"OK, the first YUGEST day in office, Trump's markets started with the Queen of Spades. Presidents are judged by their performance in office by how the economy did, how the labour situation changed, how the equities markets did. Whether George Bush (junior) likes it or not, he inherited an economy and a stock market that trended lower"

To market to market to buy a fat pig Trump is in. This is YUGE. Or perhaps not. He has got off to a flying start. Or not? He was inaugurated Friday. He is probably still exploring all the rooms and trying to find the hairdresser that the French president had at his beck and call. Or the bathroom, and wondering why there wasn't enough gold plating. And mirrors. No, stop it. This article was from this morning - Dollar Declines, Gold Gains With Industrial Metals: Markets Wrap, starts this way: "The dollar slumped after Donald Trump in his first days in office offered little news on his plans to boost growth while stirring concerns over protectionism."

Huh? The guy just had tea with the outgoing president on Friday, he has already done a few things. As Barry Ritholtz points out Friday, in his article titled Love Trump? Hate Him? That's No Way to Invest; "Yes, Trump as of today is president. Your personal view of him -- either positive or negative -- is irrelevant to how you should be managing your investments." Thanks Barry. My thoughts exactly. Presidents and political movements come and go, and sure, protectionism and insular thinking is a huge negative for us as a collective (humans - all shapes sizes and apparently colours), the force that is global trade has started. Some suggest that China may come closer to Europe. Who knows. I ain't changing my mind on the companies that I own, that should be your mantra.

OK, the first YUGEST day in office, Trump's markets started with the Queen of Spades. Presidents are judged by their performance in office by how the economy did, how the labour situation changed, how the equities markets did. Whether George Bush (junior) likes it or not, he inherited an economy and a stock market that trended lower. He had some, if not much control. Humans spend and consume based on how they see the current and the future. For instance in 2009 nobody wanted (nor would the banks give them) finance for a car or house. That has real current economy implications, for jobs and consumption. To follow on from Larry Summers at Davos last week, nobody really knows what to expect. Let us all just own the same stuff, and like the much loved urban plant, the yesterday, today and tomorrow shrub (Brunfelsia pauciflora), keep on keeping on. i.e. Do nothing.

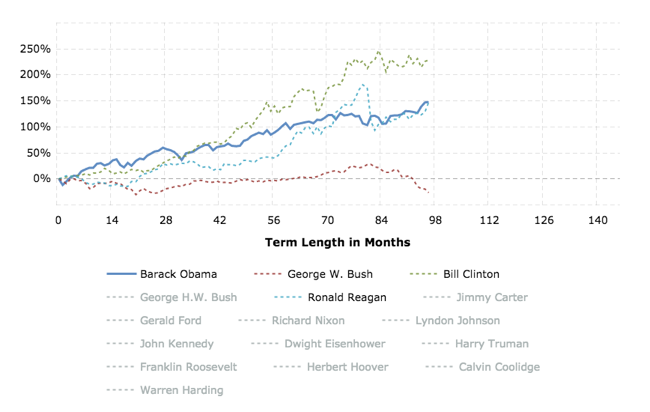

For the record, as per this image below (courtesy MacroTrends - Stock Market Performance by President). Bill Clinton and Ronald Reagan during their time in charge had the same stock market performance over their respective presidencies.

By session end on Wall Street Friday, the Dow Jones Industrial Average added nearly half a percent to close at 19827, still trying to grind higher through the month of January. The broader market S&P 500 tacked on just over one-third of a percent, whilst the nerds of NASDAQ ended at 5555 (and a few decimal points), up 0.28 percent. Healthcare lagged again. GE had numbers that fell a little flat of expectations. I was having a look at both Airbus and Boeing on Friday, incredible businesses, they make the most amazing "stuff", I am always struggling to know if these are investable or not. I think the cyclicality of it all is what worries me. Too many peaks and troughs in-between, and you have to "time it" a lot more. Earnings galore this week. Starting with McDonald's, Halliburton and Yahoo! today. JNJ tomorrow! Later in the week, Alphabet (Google) and Starbucks.

Back home, where the sun shines and the rain is arriving, not quite with the ferocity we want, dam levels are ticking up. We have become dam level watchers - Rand Water Dam Levels. In the same way that you have no control over politics, you have no control over currency levels and equity markets. All you have control over in the equities market is what you can own and for how long you can own them. The stock price of the companies owes you nothing.

As the market signed off for the week, stocks were lower on the day, all major sectors lower. The Jozi all share ended the day down seven-tenths of a percent. Astral, Tongaat, Capitec and Adcock once again clocked new 12 month highs, that tells you something about the state of the economy, or at least what investors are thinking. And the good news was that there was not a single 12 month low on Friday, that tells you something too. I was also having a look at the cost of borrowing, for the government, and that (notwithstanding the best efforts of certain folks) is flat over three years. The inflationary environment and outlook may well be improving sports lovers.

Linkfest, lap it up

The Chinese President is not everyones cup of tea, which is of course an art form in China (the making thereof). He did make some great points in his Davos address last week - President Xi's speech to Davos in full. Superb speech, masterful and to the point about protectionism and how globalisation has definitely helped eradicate poverty in China. One point I did not agree with is how Xi referred to politicians being humble, 50 people in the Politburo have wealth of around 100 billion Dollars, when compared to the around 2 billion in the Congress top 50 in the US. Something close to that. It felt all right, until that moment in the speech. Anyhows, we remain long Naspers, who will continue to (through their TenCent holding) benefit from liberalisations in the Chinese economy.

When Jack Ma gathered two dozen of his closest friends to tell them of his plans for Alibaba, only one thought it would work. There is a lot to be said for execution and persistence, Alibaba reports before the market opens tomorrow, the expectations and the bar has been set pretty high. A nice interview with Jack Ma from last week at Davos - Alibaba billionaire Jack Ma gave a politician-like performance at the World Economic Forum. Jack is superb!

OK, we know that Davos will continue to flow (as Lloyd said to Harry - "A place where the beer flows like wine"), this is another excellent interview done by Alec Hogg - MTN's Stephen van Coller, disruptor. I see the evolution of the service providers in Africa offering all sorts of payment options to their consumers. We hang in there with MTN.

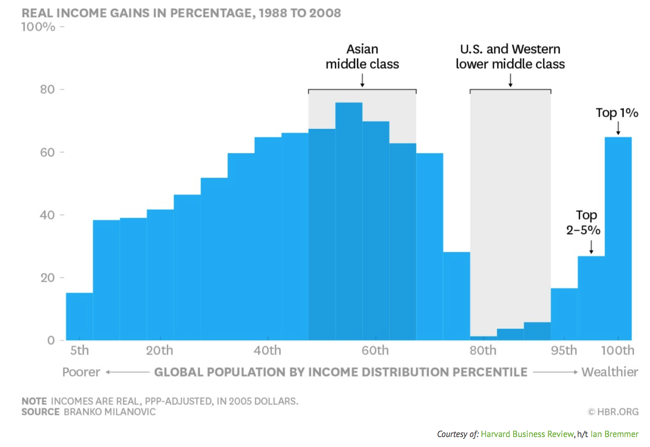

As discussed last week in that piece on the Oxfam report, there was bound to be someone who crunched the numbers harder than I ever would, they perhaps have more resources at their disposal. In this Visual Capitalist report titled The Oxfam Report is Important, But There's More to the Story, they point out that if the top 8 liquidated their holdings and gave it to everyone (on the planet), each person would have 118.39 Dollars. How do you change the world with that? Again a graph explaining why Trump and Brexit gained so much traction, see below. The overwhelming feeling is to remain long consumer stocks, such as Nike and Starbucks, Richemont and Famous Brands.

Home again, home again, jiggety-jog. UK GDP Thursday, strap yourself in, there were some pretty crappy (can you say that?) retail sales numbers last week from that region. I am guessing that all the focus this week will be on the new Trump administration and what they can do in a rush. They need to put their best foot forward and act on their promises. Not the personal ones of course, like releasing tax returns. Across to Asia, Japanese stocks are lower, Chinese stocks are flat to marginally higher. The US futures markets are pointing in the direction of being modestly lower. Earnings, I said that .... excited.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment