"The stock trades on a 17.2 multiple, hardly expensive for a quality business. Whilst the stock and the company may not display the explosive growth prospects of some of their peers, this is definitely a "safe as houses" investment. In fact, I would go further and say that it is safer than houses, you can buy JNJ for your unborn great grandchildren. They will thank you."

To market to market to buy a fat pig Stocks in New York, New York ended the session off the best levels, the major indices still managed to close comfortably in the green. The nerds of NASDAQ added 0.85 percent, led higher by strong moves northwards in the Alphabet (Google) share price. Netflix also surged after their earnings report, the stock added 19 percent by the close. IBM had a tough time of it, quarter after quarter investors have been waiting for an uptick in revenues, they have been waiting 18 quarters for that uptick and are still waiting. In the meantime, whilst the patient wait, the stock yields (pre-tax) 3.72 percent.

Your five year return on IBM has been minus 20 percent. Ten years? Up 75 percent. And to think that the old fellow from Omaha read 50 annual reports of International Business Machines, before he invested a single cent. Berkshire owns 8.5 percent of the company, whilst they have owned it, they have not seen the price appreciate. I guess there will always be International. And Business. And Machines. If your favourite holding period is forever, you should be fine in any quality business.

Visa may have a new CEO soon, they did however hike their dividend by 18 percent. 66 cents a year on a 81 Dollar share price is hardly a kings ransom. Let us just say that we do not hold that one for the yield. Folks in the US are teeing themselves up for the next debate, that is tomorrow. At the closing bell, the broader market S&P 500 had added just over six-tenths of a percent, the Dow Jones Industrial average tacked on 0.42 percent.

Back home, stocks gains were capped by a strengthening Rand, relative to all of the majors. The all share index ended the session 0.7 percent higher, financials and retailers dominated the top of the leaderboard, with the likes of Shoprite, Remgro (currently raising nearly ten billion Rand through a rights issue) and Sanlam all popped sharply. At the opposite end there were the likes of AB InBev, Tiger Brands and MTN all sinking. The one year return of the financial 15 index is nearly minus 14 percent. That tells a story of a slowing economy and political interference, looming credit downgrades. Junk or no junk, companies proceed as before. Aspen took a knock, there was news that filtered through that the company had been fined in Italy for "gouging", hiking prices by as much as 1500 percent on a cancer therapy. Not good and deserved, the fine that is. I wonder what Stephen Saad (should this be true) is thinking?

Company corner

JNJ reported numbers for their third quarter yesterday, before the market opened. Before we get into those, let us have a look at the business. They operate across the globe, although in 2015, 51 percent of their sales were from the US, 23 percent of sales come from Europe and 18 percent from Asia Pacific and our continent. The balance (8 percent) is classified as "Western Hemisphere", which means Central and South America, as well as the other countries in North America. In terms of divisions, JNJ sales are (or were last year) split as follows: 45 percent pharma, 36 percent medical devices and 19 percent consumer. The company spent just over 9 billion Dollars last year on research and development (12.9 percent of sales), many of these businesses spend around 10-14 percent of annual revenues on searching for the next blockbuster, that will save countless lives in the future.

What is quite remarkable about this business is that the bookkeeping entires go all the way back to the founding of the business (three brothers, not two), the first time the company clocked 100 million Dollars of sales was just after the second world war in 1946. They clocked 1 billion Dollars for the first time in 1970. And 1 billion Dollars in profits for the first time in 1989. In 2005 the company registered sales of 50 billion Dollars and profits of above 10 billion Dollars. In 1946, on a stock split adjusted basis, the share price was around 2 cents. The stock traded on a multiple of 7. By 1970, the average share price was 1.06 Dollars per share. And the stock traded on a 43 multiple! What?? Through ten Dollars for the first time in 1991, 100 Dollars a share for the first time in 2014. Since 2005 the stock has traded in the mid to high teens in terms of valuations. Since 2005 the company has added 20 billion Dollars in annual sales to the 50 billion back then.

It is always fun to check back. And to wonder why your grandfather just didn't buy 10 shares in 1972. The investment calculator on the JNJ website says that if one had bought (and reinvested dividends), the original cost was 981.30 Dollars and the current value would be 91,735.43 Dollars. And as a result of reinvesting and all the dividends, you would have 774 shares now. For the record, 981.30 Dollars from 1972 is equivalent to 5615.51 Dollars today. The benefits of long term stock ownership in big, well capitalised and quality businesses are plain for all to see. Of course history means nothing in investing when trying to predicting future returns. The exercise is a good one. Shortening the time frame to 25 years, the returns (including reinvesting the dividend) are 16 fold.

Let us check the results from yesterday morning, Q3 2016 Earnings. Sales were 4.2 percent better than the comparable period, adjusted diluted earnings per share clocked 1.68 Dollars, an increase of 12.8 percent from the prior period. I think that in order to show the diversity of this business, three separate businesses inside of a business, let us check the different segments. Firstly, their biggest division, pharma:

Immunology includes Remicade, which does 1.2 billion Dollars in sales just by itself. Some anxiety has emerged in recent days as Pfizer may well release in November a biosimilar (copycat biopharma drug) called Inflectra. JNJ are actually fighting this in court, watch it closely. And it is easy to see why, according to the WSJ, the analyst community has suggested that the Pfizer drug, which is 15 percent cheaper, could shave off 1 billion in annual sales for JNJ. A year of therapy of Remicade in the US costs nearly 29 thousand Dollars, before any of the medical insurance refunds. Phew. Remicade treats Crohn's disease, Ulcerative Colitis, Rheumatoid Arthritis, Ankylosing Spondylitis, Psoriatic Arthritis and Plaque Psoriasis. Yip, it is pretty wide reaching. Amgen have a very similar drug that is used to treat most of these conditions, it is called Enbrel.

A therapy called Imbruvica, which is a blood cancer drug is expected to be one of the drivers of future growth. Another drug, Xarelto competes with Aspen in the blood thinning area, the drug does similar things, preventing clotting, prevents deep vein thrombosis and pulmonary embolism. The company is confident that their pipeline which consists of around 10 therapies that could each be 1 billion Dollar of sales a year. As well as new uses for around 10 of their current therapies too. If you want to see what is in the pipeline, follow the link.

Next, the medical devices division, which is a monster standalone business by itself. Here is a breakdown of the sales

Orthopaedics is expected to be a good growth business in our opinion, it is a simple investment in people living longer and having access to high quality parts to give them a higher quality of life. General Surgery too should continue to be a global growth business, as people get richer, they are more likely to have more surgeries.

Next and last, the well known consumer business, a lot of household brands that Joe Consumer is very familiar with.

I found it quite interesting that the company reported strong sales in their anti-smoking aids in Asia Pacific and the Middle East (and Africa), that is a product you may know as Nicorette. The CFO suggested that they were a bit light in the skin care division, there may well be some purchases in that area. Acquisitions of that sort would bolster the consumer division, many short term agitators have called for a break up of the group. Separate businesses will perform better and attract a higher multiple, they say. Be more nimble they say. That may well be the case, one of the reasons that makes JNJ such a compelling investment is precisely the diversity.

The stock fell away during the course of trade, down 2.6 percent on an up day. There is anxiety over loss of sales of Remicade, one of their flagship products. The company has actually guided higher in revenues and earnings though. The stock trades on a 17.2 multiple, hardly expensive for a quality business. Whilst the stock and the company may not display the explosive growth prospects of some of their peers, this is definitely a "safe as houses" investment. In fact, I would go further and say that it is safer than houses, you can buy JNJ for your unborn great grandchildren. They will thank you. We continue to buy for new clients and accumulate for those who are underweight.

Linkfest, lap it up

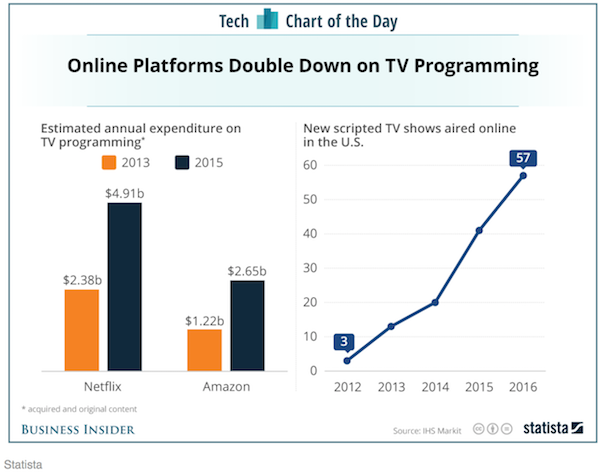

The value of your eye balls is huge, which is why content providers are ramping up their development spend - Netflix and Amazon are spending a truckload on TV programming. The monthly subscription for Netflix is less than $10 a month, which is very cheap considering the amount of time that most people spend on the site. The low prices are possible due to the massive subscriber base that Netflix has attracted, a great example of economies of scale bringing prices right down.

One of the biggest changes for society going forward will be from AI. Imagine asking a computer to diagnose a patient based on all their medical information including using data from their genome? Trying to code a computer to 'understand' something is very difficult but advances are being made - Google's AI can now learn from its own memory independently.

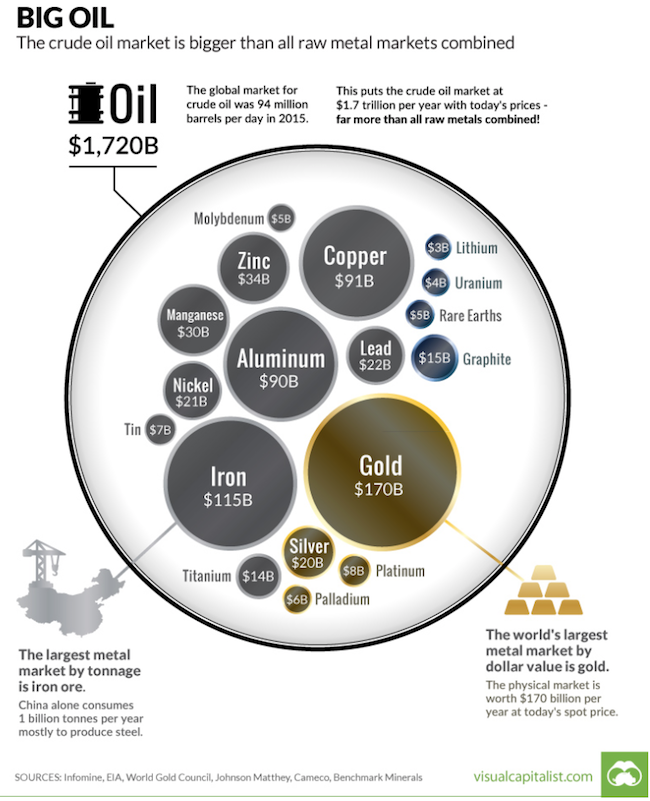

We all know how important oil is to our daily lives. I didn't realise how big the oil industry was though - The Oil Market is Bigger Than All Metal Markets Combined.

Home again, home again, jiggety-jog. Stocks across Europe are set to open marginally higher. Chinese GDP was a meet, which is a bit of a relief there I guess.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment