"Whilst Vodacom is not a broad part of our client portfolios, it certainly does have an important place. Even if earnings don't show material moves higher, the company is likely to continue to show good dividend growth. In an increasingly volatile world, locally that is. Having said that, the company still has a large portion of their earnings in South Africa. Which is seemingly MUCH better than being in Nigeria, even if only for the next little while. We are still buyers of this company for our higher yielding portfolios."

To market to market to buy a fat pig Oops. When a Fed official says that the US economy is strong enough to withstand a rate hike in June, next month, that should in a way be a cause for some sort of celebration. Not to be however, Mr. Market in New York, New York (sing it old blue eyes style!) was trading down around half a percent until Fed official Dennis Lockhart spoilt the second half. For the bulls of the equity market, that is. It can't necessarily be said that this is bad for those with cash, who have seen near zero rates for around one-third of a generation. He wasn't alone - Fed officials Williams, Lockhart stress that June meeting is 'live'. John Williams, the lesser known of the two and Lockhart both stressed the obvious. Here is the FT take - Markets underestimate chance of June rate rise, says Fed official.

The upshot of it all was that stocks sold off. The data is encouraging they said, inflation is a little hotter from a recent read (yesterday) and as such the Fed possibly need to act. I just can't understand how that is a sell, sell, sell scenario. Surely if the data is encouraging, that means the US economy is slightly hotter than people are currently giving it credit for. The other upshot, as pointed out by Barron's - Yield Curve Flattens as Fed Officials Say June Hike is Possible.

Mr. Market's freak out meant that stocks sold off, sell first and then ask questions later. The Dow ended down just over a percent (after gaining a percent the session prior), the broader market S&P 500 lost less than a percent whilst the nerds of NASDAQ sold off around 1.25 percent. Only energy and materials stocks gained, pretty much everything else sold off. Sigh, I suppose that we are stuck in this part of the cycle where Mr. Market makes sweeping conclusions about almost everything. I guess it always presents us with opportunities, when the same stocks sell off based on some large macro view, then so be it. We should actually be thrilled. A very deep piece about why you may well want to kick the macro view to the curb: The Power of Stories.

Company Corner

Vodacom reported full year numbers on Monday. The company traces its heritage back to the dawn of democracy in South Africa, I had the pleasure of being at a dinner birthday function and sat with a man who was part of the team that wrote that there would be a maximum (at the time) of 250 thousand users of the mobile service. Phones were big and clunky and took calls only, remember? It is a little difficult to believe that the touchscreen smartphones are not that old, and in terms of being mainstream, less than a decade. The iPhone is not even 10 years old. Remember the Symbian operating systems on the Nokia? Remember Nokia? Remember Windows phones, how huge that was going to be. It is Android and iOS now, to be fair there are others, not as dominant as these ones.

So why is this at all important for Vodacom? The more amazing the hardware and software, the more chance there is of consumers using more of their services, in particular more recently data. We dredged up an ancient video of us picking up a Nokia N97 and predicting more people would use the device more. And encouraging the investment in MTN, that has been the company that we have owned for years. For the time being we have been very wrong on that one, Vodacom has comfortably outperformed MTN on the returns stake for quite some time now. We continue to remain patient and await the resolution of the pending fine in Nigeria. Whether or not you think that the quantum (we don't) of the fine is "fair" or not, that is another question entirely.

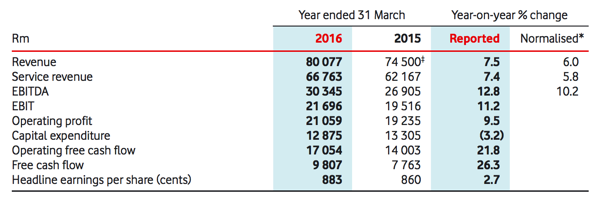

Back to the results at hand, annual ones for Vodacom. Herewith a table with the comparable year:

Whilst Vodacom is not a broad part of our client portfolios, it certainly does have an important place. Even if earnings don't show material moves higher, the company is likely to continue to show good dividend growth. In an increasingly volatile world, locally that is. Having said that, the company still has a large portion of their earnings in South Africa. Which is seemingly MUCH better than being in Nigeria, even if only for the next little while. We are still buyers of this company for our higher yielding portfolios.

Google I/O starts today. You can watch it all live via that link. Which means no expensive flights and jet lag, no hotel and fast food (just the junk you'll eat at your desk whilst you watch this delivery) and most importantly, you can stay put in your pyjamas if you want. Perhaps it will be warmer in San Francisco than it is here. The full first day schedule includes the kick off by CEO Sundar Pichai. Pretty cool three day event for all things Google and all things Android. I was doing a little snooping for my Vodacom piece yesterday and discovered that there are roughly 24 thousand unique devices that run Android operating systems. Yowsers.

For a preview of what to expect at nerd central over the next few days, TechCrunch has written this,Here's what we expect, that includes Android N, the next operating system, a real and proper virtual reality headset, as well as a home/personal assistant type device to rival Amazon's Alexa. Remember that (and the article reminds you) Google (Alphabet, sorry) bought Nest, a home automation business, in January of 2014. All sorts of nifty things have emerged, including this one - Linus, a secured by Yale and connected by Nest solution. I am guessing with that one, the power is going to have to always be on, or a battery back up system, your device had better never run out of batteries. The plus side is that keys could be a thing of the past. Expect nerd central to hit fever pitch over the coming days!

What does a picture tell? A 1000 words is what we were taught. Twitter has actually taught us that it can be 23 characters, 19 percent of the characters. Now when you are dealing with useful "insight", 23 characters as to the 140 character limit can cramp your style. Equally a link to an article takes up your valuable 140 character real estate. Twitter's response is seemingly to exclude both images and links from your amazing insight - Links, Photos Won't Count Against Twitter Limit. Think more carefully before you tweet next time, OK?

Why is Twitter doing this? It seems pretty simple, if you follow the link in the PC Mag article, you will see that photos get a 313 percent more engagement than just a line or a link - #TweetTip: use photos to drive engagement. As for Twitter stock, that is another story altogether. Trading near their 52 week lows, the company operates in what is clearly the future of media, yet the failure to get Mr. Markets endorsement on very patchy earnings has seen the stock rerated. Those of you who follow us on Twitter, would you prefer to see more photos from inside of Vestact? Let us know, to improve the experience.

Linkfest, lap it up

As global poverty levels drop the distinction between "developed" and "developing" is getting more blurry - The World Bank is eliminating the term "developing country" from its data vocabulary.

One way to see if a currency is over, or under valued is to compare the price of goods. Theoretically the price of goods should be relatively similar between countries. The most famous comparison between currencies is the Big Mac index, based on that index the R/$ should be at R/$ 5.68 - The Big Mac index. Notice how emerging market currencies have been the most sold off. One thing to note though is that the index doesn't take into account the cheaper rent and wages paid in RSA compared to the US.

Alternate investments generally charge more, use leverage and are seen as an investment tool for the wealthy or sophisticated investor. How do you measure the performance of these funds though - How Should Alternative Investments Be Benchmarked?

Do you want to know how Netflix can spot a new show and stick it on their popular streaming service. It turns out that Cindy Holland, who has been at Netflix for nearly 14 years according to her Netflix profile, is driving this hard. A rare interview given - How Netflix Exec Cindy Holland Spots A Hit Show. Related in some way, Holland finds herself on the list of The Most Creative People in Business 2016.

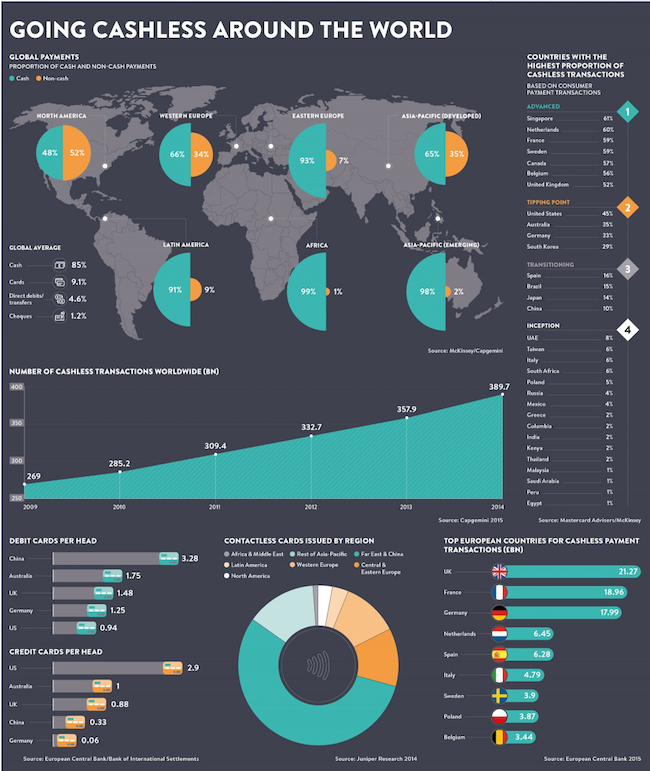

Visa, MasterCard? Apple Pay? Android versions of Pay and so on? This is pretty darn cool - The Shift to a Cashless Society is Snowballing.

Home again, home again, jiggety-jog. Hey! Tencent results today. This is big news for our shareholders of Naspers of course. Those results are normally received after the Hong Kong close and before the US open, so around 11 to midday local Jozi time. Those are most exciting and we will report in the coming days on the results. I do wish that Google Finance would fix the split of the Tencent stock in Hong Kong on their graphing tool, it is all a bit weird to see that massive step down, have a look and let me know what you think.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment