"A few Harvard mates (led by the Zuck) created a platform, before the launch of thefacebook.com, which originally was for connecting people through social networks at colleges. The likes of Berkley, Chicago, Columbia, Cornell, really an Ivy League connection tool."

To market to market to buy a fat pig Stocks locally nearly broke into record territory by the close of trade, the Jozi all share index was boosted by a broad based rally, from financials to resources, industrials to banks, it was one of those days. Session end the Jozi all share added nearly two-thirds of a percent, South32, MTN and Bidcorp were at the top of the leaderboard, Kumba down over four percent after the prior days remarkable session.

Glencore struck a 12 month high early in the session, only to close marginally lower on the day. We do not talk enough about what is a huge constituent and potentially (as a result of their mining for battery inputs) a very important company into the future. Funny, the Glencore price, in Rands, here in Jozi is down 15 percent over three years, for the last 12 months however it is a completely different picture, up a whopping 60 percent.

In their London listed price, i.e. Pound Sterling, the one year return has been much better, up 78 percent. Three years? The stock is down 12.6 percent. The Pound, due to the pickle (an awful pickle old chap) of Brexit, is going to struggle to find a level in the coming months/years, as Brexit talks are weighed down by the machinations of politics. I suspect that we are going to see the same old, a watered down event that will have so many concessions on both sides that the "people have spoken" event of last year may seem closer to a Greek no vote on austerity. Talking Greece, they were back from a bond issuance hiatus with a nod of approval from the German Finance minister, which is no mean feat.

This morning there is a whole host of moving parts announcements, including a trading statement from MTN for their half year (results next Thursday), the company expects basic earnings per share to clock between 280 to 300 cents. It looks "light", a large part of the movement of MTN has in some essence been related to the fortunes of the oil price, remembering that two of their three territories (Iran and Nigeria) are hugely reliant on oil revenues. We shall see how the stock reacts at the open.

Anheuser-Busch InBev or AB InBev as we know it, also reported numbers this morning for their half year. A massive day for European markets, VW and Nestle, Orange and Bayer, Airbus and Deutsche Bank. Royal Dutch Shell ....... wow. It is going to be an incredibly difficult day to try and analyse all of these "things".

Janet Yellen and her trusty crew were the focus once again, the 45 day cycle continues to roll around with the regularity of the good old fashioned milkman. Here goes: Federal Reserve issues FOMC statement. Inflation, or to be more precise, a lack thereof, has meant that the Fed can continue to easy pedal into unwinding the vast balance sheet and the multiple programs that they have engaged in, post and during the financial crisis.

One learns along the way that whilst the Fed is wildly important in trying to hold and keep the punch bowl at several different levels and heights, they are definitely not the be all and end all of the financial markets. Too much emphasis (for us equity investors) is placed on central banks with regards to equity market movements. Earnings drive share prices, and we are in the midst of what is a very important week as far as that is concerned.

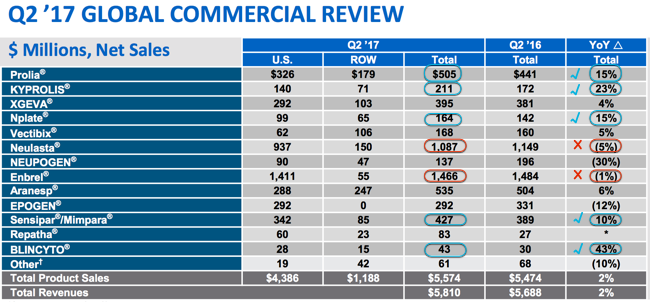

Boeing soared, perhaps a giant short squeeze, the stock rallied nearly ten percent over the course of the session. Strangely I saw a broker report suggest that there is as much as 40 percent plus downside from here, tell that to the happy long only owners. Amgen shed some ground post what were good numbers, we are mindful that it has been a good year for not only this business, equally for the overall markets, I suspect that many have been caught off guard. And will always be caught off guard, it was the great Peter Lynch who said that (and I am paraphrasing here) most people spend large amounts of time worrying about infrequent events in equity markets. i.e. the chattering classes are always worried about "losing" and don't stay the whole distance.

Scoreboard time. As the bell went clang, stocks had in some parts reached another record closing high, the S&P 500 added 0.03 percent, the Dow Jones cracked on the pace, advancing 0.45 percent, with the nerds of NASDAQ up 0.16 percent by the close. A weaker Dollar (as a result of a dovish Fed) meant that a broad based commodities rally was no doubt going to transpire. More results tonight, the busiest thus far this year, standby tomorrow for some analysis!

Company Corner

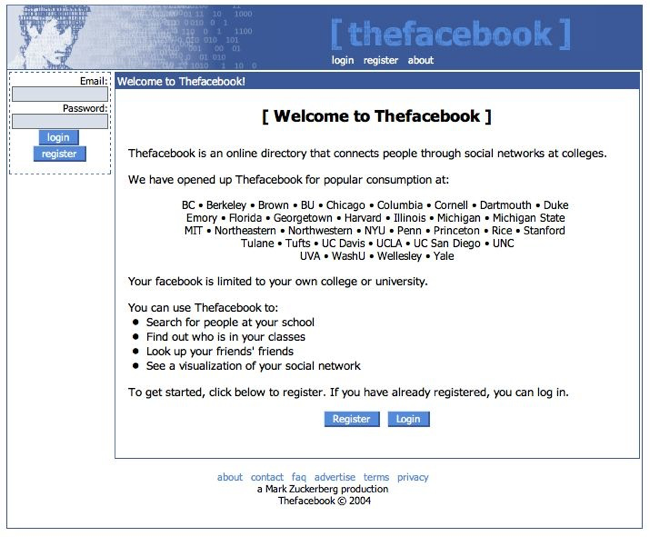

It is still a phenomenal story, the growth of Facebook from a dormitory, nearly 13 and a half years ago now. The date most people take as the launch of what is now a sprawling network is 4 February 2004. I had been sitting in my Vestact chair for a little over a year. A few Harvard mates (led by the Zuck) created a platform, before the launch of thefacebook.com, which originally was for connecting people through social networks at colleges. The likes of Berkley, Chicago, Columbia, Cornell, really an Ivy League connection tool.

It was pretty lame by the high standards we expect today, yet is was simple and effective and pulled at the core of us all, communication. It is what separates us from the beasts, the ability to communicate more effectively (sometimes it seems not) than any other species. Facebook enables us to keep abreast of our friends and their lives, what is important to them and what they think about it.

Along the way, Facebook acquired Instagram and WhatsApp (Buying WhatsApp), as well as "less successful" (for now) Oculus. They spun out Messenger from the core product offering, that application is used widely and will continue to have multiple applications (like paying friends, etc.). For laughs, kicks and giggles, let us share the "original" Facebook image, those are freely available on the web, here was one I found:

At the time of the IPO in May 2012, it was the largest valuation of an IPO ever, over 100 billion Dollars at 38 Dollars a share. At the time, the company raised the third largest amount in US IPO history, 16 billion Dollars. Technical glitches at the get go overshadowed what was the highest trading volumes for an IPO ever, the next few months were horrid for the stock. By the end of that year, the main platform had a billion users, monetising them on mobile was the next market handwringing moment. By late August of 2012, the stock had halved (and some more) from the IPO price. The rest, as they say in the classics, is history. Revenue growth has been nothing short of eye popping, from 400 thousand Dollars for the year 2004 to 9.321 billion Dollars in revenues for the quarter just passed.

For the quarter? Wow. Revenue estimates for this year are for close to 39 billion Dollars, and then the market expects beyond 50 billion the year after, maintaining the growth trajectory. As a result of the company being able to monetise their multiple platforms aggressively, earnings growth has kept pace too. The market expects earnings per share for the current year to come in at about 5.10 and then over 6 Dollars a share for 2018.

In the pre-market the stock trades at 171.10 Dollars a share, meaning that on current year estimates (yes, estimates), the stock trades on 33 times. Next year, 28 times. With around 18-20 percent earnings growth expected by Mr. Market, that means the PEG is 1.55 times. My Bloomberg app on my (not so fresh anymore) iPhone, tells me that the estimated PEG ratio is closer to what people would consider good value, 1.01 times.

For what it is worth, people have consistently gotten the price of Facebook "wrong", their estimates have always been way too low and the company has been able to evolve at a breakneck speed. In part due to their incredible in-sync with the trends, and in part just plain old user adoption. According to the Internet World Stats, of a global population of 7.5 billion people at the end of March 2017, 49.7 percent of all people used the internet.

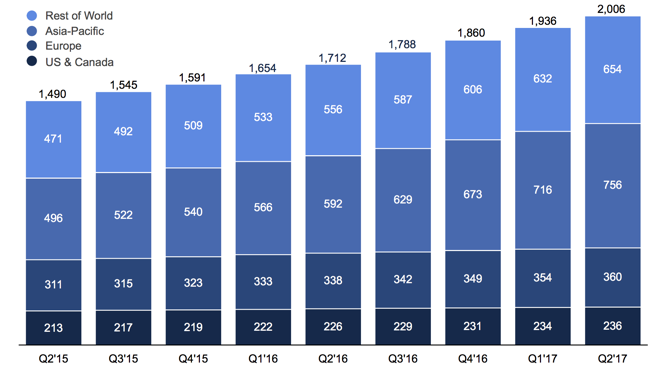

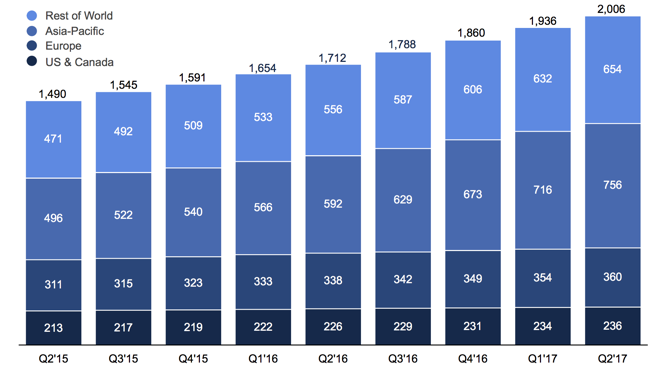

So I guess we are at that point, where the world drops over to more than half of us using the best tool and the finest leveller of them all, the internet. I share "The Zuck's" theory on that, the more people have access to this tool, the better their lives will be. Cost is the key here, internet costs that is. What is also very interesting, for Facebook and their competitors is that there is room for growth across many regions, Facebook has a pretty good spread, herewith their monthly active users by geographical regions:

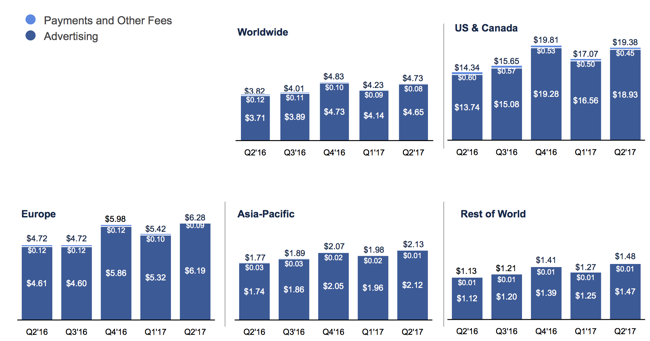

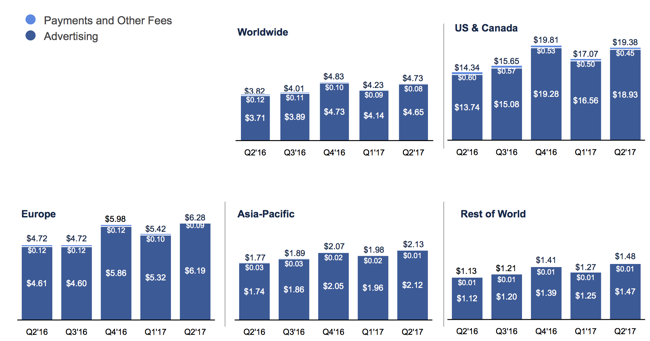

The reason why I think that there is plenty of scope for growth is that the average revenue per user for Facebook in North America is three times higher than in Europe, and around four times the average worldwide user. There continues to be growth across all of their regions, see the slide from the presentation below here:

That slide from the presentation is the most important for me. The stock market reaction to the earnings was interesting, initially the stock sold off sharply and then rallied as the earnings conference call proceeded to unfold. Whilst the company has aggressively added to their staffing compliment along the way (there are now over 20 thousand Facebook employees), all the major metrics have kept inline from a costs point of view. The research and development expense still hovers around 20 percent of revenues, marketing and sales in the low teens, general and administrative in the 6-8 percent bracket. Operating margins have fluctuated between 40 and 50 percent over the last two years, currently 47 percent. This is important, the company continues to search for growth whilst being mindful to keep an even keel.

Part of the reason that the stock popped later is that even in light of increased spend from the company, they are going to explore ways to monetise WhatsApp and Messenger more aggressively. What to do? I get the feeling that we are still in the infancy of exploring all sorts of applications on the existing platforms, using artificial intelligence to serve you the content that you should be getting, connecting you with likeminded people, finding new favourable and lasting relationships, be that with new service providers or opportunities. We continue to recommend Facebook as a strong buy, obviously one needs to keep an eye on trends a little more closely, they have all the "right people" at the helm. And ..... the company is about to breach the half a trillion Dollar mark, not bad for a flopped IPO now, wouldn't you say?

Linkfest, lap it up!

The growth in China's economy has been massive which has been good news for wealth creation both in China and the globe - Capital accumulation, private property, and inequality in China, 1978 - 2015. As China has created more wealth, so has the inequality, which makes sense. Those who own capital early benefit the most from growth but those who are at the bottom have benefited from the growth too, just not as much. How big of a problem is that?

"Despite the decline in its share of world population, China's share of world GDP increased from less than 3% in 1978 to about 20% by 2015"

Even large economies are not immune from the effects of uncertainty. Brexit is a big question mark over what the UK economy will look like in a few years time, the result is lower investment, which also contributes to a weaker Pound - The Brexit slowdown continues - Britain's economy grew just 0.3% in the second quarter.

I love reading about how people's views on the stock market changes over time. Generally people are influenced by what worked recently in deciding what to do going forward, in this piece Ben takes a look at what the stock market meant once the great depression was over - A Market History Lesson From Peter Bernstein

Home again, home again, jiggety-jog. Stocks across Asia are mixed to mostly higher, phew Tencent is up nearly two percent this morning to a record high. Naspers might well propel the local market to an all time this morning. That would be good.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Email us

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

You will find more statistics at Statista

You will find more statistics at Statista