"Woolworths released a trading update yesterday. The stock has been under exceptional pressure. Over a year it is down nearly 30 percent. Over five years the stock is up 65 percent. There is no doubt the stock price "got ahead" in the face of what was a deteriorating outlook."

To market to market to buy a fat pig Ha ha, the band plays on and the choir sings the same song, and this is almost all of the time. The Trump rally is running out of steam. Even the optimistically cautious Eddy Elfenbein has suggested it looks a little tired. I did read Bill Miller's piece - 2017 Outlook. As suggested before, and in fact as Miller cautions in making forecasts, these are almost always hard to make, almost impossible to be right. It is sometimes interesting to get the long dated historical context:

"The great bond bull market which began in October 1981 looks to have ended in July 2016. Treasuries began that period yielding 15.83%, the highest in US history, and ended it yielding 1.35%, the lowest in US history. Put differently, they began it the cheapest they had ever been, and ended it the most expensive they had ever been."

That in itself is "interesting". It matters very little to us as equity holders, it is just noticeable that both the big bond guys globally, Gross and Gundlach have cautioned that at specific levels (Gross is at 2.6 percent on the ten year, Gundlach is over 3 percent), the bond rally is "over". Meaning that this current rally in treasuries is far longer than the growth that Australia has had in the last quarter of a century. True. Notwithstanding a commodities slump, Australia has not experienced a recession for 25 years.

That makes me wonder then, and Bill Miller answers the question is that he thinks (as usual), some stocks are cheap and others are expensive. The market, he thinks is at fair value. So whilst it is always good to read a brilliant mind like Miller (he ran the Legg Mason Capital Management Value Trust, which beat the index for 15 consecutive years), he himself admits that it is always tricky to forecast. His experience tells him that the path of least resistance seems to be up. For now.

Stocks as a whole in New York, New York, ramped off their lows of the session (about halfway through), yet they still managed to close in the red. All the major indices, the Dow, the nerds of NASDAQ and the broader market S&P 500 lost between one-fifth and one-third of a percent, a day of modest losses is what the scoreboard will show. Unlike up the road where the 3 and 4 of the Proteas were tearing the Sri Lankans apart, making them look like a cheap cup of tea. Is there such a thing?

Local, where the weather is still spectacular, and the rain steady if not regular (the Vaal dam is up to 55 percent full), markets were mixed. Stocks closed all of 6 points (or 0.01 percent) higher. Resource stocks were 0.87 percent higher, industrials were around four-tenths lower on the day, led lower by Naspers, down 3.8 percent on the session. Phew. Richemont was leading the charge, see a writeup on the trading update from yesterday morning. This is the first time that the stock has been above 100 Rand since last March. Almost coinciding with Hashim Amla's return to form.

Someone sold Spar down 13 percent in the blink of an eye, we heard via the via that it had to do with them opening stores in Zim. Sounds like #fakenews. WRONG. Anyhows, someone sold, and someone bought, the stock ended the day down half a percent. Huh? Yeah, you go and figure that one out too.

Company Corner

Richemont produced a 3rd quarter trading update for the period to end 31 December yesterday, just before the market opened. Jewellery sales across their platforms were stronger. Asia Pacific showing good growth, thanks mostly to South Korea and Mainland China, Macau and Hong Kong still a little in the dumpsters, the release suggests continued declines. I suspect a slight change in shopping patterns, mainland customers will become bigger consumers, even with the higher duties. In China it is called "consumption tax", see Import-Export Taxes and Duties in China. As far as my "research" on Hong Kong, the rate is zero for imported jewellery, it is by extension far cheaper to buy luxury items in Hong Kong than on the mainland.

Total sales for the three months, when compared to the prior reported period was 6 percent stronger at actual exchange rates. At constant rates, it was 5 percent better. The market obviously had pretty low expectations, the stock soared 8.6 percent in their primary market, Zurich. Locally, the Rand being stronger against a basket globally meant that we "only" gained 6 percent. It has been really tough for stock holders, the stock price was here in August of 2013. For most retail clients, understandably, the stock prices "not going anywhere" is too much to bear over a period such as that. I think when owning this business, you have to be mindful that fine jewellery and luxury goods are enduring. Brand replication at this quality is very hard and takes decades.

I remember writing this, back in 2014, and like the quality of their brands, it remains true today: "There is not only the price of the pieces that are beyond reach of most, but they are difficult to reach. Exclusivity is however in the luxury goods business part of the allure. A rich and discerning customer wants to know that they are part of an exclusive and select group. And that is at the heart of it all, much like natural beauty (Table Mountain to the Kruger Park), you cannot replicate quality Maisons with hundreds of years of history. In fact, the bulk of the Richemont brands are over a century old. From the Richemont website, here are the years of founding of the respective businesses: Purdey (1814), Baume & Mercier (1830), Jaeger-LeCoultre (1833), Lange & Sohne (1845), Cartier (1847), Officine Panerai (1860), IWC (1868), Piaget (1874), Lancel (1876), Alfred Dunhill (1893), Van Cleef & Arpels (1906) and Montblanc (1906)."

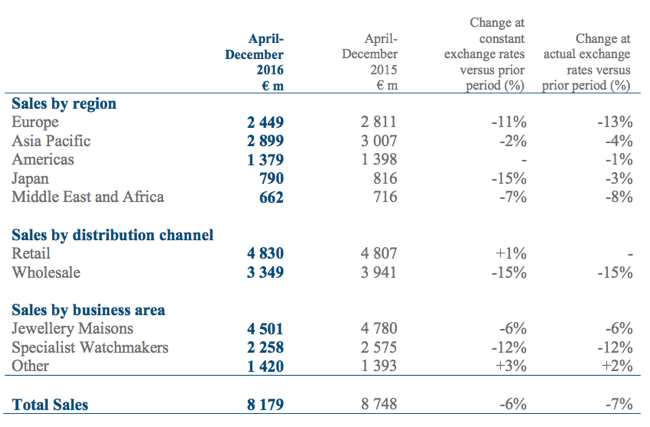

The nine month numbers look a whole lot less exciting than the three months past. In fact, you would wonder if we are talking about the same thing. Here is a regional sales table:

The only noticeable positive is that some of their businesses that they were not too in amid with, the likes of Chloe and Lancel (if memory serves, some of the leather businesses were being earmarked for sale) are "ok", and that being all relative. I get the sense that "softer" luxury has had a better time of it late, which is why leather sales have been better globally. Much better than watches, there is definitely a move afoot where wearables are going to capture a larger part of the market, at the expense of all the watch makers. I get the sense that perhaps the mid tier producers will be the ones in peril, not necessarily the high end.

Have they turned the corner? I would caution against wild two am cork popping, these are "good signs" however. I suspect that sales have bottomed and at some level this tells you something about the global customer patterns, they are in another early stage of improved sentiment. The business is hardly cheap and possibly trades at the correct level, right now. We remain holders of this company, that owns some of the most iconic brands on the planet. Brands that have been selling for centuries. Brands that are likely to continue to sell to richer consumers across the globe for decades to come. We stay the course here and accumulate on weakness.

Woolworths released a trading update yesterday. The stock has been under exceptional pressure. Over a year it is down nearly 30 percent. Over five years the stock is up 65 percent. There is no doubt the stock price "got ahead" in the face of what was a deteriorating outlook. Harry Hindsight knows all of this, Harry can tell you almost anything that you want to know. That counts for nothing, if you own the stock, if you followed your rights a couple of years ago, it means very little.

What is important to know is that you hold a diversified business, both by product range and by geography (Aussie and here), and that the core consumer of Woolworths is in the higher LSM (Living Standard Measure) groups. That means little. Indebted consumers are amongst all groupings, and can all fall into the same trap. Finance should be taught at all levels of school, how to use leverage (i.e. when to use debt and when not to), and to start saving immediately.

Herewith the trading update: "Group sales for the first 26 weeks of the 2017 financial year increased by 6.7% compared to the prior year. Woolworths Clothing and General Merchandise sales increased by 3.5%. Price movement was 7.3%. Sales in comparable stores grew by 1.2% and retail space grew by a net 2.9%. Woolworths Food sales increased by 9.5%, with price movement of 9.2%. Sales in comparable stores grew by 5.6% and retail space grew by a net 7.9%."

That sounds average and it really is. It is as much a function of having done really well and now levelling off. And then the trading update, which everyone has been suitably anxious about for the last few weeks. The company is able to give a 6 months range that is minus 7.5 to minus 2.5 percent lower than the comparable period, that is on Headline Earnings per Share. Strangely the stock ended the day up over a percent, and today has started over half a percent better. Strangely if one hadn't been watching this for a while.

I like the Australian plans to roll out a premium food offering through David Jones, see - David Jones - Investor Roadshow. Heck, they may even sponsor a few seasons of Masterchef Australia! Rather them than Coles. According to the Wiki entry on Masterchef (the down under one), there has been demand at a supermarket (and restaurant, the premium category) level for more premium foods and ingredients.

What to do with the company holding? Nothing. The yield underpin is around 5 percent, the company is unlikely to drop the dividend, and whilst the next 6 to 18 months may be tough, I suspect that rates here are likely to be steady. They may even go lower. A well run business, more when they release their numbers on (and around) the 16th of February.

Linkfest for days

I like this post from the BusinessInsider - The 10 best tech gadgets I used in 2016. The new Amazon Echo is not only selling like hotcakes, it is also versatile and really works. I expect Apple to deliver a similar device this year, they have the Siri technology.

What to make of this? Facebook is working on a way to read brain waves that could let you send your thoughts to people. Science fiction? Or for real? Either way, Facebook (And Google and Amazon for that matter) are likely to be at the forefront of AI technology over the coming half decade.

Talking of Amazon, they are planning to hire 100 thousand people (and a whole lot of robots) over the next 18 months. The times they are a changing. Good Times for Amazon, Trouble for Macy's. Old department store? No thanks. Newish internet store with everything imaginable and delivered to my door, via a drone? Yes please.

Home again, home again, jiggety-jog. Stocks have started better. Wells Fargo reports today, as do a whole host of US banks. It is that time in the reporting cycle again, when real companies with services and products with real customers making real life decisions based on how they see their circumstances make decisions. Yes, our favourite season, earnings season.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment