"This is a fantastic business facing a short term cycle slump in soft luxury. Currencies move in cycles and so do consumer demands. Great businesses like this will ride those waves. People will still be wearing glasses in 50 years time."

To market to market to buy a fat pig I read the headline, investors sell stocks on worries of interest rate hikes, or something along those lines and let out a sound of disgust. Not a snort, that could be a calamitous mistake in an open office environment. Investors do not sell stocks as rates go up and down. Traders do. Short term participants. Anyhow, the Fed may well choose to raise rates again (like they did in December) and then watch for a while. They would probably find that there was very little change.

I recall an interview with Warren Buffett in which he said that if the Fed raised rates 50 basis points next week Wednesday his theory on the world wouldn't change, they would still be buying stocks. In fact, secretly, I guess, Buffett wants stocks to fall, so that he can have another bite of the cherry. Cheerfully optimistic, yet pragmatic at the same time. That is what is so likeable about the guy, he is the uncle you wish you could lean on for advice.

Off at a tangent, what a twist. Last evening on Wall Street, the minutes spill over from the session prior still took centre stage. Stocks sold off hard initially, recovering in the second half of the session, unfortunately for the bulls it all ended lower. The Dow Jones Industrial Average lost just over half a percent, the broader market S&P 500 lost nearly four-tenths of a percent, whilst the nerds of NASDAQ was the worst of there three majors, down 0.56 percent on the day.

On the company front there were numbers from Walmart, a comfortable beat, the stock was up over nine and a half percent on the session. So I was trying to work it out, department and old retail, nope the consumer doesn't want that. Big discount retail and online retail (possibly both price), yes, the consumer wants that. In with the new (and newish, all relative) and shipping out the older methodologies. Old Jim Cramer always used to say, there is always someone making money.

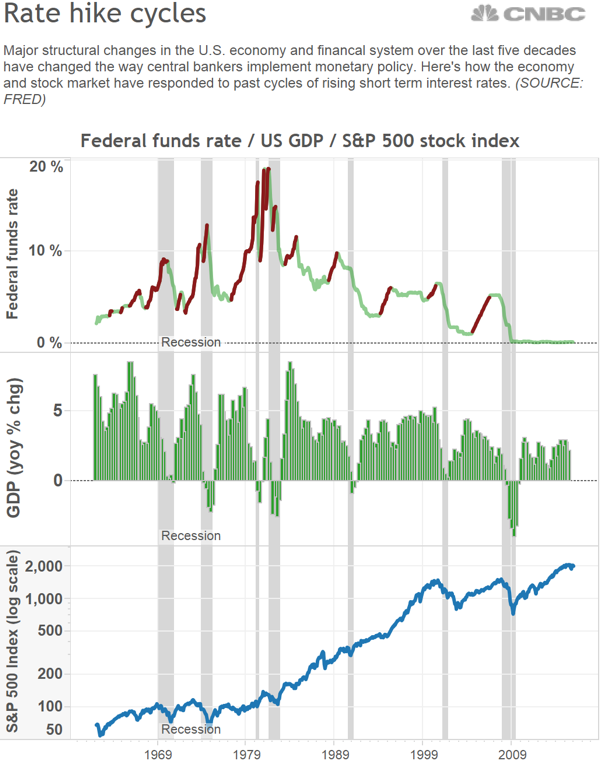

I found this fabulous image in an older (December last year) associated article from CNBC titled - Lose the jitters: History on the side of rate hikes. An excerpt from the article sounds pretty much like where the US economy is right now: a CNBC analysis of six rate-hike cycles over the last three decades shows that rising rates were often accompanied by falling unemployment, rising stock prices and solid economic growth.

That is pretty far back and I am not necessarily a fan of saying that past anything is an indication of forward looking anything. It never is, all two points in history are completely different from one another. Here is the graph of Fed funds rate, GDP in the US and how stocks performed since March of 1962, over fifty years ago. There are in that time 4 long periods of recession (two negative GDP reads, or more) and 3 short ones. In that time stocks are up so incredibly smartly. The series of images:

So what is the conclusion? Stop worrying about recessions, rates and try and filter out the noise.

Talking of which, locally we had an MPC meeting - Statement of the Monetary Policy Committee. There is also a Summary of assumptions. International commodity prices are expected to stabilise after this year. As are world food prices. Growth is expected to be muted. All of these assumptions always discount humans and their ability to either make huge forward (or backward) leaps. Famous Yankees baseball coach and player Yogi Berra was equally famous for his weird and off the wall remarks. This is my favourite: "It's tough to make predictions, especially about the future."

Indeed, which is why it is hard to make and stick to predictions. In conclusion, the inflation outlook looks worse in the short term, better in the medium term. The MPC has not factored in the much lower currency at this point. Which is more than a little bit of a problem. The upshot of it all was rates on hold, we will watch it. And stocks took half a liking to that. And then fell, as the Rand strengthened a little off the worst levels of the day. At the end of the session stocks as a collective had fallen a little over four-fifths of a percent. Resources were the main culprits, selling off three and one-third of a percent. Industrials squeaked into the green, ever so little. All in all, something to think about.

Company Corner

Luxottica is one of our non-core holdings which requires an extra look after some wild share price swings. To put things into perspective they hit $71.60 a share in October last year after a good run only to close at $54.37 last night. The price in Euros hit 65 Euros in October last year and closed at 49 Euros yesterday. This is not just a currency issue, the share price has been under pressure.

Concerns

The fall in the share price has been a result of a number of factors. The main factor has been the slow down in luxury goods sales in the likes of Hong Kong and Macau. Former high flying areas for the company and the sector. Plotted against LVMH and Richemont, the share price movements downwards form October 2015 are similar.

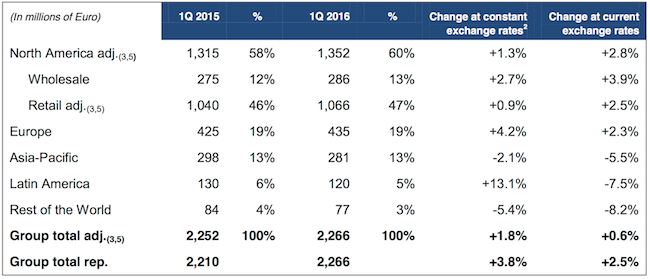

As you can see from the image below, which reflects the latest sales update, Asia representing 13% of overall sales, went backwards. As I am sure you can also see, the currency impact was big in the developing markets they operate in. Although the Euro weekend to the Dollar, it strengthened to virtually everything else. North America is still their dominant market which I would say is a good thing. The US economy is stronger than most and as the job market improves and oil prices remain low, the consumer should get stronger.

Another concerning issue is the ownership structure. Leonardo Del Vecchio is the 80 year old founder of the business who still owns 61.9% of the company. In October of 2014 Del Vecchio had a run in with the long serving CEO Enrico Cavatorta who quit. This caused a bit of a board revolt and some people left. Eventually Del Vecchio was happy to settle with two men, Adil Khan and Massimo Vian, who ran the business as co- CEO's.

At the end of January 2016 Leonardo Del Vecchio forced Adil Khan to quit, paving the way for Del Vecchio to become executive Chairman. Massimo Vian will remain the sole CEO but clearly still reports to Del Vecchio. The share fell 7.5% that day. There has not been much news on that front since but clearly corporate governance is a risk for this business. At least your interests are certainly aligned with the man running the business.

The last risk I would like to touch on. The stock still trades at 25 times this years earnings and 23.3 times next years earnings. This implies a 9.4% growth in earnings. The company is expensive on that type of growth.

Positives

They have an incredible array of brands and completely dominate glasses around the world. The stock ticks many great boxes.

Healthcare is a strong theme, people's eyesight is crucial to their standard of living and Luxottica's prescription business is at the forefront of innovation in this regard. They are busy constructing 3 new laboratories for the production of ophthalmic lenses. (According to Wiki these bend light to correct focusing defects of the eye)

Fashion and soft luxury will also be huge theme going forward. Sunglasses are a massive fashion accessory and will continue to do so. Plus they do actually protect your eyes and perform a function, unlike luxury watches.

They are the leaders in eyewear for sport. I suspect this will be a strong growing theme around the world as people get more active. Golf, cycling, running and many other activities require good eye protection.

Sunglass hut is a great retail store and has a strong presence in most shopping hubs around the globe. They are also on top of the shift to ecommerce. The groups online retail is flying, growing sales by 17%

Conclusion

This is a fantastic business facing a short term cycle slump in soft luxury. Currencies move in cycles and so do consumer demands. Great businesses like this will ride those waves. People will still be wearing glasses in 50 years time. In fact according to Mark Zuckerberg, smart glasses could be the next big wearable device (they just have to look less dorky than Google Glass). The Luxottica brands will continue to thrive in this environment. We continue to hold and are happy to add for more adventurous clients.

Linkfest, lap it up

Who would have thought that Scrabble was such a big deal in Nigeria? Not me. It is actually huge, and must be excellent for language skills. Perhaps we could do the same here in Mzansi? Dominant Nigerian Scrabble Players Find That Shorter Is Better

Carpooling is a good way to save resources, Google is now making it easier to locate people who live near you going to the same office park/ surrounding areas - Google is launching its own ridesharing service.

It seems that "short sleeves to short sleeves in 3 generations" doesn't hold true if you are rich enough - How England's 1% remained the same since 1066.

Conflicting views is what makes a market. In this case there are two blog posts on the same webpage, published on the same day - The Starbucks Growth Machine Will Continue For Years and At $55, Has Starbucks Hit Its Growth Ceiling?. We are in the same camp as the first blog.

I could not believe that I was seeing Tim Cook, Apple CEO at the IPL last evening. It is all part of a bigger trip, Cook meets the India Prime Minister tomorrow - Tim Cook has completed the holy trinity of India-Bollywood, cricket and religion-in just two days.

Home again, home again, jiggety-jog. Oil is up again, the correlation between stocks and oil seems to be gone, perhaps until it falls off a little. The Rand is kind of steady. Asian stocks are generally higher than they were earlier. Richemont released results that look average, very mixed. Phil Mickelson is going to have to pay back some money to the SEC - Golfer Phil Mickelson Sued, Two Others Charged in Insider-Trading Case.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment