"Google announced a new phone yesterday, it is the "Pixel". From the website, Made by Google, the intro is titled Meet Pixel, Phone by Google. There was also the release of a home connected device, a speaker that is powered with the "Google assist" software. It is activated by saying, "OK Google"."

To market to market to buy a fat pig In for a penny, in for a pound. The expression means that no matter how deep the time and effort to finish the job, you're in and you must finish. Except in Theresa May's case, the pounds and pence are worth less to Dollars. Yesterday the Pound sank to a 31 year low, I commented in the office that 1985 was a time of Margaret Thatcher, Ronald Reagan and Mikhail Gorbachev. Of those three, only Gorbachev is still alive, he still speaks about matters political.

It was also a time of the cold war, 1985, although glasnost and perestroika were Russian words we were about to get used to. The Berlin Wall was still up. TVs came in the large (and very heavy) tube variety. The original Schengen Agreement was signed in 1985, five states, Belgium, France, West Germany, Luxembourg and the Netherlands are signatories. The first smoking ban in restaurants is introduced in Aspen, Colorado. Remember that you could still smoke on an airplane back then! Steve Jobs had resigned from Apple in 1985 to start NeXT, a business that Apple would eventually buy. There were only 4.8 billion of us back then, in 1985.

And to really let you know how old you are, Ronaldo was born in 1985, as was Michael Phelps. That was the year Rock Hudson died, I remember it well. Orson Welles died a little over a week later. Did you know that Welles' father Richard, invented the bicycle lamp? And to top it all off, the film Back to the Future (quite fitting) was released that year.

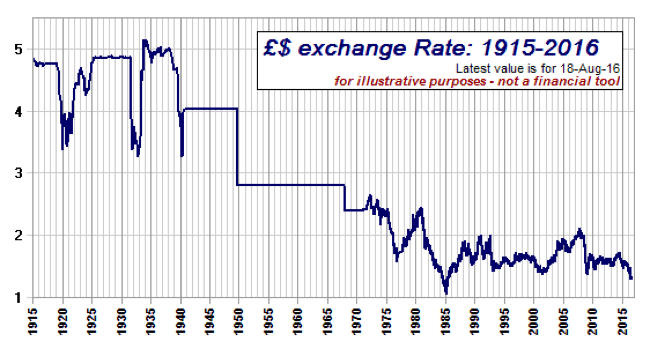

So that is what was happening when the Pound was last at these levels to the US Dollar. Heck, the Euro didn't even exist back then. Marks and Francs, Guilders, Pesetas and Liras, that is what it was. We certainly are now going, way, way back. So the current level of the Pound to the US Dollar is 1.2738 (as I write this). Back in November of 2007, the level was within a whisker of the 2.10. There is a fellow (Mike Todd) who has taken the trouble to upload a very long dated graph of the Dollar to the Pound:

What this graph does tell you is that floating exchange rates are a relatively new thing for capital markets, not even fifty years old. Whilst we take exchange rate interchangeability for granted, as you can see from two majors, it is "new". Whilst this list is not exhaustive List of countries by exchange rate regime, it does provide insight into the few "proper" central banks and currencies at the bottom of the list, under floating and free floating. There are Shekels, Rands, Kiwis (NZ Dollars), Bahts, Liras (the Turkish kind), Reals (Brazil keeping it ... ) and Wons inside of the floating inflation-targeting framework currencies, inside of "free-floating" (no exchange controls, that sort of thing), the list is even smaller.

The FTSE soared to an all time high, over 7100 points for the first time. It did settle back at 7074 by the close. Lean in a little here, since the last day of the last millennium (31 December 1999), the FTSE is up all of 2.08 percent in that time. It has halved from those levels twice, in March of 2003 and then again six years later in 2009. As always, it matters where you drew your line in the sand. In keeping with the 1985 theme, the FTSE is up 454 percent in Pound terms since the middle of that year. For comparisons sake, the broader market S&P 500 in the US is up 938 percent in Dollar terms. Most of the major outperformance has come since the financial crisis of 2008.

The gold price weakened on the day, the Rand strengthened a little and at the same time a Fed member, Loretta Mester, suggested that the November meeting was "live". Meaning a rate hike may happen then. That is with a November 2 announcement, with the meeting taking place over two days. Here is the Bloomberg story - Fed's Mester Says Case for November Hike Will Likely Be Strong.

Stocks in New York, New York, slid away from a better start, down around half a percent for both the broader market S&P 500 and the Dow Jones Industrials by the time the closing bell rang, the nerds of NASDAQ lost just over one-fifth of a percent. Basic materials stocks were the noticeable losers, down nearly two percent on a stronger Dollar which often equals weaker commodity prices. Twitter was in the news again after-hours, the suggestion from the WSJ is that Twitter Is Expected to Field Bids This Week. Salesforce .... phew, that would be a big transaction relative to the "other" potential bidders such as Disney and Alphabet. I guess if the journal reports that the buyers are lining up here, we should just wait. Something that seems to be incredibly hard in the tweet and highly twitchy modern era. An era where you can say something at any time, and someone is always watching. Twitter stock is up nearly four percent after-hours, after losing steam during ordinary trade.

Stocks on the local front, with a local flavour added three-quarters of a percent, both Famous Brands and Anglo American reached intraday 12 month highs, before settling back to lower closes. In the up/down columns, AngloGold Ashanti was hurt badly by the falling gold price, Barclays Africa was top of the winners pops, in pretty much a broad based rally. There was not too much news on the go, a diamonds update from Anglo (an investors best friend? Not so much) and an acquisition by hard charging food group Rhodes. Who possibly have the best location for a head office around, where the road from Pniel meets the road to Franschhoek from Paarl. Nice in summer under the tall trees, not so great during the winter, which the folks from down there try and not share. As much.

Company corner

Google announced a new phone yesterday, it is the "Pixel". From the website, Made by Google, the intro is titled Meet Pixel, Phone by Google. There was also the release of a home connected device, a speaker that is powered with the "Google assist" software. It is activated by saying, "OK Google". Remember that to activate Siri, you simply say, "Hey Siri". When I do this at my desk, it seems to activate Michael's (next to me) phone. Good voice projection I guess. And then some streaming devices, "coming soon", premium TV to Audio streaming. The connected home is here, it will take a while to integrate it all and my sense is that we will all bumble through until we learn. The internet of things is being unveiled in front of our eyes here, with the Amazon Echo, Apple HomeKit and Google Home automation devices. And Virtual Reality headsets, don't forget those.

Google in their blog section on the website have an overview themselves - Introducing Pixel, our new phone made by Google. I really like the fact that they are going to be "in" the hardware and software, to close the entire ecosystem (whilst still keeping it completely open, if you know what I mean). Google reckons that this is the best smartphone camera ever. There are two sizes, to compete with the iPhone (I guess), the starting price (for those of you who live in the US, the UK, Canada, Germany and Australia) is 649 Dollars. This is NOT a cheap phone.

Google assist was unveiled by Sundar Pichai (the Siri of Google) - A personal Google, just for you, there are some lovely little factoids in that piece. In 18 years of Google, we have reached some level of artificial intelligence. The age of internet and robots will collide at some level. The company is pretty sure that the next decade is going to be amazing, I have to agree with them. All the products look good and user adoption will be determined in the coming week, when the company no doubt will let us know of the demand for their products. We continue to recommend the parent company, Alphabet, as a compelling investment for a "long, long" time.

What do other people think of the handset, the VR, the home integrator and "assist software"? I think that it is worth noting that Google is going for premium first and foremost, they want people who spend all day and every day with their handsets to spend a little more, to do a whole lot more, see the CNET take - Pixel and Pixel XL unveiled: Google's post-Nexus phones come out swinging (hands-on). USB charger of course and the headphone jack for those lovers of "wired" headsets. I drew the same conclusion last evening in a tweet when someone suggested that this is an "iPhone killer" (seen many), I think that this is competing head-on with Samsung and their top end phones. I think that bringing people into an ecosystem, where the user and the company controls all the hardware and software (the ecosystem) is very important. Choices are a good thing, democracy and capitalism enable such things.

Linkfest, lap it up

Here is the reason that taxes are rising on sugary drinks. If the government is fitting the bill for medical costs, raising taxes on the behaviors that cause increased costs for them makes sense both in raising more income and disincentivizing the behavior - Sugary drinks can kill

Here is one of the reasons that Amazon wants to build its own delivery service. Another reason for building their own delivery service is so that they control the customer experience from start to finish - Amazon spends more on shipping than it makes

This looks like a great initiative to up skill people with relevant skills to our modern society - CodeX program. Learning to code is a skill that you will be able to use for the foreseeable future.

Home again, home again, jiggety-jog. Stocks across Asia are mostly higher, remembering that this week is one of the "Golden week" vacations in China. A time of mass moving of people, both for family and for tourists. According to the China daily, which has accessed this information from the state media arm (Golden Week to see rising tourism revenue), Chinese tourist destinations are expected to receive 589 million visitors. The numbers are quite simply mind boggling. On the very first day of the Golden Week, 14.4 million passengers travelled by train, a 15 percent increase from last year. That is double the entire population of Hong Kong, for a little perspective. Perspective is something that we need a lot of.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment