"The company announced yesterday that they were acquiring a menswear line in Aussie, a brand called Politix. It is not big, sales of 56 million Aussie from their 75 stores (including 31 concessions across Australia) is not going to be an immediate changer, that is 585 million Rand in annual sales."

To market to market to buy a fat pig Stocks across the seas and far away bettered and bettered through the session, after having earlier in the day indicated a negative open. There was a services PMI number that jumped to an 11 month high, crude oil ramped up sharply after a bigger than expected drawdown on US stockpiles. Yes, that is still a weekly reported number that is very important. Apparently, I can recall when I was trying to work this all out a long time ago thinking that was the one number for the oil price. OPEC was a whole lot more important back then too. It is the one commodity that we use day in and day out, be it in by-products of crude, or for gasoline when we fill up.

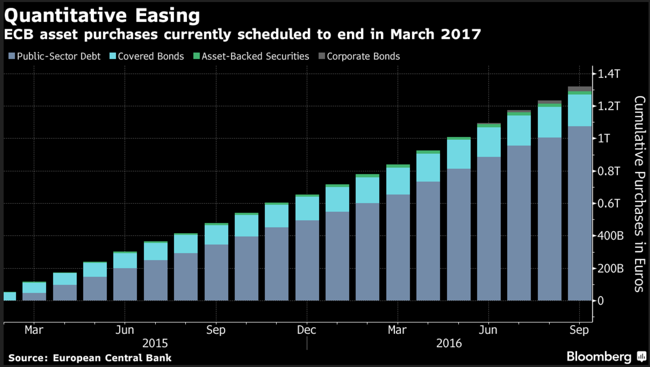

You will also recall news that the European Central Bank is going to begin their taper, something the US Fed did around two years this time. I recall the pictures of the funny looking oversized hamster from the Amazon jungle, the tapir. Yes? No? Perhaps more pig or boar than hamster. The supposed end date of the current ECB bond buying program is March next year, if they reign their necks in sharply now (see the Bloomberg article - ECB Said to Build Taper Consensus as QE Decision Nears), the program should end around the middle of next year. What has the ECB bought? According to the graph from the story, via the ECB, it has been mostly public sector debt:

And some covered bonds. Huh? We know what public sector debt is, what are covered bonds? According to Investopedia, it is as follows: "A covered bond is a security created from public sector loans or mortgage loans where the security is backed by a separate group of loans; it typically carries a maturity rate of two to 10 years and enjoys relatively high credit ratings."

So, if you want to know why the gold price took a dive a couple of days back, one of the reasons was the ECB winding in their QE program, and the other was that the Fed meeting 1-2 November was "live", meaning rates may go up. Is there any logistic problem that stops the Fed from setting the rate one-eighth of a percent higher? I mean, instead of raising rates by 25 basis points every time, in increments, why not raise it half of that until you reach one percent? Move the range every meeting a little higher and then monitor.

There was also a small matter of a September 2016: ADP Employment Report, something that is always the appetiser to the non-farm payrolls number released on the first Friday of every month. Unless it is too close to the end of the last month. i.e. if the 1st or 2nd of the month falls on a Friday, there is understandably not enough time for the US Labor Department to collate all the data. This was the lowest gain since the month of April, the labour market in the US has been one of the reasons why the Fed could actually start ratcheting rates up, inflation has been non-existent and that has been why they have not reacted faster. Remember the big debate of whether the recovery in employment would look like a V or a bathtub, many doomsayers expecting bathtubs and double dip recessions and deep pain? Well, I guess this graph settles the argument:

Yes, that looks distinctly like a V, you would say?

Stocks rallied across the street, led by energy and basic materials, in the end the Dow Industrial Average ramped 0.62 percent, the broader market S&P 500 rallied 0.43 percent, whilst the nerds of NASDAQ were in the middle, up half a percent by the closing bell. Salesforce was pulverised, down nearly six percent as the hard charging chief, Marc Benioff, had delivered his plan to investors and analysts alike of his number one goal right now, to buy Twitter. See the NYT story - Marc Benioff of Salesforce Addresses Acquisition Talk. The stock is down nearly 8 percent since they revealed plans to acquire Twitter. Twitter on the other hand, with expressions of interest and no hard and fast bid, has rallied nearly 35 percent in the last ten trading sessions.

Back home here, local was mixed, some lekker and some not. It was Miller and Phehlukwayo time at Kingsmead, KZN's finest showing the dudes in canary yellow how to go about batting with one working leg. OK, most of them had working legs, that is not fair. Interesting cricket stat, of the highest 11 run chases of all time, Australia have been on the losing end 8 out of 11 times. Hey, they have all those world cups in their cabinet, I wouldn't mind being on the losing end 20 times in the highest run chases for half of those trophies. Silverware aside, sport is an emotive thing in which one eyed fans totally lose their objectivity and become completely irrational. Really. Not too dissimilar to market participants, emotive and tail chasers. The amount of crap that I have heard over the years. Really.

Excitement on the JSE yesterday was the announcement from Blue Label Telecoms - Final terms announcement for the recapitalisation of Cell C and renewal of cautionary announcement. Blue Label are going to buy 45 percent of Cell C, that means assuming a pile of debt too. Nobody is quite sure what the debt levels are at the number 3 mobile operator in South Africa, this Sunday Times article - All options on the table for Cell C, suggests 14 billion Rand. This article - Blue Label to invest R5,5bn in Cell C - from the same fine journalist, Duncan McLeod, from yesterday suggests that the debt levels will be below 8 billion Rand after the cash injection.

Net1 will become a shareholder in Blue, in return providing much needed cash to Cell C. The market cheered the transaction, Blue Label stock rocketed nearly 9 percent to an all time high of 20 Rand and 20 cents, a market cap that is nearly a billion Dollars. Say what you want, you have to hand it to the Levy brothers and the folks that are around them. Net1 stock also rallied hard, over ten percent up on the day. They are certainly taking a big call here, I often think that people underestimate the role that data is likely to play in the economy in the future. Data prices will get cheaper, that is true too.

Quickly, to the indices, stocks here in Jozi, Jozi fell one-third on the day, financials were down around four-tenths on the day. Capitec and EOH reached 12 month highs. Remgro sank over four percent, Anglo was the best of the winners, up one and three-quarters of a percent. Losers sadly outpaced winners by a factor of nearly two to one.

Company corner

A relatively small announcement yesterday from one of our core holdings, Woolworths. Now remember that if you have been a shareholder for more than a few seconds, you would have been involved in the rights issue in which the company issued more shares in order to part fund the purchase of department stores in Australia, they are becoming a bigger clothing business. Fashion, at the top end of what is normal. This is not a 500 Dollar pair of leather shoes kind of market, this is the market where the shopper is undoubtably rich, not at the level of extreme luxury though. And the purchase yesterday confirms and rubber stamps that line of thinking (WTF, you can't stamp a line?).

The company announced yesterday that they were acquiring a menswear line in Aussie, a brand called Politix. It is not big, sales of 56 million Aussie from their 75 stores (including 31 concessions across Australia) is not going to be an immediate changer, that is 585 million Rand in annual sales. Not nothing. Woolies had annual sales of 66.9 billion Rand. This is less than 1 percent of total sales, if they can ramp the brand across all of their locations in the Southern Hemisphere, it will get bigger. At first glance a blazer from the website costs around 250 to 370 Dollars, Aussie. 3800 Rand at the top end of the range for a blazer. The Country Road jackets in Aussie are more expensive, I was wrong on my initial thinking that they were "more premium".

Does this move the needle? No. Is this part of the long term trend of trying to identify good brands that will grow revenues at the fringes? Yes, and all of this creeps up on you.

Linkfest, lap it up

Gold has had a strong year so far, up over 20%. This was achieved even though one of the main buyers of gold was not in the market - Only 3 countries have been building up their gold reserves this year. A big chunk of the demand has come from ETF demand.

How many of these events do you remember? Some of them are large long lasting events like the dot com bubble bursting, others were much shorter like the Chinese debt concerns last year - Black Swans: 9 Recent Events That Changed Finance Forever. Depending on your time frames, these events presented buying opportunities.

Great investors know how to communicate to their clients yet the average person will have over 50 different portfolio managers in their investing life time - They All Have One Thing In Common.

Home again, home again, jiggety-jog. Stocks across Asia are up! I suspect that we should enjoy a day of gains here locally, it has been tough out there, business confidence sank to the same levels that the Pound last saw to the US dollar, true story, business confidence in South Africa is at a 30 year low. What? Does it feel like that to you, in your business that you own or work for?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment