"A rights issue, the buying of Al Noor, reversing into the London listing and on top of it all, the confusion amongst retail investors of what their actual price is for the stock. We can deal with all of those briefly"

To market to market to buy a fat pig As you were. Sell in May and all that jazz, the goto market globally is the S&P 500, and that index happens to be 1.28 percent lower for the month after yesterday's move higher in New York. Year to date the index is up just over two percent. Over the last 12 months, the broader market S&P 500 is down 1.67 percent. Stretch that out a little more and extend that to two years, you have the benefit of a decent 2014 and a late rally that year (Santa Claus), the return before dividends is still a paltry 10 percent over that time. Over three years that extends to 26.7 percent, that starts to resemble longer dated stock market returns.

Anyone who thinks that stock investing is easy, has obviously been in only certain stocks. Investing is hard, yet it is extremely rewarding. The returns come after having made sure that the companies you invest in are of a certain quality, the earnings follow and the stock rerates over time. I can't stress enough how we don't own the index, and never will. That is not our job, that is not what we do here. Ironically for many retail investors that are forced monthly savers through pensions, they should be doing exactly that, finding the lowest cost index tracking option and benefit over time from Dollar cost averaging and dividend reinvestment. If there was a quick way, it wouldn't be quick any more, investors would crowd it out in two ticks.

By the end of what was a very good session for stocks, the Dow Jones industrial Average added just over four-fifths of a percent, both the nerds of NASDAQ and the broader market S&P 500 added 0.7 percent by the time all was said and done. The oil price went through 50 Dollars a barrel for the first time in six months. Financials had a ripping session, it was energy and basic materials that added nearly 2 percent. There was selling specifically in Alibaba, the SEC was investigating some of their reporting. JD.com, also in the sector was lower as a result too, the other stock that we hold indirectly, Tencent via Naspers is off nearly a percent this morning in Hong Kong. I suspect that not being listed in New York, and being a Chinese based company is sometimes a blessing.

Back at local is lekker HQ here in Jozi, stocks as a collective added over a percent and a quarter. It was a rally that was pretty much broad based, unless you were in gold shares or the precious metal itself. Financials added over two percent, the afterglow of having staved off a ratings downgrade from at least one of the ratings agencies, at least for now. As Paul said, the political landscape is one thing, all these guys really care about is the ability to meet certain tax collection targets and to look to meet certain budgetary targets.

Of the majors, only three stocks were down, the solitary gold company inside of the ALSI 40, AngloGold Ashanti, Vodacom was the other (marginal) and lastly Capitec. Some rumblings there around investigations, question marks of any sort always equals sell first. At the other end of the scoreboard were FirstRand, Glencore, Sasol and BHP Billiton, which were all up over three percent plus. Of the majors, only Reinet and British American Tobacco were reaching new 12 month highs. The former on numbers out during the day, they looked decent enough at first take. A large magnitude of results came rushing at us, we will continue to deal with those as we go along.

Company Corner

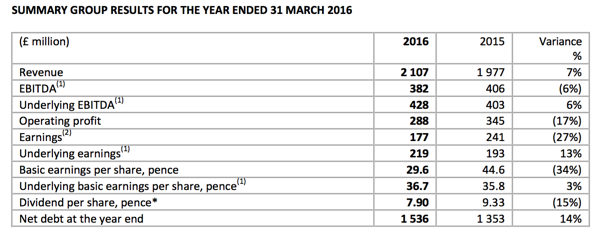

Mediclinic reported numbers yesterday, for the first time as a UK listed entity. So what is important to note is that there is really no comparable currency of comparable business in the current format to measure against. A rights issue, the buying of Al Noor, reversing into the London listing and on top of it all, the confusion amongst retail investors of what their actual price is for the stock. We can deal with all of those briefly. Firstly, herewith a table with the "comparable" period from last year:

At face value, none of that looks particularly good now, it is important to note that the group continues to make progress in all their markets. Switzerland was pleasing, South Africa was decent, the UAE is going to benefit from cost savings across a larger beast, effectively doubled after the Al Noor reverse takeover. The reason why something is called a reverse takeover is normally when a much larger business uses a more favourable platform (in this case a London listing) in order to achieve a "take over", when in theory, Al Noor integrated Mediclinic. That is now water under the bridge, as the company embarks on delivering a quality service. In the outlook segment Mediclinic says Notwithstanding the on-going changes in the global and regional economies and the regulatory changes that continue to impact healthcare and its affordability, we are continuing to see a strong demand for quality private healthcare services across our three operating platforms.

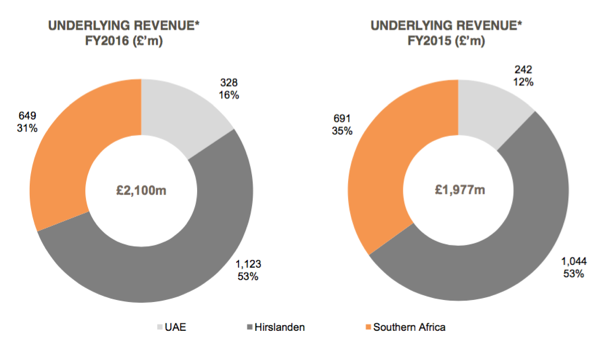

How does the group look now? The revenues for the UAE operation in the below revenue contribution by geography only includes the mainly Abu Dhabi based Al Noor from the date of acquisition, i.e. only a month and a half:

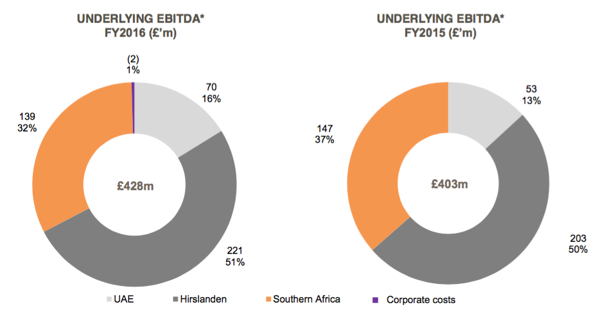

You can have monster revenues, what matters most to investors at the end of the day is whether or not those businesses are profitable or not. So then, let us look at the breakdown of the underlying EBITDA (Earnings before interest, taxation, depreciation and amortisation). The reason why investors and accountants like to look at EBITDA is that it eliminates both accounting and financing effects, and can make like-for-like comparisons a little easier. Of course the other major comparison is to take free cash flow generated and measure that against another company, I guess one should always take a holistic view of a company and factor in everything, before coming to any conclusion on whether the business is likely to be a good investment (at this point) or not.

Again, we are going to stress that these numbers will evolve rapidly and that you won't necessarily be able to gain much from the comparable reporting period until this time next year. At that time, currencies would have "settled", the transaction in the UAE would have been errr .... bedded down. We like the sector, we like the company, we like the fact that they have a big shareholder in Remgro that can be alongside you as an investor in order to embark on more transactions, if needs be. We continue to accumulate the stock, we really think that the future is very bright, the company will execute properly and professionally.

Finally, let us deal with your price paid. I have fielded many calls lately about people who are either questioning the price paid, or worried that they have lost money on the investment. Trying to keep it simple, you were bought out of your old Mediclinic shares at above 127 Rand, in return you were awarded new Mediclinic shares in the ratio of 0.625 of the old ones at the prevailing Pound price of Al Noor. At the time of the award the Rand was on a far weaker showing against the Pound Sterling, hence your price purchased for the new Mediclinic shares (listed in London) is higher. The easiest thing to do, to determine whether or not you are in the money is to go back and look at all the transactions on your statement, the Rand amount, including the Mediclinic rights issue, and see what the total is (we have clients who have bought them in multiple transactions). And then compare it to the Rand value of the Mediclinic shares you own now. Easy enough, not so?

Linkfest, lap it up

The headline says it all, no need to add anything else, hardware and software is much better than yesteryear - Technology has advanced so rapidly that a laptop computer today is 96% cheaper than a 1994 model and 1,000X better. What are your expectations for gadgets and indeed if many technology firms are working hard on transportation, surely the future looks brighter for consumers?

Unfortunately we associate SnapChat with racy pictures, when in reality it can become a very powerful advertising platform. It turns out that the amateur nature of the posts is well received, consumers relate well to the average - These 5 Startups Used Snapchat To Boost Their Brand (And So Can You).

Robots are finding more roles in the work place, they are now starting to take customer facing roles - SoftBank's humanoid robot Pepper is getting a job at Pizza Hut. As the minimum wage debate continues in the US, Pepper adds a new dynamic to the equation.

It seems that barley arrived in China 1000 years earlier than originally thought, it was also used to make beer before anyone grew it for food - Cask from the past: archaeologists discover 5,000-year-old beer recipe.

It is scary to see how people are just kicking the can down the road when it comes to planning for retirement. It is a human default to ignore a problem until we have no choice but to address it, in this case we ignore retirement saving until retirement is basically on us - 48% of Americans saving for retirement are pretty sure they have no idea what they're doing. Sad to see that 33% of people in the US said that they have no retirement savings.

On the South African front it is also a sorry sight - Most South Africans are nowhere near ready for retirement. It seems that the 'head in the sand' strategy is what the majority of people go with. Is this a symptom of people believing that governments and regulations will keep them safe down the road?

Sticking with the retirement theme, Ben Carlson speaks about how people over estimate what their annual returns will be resulting in them not having enough when it comes to retirement - How Return Assumptions Affect Investor Behaviour

Home again, home again, jiggety-jog. Stocks are mixed across Asia, marginally higher at the moment. Stock futures are mixed to flat.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment