"Will it come immediately? I doubt it, there are many more middle income neighbourhoods around the world. Global comparable sales up three and a half percent, across the 36 thousand restaurants in over 100 countries is a decent enough reflection of the global economy. Depending on where you are in the world, the offering is a quick fix of calories or a soft luxury."

To market to market to buy a fat pig A mixed close for Wall Street Friday, earnings still continue to stream in thick and fast. See below in the company segment, my colleagues have told me to be strict about separating the various segments, otherwise we end up with a fruit salad. And we are looking for more than one flavour. Chocolate or vanilla? Personally I prefer both over many other exotic flavours. Talking of exotic flavours, AT&T are buying Time Warner for 85 billion Dollars. There was some news that Apple would go after Time Warner, obviously the content is what everyone is after here. AT&T will pay half cash, half stock. I tried to understand the content side, who has what, who is likely to be the winner in all of this. Consolidation is obviously the key in all of this, Apple may build up their own content in time, they certainly have the resources to take on Netflix and Amazon. I suspect that unlike many people think, there is loads of space for multiple entrants.

By the end of the session stocks had finished mixed, the nerds of NASDAQ was boosted by the likes of Facebook (traded at an all time high) and Microsoft (also trading at an all time high), one pre their results and the other one post their results. The Microsoft all time high comes nearly 17 years after the dot-com high (adjusted for splits) just before Christmas 1999. Talking of which, I saw Christmas decorations this weekend. With a little over two months to go, I am not surprised I guess. Microsoft have done good work in directing all their customers to pay a subscription based monthly (or annual) for the office suite, as well as having a strong cloud product. Not a coincidence.

The nerds of NASDAQ closed up 0.3 percent, the Dow Jones Industrial closed 0.09 percent off for the session, whilst the broader market S&P 500 lost a smidgen, less than one-fifth of a point lower for the session. We are about 50 odd points away from the all time highs. Provided that we see decent earnings this week from the likes of Apple, Amazon and Alphabet (the company formally known as Google), stocks may get a decent leg up this week. Oh, and there is the small matter of the first look at US GDP this Friday. A big week! And at last, mostly earnings related.

On the local front we had stocks up two-fifths of a percent by the close, resources were rocking, up one and three-quarters of a percent by the end. At the top of the leaderboard was Anglo American, at the bottom was BATS after announcing the deal with Reynolds on Friday, that is really big money relative to their market capitalisation, 47 billion Dollars, dilution and more gearing is a little insipid in the short term.

Company corner

McDonald's results Friday beat the street and the stock jumped over three percent. It hasn't been the easiest in their operating space, the stock, notwithstanding their move Friday, is down three and a half percent year-to-date. Owning stocks shouldn't be a quarter to quarter thing, nor year to year, and the giant golden arch in the sky stock is a testament to that. The company has delivered 40 consecutive years of dividend increases. Through the savings and loans crisis, through the dot-com crisis, the financial crisis, you name it, McDonald's stock has delivered dividend growth. The company basically pioneered the restaurant franchise model and is synonymous with fast food. Perhaps in a changing world where habits are trending healthier, the company may come under pressure from fresh food again. Or they may just tweak their menu, or perhaps the reality is that ultra healthy food is a rich people thing.

Will it come immediately? I doubt it, there are many more middle income neighbourhoods around the world. Global comparable sales up three and a half percent, across the 36 thousand restaurants in over 100 countries is a decent enough reflection of the global economy. Depending on where you are in the world, the offering is a quick fix of calories or a soft luxury. The company also offers employment for hundreds of thousands of employees across the globe, not the most glamorous job, it is a look into the organised workplace for most first time entrants.

The stock has done well, it is a steady Eddy, 1000 Dollars invested in 1991 (25 years ago) has delivered returns of just over 800 percent, including the reinvestment of the dividends. The yield now stands at 3.3 percent (pre the tax). On a 21 multiple I would have to say that the stock is well priced, in this space we prefer the coffee business and the higher margin food of Starbucks. You can't own everything and that is also something you have to come to terms with as an investor. Starbucks has underperformed McDonald's both YTD and over the last 1 year, the five year chart tells an astonishing story however, Starbucks up 154 percent versus McDonald's up 23 percent. Of course that tells you exactly nothing about the future of the business, a historical chart!

At the opposite end of the markets liking was GE, the stock was down sharply in early trade, managing to recover by the end of the session to be just under one-third off. It wasn't so much the current results, rather than forward guidance on revenue had been lowered. Their power and renewable energy businesses had performed "well", their oil and gas business (which is more recent business) is struggling, along with the rest of the folks in that sector. The only stock to have stayed the course in the Dow Jones Industrial Average is hardly the most exciting company you can own. And as a result of the sectors they operate in, is bound to be more cyclical than a food business of any sort.

I suspect that the company is likely to struggle over the next 12-18 months, with no growth and a 20 multiple, do not expect anything other than a market performer. Which of course sometimes catches you off guard! The company however tells you what every investor wants to hear, that they have paid a dividend each and every quarter for over 100 years. Think about that. Multiple World Wars, multiple recessions, inflation, stagflation and the list goes on and on. And GE? No worries, we will pay you a dividend year in and year out. The financial crisis and the exposure to too much finance and not enough industry was a bad patch, hence the move back to the "old business". Whilst this is possibly a stock that you can own forever, there are certainly businesses (in our opinion) with better prospects in the medium term.

Linkfest, lap it up

As technology changes and technology moves on, there are winners and losers. Change is always difficult, two companies bearing the brunt of anti-change sentiments are AirBnB and Uber - The next 10 days will decide whether Airbnb lives or dies in New York City. Over the weekend the law was passed that people are not allowed to advertise rentals for less than 30 days at a time. The fact remains that Uber & AirBnb allow for societies to more efficiently use resources, making society better off as a whole.

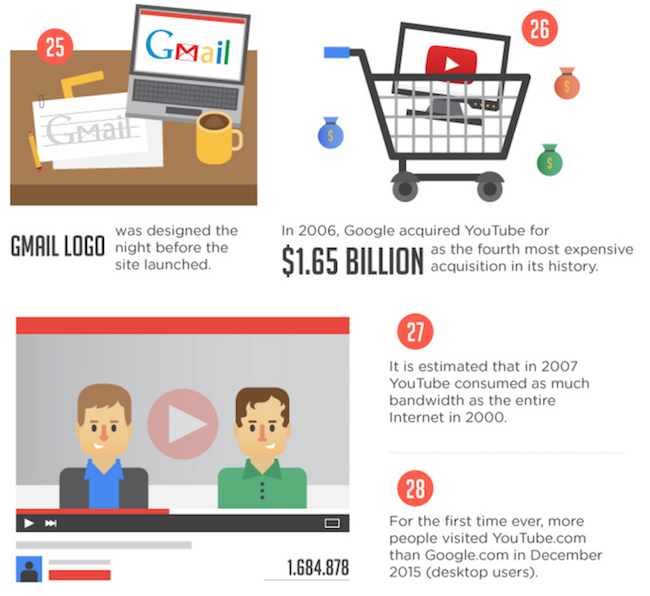

There are some amazing facts about Google - 55 Facts You May Not Know About Google.

The goal of any corporation is to get the most out of their employees, working longer hours doesn't always lead to getting more work out of employees. Finding the average work hours worked and then comparing it to the amount of work produced/ productivity levels will help researchers get a better understanding of that work/ life sweet spot - Americans Work 25% More Than Europeans, Study Finds.

Home again, home again, jiggety-jog. If you like wearing Yellow and Orange, then your sporting teams had a fabulous weekend. Sundowns can proudly sport a star for the African champions above their badge, the only other South African team to do this are the Bucs. The Cheetahs were deserved winners of the oldest rugby completion in the world. Western Province have won this trophy 33 times. Wow. Famous Brands results this morning, and MTN have a quarterly update, we will have more on that tomorrow.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment