"What is clear to me, and to many, is that this continues to be a growth industry. Many more people can enjoy something that was only available to richer people of yesteryear"

To market to market to buy a fat pig Yesterday was decision day on rates, for the local market. Expectations were for no change, and that is exactly what happened, the SARB decided to leave the repurchase rate at 7 percent. Which means that for your debt, you get that rate plus what the bank adds on top of that, i.e. the prime lending rate. For each 1 million Rand in mortgage debt currently, you are (at 10.5 percent, which is the "par" rate), you are likely to be paying 9,983 Rand a month.

Nearly 10 thousand Rand a month on each one million Rand of mortgage debt, provided of course that you are paying over 240 months, which is 20 years. If you shorten that to 180 months (slash off one quarter of the time), your cost of servicing the debt rises to 11,053 Rand a month. An extra 11 odd percent per month to shorten the duration of the loan by 5 years.

What is even more amazing however is if you shorten the duration to 10 years (or half), the amount payable is 13,493 per month. You pay an extra 35 percent for ten years (per million Rand mortgage) and you can halve the time spent in mortgage debt. Wow. If then you flip it around and invest that 13,493 Rand a month (161,916 Rand a year) for ten years, and earn a very modest seven percent per annum, you will not only have your house after 20 years (and whatever that is worth), you will also have nearly 2.4 million Rand with which to compliment your retirement savings. Such is the power of paying mortgage debt down quickly, and then saving that money.

Of course most people should do this, they don't. Live happens in between. I used the Nedbank Loan Repayment Calculator and the MoneyChimp Compound Interest Calculator to arrive at these numbers, loose and fast, an indication I know, nonetheless it is pretty useful.

You can read through the South African Reserve Bank's Monetary Policy Committee statement and see if you are any the wiser after. You can even read (flip the table 90 degrees to the right) the Selected forecast results: MPC meeting January 2017. Please, though, do not use these assumptions and forecasts when buying a slice of a listed (or unlisted) business. A business works through these cycles, they are not roadblocked by them, growth and credit that is. The good news for the outlook is that the firmer Rand to the basket means inflationary concerns have abated. And that there has been some rain, more food at cheaper prices.

Stocks in Jozi, Jozi by the close were mixed, the overall market gains were driven higher by resource complex, which was up another 1.85 percent. The ALSI closed up 0.57 percent, comfortably above the 53 thousand point mark. Amplats, South32 and Kumba were having a stonker (noun - something which is very large or impressive of its kind) of a day, all up over five percent apiece. There were new 12 month highs for Anglo, BHP, Glencore, Capitec (again) and Tiger Brands too.

Across the drag (size of universe speaking), stocks in New York, New York had an impressive day. A record for the nerds of NASDAQ, that index closed at 5600 (and some change), up nearly nine-tenths of a percent. The broader market S&P 500 added two-thirds of a percent, whilst the Dow Jones Industrial Average managed a gain of 0.57 percent on the session. Dow 20K watch is back on the cards, the index is now only 88 points from that milestone. Alibaba had a good day after results that impressed all and sundry, AT&T and JNJ not so much. We will look at some of these, as well as Stryker, who reported after-hours. We will have all of the wraps, starting below.

Company Corner

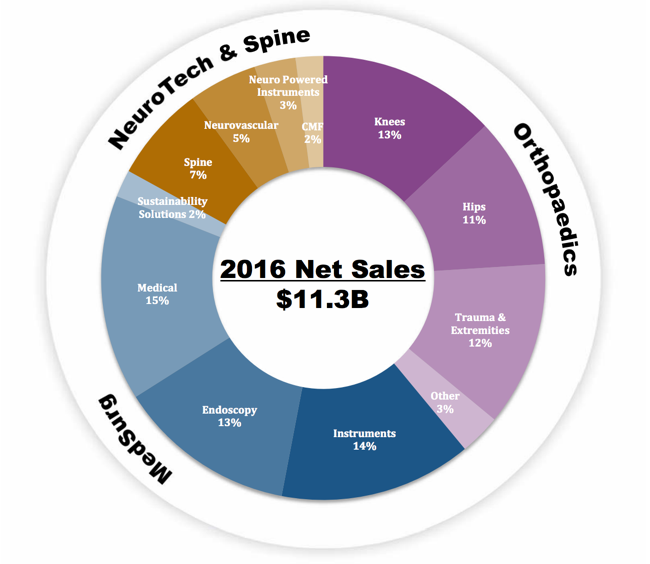

Stryker reported numbers post the market close. In a recent JP Morgan healthcare conference, a couple of weeks back, the company gave a great breakdown of all of their business divisions. As "they" say in the classics, a picture is worth 1000 words, download it here: 35th Annual J.P. Morgan Healthcare Conference Presentation.

It is a business that is well diversified across different segments, hip and knee replacements are becoming increasingly minor procedures (if there is such a thing). Let us take a dive in - Stryker reports 2016 results and 2017 outlook. Net sales for the year were up nearly 14 percent, reported net earnings were 14.5 percent up on the year to 1.6 billion Dollars. Decent enough margins, they are selling everything from bone cement to hospital beds to complicated surgical equipment. Spinal implants, that looks next level!

The bionic man of yesteryear is to a certain extent a reality today, although these are the products that you are grateful for, you are less likely to rush out and use (get) them willingly. Whilst a hip and knee implant will change your life for the better, and lift the quality of your life, you do not want to get to the point in which you need them, if you get my drift.

Guidance for the year ahead was decent enough, the company expects earnings per share for the full year to be between 6.35 to 6.45 Dollars for the full year (1.40 to 1.45 Dollars in the first quarter). That compares to the 5.80 Dollars on the same metric, that being just reported for the full year to end 2016. At the closing price of 121.5 Dollars last evening, the stock trades just shy of 21 times earnings historic and on the company guidance in the midpoint of the range given, just less than 19 times.

Hardly a bargain, on a PEG ratio basis (Price to Earnings over Growth rate), it is closer to 1.8. Which again, is not "cheap", nor is it wildly expensive. Which is why I guess the market hardly budged after-hours on these numbers, if the company is likely to produce 10-15 percent earnings growth, the market is happy to rate the stock on a 19 multiple forward. With a dividend yield of only around 1.4 percent, you are certainly not buying this one for the income.

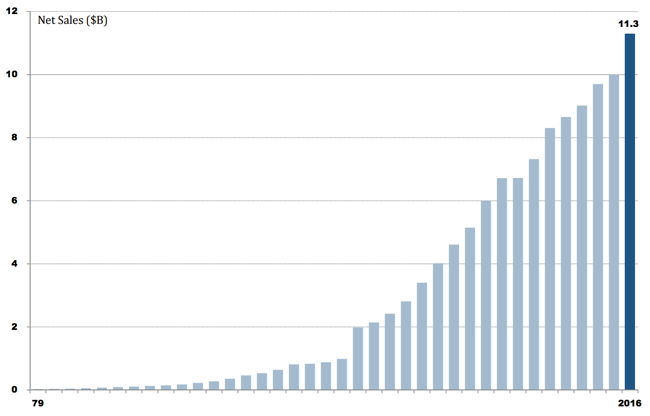

What is clear to me, and to many, is that this continues to be a growth industry. Many more people can enjoy something that was only available to richer people of yesteryear, from that same conference presentation that we spoke of above, the growth in Stryker revenues has been a sight to behold, this is from 1979 to last year:

The company continues to make acquisitions, they have now integrated the MAKO business into theirs wonderfully well (acquisition done back in 2013), having sold their incredible robotic arms that deliver bespoke knees and hips to their "customers". Check them out - Robotic-Arm Assisted Technology. There are 381 of these worldwide, so far, with 333 of them in the US. With their bigger business and bite sized acquisitions, they are able to roll out these products at a faster rate. We expect the company to continue to look at these, as and when they arise. The company spent roughly 15 percent of their market cap on acquisitions over the last three years.

This is a growth business that you are buying on a fairly "cheap" forward multiple. The growth thesis is also contained inside that their international presence is fairly limited, they are predominately a US based business, so there is plenty of scope to tap rich developed and richer middle income people in developing markets. We remain buyers of what is a great business with superb leaders, I like Kevin Lobo. Defensive in nature, growth in future.

Linkfest, lap it up

Our mottos around here include "keep on keeping on" and "be optimistic". It is natural that I would like a website that is full of Human Progress. This article link below deals swiftly with the doomsday prophet Paul Ehrlich, who delivered a speech nearly 5 decades back. Like Malthus who went before, we were all going to starve to death: "The battle to feed all of humanity is over. In the 1970s hundreds of millions of people will starve to death in spite of any crash programs embarked upon now. At this late date nothing can prevent a substantial increase in the world death rate..." And that is just the prologue, you can read the whole book here - The population bomb. So he is an idiot, right? As this article points out, people still want to hear him, and real policies were enacted - Paul Ehrlich Addressing Vatican Conference on Biodiversity. It is a real pity that we give bearish views so much substance. Stay long food businesses like Tiger Brands.

I suddenly figured yesterday when Paul asked for a "free link" (not a subscription one), that many of you would not have been able to incorporate the Byron Wien Announces Ten Surprises for 2017. No worries, follow that link there to the "free" resource. Point 6 is a little extreme? With all going on, who actually knows nowadays though, right? Like we said yesterday, point three is one I "like": "The Standard & Poor's 500 operating earnings are $130 in 2017 and the index rises to 2500 as investors become convinced the U.S. economy is back on a long-term growth path. Fears about a ballooning budget deficit are kept in the background. Will dynamic scoring reducing the budget deficit actually kick in?" Stay long, ignore the "noise" is essentially the mantra.

You know that a sport has gone main stream when universities have teams representing them and competing at a national level. Tencent owned, League of Legends is moving out of the realm of only being played and followed by 'nerds', to a more mainstream following - Big Ten Universities Entering a New Realm: E-Sports. Stay long TenCent and Naspers!

Home again, home again, jiggety-jog. Markets across Asia are all up. Japanese markets are up a lot. TenCent is up nearly a percent and a half, that matters to us down here. Like a lot.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment