"Anyhows, that is not for the Fed to care about, that is for the astute investor. The astute investor wonders about trends, the same and future. Wonders about company share prices relative to their prospects."

To market to market to buy a fat pig Stocks across the oceans and far away made it two from two up days. There was the release of the Fed minutes from the December meeting and it was not a surprise to see that the Fed officials are just as cautious as many market pundits as to what may transpire in the Trump world. You can read them if you want - Minutes of the Federal Open Market Committee, December 13-14, 2016. The thing that amazes me is always how many people are present at these meetings. There are a lot of smart people on the job there, aspiring to become the best forecasters and watchers in the world.

There are some interesting tidbits in there: "Asset price movements as well as changes in the expected path for U.S. monetary policy beyond December appeared to be driven largely by expectations of more expansionary fiscal policy in the aftermath of U.S. elections." That is the market second guessing any sort of economic stimulus provided in the US by the incoming government administration. And again, along a similar vein: "Broad U.S. equity price indexes rose over the inter-meeting period, apparently boosted by investors' expectations of stronger earnings growth and improved risk sentiment, with much of the rally coming after the U.S. elections." Yes, we know, we were there!

GDP projections have ticked up, the outlook for higher inflation has increased, the outlook is always cloudy as to what is going to happen next. Which is why economists must be equipped with as many hands as the Hydra has heads. Which is why when you are wrong, two hands grow back in that place where one fell flat. Always be predicting. The problem with forecasting is that you are setting yourself up for a specific scenario, we all realize that "things change" and sometimes quicker than we think. Blackberry. The housing market. Politics. Some things remain constant though, some things remain the same. Like eating and sleeping. Communication stays the same (our desire and yearn to let ourselves be heard louder), the methods differ. Think SMS to WhatsApp migration. When last (provided you have a smartphone) did you send an sms? Long time, right?

Anyhows, that is not for the Fed to care about, that is for the astute investor. The astute investor wonders about trends, the same and future. Wonders about company share prices relative to their prospects. Wonders about optimum utilization of shareholder funds. Of course, as owners of the business, you can change the makeup of the management team, if you think that the board could do a better job. That is the job of shareholders, to make sure that the company executes on current policy inside of the current environment. That is not a job for the Fed. The thinking from the market Hydra (the collective that thrashes about and lurches from here to there) is to try and second guess what the Fed is going to do, and what that means for prices. In the long run you invest in companies, not share prices and certainly not the Fed.

Be that as it may, a stronger set of economic data to start off the year has prevented us from experiencing the same fate as this time last year, the Dow Industrial Average added three-tenths of a percent to close less than 60 points away from the Dow 20 thousand mark. The broader market S&P 500 gained 0.57 percent on the session, whilst the nerds of NASDAQ were the standout of the three, up nearly nine-tenths of a percent. Record motor vehicle sales for the year of 2016, and seven straight year gains were revealed by the motor vehicle companies.

Check out the month of December sales in the US (1.688 million vehicles for that month alone), where 102 Rolls Royce and 86 Lamborghini machines were sold - U.S. industry sets new high behind solid GM, Nissan, Honda gains. 20 percent more VWs sold in December, over the previous December. See the headlines saying "VW scandal dissipates as consumer forgets, sales up 20 percent". Nope, thought not. See also - Auto stocks rip gains after U.S. demand dazzles

Over in Jozi, where us Jo'burgers are putting our shoulder to the wheel whilst the CapeTonians watch cricket (I am kidding sports lovers), the market sold off heavily to begin with, recovering later in the day. Ha ha. We get our turn late next week, I am definitely going to go to the Wanderers next weekend and drag the family along. One has to, after all, it is Hashim Amla's 100th test match. Investing is like cricket, long periods where nothing seems to be happening to the untrained eye. To the trained eye, each and every move and run is essentially as important as the last, or the next.

In the end, the ALSI slipped just over half a percent on the day, the Rand overnight seems to be catching a bid. Financials were the winners, resources were the noticeable losers on the day. Imperial and Astral were noticeable 12 month highs, whilst some of the Rand hedges were being backed up. The Dollar has weakened nearly 13 percent to the Rand over the last 1 year. Over five years .... I don't want to talk about it. Not too much going on, by the time 2 in the afternoon had rolled around we had a total of 6 odd SENS notifications. Expect more next week!

Linkfest, lap it up

Balance this and balance that. The average US worker gets 15 days off a year (and only takes around 11 days), the average European takes all 30 of their leave allowed days a year. The debate about what is better or worse is of course ...... open for debate. With the French government allowing workers to unplug from work during off time, I wonder whether productivity will rise in the workplace? The Real Reason the French Work Less Than Americans Do. It seems that the Americans consume a lot more stuff than the Europeans! Gathering resources to get things is the American way, little experiences is the French way. Each to their own.

The price of battery storage is falling fast, as a result of aggressive investment and subsequent demand in "cleaner" technology. The calendar new year has started with a bang for Tesla - Tesla Flips the Switch on the Gigafactory. I follow the online blogging service SeekingAlpha, I cannot recall whether or not I have seen any stock attract such polarized views of what comes next for the stock price. That fellow is either amazing for you, or full of BS, there does not seem to be a middle.

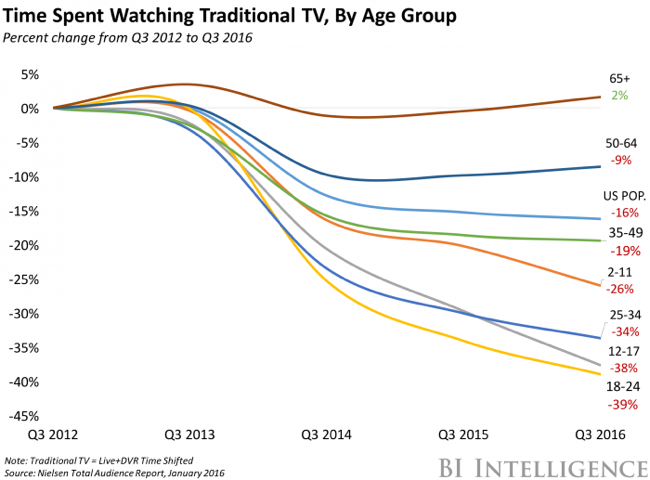

I often hear from younger people, "I do not watch TV". My kids watch TV, soon they may not. They also watch a lot of creative and interesting things on YouTube, from how to play X or Y on the Piano, how to build this creative thing to plain old SuzelleDIY. You know .... because anybody can. This chart reveals that if my kids stick to the international "norms", then they may quickly not be TV watchers - Traditional TV's demographic woes get worse. What does this mean for Disney and Naspers' DStv business? Perhaps more relevant for Netflix, YouTube (as owned by Google) and the broader networks. People will watch screens, they may not watch the traditional box in the way you did.

Home again, home again, jiggety-jog. Stocks are trading up to begin with. This seems like an aerobics session, up and down, and up .....

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment