individual stocks, it makes sense to be dollar cost averaging over time, i.e. adding time and time again, each and every month and sticking to a long dated plan. As such, you are buying the index each and every month, regardless of whether the prices are up or down or flat. The valuations for the single stocks that make up the components of the index are set by individuals at the back end of the money making decision, the share prices don't get made up. Even the algorithms designed to trade are written by humans, so whilst you may be trading against "machines", all of the hardware and the software are made by people. i.e. the machines trading are programmed to recognise human patterns and then move faster. It is an extension of human emotion.

I am getting to a point. In a world where there is more and more passive investing, index investing, who is going to set the prices of the individual stocks? Just the natural flows from monthly buying and selling (redemptions and additions), or will money managers and individuals set the bulk of the prices? When is the tipping point in investing humanity when the flows are overwhelmingly passive and then how will company valuations be determined? Makes you think, doesn't it? Or am I completely way off the mark? Or even worse, have I "articulated" it poorly?

Back to Jozi, the city founded on a large pile of gold, the stuff that Tutankhamun's mask was made of, markets were mixed to marginally better. The Rand to most major currencies is mixed to better here again, 17.07 to the Pound Sterling, perhaps we can collectively afford a Wimbledon ticket next year to watch on Court 2 in the cheap seats. You in? The fat finger Pound issue Friday saw 12 month lows being recorded for the likes of Brait, Capco, Hammerson, Intu, as well as Reinet and even Woolies. And Truworths. In the 12 month high column Exxaro, Anglo American, Capitec (that is an all time high) and the Rhodes Food Group.

There was a well received trading statement from Pick n Pay stores, the half year to 28 August (26 weeks) will see headline earnings per share increase by between 20 to 25 percent. It is amazing how Mr. Market loves a turnaround story, equally it is amazing how much can be done inside of a business when there are years of inefficiencies unwound quickly. As the trading update says: "A successful turnaround requires a programme of improvement over a number of years, and this result represents the seventh consecutive reporting period of substantive profit growth." Credit must be dished out where it is due, this is a very strong brand in the consumer domain, the company has done a lot to steer profitability northwards.

What I was quite "shocked" to see was that the Shoprite share price is up nearly 33 percent year-to-date, whilst Pick 'n Pay stores share price is up only 5.6 percent. Over five years, the Pick 'n Pay share price is up nearly 93 percent, whilst Shoprite has lagged, up 62 and a half percent. Over ten years, the Shoprite share price is killing it, up 654 percent, relative to the Pick 'n Pay stores share price of 137 percent. The Shoprite share price has not really budged since late 2012. 4 years. Meanwhile, the valuations have caught up and the stock may still be in the low end of forward expectations, representing good value. The Spar share price is ahead over five years, up 100 percent. The last 12 months sees the Spar share price marginally down. Our preferred investment in retail is Steinhoff and Woolworths. In the food space it is Bidcorp, Famous Brands and Tiger Brands.

Linkfest, lap it up

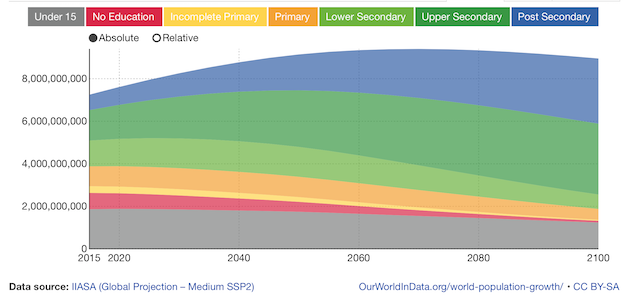

Over the next 85 years the projection is that the number of people with a post secondary education will go from around 700 million people to over 3 billion people - Projections of the Total World Population by Level of Education, 1970 - 2100. For that to happen the education model will need to change to accommodate all the extra people and to make it more affordable

The more that emissions come into focus with the end goal being a penalty for over polluting, the incentives increase to find environmentally friendly alternatives - The UN has landed a historic deal to curb airplane emissions. Battery technology still has someway to go until we can have solar powered aircrafts in commercial use.

Staying on the aerospace topic, having competition for being the first company on Mars can only be a good thing - Boeing says it will beat SpaceX to Mars. It is a bit mind numbing that the goal is to have a humans on Mars in the next 6 years.

Home again, home again, jiggety-jog. In two and a half weeks there will be results from Alphabet and Apple, midweek. Two weeks ago it is Visa. Microsoft is in ten days time, Amazon on the same day. Facebook at the beginning of November. Exxon Mobil just before that, at the end of the month. JNJ next Tuesday, GE next Friday, JP Morgan this Thursday and Wells Fargo this Friday. P&G in just over two weeks. These companies will all give you a better idea of how things are going out there, with regards to consumers and trends. There is more about the future of companies, and by extension the economy, where people are likely to be employed in the future, in their annual reports and numbers than there are in any government releases or Fed releases. Read those rather, that is a better place to make money in equity markets than trying to "time the Fed".

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment