"Interesting commentary too from Lagarde, the middle class is growing in the developing world, shrinking in the developed world, more wealth at the top and some people even moving down. Summers feels that the middle class in developed countries have this idea that their government is not fighting for them, and are fighting for minorities and the developing world's middle classes."

To market to market to buy a fat pig Local, where another set of kids went back to school, all rather late, the weather was cool and breezy. Stocks as a collective were a little warmer than that. At the get go we clocked 53 thousand points on the all share, by the close we had managed just over one-fifth of a percent gain on the day. The Rand to the Euro and Dollar was marginally weaker through the day, financials and banks, as well as some selected retailers were the winners on the day.

The reason was half attributed to the fact that inflation, as far as the closer watchers of these things are concerned, is thought to have peaked. With the firmer currency and a steadying (and lower on the day) oil price, we might be through the worst. The last inflation read saw some basic foodstuffs like sugar register monster gains in price year on year. Tiger, Amplats, Woolies and Shoprite, as well as Aspen found themselves at the top of the leaderboards, at the opposite end of the spectrum was Remgro, Steinhoff, Old Mutual and MTN.

The publication can be downloaded here - Consumer Price Index, December 2016. Food and non-alcoholic beverages prices rose nearly 12 percent year on year, this carries a nearly 15 and a half percent weighting in the Stats SA basket. Depending on where you sit in terms of living standards measure (LSM), food can be more or less of your monthly spend. The less you earn, the more it is. Bread and cereals registered a 17.4 percent gain year on year, fruit a 19.2 percent gain, and the aforementioned sugar a 21.3 percent increase from December 2015. Your meat "only" cost 7.6 percent more, milk, eggs and cheese was 10.5 percent higher and vegetables clocked a 8.9 percent increase. If you are living a more hand to mouth existence, you can see how things certainly got tougher through 2016.

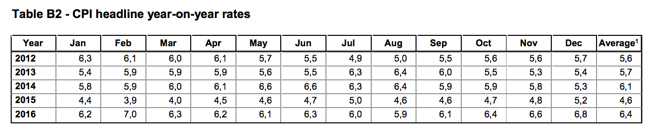

Transportation and housing, which form a 40 percent plus weighting in the basket collectively, registered lower than the headline rate, good news for consumers. The other good news is that rains have come, if not enough to please everyone. The crop is expected to be far better, more will be revealed in the coming months. Tiger and Pioneer were the two biggest beneficiaries of the CPI release, Stats SA is to be commended for their shorter turnaround time in publishing fresher stats. It is fair to say that Pali Lehohla, the Statistician-General for Statistics South Africa, runs a very tight ship over there. Best known for that yellow suit! For the record, herewith an interesting table going back to 2012, revealing the "base" and subsequent rise in headline inflation since then:

Stocks in New York, New York were mixed, the Dow Jones Industrial Average was dragged lower by cooling energy prices, the IEA chief in Davos stating what is "out there" already, suggesting that the frackers (US onshore producers) would provide a "significant" boost to production. Meaning that there would be more supply from the US. Meaning that no matter how hard the special cartel that is OPEC tried, private enterprise was better, hands down. Fancy that, capitalism beating state intervention!

The big names in oil came under pressure, energy collectively was down six-tenths of a percent, causing the blue chip index to slip by just over one-tenth of a percent. Earlier in the session the kings of Wall Street, Goldman Sachs, had reported numbers ahead of expectations, thanks in part to late year volatility. By session end the early excitement around Goldman had dissipated and an assault on Dow 20K is just going to have to wait a little longer. The reason why I put Goldman and the Dow in the same sentence is that GS has the highest share price of all the constituents and price is what matters, and not market capitalization. The Dow divisor! The current Dow divisor is 0.14602128057775. Huh? The value of the Dow jones Industrial Average is worked out as follows = (price of stock 1 + price of stock 2 .... + price of stock 30) / Dow Divisor.

See why for most people who look for a clearer reflection of the broader market of are automatically drawn to the broader market S&P 500, which has many more stocks and the index is determined by market cap instead of price. That index, the S&P 500 rose 0.18 percent to 2271, whilst the nerds of NASDAQ rose nearly one-third of a percent to 5555 (point 65). The record high the latter lies last Friday, the 13th, Freddie and all. Earnings season is starting to get some momentum, GE results will be this Friday and then some of the technology stocks will also start reporting, Alphabet this time next week is always a big favorite of Mr. Market. Apple is on Tuesday after market, those will of course be closely watched for global subscriber numbers. And then Facebook is in February.

I really enjoyed a panel discussion hosted by Bloomberg at Davos yesterday, there was hedge fund manager Ray Dalio (just outside that top 8 on Forbes's list), academic and policy legend Larry Summers and IMF chief Christine Lagarde, who were joined by the finance ministers of Italy and Brazil - The Crisis of the Middle Class: Davos Panel. Larry Summers gave his two cents worth on Donald Trump and the "rise of the middle class" as was the discussion, and it went something like this: "The United States has just elected the worlds most visible symbol of conspicuous consumption" (at around 13:30 in the video). He continued, "that is a bizarre manifestation about a concern of inequality". He also made some good points about inequality: "A lot of the people who voted for Donald Trump and a lot of people who voted for Brexit, think too much is being done for the poor."

Interesting commentary too from Lagarde, the middle class is growing in the developing world, shrinking in the developed world, more wealth at the top and some people even moving down. Summers feels that the middle class in developed countries have this idea that their government is not fighting for them, and are fighting for minorities and the developing world's middle classes.

Summers has an incredible way of trying to explain how this has all transpired, and he really nailed it, in my opinion. An old pal who has just moved back from the UK to sunny ZA, suggested that a 75 percent hurdle rate should have been set for the exiting Europe vote by the UK. Agreed. How this is all unpicked, 40 years of trade agreements, in a hurry, remains to be seen. Great discussion on who the middle class is, and what the anger is. Being left behind is something that we often associate with poor people, not middle class people. If you have 49 minutes and 6 seconds to spare, you could do worse than watch this piece. If only to see Ray Dalio squirm when Summers is talking about closing tax loopholes, and the cameras focusing on him. Ai shem, don't feel sorry for Ray, he is "worth" tens of billions of Dollars.

Linkfest, lap it up

Oh dear. I guess not unexpected, this was always going to be complicated. Bloomberg reports - Amazon Said to Walk Away From $1 Billion Souq.com Takeover Talks. I guess as shareholders of both Amazon and Naspers, one is torn on who one wants to own these assets. Meanwhile, Naspers announced that they had closed the Allegro transaction and that they were now in possession of the 3.253 billion Dollars. Yowsers, that is a lot of money!!

Talk about strange jobs in the modern economy, these, via Bloomberg Mermaid Instructor? Canine Masseuse? The Oddest Hotel Jobs on Earth. Perhaps with the rise of the "home stay" economy, hotels have to get a little more inventive? In this space we continue to recommend Priceline and have at the fringes been long time holders of City Lodge.

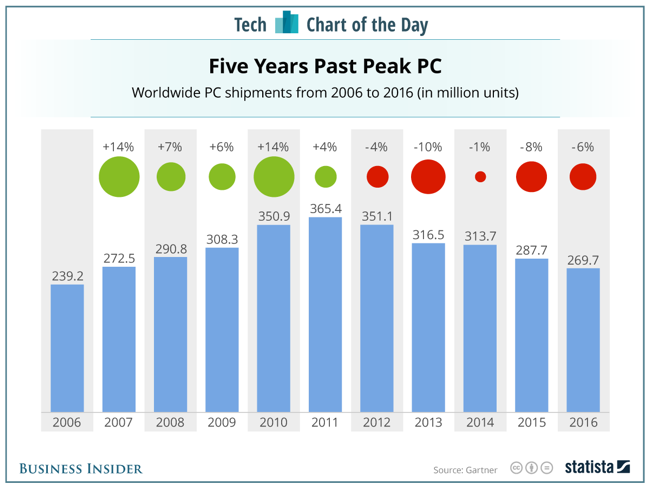

The only "hardware" company that we own is Apple, this is a pretty interesting - PC sales in 2016 were the lowest they've been in a decade. See the associated graphic, which brings it home. The rise of the smartphone and tablet, which means that you can take your "pc" in your packet and bag, no matter where it is that you go has been partly to blame. Perhaps the focus should be on that, rather than falling PC sales. Courtesy of the BusinessInsider

Home again, home again, jiggety-jog. Netflix had blowout numbers last evening, the stock is up nearly 8 percent after hours. You can't own it all, I guess. We will do a deep dive and revert on what is a company that has certainly changed things up over time, from DVD drop boxes to their own content watchable on a smart phone, the company has always kept relevant.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment