"Going forward only once things have normalised in Hong Kong and Macau will Richemont move back into growth mode. Until then expect the dividend to continue moving higher (the dividend has been upped by 6%) and the stock price to be at the mercies to currency changes. If you are looking for a Rand hedge and a stock that is focused on the international consumer, Richemont is a great option."

To market to market to buy a fat pig A big mixed bag in the Wall Street close on Friday, whilst stocks may have ended higher, the difference in all of the indices was strange at face value. A little more digging saw that Coca-Cola and McDonald's were on the back foot as a result of the FDA ruling on sugar content on packaging. See the WSJ article: FDA Approves New Nutrition Panel That Highlights Sugar Levels. Obviously it will impact Coke, and obviously McDonald's. Perhaps McDee's can simply sell the high margin water with their meals. Problem solved. And the consumer feels that they are going to be eating better.

I am guessing out loud here that both Coke and McDonald's will respond to consumer related patterns and adjust. It may well take more than a decade before you see real changes, heck, the breakneck speed at which Woolies are responding to their consumers is something to behold. All sorts of interesting products on the shelves. Stuff like this - CarbClever Vanilla Dairy Ice Cream 500ml. Do you think with the added costs (and admittedly for rich people in this country) will push the inflation needle, or will the lower consumption of traditional food sources lower the demand (and by function the price) on the other side? Not sure at all, your input would be appreciated. For the record I haven't tried this product, equally for the record, my diet mantra is "the fresher the better". Avoid all processed foods at all costs.

As Coke and McDee's are both Dow constituents and were lower on a day that the rest of the market was higher, it was not surprising then that blue chips underperformed the rest of the market. Blue chips ended the session up 0.38 percent, whilst the broader market (a better measure) S&P 500 added six-tenths of a percent to close up shop at 2052 points. The nerds of NASDAQ added double that, Alphabet (Google) and Apple added over a percent each.

It is worthwhile to just try and sign up for a day or two, just to get access to this article from Barron's - Stop Worrying About the Stock Market Crashing! As the article points out, from the 1987 highs to the very well documented lows, the market took nine whole months to reach the same levels. In fact, if you had gone for a year long sail around the world (fewer ways to communicate back then) in the middle of 1987 and then returned, you would have asked, what was all the fuss about? And that is our point, stay the course, hold the quality. The end. One of my favourite Peter Lynch quotes is "The real key to making money in stocks is not to get scared out of them." Ever, you hear? Make sure that last sentence was made in your best Mr. T voice.

On the local front stocks closed off their best levels, we did manage to end half a percent higher. We may have ended the US season, in terms of Q1 earnings, we are currently in the business of earnings season here. This morning there is a small matter of Pioneer Foods, Balwin Properties, Rhodes Foods, a trading statement from Mpact and lastly, by no means least(ly), PPC are raising around 3 to 4 billion Rand. Which is big, even relative to the market capitalisation. And then the weirdest announcement I have seen in a long, long time, this time from Standard Bank, let me know what you think about this one:

"The South African banking operations of Standard Bank Group have been the victim of a sophisticated, coordinated fraud incident. This involved the withdrawal of cash using a small number of fictitious cards at various ATMs in Japan. The target of the fraud has been Standard Bank and there has been no financial loss for customers.

Standard Bank has taken swift action to contain the matter and the gross loss to the bank is estimated at R300m. This is prior to any potential recoveries that may serve to reduce the loss."

Wow. It sounds coordinated and definitely happened on some social network, I am guessing platforms with multiple users could be used. Which begs the question, if an encrypted platform is being used, who should coordinate the police work? And should the hardware and software companies engage the authorities in some cases? All we know is that cybercrime (and the fighting thereof) should be higher on the agenda in the coming years. Extra costs for financial institutions. Early days for the Standard Bank share price, the stock is up a smidgen.

Company Corner

On Friday morning we had the full year numbers from Richemont. There were many moving parts to the results but on the whole the numbers were disappointing, the stock dropped around 5%. Here they are - Richemont audited consolidated results for the year ended 31 March 2016. (Investor relations and management do a great job in making these documents easy to read/ use)

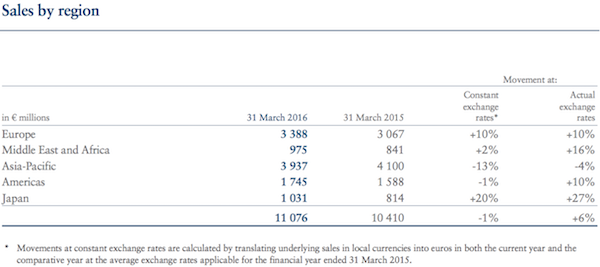

To the numbers, sales were up 6% to EUR 11 billion, operating profits down 23% BUT diluted earnings up 67% to EUR 2.2 billion. The operating number doesn't look great due to the prior year having a gain from a once off property disposal and then costs relating to a restructuring. On the Diluted earnings / Net Profit side of things, the big surge in the number is due to a non-cash gain from the tie up of Net-a-porter and Yoox.

Looking at the sales numbers below, things still haven't normalised in Hong Kong and Macau due to the crackdown on corruption by the Chinese government. The bright spot is there has been strong growth in mainland China, even though it is off a relatively low base, comparable sales for April 2016 are 26% higher than the 2015 number. The big surge in Japanese sales is thanks to a weaker Yen, tourists took advantage of the lower price.

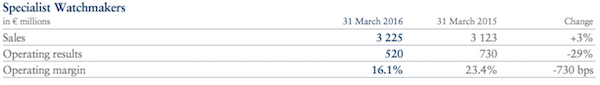

The watch division is where most of the pain was felt, even though sales were marginally up the profit margins were way down. Profit margins for watches were down 730 basis points partly due to the need to lower sales prices to get stock moving.

Over the last year the stock has been re-rating from a growth stock to a defensive stock. In Swiss Francs the stock is down 31% over the last year. Thanks to Rand weakness the stock is down 15% here on the JSE. Due to this rerating the stock now trades on a P/E in the mid-teens reflecting that the market doesn't expect much earnings growth from the company. There is still a premium on the stock due to the defensive nature of their brands.

Going forward only once things have normalised in Hong Kong and Macau will Richemont move back into growth mode. Until then expect the dividend to continue moving higher (the dividend has been upped by 6%) and the stock price to be at the mercies to currency changes. If you are looking for a Rand hedge and a stock that is focused on the international consumer, Richemont is a great option.

Linkfest, lap it up

This is what is happening in Venezuela, when socialism brings a country to it's knees and the ruling elite blames everyone else. One of the biggest brands in the world has been forced to shut as they can no longer gain access to one of their core ingredients - Venezuela food crisis forces Coca-Cola shutdown.

Wow. I was blown away by the engineering feat from not so long ago. You may have walked across the Brooklyn Bridge, it is on the list of "things to do" in New York. The author's conclusion is that America should build and add to infrastructure, even if it seems difficult. An uplifting piece for Monday - The Maker of Things.

Wanting to stop work early and receive State benefits? I guess in South Africa whilst we have these benefits, realistically, you do not want to be on them, that means you fall below a certain threshold. The whole idea of retiring early or retiring at all is going to be completely foreign for some generations, in the UK - Work until 70 for more generous state pension, says Lord Turner.

Chart of the week from the Visual Capitalist is on consumption patterns of millennial folks versus the average consumer. The chart is simply titled Making More Happen With Less. More coffee, less food as well as more "cash" related transactions and less credit. Starbucks, stay long?

One of the biggest things to come out the Google I/O (input/output) conference is the new platform for Virtual Reality, coming in the Fall in the US. It is called Daydream, watch for further updates - A platform for high quality mobile virtual reality. I am guessing it will be pretty cool!

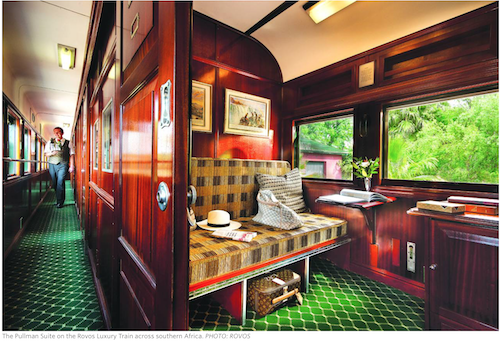

Great to see a South African operation getting a mention in the WSJ travel section. Unfortunately towards the end of the article the journalist notes that rail infrastructure spend has been lagging - Reliving the Golden Age of Train Travel in Southern Africa. I did a 3 day train trip across the US and it was great fun, the Rovos Rail takes it to a whole new level.

Home again, home again, jiggety-jog. Stocks are a bit lower to begin with here, resources are sharply lower. Construction stocks, PPC mostly, is down over 11 percent. This stock is trading near a 52 week low, and depending on your time frames, it may well be an amazing opportunity. In general we steer clear of mining and construction, so I guess this counts us out of the rights issue and an investment in the stock in any way.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment