"Peer into any larder or kitchen storage space in South Africa and you are more than likely to find some Black Cat peanut butter, Fatti's and Moni's spaghetti (or penne if you will), Ace mealie meal (or instant porridge), Tastic rice, Golden Cloud flour, All Gold tomato sauce, Oros on the drinks front, along with Energade, Rose's and Hall's, Koo jams as well as Albany bread in the bread bin."

To market to market to buy a fat pig Stocks locally dipped at the bell, inside of the closing auction folks thought ahead of a review from some ratings agencies that caution is perhaps the better part of valour. I am not too sure why people cannot do their own analysis and rely on the paid analysis (and sometimes flawed and exposed analysis) of certain ratings agencies. If you cannot do your own homework yourself, please do not rely on someone else to do it for you. The only thing that will transpire from that is that come test or exam time, (when the investment itself is held by YOU), then you are left fumbling for the pencil and wondering what the answers may, or may not be.

Granted that big external pension funds set themselves parameters to only own investment grade bonds, surely the analysis internally is better than external advice. The ratings agencies wagging their long lecturing fingers at certain quarters and suggesting this or not that may well be advice well heeded, I am cautious. There is a very rude humorous story about a certain villager in a Mediterranean fishing village who does a single thing wrong, and then becomes known for that for eternity. That is how the ratings agencies feels for me, they did one thing very wrong which played a big part in the financial crisis, and now lectures continue. I suppose the whole world was complacent, you can make a mistake, pay the penalty and move on. After all, the American example should be followed.

The ratings agencies are a necessary part of the investing cog. If someone (Fitch, Moody's, Standard & Poor's) highlights the risks and acts as an advisor and not necessarily as a referee between the issuer and the participants, then we possibly need someone to do that unenviable job. The market decides on the credit quality of the country ultimately. In recent days Greek 10 year bonds have dipped below 7 percent, they had a 6 in front of them at some stage. Heck, Portugal is at 2.99 percent in a negative broader Eurozone economy. There are serious problems and then there are serious problems, luckily for Greece and Portugal, their older brothers and uncles are loaded, and are willing to take them in for a while whilst the storm passes.

No such luck down in this neck of the woods, we are on our own. The only other comparable country, with similar pains is Brazil, currently with government bonds marked as non-investment (or junk if you will) grade. The yield on their generic 10 year government issued bond is 12.89 percent. Our comparable 10 year bond, the R186, which matures in 2026, yields 9.41 percent as of close of trade yesterday. That has been creeping higher and higher over the last three or so weeks, in anticipation of the findings of ratings agencies Fitch and Standard & Poor's. The findings are expected to be released around June the third, which is Thursday next week. It is like waiting for the team sheets in which your personal performance has absolutely no bearing whatsoever. Stick this event in the drawer of things you have no control over, yet you can do something about.

Over the seas and far away in New York, New York (I was listening to Frank Sinatra the other night with my youngest daughter, she thinks he is "pretty good") stocks traded in a hacksaw manner from start to finish. The broader market S&P 500 was essentially flat with a teeny-weeny bias to the negative, the Dow Industrial Average (which turned 120 years old yesterday) sank 0.13 percent, mostly as a result of energy stocks, whilst the nerds of NASDAQ were carried higher with strong moves across the majors, Facebook inc. and Apple up. Facebook are trading near an all time high, whilst Apple stock went through the 100 Dollar a stock mark, something that last happened, errr, a month ago. Over the last five sessions the stock is up nearly 7 percent. Over the last year the stock is down 24 percent.

I laughed when I saw a headline that went something like this: Apple is not the next Blackberry, rather the next Microsoft. Microsoft trades on nearly 40 times historical earnings, the market has it nearly 19 times current earnings. By the same metric, if Apple was the next Microsoft, the market cap of the maker of the iPhone would be over 1 trillion Dollars already, and the stock would (if the market gave it the same rating) trade near 190 Dollars a share. In other words, I wish Apple was rated by the market as the next Microsoft, whatever that means.

Company Corner

Peer into any larder or kitchen storage space in South Africa and you are more than likely to find some Black Cat peanut butter, Fatti's and Moni's spaghetti (or penne if you will), Ace mealie meal (or instant porridge), Tastic rice, Golden Cloud flour, All Gold tomato sauce, Oros on the drinks front, along with Energade, Rose's and Hall's, Koo jams as well as Albany bread in the bread bin. A look in the fridge may reveal some Mrs. Balls, Colman's mustard, Crosse & Blackwell Mayonnaise as well as other well known perishable goods such as Renown and Enterprise sausages.

Under the sink you are likely to find some Jeyes fluid, Bio classic, and in the bug zapping drawer some Doom and Peaceful sleep to ward off the bugs during summer. Into the bathroom and you will find old favourites such as Ingram's and Kair, as well as Perfect Touch and Dolly Varden. I remember using the glycerine (it is sweet) to dip pacifiers into when my kids were younger, it made the "dummy" taste that much better. Talking babies, feeding time means Purity, provided your baby is of the "right" age. Lastly, for those of you with the sweet tooth, you are familiar with Beacon chocolates, a Durban born confectionary business.

These products are all under the stable of Tiger Brands, the good old fashioned Tiger Oats has been a generational favourite for breakfasts through the ages in South Africa. Tiger Oats traces its roots back to downtown Jozi, where in 1920 the business was founded by Jacob Frankel, along with the help of a fellow by the name of Joffe Marks. The company used to own both Spar and Astral, unbundling them along the way. As well as Adcock Ingram, if you had held all of these businesses through to today, even from two decades back, you would certainly have "done very well" for yourself. Tiger has delivered superior returns to their clients over the decades.

Recently the company has stumbled along, they did in essence exit Nigeria after a three year nightmare, the way the situation looks in Nigeria now, perhaps for the better now come to think of it. Currency devaluations, the flourishing parallel market (call it black market or "real" market) and general government flopping may well lead to a recessionary environment in the West Africa powerhouse. They still do have a business in Nigeria, just not the milling business. Tiger owns 100 percent of biscuit business Deli foods, and have a 49 percent stake in UAC Foods, a business that has a stake in Mr. Bigg's, I thought that was owned by Famous brands. Perhaps those are the shareholders, indirectly there is Tiger and directly, Famous Brands.

This is not to say that "things" are better here in South Africa. It is however their home market, they certainly understand it better, as do their customers. I often think that Tiger will benefit from cross border trade across the continent, and do bite sized acquisitions along the way in their core markets, maybe the Dangote Flour deal was their Arnheim, the proverbial bridge too far.

That is in the past, and whilst we look ahead to the future of the business, we should recap their results quickly. These results were for the six months to end March 2016. By following the link you can see the presentation. Volume growth of just one percent was better than one of their peers reporting earlier in the week, the Pioneer Food Group, which experienced a 5 percent decline. Perhaps a strong marketing push in an environment that has been relatively tough, supermarket bosses have urged consumers to keep costs low by doing one thing or another. Whitey Basson, the CEO of Shoprite had suggested that the drought was not an excuse to pass the costs onto the consumer.

Both Phil Roux of Pioneer and outgoing acting CEO Noel Doyle of Tiger agreed that you couldn't pass the full extent of the price increases onto customers, obviously there will be margin compression, 70 basis points was shaved off on that score. Good cost saving, from the aforementioned Doyle (count them beans Noel) added 80 basis points, score for the Tiger. Perhaps the onus should be passed onto shareholders to absorb that, in the interest of social cohesion, as tricky as that all sounds. All in all, a satisfactory result was delivered in a very trying environment.

It is likely to remain trying for Tiger Brands, as well as their competitors. Pussy cat or roaring 350kg's of feline fury? There is likely to be more inflationary pressures rearing their ugly heads from time to time. The company will focus heavily on costs, the new chief Lawrence MacDougall (Doyle moves back to Chief Operating Officer) has over three decades of experience in fast-moving consumer goods, having worked for Mondelez and Cadbury's (same-same company, Mondelez acquired Cadbury's). Kraft and Mondelez split in 2012, separate businesses were formed, that is another story entirely though.

The market initially reacted negatively to the results, after a few hours and no doubt the presentation, the stock has had a flurry recently. Tiger was up nearly four percent at one stage yesterday. We envisage a tricky outlook for the group over the coming months, we do however think that year on year comparisons may become a whole lot more palatable this time next year, all things being equal. And by that I mean no new shocks to the system, no massive currency swings as a result of a political disaster, or more bad weather related activity. Those are out of your control. We continue to recommend the king of the food market in South Africa, strong brands will see them through to another few decades of growth, plus African consumer activity should eventually feed to a larger export base. for now we continue to hold, we will accumulate on weakness.

Linkfest, lap it up

Have a look at how insanely quick the Model X is - Tesla Model X beats sports car while towing another car. Musk and his team created a thing of beauty, it makes sense why there are waiting lists for these cars.

As Apple looks for places to invest their over $200 billion cash pile there are many rumours and theories of where the company should deploy the cash - Time Warner, Netflix Climb on Report of Apple Interest in Media. I can see Apple and Netflix being a good fit, the profits generated from the acquisition would still not really move the needle much on Apples side though.

Following the article in yesterdays links, robots are finding employment in other sectors too - iPhone manufacturer Foxconn is replacing 60,000 workers with robots. One of the market commentators made the comment yesterday that "Finally, FoxConn will address the working conditions of its employees".

And another example of the robot from yesterday, Pepper may have a friend called Salt at McDonald's, some time soon and fits squarely into the box, unintended consequences - McDonald's Ex-CEO Is Right When He Says A $15 Minimum Wage Would Lead To Automation

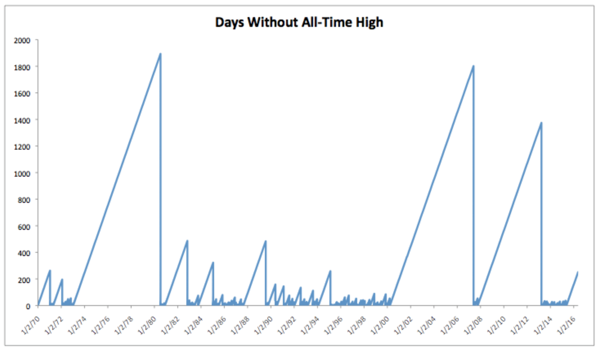

This is worth a read, it is a little technical but worth a long, hard read - Was That A Bear Market And Is It Over?. The article takes a graph, below, and points to days traded without an all time high. Currently, on the scale (excluding the financial crisis of 2008 and the tech bubble bursting in 2000) this is the longest period of this nature. Check it out, over 250 days without hitting the last all time high:

And then lastly two pieces from our old pal Josh Brown, following on from above and some superb weekend reading special - "I don't know" hits a 26-year high and also from the same blog, I particularly enjoyed the reference to bloggers - The Conditions You'd Want Are Already Here.

Home again, home again, jiggety-jog. Tencent is trading at a 52 week high, up nearly three percent. Which means that one of our biggest listed stocks, Naspers, may well benefit hugely from an up day after a down day yesterday. It too could touch or reach out for an all time high. Stocks across Asia are all higher. Oh, and there is a G7 meeting going on, don't all yawn at once. And lastly, to all you Red Devil fans out there, the special one has arrived. Will it change fortunes? Chat this time next year, OK?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment