"Tiger brands reported their full numbers to end September, both the CEO Lawrence Macdougall, (relatively new at the business) and the CFO, Noel Doyle, (an old timer at the business) were on the telly yesterday on CNBC"

To market to market to buy a fat pig A local inflation read, comfortably outside of the South African Reserve Bank band yesterday threw a spanner in the works. Low growth and higher inflation are not the parameters for much wriggle room, neither for all participants in the economy nor the Monetary Policy committee, who has the job of controlling inflation. Their toolbox is small, there is little they can do other than hike rates. And I guess that may be coming, expectations are for at least the moment to show no change. For now.

From a great position mid morning, in which stocks enjoyed the afterglow of US record setting markets, we slumped towards the end of the day, the Jozi all share index slipped nearly a percent. Resources were the only sector that was in the green. Just before the slump in banking stocks there were new 12 month highs for Standard Bank, FirstRand and Nedbank. By the close Nedbank was four percent off their 52 week high and over three percent down for the day. South32 and Anglo American were amongst the top winners on the day, followed closely by Bidcorp and Tiger Brands, Tiger of course printed numbers, see the full write up below in the company segment. No Doom! At the opposite end of the spectrum in the losers column was Naspers and Redefine. Parliament, that was full of cryptic messages, I guess politicians will always act in that sort of manner.

Over the seas and far away in New York, New York, stocks were a mixed bag by the end. The Dow Industrials closed at another record, up nearly one-third of a percent to 19083, the broader market S&P 500 also closed at another record, a smidgen higher (0.08 percent) to 2204 points, the nerds of NASDAQ slipped away by the close to be 0.11 percent off on the day. Remember that today is the day of major celebration in the US, the Thanksgiving "weekend", with equity markets closed today and then a half day tomorrow. Around 46 million turkeys are eaten today in the US. Of course much is made of Black Friday tomorrow and Cyber Monday after the weekend. The shopping kicks off for the holidays, I hope that you have written your lists and make sure that they are all in order. Quickly!!!

Two big moves from some majors, unfortunately for Eli Lilly (the stock sank over ten and a half percent by the close), their Alzheimer's Drug Fails Trial. They have been trying really hard in order to crack this crippling ailment, your mind is the most powerful thing you have. Eli Lilly has tried hard here and has unfortunately for humanity shelved this research for a while to focus on other avenues, future blockbusters.

The other stock in a completely different area, John Deere (Deere and Company actually), had a cracking time, the stock was up 11 percent by the close to an all time high. The stock has not had the best of times since the financial crisis, in the commodity height of May 2008 the stock was a mere ten odd percent lower than it is now. The best time to have collected that business, along with many other generational lows was in March of 2009. Nearly 30 Dollars a share back then, since then the stock has quadrupled. Mind you .... the S&P 500 has done about the same. Still, this is a good brand and a business that will always have customers, from combine harvesters to landscaping. Great gear, loyal customers, the share price is aligned closely to commodity prices, which is a tough old ask to be "sure" of.

Company corner

Tiger brands reported their full numbers to end September, both the CEO Lawrence Macdougall, (relatively new at the business) and the CFO, Noel Doyle, (an old timer at the business) were on the telly yesterday on CNBC - Tiger Brands FY profit up after Nigeria sale. It is tough out there, solid numbers, not altogether any volume growth, steady enough though. It is interesting how the CFO Noel Doyle reckons there is still likely to be heightened cost inflation with regards to their inputs (grains), not all of that can be passed onto the customer.

Straight to the Group Results Presentation. We were scratching around for all the brands known well to all South Africans, most especially after this slide from Tiger. This is where these respective brands sit in their categories in a survey done by Nielsen over a rolling 12 month period:

All the major brands that you would expect to be there, of course what is missing here is maize meal, that was the first noticeable thing. Or course in that department for Tiger is Ace, both the traditional offering as well as porridge, and then of course King Korn and Morvite. Breakfasts and of course side starches. Grains contribute 12.845 billion Rand (out of a group total of 31.698 billion Rand), groceries (Koo, Crosse & Blackwell, Black Cat) contributed 4.7 billion Rand. Snacks, Treats and Beverages (Oros, Energade and Maynards) sales for the full year contributed 2.271 billion and 1.326 billion Rand respectively. Home, personal and baby care (Doom, Purity) sales were 2.437 billion Rand. International, which is their African businesses, had sales of 5.386 billion Rand.

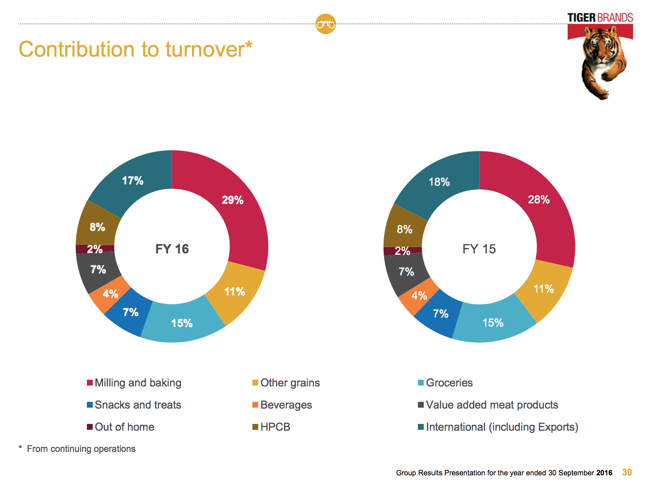

Here are two very nice graphs below of the separate businesses by revenues first, this compares 2015 to 2016.

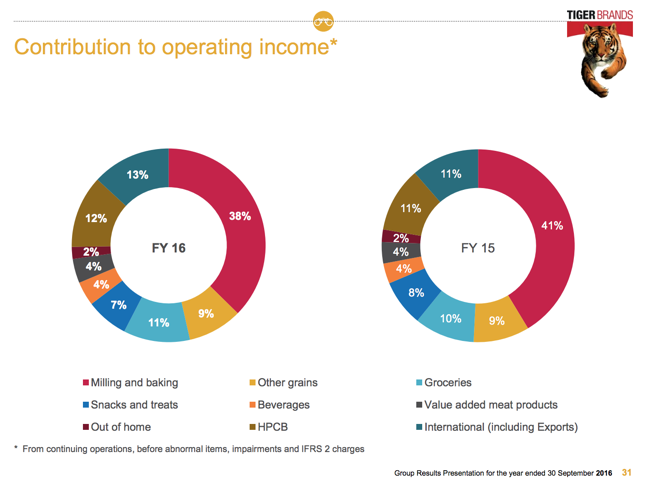

And then after that, their operating income when compared to the year prior, 2015.

Grains (staples) is their most important business, in that part they have struggled to deal with rising input costs. As they point out, raw material costs rose 22 percent. Wow. That is a tough old struggle, to keep your costs low and to make sure that the customer certainly does not bear the full brunt of all of that. The company has managed to cut costs by 380 million Rand in the last financial year, mainly on procurement savings. Improving costs at the fringes in all departments. And of course nearly 100 million Rand saved on manufacturing efficiencies.

Consumers have been grappling with rates going up, slow economic growth and joblessness has ticked up. Consumers will "shop down" to more affordable brands, which is why Tiger and their lengthy brand association with South Africa must continually stay relevant.

Earnings! What do those look like? Total headline earnings per share increased 19 percent to 2127 ZA cents, dividends for the second half was 702 cents per share, bringing the full year dividend to 1065 cents per share. At the closing price last evening the stock traded up nearly 2 percent to 392.24 Rand, the multiple historical is now 18.4 times, with a dividend yield of 2.72 percent. It is hardly the cheapest of all the stocks around, we have seen some of the retailers beaten up lately. The analyst community have the stock trading forward on around 16 and a half times. As the company pays out around 50 percent of all earnings in dividends, the dividend yield forward is over three percent.

This is a keeper. This kind of business continues to make progress year in and year out. The company will not be the overly volatile one in your portfolio. Volatility in earnings and by extension share prices is enjoyable when share prices go up, not so much when share prices go down. Tiger has certainly had their fair share of problems over the last half a decade, Nigeria is now a bad memory and out of the equation. We will accumulate this business on weakness, it is almost as timeless as some of their brands. Hey, Black Cat Peanut Butter turns 90 this year, remember these two classics - Black Cat - Packed with Protein Power and Black Cat Peanut Butter - The Boy with Nine lives. Classics, ha ha!

Linkfest, lap it up

While Trump is still president-elect, peoples imagination of what Trump is going to do while in the White House can run as much as they like - For Analysts, Trump Can Literally Make Everything Great Again. Even if analyst assumptions about Trump policies are correct, how they play out in reality will be different.

If Amazon can make the live sport streaming, business model work it will be a game changer for the entertainment industry. At the moment, sports rights are very expensive, so it is very difficult for companies like Amazon and Netflix to include live sport in their packages - Amazon is in talks to start streaming sports on Prime

If you ever need an example of why governments should leave economies alone and in particular the currency markets, have a look at the Nigerian Naira - To save its currency, Nigeria's central bank wants people jailed for holding on to US dollars. The currency is weak because it is incredibly difficult to get your hands on foreign currency, by trying to manage their currency they are only making things worse for what they re trying to prevent.

Home again, home again, jiggety-jog. Stocks will likely have a low volume day across the globe, both today and tomorrow. Japanese stocks are higher. Shanghai and Hong Kong are mixed. Stocks here have also started mixed to higher after a bit of a late afternoon pasting yesterday. Let us hope, that unlike in the last little while, it stays that way!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment