"The stock sank over 15 percent as the company cut their sales forecast for 2016, sales are softening, with the chief suggesting that they were not relying on the consumer to spend more, perhaps he should have suggested that he was not relying on the core Macy's customer. Do you think that it was or is a coincidence that all this happened on the day that Amazon.com founder Jeff Bezos snuck into fourth place on the "wealthiest" list. Amazon stock climbed to another all time high, the stock rallied nearly one and a half percent to 713 Dollars, a ten year return is an eye watering 1935 percent now."

To market to market to buy a fat pig Macy's stock was kicked in the chops last night, the red star looked more like a starfish missing a limb or two. No worries, it will grow back, if human science could engineer the same characteristics and apply that to modern medicine, now that would be an epic medical breakthrough. It will come, I suspect we are closer than ever I think. The flagship store might be the one best known to those who have visited New York, the Herald Square location is truly eye popping, multiple floors of what used to hold the record of the world's largest department store for 85 years. South Korean department store franchise, Shinsegae, opened a store of nearly 50 percent bigger (in floor space) than the flagship Macy's store in 2009.

Macy's have around 870 locations across the US. And annual sales (2015) of 27 billion Dollars. The stock sank over 15 percent as the company cut their sales forecast for 2016, sales are softening, with the chief suggesting that they were not relying on the consumer to spend more, perhaps he should have suggested that he was not relying on the core Macy's customer. Do you think that it was or is a coincidence that all this happened on the day that Amazon.com founder Jeff Bezos snuck into fourth place on the "wealthiest" list. Amazon stock climbed to another all time high, the stock rallied nearly one and a half percent to 713 Dollars, a ten year return is an eye watering 1935 percent now. Bezos is wildly rich. He used to deliver wrapped parcels to the post office in his pickup truck around 20 years ago. Now he sells Amazon stock to fund missions to space. Like Elon Musk, Jeff Bezos has dreams of moving humanity elsewhere.

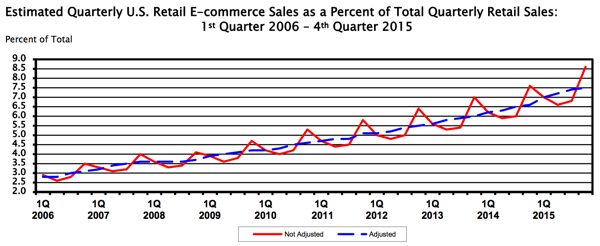

Is it a coincidence that Macy's has floundered recently and that Amazon sales continue to grow sharply? So much so that the company has to invest heavily in their business in order to keep up with continued demand. The shopping experience has and continues to change, online retail is still a small part of the US landscape. According to the US Department of Commerce (note, not ecommerce yet), total ecommerce sales in the US for 2015 were estimated to be 341 billion Dollars. As a percentage of total sales last year in the US, that is only 7.5 percent for the year. It is growing at breakneck speed however, ecommerce sales were 8.6 percent of total sales in the fourth quarter. Herewith the graph from the above link release, showing sharp growth in overall ecommerce sales over the last decade.

If total retail sales last year in the US, as estimated by the US commerce department, were a whopping 4.694 trillion Dollars, should we be spooked by an old department store type model telling us that the consumer is taking strain? Most especially when their annual sales are 27 billion Dollars, and I am sure a pretty important part of a snapshot of US retail? I am not too sure what to make of it. It may well be a sign that the consumer is pulling back for a bit, perhaps anticipating higher interest rates. All the employment data, and in particular more recently the wage numbers are pointing in the right direction. I would say a blip, perhaps segment in sector specific. Retail sales numbers in the coming months may be watched just a fraction closer than before.

Macy's, the company that managed no problem to operate through the cold war with that red star as their logo, perhaps consumers were defiantly and unashamed in their support of free enterprise with a red star, managed to send the rest of the market softer. Bloody Bloomingdales (Macy's own that brand too), the broader market S&P 500 sank nearly a percent, the Dow Jones Industrial Average was off 1.21 percent, whilst the nerds of NASDAQ sold off just over a percent. Cyclical consumer stocks took a heavy beating, Nike, Home Depot, Lowe's and Starbucks were some of the big stocks to sell off sharply.

Walt Disney had company specific news in the session prior, the stock ended down 4 percent on the session, their 80 percent stake in ESPN a bit of a laggard currently. We were chatting about sports rights and how they are likely to be delivered (what medium) in the future, whether or not more people are going to watch more sport (and not less) and the advertising around it. The conclusion was that streaming is certainly shaking things up, cord cutters at the fringes possibly didn't use the sport option and realised that they were/are paying for it. Disney, at all the other divisional levels did well, including the resorts and parks. Any person who has been to one of the parks will not be surprised to learn that the profits are around one quarter of the park division revenues. Profitable for sure! 25 Dollar burger, fries and soda meals.

The movies segment did well, Zootopia, the Jungle Book and the Star Wars movie all did well. The company took a 147 million Dollar charge as they closed their video-game segment, goodbye Infinity. Bright was saddened to hear that the Aladdin console game would be without sequels, it obviously resonates positively with his childhood. As the WSJ said, a rare EPS miss for what is usually a very reliable business. You have well thought that Disney may have struggled to stay relevant in the internet era, if anything, it is ironically the cash cow (ESPN) that is the struggling part of the overall business. The stock looks expensive (relative to what you get) at 19.1 times earnings and a relatively low 1.39 percent yield. If the stock did go quite a bit lower, it may well become a very attractive proposition. Having said that however, this may be the case when a company of this nature always trades at a modest premium.

Back at home here in Jozi, Jozi, stocks gained half a percent on the day, dropping at the end of the session. Resource stocks enjoying a good day, up over three percent (it was comfortably over 4 percent at one point). Life Healthcare had decent enough results, the stock was up over 5 percent. The company has invested heavily in two other territories (just short of 5 billion Rand in total), namely India and Poland, with mixed results thus far. Early days I suspect. M3 Calgro also reported numbers, they were pretty spectacular, they certainly have the right formula where some of the others have failed. Huge developments with thousands of units. Good for them, work hard and smart.

Linkfest, lap it up

This is what the future of space travel potentially looks like, shooting a super powerful laser into space could have some large unintended consequences - Scientists say they can get spacecraft to Mars in 3 days using lasers - but there's one big problem

There are rich people problems and then there are rich people problems. In this case it is where to put all the money that is coming through the front door - The 2016 rich list of hedge fund managers. The top 25 hedge fund managers made around a combined $13 billion last year. Just the managers (These hedge fund managers made $4.7 million per day last year)!

Sticking with money, have a look some rare coins from the last 100 years - Making Cents of Rare Coins. I think the coin with the words "In God we Rust" is my favourite.

Japan can be seen as a global leader, electric cars have an entrenched role in society now - Japan Has More Electric Car Charging Points Than Gas Stations. It does seem that the definition of electric vehicle charging station is rather liberal.

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks locally will start lower again, a little bit of a drag here at the beginning. For the time being whilst we are in this "zone" of looking for central bank direction, muted global growth and in particular looking for direction from Chinese growth, stock prices might well present opportunities from time to time. There are always opportunities in a market, there are always companies that are looking to wrestle the initiative away from others.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment