"On the local front, in Jozi (Jozi), we continued to see the retailers roll in with their trading and sales updates for the December period. The market didn't take too kindly to the Mr. Price trading update, although it was difficult to tell on a day that saw all the retailers lose a little steam after a tremendous week last week."

To market to market to buy a fat pig Some sort of clarity from the UK PM led the Pound down the other street, the best single day performance since the financial crisis for that currency - In 'Brexit' Speech, Theresa May Outlines Clean Break for U.K.. Comments from the US president elect Trump overnight on the Dollar being too strong have led to the Greenback taking a marginal hit - Dollar falls to one-month low after President-elect Donald Trump describes it as 'too strong'. And of course it is all relative, a longer dated historical look back will reveal that the Pound to the Dollar has been on a regular slide, back in the 60's the exchange rate was around 2.8 Dollars to one Pound.

The economic prowess of one has gained traction, not so much for the other. It used to be nearly 5 Dollars to the Pound 100 years ago - A graphical history of the Dollar Exchange Rate. Of course remember that currencies were pegged to metals and to one another, free float is a relatively "new" thing, only in operation for the last 45 odd years. For the record, we have a little way to go before we get to the 1.05 level (Dollars that will buy you a Pound), reached in Feb of 1985. Ronald Reagan was just sworn into the White House, George H Bush was deputy president. We were just discovering the hole in the ozone layer. The wreck of the Titanic was discovered that year. Jobs resigned from Apple to go to NeXT. Yeah, that is when these two currencies were relatively weak and strong against one another.

Markets .... those on Wall Street recovered towards the end of the session, the Dow Jones closed up shop down three-tenths of a percent, the broader market S&P 500 lost exactly the same amount, whilst the nerds of NASDAQ lost nearly two-thirds of a percent. Industrials and mostly financials were to blame for the losses, perhaps the Fed may well back off from a steeper rates trajectory is the market thinking here. The truth is that we are all reliant on the incoming data and will continue to "watch it" in the same way that everyone else does. JP Morgan, Wells Fargo and Bank of America were amongst the biggest losers on the day. Apple was a noticeable "winner", the stock gaining some traction after a series of broker upgrades for next year revenues based on the projections of the "new form" iPhone expected later this year.

On the local front, in Jozi (Jozi), we continued to see the retailers roll in with their trading and sales updates for the December period. The market didn't take too kindly to the Mr. Price trading update, although it was difficult to tell on a day that saw all the retailers lose a little steam after a tremendous week last week. I can't say tremendous without thinking about that other fellow, that chap who is about to assume the most powerful office in the world on Friday. Tremendous and very, very .... Cashbuild, Holdsport and Shoprite all with updates too, Cashbuild the best "received" of that grouping. By the close of the bell, stocks as a collective had given back nearly two-thirds of a percent.

Of the majors, British flavoured stocks were the order of the day, what-what, Intu, Investec, Old Mutual, Hammerson all at the top of the respective leaderboards. And KG Rabada too, he has jumped to sixth place. At the bottom (likely to be reversed today on a weaker Dollar) was Kumba, Amplats and then Aspen. Capco gained over five percent on the day, they had bounced off a 12 month low though. The Pound has shed some of the gains to the basket of currencies, expect a little reversal of some of those gains yesterday. I think that the Germans are pretty happy with a little more clarity on the matter, they encouraged and endorsed the fact that there is more clarity. Agreed.

This annual Oxfam report that comes out every year at Davos is misleading. I have not read the full report, huge disclaimer, I agree with the principles, before I get bashed out of sight. Sure, the top eight people have as much wealth on paper as the bottom half of the world, it is easy to highlight inequality. How did we get there though? Was it horrible mismanagement of economies and dictatorships, as well as power hungry people that left billions of people in the lower rungs of the globes money stakes? Probably. What is always missed is that the poverty rate has come barreling down globally, 35 percent of the world lived in extreme poverty in 1990, that number stands at less than 10 percent. So something has been done. With the fall of the "wall", global trade and more transparency (and accountability) has led to lower poverty rates.

Bill Gates clearly is a smart fellow, it is worth pointing out that he didn't inherit his wealth, he didn't steal it like many dictators, he was in the right place at the right time with a revolutionary product for the masses. Give the man a freakin' medal (I am sure he has some) for having changed productivity for the better. Spreadsheets, Word, Powerpoint and Mail, as well as browsing and all the other newer hardware and software has made our lives infinitely easier over the last few decades. If you do not have people like this, selling products that better humanity, we would still be writing stuff with ink on poorly made paper. I don't care if you put forward the idea that someone else would have done it, if Gates hadn't, the point is that they didn't and we are all the better for these inventions.

Productivity gains over the decades mean that we have more time to be more aware and contribute back to society on weighty matters such as poverty reductions, emissions controls, recycling and so on. Without broader society making these productivity gains, we would be all focused on the bread and butter issues. Rich people buy Teslas so that they can reduce their personal emissions, thereby making incremental changes collectively. Did a king or dictator make electric vehicles available to the masses? No, it never happened. No inventions were made by politicians, other then squirming to be re-elected (not fair, feeling angry).

So, instead of bashing the rich for their contribution to society (and ignoring the fact they are giving it all back to cure cancer, eradicate malaria and increase literacy rates), perhaps Oxfam should use Davos to point out all the failings of poor economic policies and the crack down on personal freedoms. Capitalism may not be perfect, it sure does more to promote equality than communism/extreme socialism, and that in itself is ironic.

In shaming and pressurising world leaders to cut off the non compliant nations (don't trade with North Korea), that would be more helpful for poverty eradication. Last I checked Bill Gates is giving his time and exceptional wealth to do what blundering government's can't. He sits in poverty surroundings to understand what people need and want. So there. Obviously I agree with the report, it really is time to do something to eradicate global poverty (which humanity has done in large part), a different methodology is needed. Embrace free trade and the human spirit, let all politicians be equal and serve the interests of the people. Lastly, if you asked any one of these billionaires if their starting point was to be rich, they will tell you no. Their starting point was to build something to better humanity. I applaud the giving pledge and the fact that their billions will fund charitable organisations that make real differences.

Linkfest, lap it up

Over here at Vestact we really like fitness, wellness and ath-leisure as investment themes, companies like Nike, Under Armour and Discovery, Holdsport, Brait (Virgin Active) and the like. He may not be your cup of tea, this is however quite a interesting - Richard Branson's Next Big Idea: Sports Festivals. Back to the track, sounds fun and exciting!

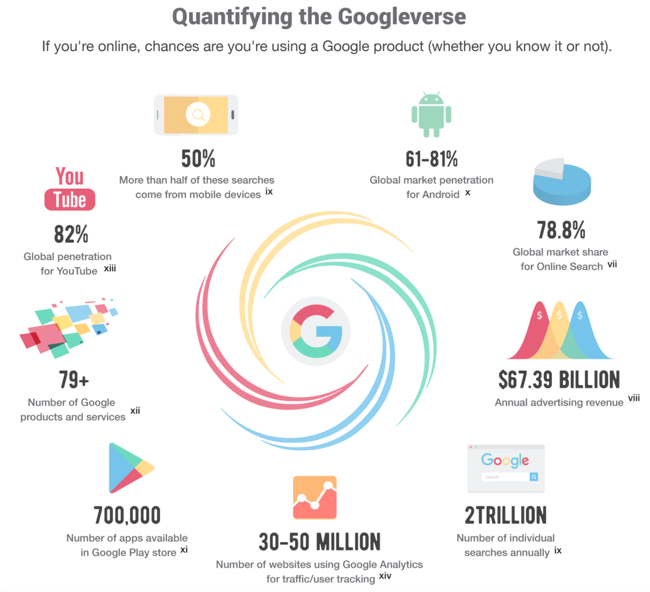

Some people seem to be worried about being tracked on the internet. I don't care, I wouldn't really "worry" what Google did, or didn't know about me. If you do however, this is for you - How Google Tracks You - And What You Can Do About It. I like the fact that Google can second guess what you want and serve you with content that applies, rather than random stuff. We really like both Alphabet and Facebook as the advertising kings of the internet.

Home again, home again, jiggety-jog. It is Davos time again sports lovers, that time of the year that everyone goes all the way to a small Swiss village in the far East of Switzerland to speak to one another. When they could do it from the comfort of studios elsewhere in the world. That said, there is a place for face to face meetings between these people.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment