"... essentially going out and finding out as much as you can about how people feel about the products that they ... it's just asking questions, basically. And Apple strikes me as having quite a sticky product and enormously useful product that people would use, and not that I do."

To market to market to buy a fat pig A mixed bag back home here, stocks slipped in the last two hours of trade, down a little over one-quarter by the close of business. Financials were the biggest laggards, the currency was pretty steady post the budget speech and has found "a level" now. New 12 month highs for Adcock and Clicks, people getting their meds and vitamins? Hair products and deodorant? All good there people? The strong(er) Rand dragged much of the top dual listed stocks with it, Intu, Hammerson sliding with banks. At the other end of the spectrum, in a rather sparsely populated #winners board, there was the likes of Kumba, Steinhoff and South32, as well as Sasol post their results.

MTN was also there, after they released an updated trading statement ahead of results due on Thursday. I tried to answer a few questions for a journalist, this is what I wrote about the rather ugly looking trading statement: "It has been a "very difficult" time for MTN. They are throwing the kitchen sink here at this point, the new chiefs will be inherited a house that is structurally sound, in bad need of a repair. Remember that they (MTN) pay the Nigerian fine in Naira. They don't have to bring the money here, they do have to report it here, get that? I would say, wait for the numbers. I suspect that in six months time (from now), you will get a very clear idea of strategy with the new team be that banking and payments, music and internet, entertainment and streaming, etc. Predictions are too hard to make, best left for other people."

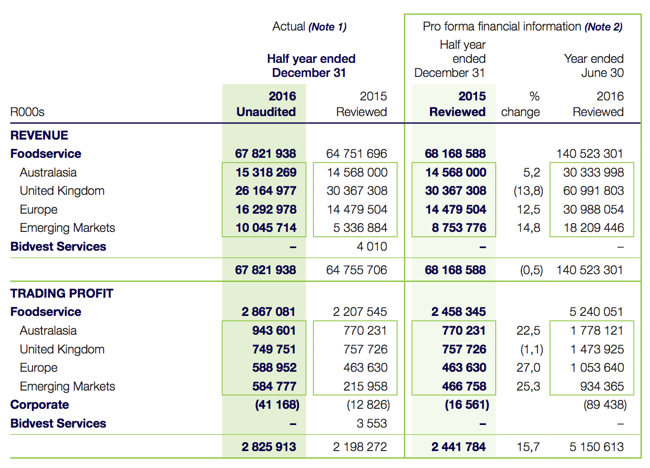

In short, let us wait to see what the results reveal, and then revisit in six months time, to see what the strategy says. The stock added 0.8 percent on the day. Meaning that basically there was nothing new in here that the market was not expecting. Rob Shuter would have had his second day on the job in two weeks from today. There were also results from Hulamin, I passed the CEO in the halls of the JSE, the CNBC producer said I had been rude about their business on the box (I was just before him), which I had not, I was a little unsure of what to say. Play the reel, I should have shouted. Bidvest also had results, as you well know, we prefer the food part of the business, BidFood/Bidcorp. The Bidvest share price was down a bit, over a percent. Both stocks have done "decently" in the run up to the unbundling and beyond.

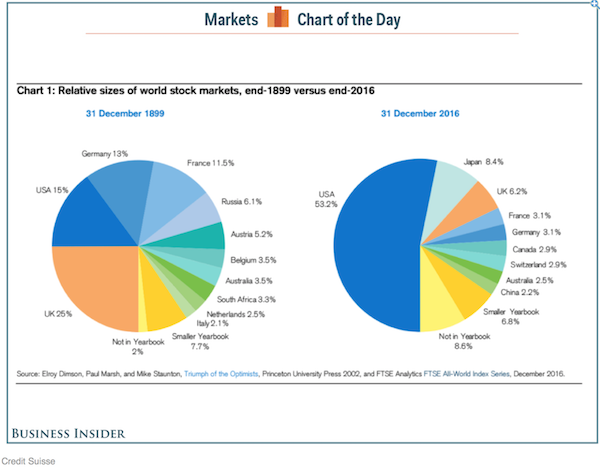

12 in a Row. "Make that a dozen" is what I hear Mike Haysman say in the background. The Dow Jones continued the winning streak to a dozen sessions in a row, the longest streak since 1987 (The US stock market is on the verge of making history). When Three men and a baby was the highest grossing film. Zero academy award nominations by the way. In 1987 Michael Douglas won best actor for his portrayal of Gordon Gekko in Wall Street. According to Wikipedia, on the 9th of January that year "Police raid English-language newspapers, seizing documents related to an advertisement calling for the legalising of the African National Congress." Do you remember the incident? Govan Mbeki was released from Robben Island prison that year. Do you remember that? It was sure a long time ago.

Spandex, jelly shoes, parachute pants, aerobics, the rise of athletic wear, Doc Martens, punk wear. Yip, that was the last time that the Dow Jones had 12 winning days in a row. Dig out those old photos (they would be physical), have a large laugh at the lot. You are not cool now. At session end the Dow Jones had grabbed another 15 points to the good (0.08 percent higher), the broader market S&P 500 added one-tenth of a percent, whilst the nerds of NASDAQ added 0.28 percent on the session. All record highs for all the major indices. And of course, this all comes ahead of the Trump address to congress. Bloomberg says - Trillions of Dollars Are at Stake When Trump Speaks to Congress. YUGE. Incredible. You're going to love it.

It was Warren time part II on the box yesterday, the 10th year that CNBC (and Becky Quick I think) have interviewed Buffett after his annual letter. It is always in Omaha, it is always in a store of some sort that Berkshire owns or has a stake. That is the way that Warren rolls. He is as sharp as a pointy HB pencil (some people have sharpening skills), he is witty and practical. That is what everyone loves about him, the old man investor. The billionaire next door. Lucky for us, in the age of the internet, there are transcripts, this one is "unofficial".

I do not agree with everything he says. For instance, to say that there was nothing in America 240 years ago, that is wrong. History is written by the victors. Most people will answer 1492 if you ask them "when was America discovered" in the same way that they will answer David Livingstone "discovered" Vic falls. It was there all along and there were many people living in North America before the early settlers arrived. I know what he means though. What was quite interesting to me is how he describes current valuations in stocks. Here is a copy and paste of the whole piece:

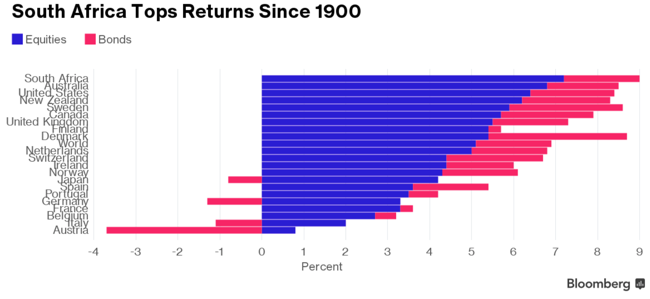

"And we are not in a bubble territory or anything of the sort. Now, if interest rates were 7 or 8 percent then these prices would look exceptionally high. But you have to measure, you know, you measure everything against: interest rates, basically, and interest rates act like gravity on valuation. So when interest rates were 15 percent in 1982 they'd pull down the value of any asset. So, what's the sense of buying a farm on a 4 percent yield basis if you can get 15 percent in government's? But measured against interest rates, stocks actually are on the cheap side compared to historic valuations. But the risk always is, is that - that interest rates go up a lot, and that brings stocks down. But I would say this, if the ten-year stays at 230, and they would stay there for ten years, you would regret very much not having bought stocks now."

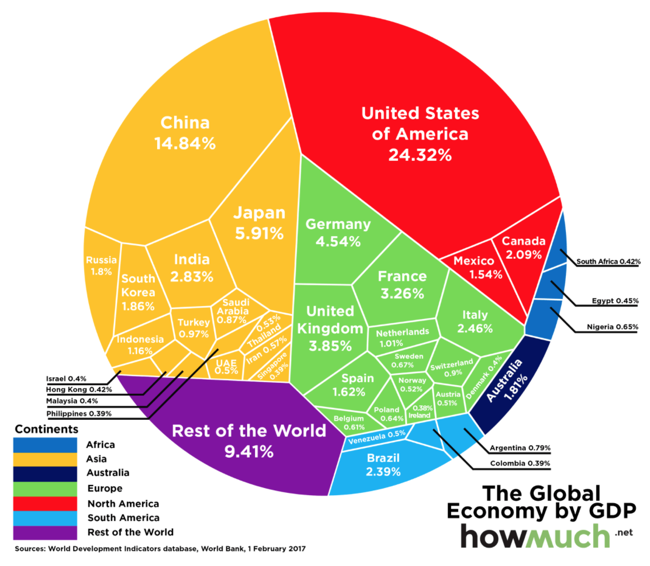

He is comparing all asset classes here, and referencing them to one another. The risk free rate (230 is the number of basis points that the ten year treasury yields) is low, then stocks are cheap if the yield is right. And Buffett reckons that rates are not moving much higher any time soon, remembering the Fed dots that look like a bunch of flying saucers in formation. The long term rate is below 4 percent. On a relative basis, stocks are cheap is what he is saying regardless of where rates go. He suggested to Becky Quick (my guess is that she is around my age, 40, an internet search reveals she is 44) that in her lifetime, the Dow Jones would approach 100,000 points and "that just requires the American system continuing to function pretty much as it has."

Berkshire has bought around 20 billion Dollars worth of stock since the election, including a rather large stake in Apple Inc. Before the results (and perhaps shortly after), they had bought 133 million shares, Buffett himself 123 million, the balance going to Ted or Todd, the professionals that they have hired. That is around 2.2 percent of the company. When asked why, quite simply he said, "'cause I like it". Buffett continues:

".... going out and finding out as much as you can about how people feel about the products that they ... it's just asking questions, basically. And Apple strikes me as having quite a sticky product and enormously useful product that people would use, and not that I do. Tim Cook's always kidding me about that. But it's a decision-based ... but again, it gets down to the future earning power of Apple when you get right down to it. And I think Tim has done a terrific job, I think he's been very intelligent about capital deployment. And I don't know what goes on inside their research labs or anything of the sort. I do know what goes on in their customers' minds because I spend a lot of time talking to 'em."

Berkshire have doubled the number of shares that they own of Apple since the beginning of the year. My daughters asked at dinner last evening, why so "late"? i.e. Could he not have owned them years ago? The answer is yes, Buffett wasn't convinced yet. It took 50 years of reading IBM annual reports before he a bought a share. He tells a story of taking his great-grandkids to Dairy Queen and they bring their friends along sometimes. As far as I can tell, there are plenty of spots in Omaha to go for an ice cream of this sort. If you want to meet Warren, hang out at the various Dairy Queen outlets over the weekend. He explains, and it is pretty simple:

"They've all got a iPhone and, you know, I ask 'em what they do with it and how ... whether they could live without it, and when they trade it in what they're gonna do with it. And of course, I see when they come to the furniture mart that people have this incredible stickiness of - with the product. I mean, if they bring in an iPhone, they buy a new iPhone. I mean, they're ... it just has that quality. It gets built into their lives. Now, that doesn't mean something can't come along that will disrupt it. But the continuity of the product is huge, and the degree to which their lives center around it is huge. And it's a pretty nice, it's a pretty nice franchise to have with a consumer product."

The long and the short of it all is that even the most successful investor in the world did some of his own low level research before he dipped his head deep into the financials. At the end of the day, a business sells products and services that customers interact with. And if consumers want more of it, and think that the product is amazing, as long as that remains that way, people will want new iPhones and get locked into the ecosystem deeper and deeper with all the new services that you do not yet know about. Great interview as ever. Stocks are going to be fine, politics and markets don't mix, as long as America stays the course, everything is going to be OK. The biggest worry that he (Buffett) has is nuclear war. Really. Read it. Listen to it, it is part of the knowledge accumulation. For the record, Apple traded near the intraday all time high. Own it (Apple). Until something changes. Pay attention.

Linkfest, lap it up

Want to go to the moon, the far side of the moon? It is closer than you think, Elon Musk suggests next year - SpaceX to Fly Passengers On Private Trip Around the Moon in 2018.

You are going to need to store it somewhere. The article talks about the driverless car revolution - The race for autonomous cars is over. Silicon Valley lost. - "Last year in the U.S. market alone Chevrolet collected 4,220 terabytes of data from customer's cars." Stay long Amazon and NVIDIA as winners in the cloud wars?

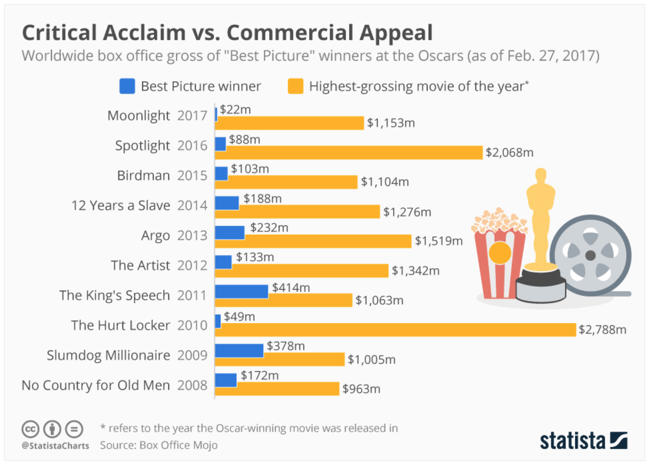

The difference between IFRS and GAAP? Or how did PWC mix up two different movies? Here - It seems like we now know how the wrong Oscar envelope got into Warren Beatty's hands. Poor Brian Cullinan was simply starstruck. What is more of a mix up, and we were talking about it yesterday, was the difference between the Oscar winning movie gross at the box office, and the best grossing film of the year. Which begs the question, who really won what? Courtesy Statista: Critical Acclaim vs. Commercial Appeal.

Home again, home again, jiggety-jog. Stocks have started about flat to begin with. Stocks across Asia are mixed to higher. US Futures are marginally lower. C'mon, 13 in a row!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063