"Mind you, the English Premier League just sold television rights to a Chinese streaming service for a three year period for 564 million Pounds. The premier league is expected to generate over 8 billion Dollars in broadcast rights for the period to 2019. In the US, NBC just paid 1 billion Dollars for a 6 year deal to 2022. Supersport paid around 296 million Pounds to show games across SubSaharan Africa for the period 2016-2019."

To market to market to buy a fat pig Stocks across the sea and far away closed the session off down a bit, the S&P and the nerds of NASDAQ slipped around one-quarter whilst the Dow Industrials closed the day down nearly one-fifth. Energy stocks were marginal winners on the day. The winners this week are Black Friday and Thanksgiving, which is Thursday. Black Friday of course is that day post Thanksgiving. It is a huge shopping day, traditionally the retailers passed from the red to the black, an accounting term for profitability of course. And the day is also regarded as the start of the shopping "season" ahead of Christmas.

Buyers of goods falling all over themselves, the great culture of retail therapy has been taken to a new level. Nowadays and in the internet era there is Cyber Monday (next Monday) which follows Black Friday. That shopping day was first coined in 2005, more as an extension of Black Friday than anything else. So ..... if you have anything on your wishlist for Santa, now is the time to pencil it in, OK? And sneakily drop it into the lap of the person who is likely to be buying the presents this year.

Alibaba make a huge thing of singles day in China, the biggest shopping day of the year, with sales on their platform alone this year around 17.79 billion Dollars. Whoa!!! Last year Black Friday was 4.5 billion Dollars, collectively this year it is unlikely that Black Friday and Cyber Monday will get to one-third of the sales of singles day. So perhaps, rather than dropping the shopping list into the lap of the buyer, go and get yourself a gift this year, OK?

On the local front here in Jozi stocks finished the day flat, up 8 points. Better than 8 points down I suppose. Resources sank, down one and two-thirds of a percent, industrials up two-thirds of a percent. The Rand was weaker to the US dollar, that index was on a tear (at a 13 and a half year high). In fact, the last time that the Dollar index was at these levels was when Andre Agassi was the world number one mens tennis player. He is now married of course to former number one Steffi Graf, between them they have 30 grand slam titles and two children. I hope they have a lot of cupboard space for all those accolades.

Dischem of course listed Friday. You got no stock, you had to be an insider. Michael was actually on the box with the founders Friday morning. The Salzman couple put their best foot forward, TV was a relatively new experience for them. Michael told me that they said they were nervous. They ended up placing 236.8 million shares, total shares in issue as of Friday morning was (is) 860.1 million shares. Total shares traded Friday was a whopping 23.2 million shares, or 2.7 percent of all shares in issue. Or 9.8 percent of all the shares placed. Is that a lot? I guess there is bound to be a flurry at the beginning.

As Michael pointed out, the Salzman family own over 53 percent of the business, they are at current levels (including the whopping dividends that the group has paid) possibly Dollar billionaires. Good for them, celebrate all the successes that they deserve. The group also does an enormous amount of charitable work, ironically the richer people become, the more charitable they become. Again, encourage people to get rich so that they can continue to give back to society.

It is a short week for stocks, Friday is likely to be very quiet (it is actually a half day for equity markets) whilst the US markets will possibly be still trying to digest the outcome of the US election. And what it all means. I am very sure that by April or May next year we will have a very clear idea of what the Trump administration is trying to implement. And whether or not it will fly globally. This vote is about pushback from a segment of society that somehow feels aggrieved at the pace of globalisation, amongst many other things too. We can only watch and wait like all the other people involved in the deep and liquid capital markets.

Company corner

Naspers released a trading statement on Friday afternoon. Just Thursday we had the numbers from their largest investment, Tencent, we covered those Friday - Tencent 3Q numbers - Strong top & bottom line growth. This trading statement has a few moving parts. As they often say (the Naspers board, they!), they consider "core headline earnings an appropriate indicator of the sustainable operating performance of the group, as it adjusts for non-recurring and non-operational items."

This metric is likely to be between 23 and 28 percent higher than the prior reporting period. At the top end of the range this is expected to 216 US cents of earnings for the half, at 14.40 to the ZAR that translates to just over 31 Rands of earnings. For the half. Results are expected this Friday, there and there abouts. It is best to value this business on the sum of the parts, rather than out and out earnings. They are building businesses that will take them to the next stage of growth, ecommerce and classifieds.

The recent action in divestments and consolidations show you that Bob van Dijk's style is likely to be more focused. Naspers sells Allegro for $3.2 billion and Naspers Ibibo mergers with MakeMyTrip. The TV business is becoming increasingly crowded, TV on demand at cheaper costs is here, the internet speeds (and costs) matter the most in their territories. And the live sport. How that is going to compete as an entertainment form in the future is critical.

Mind you, the English Premier League just sold television rights to a Chinese streaming service for a three year period for 564 million Pounds. The premier league is expected to generate over 8 billion Dollars in broadcast rights for the period to 2019. In the US, NBC just paid 1 billion Dollars for a 6 year deal to 2022. Supersport paid around 296 million Pounds to show games across SubSaharan Africa for the period 2016-2019. Total club wage costs last season? 1.5 billion Pounds, for the Premier League only. Wow. Live sport (sometimes you don't need it - the Springboks on Saturday), most of the time you can only watch it live. Stay tuned for Friday and Naspers results. For the record, Naspers tacked on just over two percent on the day. The stock is now a single percent higher over the last 12 months. Santa Claus rally, where are you?

Linkfest, lap it up

The consensus before the elections was that if Trump wins stock will drop. That was true for a very brief period, even when the consensus is overwhelmingly in one direction it is still close to impossible to regularly call short term stock moves - A Lesson from the Market's Overreaction to Trump's Win

"As I've shown before, increasing your time horizon in the stock market substantially increases your odds of making accurate forecasts. In the very short-term, the stock market is almost entirely random with daily fluctuations averaging just 0.03%"

"On a monthly basis the average return skews marginally positive to 0.7%, but still appears to be largely random"

"Over an annual basis the average return jumps significantly to almost 13%. The returns still appear somewhat random, but they have a significant positive skew"

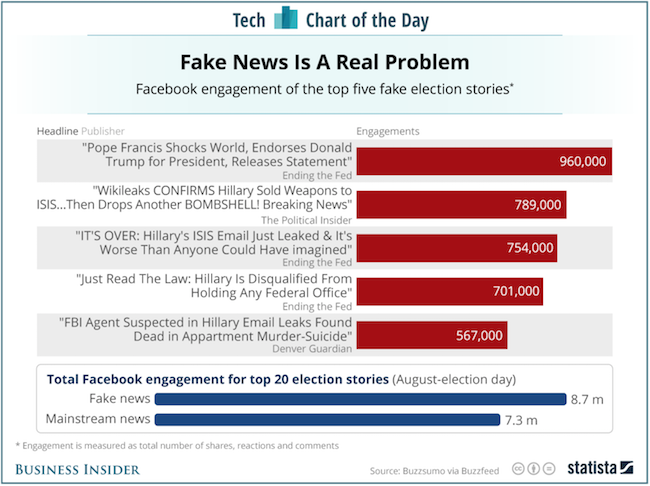

Since the election social media companies have been getting heat for not filtering fake stories out of news feeds. Part of Facebook's problem is that the more a story is interacted with, the higher it appears on someone else's news feed. So these highly sensational stories get high levels of interaction which feeds into more interaction - Facebook's fake news problem in one chart

It is only a matter of time until the globe becomes cashless. Cash is an inefficient way of transacting, not to mention tax evasion and other illegal activities that happen thanks to cash - China's central bank is hiring blockchain experts to help it kill off cash. Interestingly, the US will probably be one of the last countries to drop cash because citizens feel it is their right to be able to transact in a manner that the government can't track (cash).

Home again, home again, jiggety-jog. There are a few big events this week, US durable goods orders Wednesday and UK GDP Friday, as well as Fed minutes midweek too. Flash PMIs, if that is your thing. On the local front this morning there have been food businesses reporting numbers, Rhodes, Astral and Pioneer. That should give a good idea of where the consumer is. We will review! Stocks across Asia are mixed to better, US futures are marginally higher, we should hopefully do "better" than Friday.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment