"Content creation is the moat around the company at the moment, it is what differentiates Netflix from other streaming providers. The Crown, a series that depicts Queen Elizabeth's life, won Best TV Drama & Best Actress of TV Drama at the Golden Globes, so their push into new content is working."

To market to market to buy a fat pig Local was lekker for a while. We listened in to Theresa May's speech about the awesomeness of Britain that it needs a Great in front of it. Has a good sound to it. I suspect the first new thing that Donald Trump should do as US president is rename the country to "Great United States of America". Now that it has been made great again. Apparently Ronald Reagan used that line first - Make America Great Again. What about making politicians great again? So that they can use public transport, send their kids to public schools and public health facilities? Most importantly, institute term limits for politicians. 8 years, or something like that.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

Anyhows, we are getting off topic here. Jozi stocks as a collective closed down a smidgen.

In New York stocks slipped last evening, perhaps it was the fact that the Fed saw the labour market tighten (meaning higher wages were next), which meant that rates would go up on cue, three times this year. Not everyone is a believer, how can you blame them when Stanley Fischer said rates were likely to rise four times last year. And we got a single rate hike at the end of the year, so even the insiders had little clue as to what was likely to transpire. Unfortunately for exceptional economists, they too have to make forecasts and then shift them as the incoming data changes. This is no different for the great Stanley Fischer. Anyhows, stocks slipped away, we closed down just over one-third of a percent on both the Dow and the S&P 500, the nerds of NASDAQ were lower by around one-quarter of a percent.

Once again energy stocks took some heat, healthcare stocks sank just over four-fifths of a percent, there are (to use a Rumsfeldian) many unknown-unknowns. And they may be YUGE, they may just be hot air. Whilst there is a great swear in of the 45th (and most important ever in the history of everness) President of the USA, there is the small matter of earnings season that continues today. It is the turn of General Electric, a stock that we used to own, no longer. The one constant of the Dow over the many years. Next week is a cracker, as is the week after. You know .... I cannot wait!

Company corner

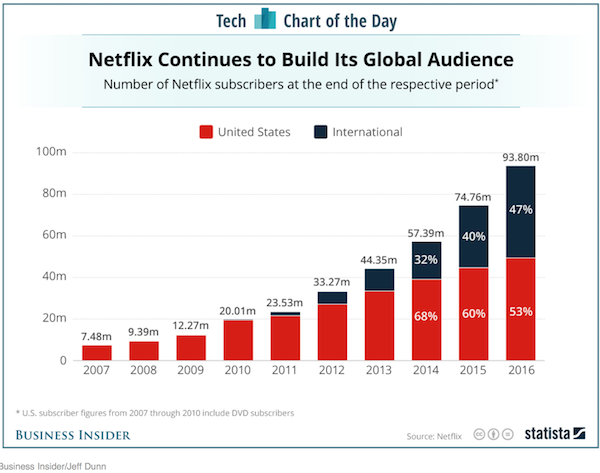

Whoa, Netflix continues to crush expectations. On Wednesday after the market close they released their 4Q results & shareholder letter. The stock shot up 8% in after hour trading. At the close of trading yesterday it only ended up 4% after all was said and done. Compared to the same time last year, streaming revenue is up 41% to $2.35 billion for the quarter. The numbers people were more interested in was what the subscriber growth looked like and the growth didn't disappoint (see below).

Note on the above image, that it says that subscribers up until 2010 includes, DVD subscribers. As most of you will know, Netflix started out as a DVD hire company, where they post you the DVD, you watch it and then post it back to them. What most of you won't know is that Netflix still has 4.1 million subscribers using their DVD service!. When was the last time you watched a DVD or even saw a DVD shop? Now add into the equation using the Post Office, talk about old school tech. This part of the business is profitable though, generating a profit of $68 million for the quarter and more than off setting the loss of $67 million from the international streaming devision.

As Sasha points out, Netflix has made 3 rather big transformations in a relatively short period of time. They started as a DVD company, then changed to a streaming company and now they have changed into a content producing company. House of Cards was their first big hit but since then they have spent billions on content, forecast to spend a whopping $6 billion on content creation in 2017.

Content creation is the moat around the company at the moment, it is what differentiates Netflix from other streaming providers. The Crown, a series that depicts Queen Elizabeth's life, won Best TV Drama & Best Actress of TV Drama at the Golden Globes, so their push into new content is working.

All this growth comes at a cost, from a valuation point of view the stock is trading on a trailing P/E of 374 and a forward P/E of 69. On a business level the company is spending huge amounts of money up front to grow their content base but also grow their international market with the result being that they are going to have negative cash flow of $2 billion for 2017! All in all this is not a stock for the faint hearted. The key question that you need to answer yourself is, will they continue to create block buster content? If the answer is yes then I would say this stock is a buy for your 'outliers portfolio'.

Linkfest, lap it up

Not the biggest release, yet I saw reference here to a Google purchase of Fabric from Twitter. From the Fabric website: "Fabric is a platform that helps your mobile team build better apps, understand your users, and grow your business." Herewith the Google release - Welcoming Fabric to Google. As Francis Ma says: "The integration of Fabric is part of our larger, long-term effort of delivering a comprehensive suite of features for iOS, Android and mobile Web app development."

A cracking interview of Bob van Dijk, Naspers CEO, by veteran journalist Alec Hogg (who is now based in London, as far as I understand it) - Naspers' youthful CEO, able custodian for 20% of the JSE. A few important things to take away: " ... we have no intention of selling Tencent's shares ... " and this should tell you a lot about the current and ongoing strategy: " ... We've always been a long-term company, that's not optimised for short-term returns ... ". On OLX, a business that they are starting to ramp aggressively: "I mentioned OLX earlier, that's simply a business model that might take five odd years before you see any return on that investment." There you go, we remain buyers of this business.

Staying on Naspers for a while here, Bloomberg reports: Africa's Biggest Company Seeks Phone-Company Partnerships. Streaming content through smartphones and tablets, using the existing infrastructure supplied by the likes of Safaricom (as the article points out, 40 percent owned by Vodafone). Did someone say fibre?

Reuters reports - Panasonic aims to move Tesla auto partnership beyond batteries: CEO. The Panasonic CEO refers to "organic photoconductive film CMOS image sensors". Huh? Check it out - Panasonic Develops Industry-First 123dB Simultaneous-Capture Wide-Dynamic-Range Technology using Organic-Photoconductive-Film CMOS. You will recall that the Tesla self driving sensors failed against the blue sky in that incident (Tesla's Self-Driving System Cleared in Deadly Crash), the one in which the single occupant was killed. He was watching Harry Potter at the time. Meanwhile - The Surprising Reason Tesla Could Jump 25%.

The Apple rumour-mill rolls on, this time with wireless charging. Why not, the watch charges wirelessly! 9to5Mac reports iPhone wireless charging reports continue as rumoured supplier sees share price surge. We like Apple as an investment. I keep saying that I am waiting for the assistant, like Alexa, the Amazon version.

Staying with the Netflix theme (somewhat), sometimes people just get it WRONG, and it is very easy to bash them for it. Hindsight, science .... you know the saying. Read this, the close ended fund CUBA story is just downright crazy, worse than the sell Netflix story - Sell Netflix, Buy Blockbuster.

It is Friday. So this is a long article for weekend reading. We don't invest in companies that sell something that is likely to come under increased scrutiny in the coming years. Unfortunately for consumers of liquor, this is an area which is likely to see higher excise duties and higher regulation. Booze has a fascinating history and connection to humanity, as you discover in this detailed piece: Our 9,000-Year Love Affair With Booze

Home again, home again, jiggety-jog. Davos wraps up today, this has been the first year that I have really enjoyed the coverage from the Swiss town below the awesome Alps. The pictures are pretty breathtaking, the cold looks fun if you are having a good ski there. No falling now. The Chinese have reported a GDP print that has met (or slightly topped) expectations, driven by consumption - China GDP hits 2016 target as Trump headwinds loom. Stupid observations about the economy slowing to 1990 rates, 6.7 percent on 11.4 trillion Dollars equals 763 billion Dollars. The entire economy was 314 billion Dollars in 1990. I would have preferred a headline, China economy adds more than double to their already YUGE economy. Adds double the entire economy in 1990.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

No comments:

Post a Comment