"Priceline reported numbers after hours. The company operates in the travel space. The investment thesis is simple, more people are going to use more online platforms to fulfil their experiences (which beats "things" in the modern era), and this business operates multiple websites and apps to facilitate that."

To market to market to buy a fat pig Not quite ten days down for the S&P 500 in a row, that had last happened in 1975. Which is a smidgen before I was born, and even I consider that a long time ago. Funny, I am at an age that is neither traditionally old nor am I young anymore. And I sure as heck don't look anything like Goldilocks. And I don't eat porridge. And best of all, whilst I know many (market) bears, I certainly am not one. That is right, like all of us here at Vestact, we are unashamedly optimistic. Sometimes when you are optimistic of the ability of the collective to overcome dumb systems set in place by flawed theory, there are some examples that prove you completely wrong. There is not a day that goes by that I don't feel the pain of the people of North Korea. It is not the fault of the people.

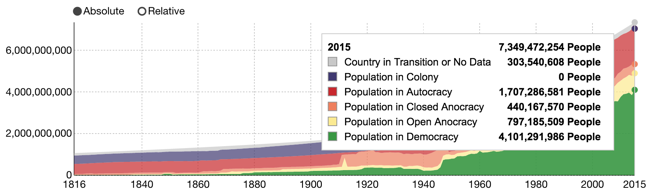

Democracy is relatively new, and we are still trying to work it all out. Our World in Data and Max Roser try and put forward their versions of democracy in the modern world, and he has some interesting graphs -> Democracy. According to the research, 150 years ago (1866) we were in the process of moving from 4 to 5 democracies. Globally. By 2010 there were nearly 90 democracies, where you can pretty much do what you want, within reason. However there are only 4.1 billion people across the globe who wake up in real democracy and implement free thinking each and every day. Check out this graph:

There is a strong link between basic user services, accountability, education and wealth with democracy. It is no secret that the North Koreans are more malnourished than their Southern counterparts, who not only have extreme pressure to succeed, they (the South) have internet that defies logic. The speeds that is. Not that internet speeds should be how you measure a country, freedoms to choose and access to the internet go hand in hand. Often flawed democracies (see Turkey) try and block internet activity. And as such, stifle long term growth. Those are matters that I am not likely to change.

To markets quick sticks. The markets roared ahead, erasing the losses from all the other trading days in November (which all happened last week) as the Clinton email FBI investigation overhang was removed. Really, that was the reason given. The FBI found nothing new. Elections and markets, sigh. One of the WSJ headlines is Dow Jumps 371 Points After FBI Says It Won't Charge Clinton. And the FT says Wall St rallies as investors bet on Clinton win. I know that it is nitpicking, surely investors do not change their minds daily? Those are traders. Investors make long dated bets on businesses and debt of countries and institutions, traders look at price and price only.

Session end the Dow Jones Industrial Average rallied by just over two percent by the close of shop, the broader market S&P 500 rallied nearly 2 and one-quarter of a percent. The nerds of NASDAQ added 2.37 percent by the close. There were strong moves by Alphabet and Amazon, Microsoft and Berkshire (who had results over the weekend). Berkshire now sits on the biggest cash pile in it's history, elephant hunting will no doubt be taking place. There is a timeless paragraph written by Warren Buffet in 1979 that holds true today more so than at any other time in history:

"An argument is made that there are just too many question marks about the near future; wouldn't it be better to wait until things clear up a bit? You know the prose: "Maintain buying reserves until current uncertainties are resolved," etc. Before reaching for that crutch, face up to two unpleasant facts: The future is never clear and you pay a very high price for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values."

So where we sit right now, where there is always uncertainty (around politics and rates and earnings momentum, Chinese debt and growth), that might represent a massive opportunity. "Things" are never going to be clear. Like ever, and you must get used to that when investing. There will always feel like a good reason to not invest. Stay the course, remember that long term wealth creation was not made by politicians or central banks, it was consumers and businesses, individuals at the core.

Back home where we were saluting the performances of Joburg's finest (KG, Quinny and Temba) in dismantling the Aussies, markets rallied sharply. OK, it was a team effort, the orange ones from Bloem had Dean, the other country Cape Town had Vern and JP, it was pretty much a team effort. That runout though, from St. David's finest (Bavuma) was something else. And now Temba Bavuma also has one more test wicket than I will ever get, or anyone in our office for that matter. And the same as Sir Don Bradman, who also only got one. Glowing in the dark over that comeback. OK, cricket aside, a quick check in with the roaring market yesterday.

The Jozi all share racked up a percent and a quarter gain, the financial 15 added nearly 1.9 percent on the session, gold shares were the big losers on the day. The Trump sell I guess. Glencore, Naspers and FirstRand were at the top end of the winners table. The currency was also boosted, perhaps the flows were strong as a result of yield searchers. Rates are more than likely to head higher in the US next month, and I suspect that will be a good thing. Here, expectations are (all things being equal) for tepid growth, weakish demand and perhaps a recovery, if the political landscape will allow it. As such, rates are unlikely to budge from where they are currently.

There was an excellent trading update from Spar (good for you), the stock has certainly been an absolute cracker. I often tell the folks in the office that if you held Tiger stock around 17 odd years ago, you have gotten one share of Astral, one of Spar and one of Adcock, it has been one of the steadiest and best stables to be in. Regardless of what you think of chicken, or retailers, or generics, or the missteps from any of those businesses. Makes you think long and hard about portfolio balancing and tinkering. Sometimes the best thing to do is to do nothing. Which in itself is taking an action and making a decision. Often this is the best action when investing.

Company corner

Priceline reported numbers after hours. The company operates in the travel space. The investment thesis is simple, more people are going to use more online platforms to fulfil their experiences (which beats "things" in the modern era), and this business operates multiple websites and apps to facilitate that. Priceline operate and own the brands Booking.com, priceline.com, KAYAK, agoda.com, rentalcars.com, and OpenTable.

Total properties on their flagship platform (Booking.com) stand at 1,065,000, which is a 29 percent increase over the same time last year. Vacation rentals were the biggest growing category, up 39 percent year-on-year to stand at 529 thousand. So, around half of all the places you can book are actually not single hotel rooms at all. Hotel rooms still dominate the number of total rooms that you can book, the total single rooms out of the million plus properties is now 24.4 million. 16.9 million are hotel rooms and the other 7.5 million are either homes, or apartments, holiday villas and of course some other "unique" bookable abodes. So, whilst Airbnb is at some level a threat to their business, many people renting the actual rooms would be happy to do so across multiple platforms.

All their other platforms performed well, with the exception of OpenTable, which they impaired by 941 million Dollars. The restaurant booking platform is pretty simple to understand and use. 50 percent of all the bookings made on the platform are done via mobile phones. It looks like a pretty exciting business, clearly the group overpaid way back when. Priceline paid 2.6 billion Dollars, all cash, back in the middle of 2014, paying a 46 percent premium at the time. Not good.

Q3 saw revenues increase 25 percent to 18.5 billion Dollars, profits were up 22 percent to 3.6 billion. Non-Gaap net income was 31.18 Dollars a share, comfortably more than the Street had penciled in. I am not a fan of the company pointing out that the analyst community were just below 30 Dollars a share, let the analysts do their job, the company should not fret about their targets and earnings forecasts. Over the last quarter 150 million plus rooms were booked over the Northern Hemisphere summer period.

What amazes me about this business is that the local market, North America and in particular the US, is not big for locals. i.e. for some reason the US local is just getting accustomed to using the platform. Rather late than never, right? Whilst the US is often at the forefront of technology, some of their general receptiveness to certain platforms boggles the mind. Payments? Crumbs, those people still use checks. C'mon people, it is 2016, send money to my app, right?

There is some concerns that their lunch may be eaten by the likes of Facebook, or even Google. In fact Google, as the CEO Jeff Boyd points out on the conference call is a great partner, see: "And then Google is continuously experimenting and iterating with different ways of answering travel queries for their customers and we work closely with them. They've been a great partner for us. We'll continue to work with them as they add new channels in the future, new ad placements, and look for ways that it will work for us and for them."

Priceline have announced that Brett Keller will run the website priceline.com, an insider of around 17 years at the business. They also guided for the fourth quarter, not exactly the biggest quarter, for the full year the analyst community has the company making nearly 69 Dollars a share. And then for the next year around 80 Dollars of earnings a share. The stock ramped nearly 4 percent in the spot market and now is up another 5 percent post market. At the indicated opening price of 1556, the stock trades then around 19.45 times, hardly expensive for a company that is growing revenues by more than that number, percentage wise. i.e. they have a forward PEG of less than 1. This may not be a mainstream investment, for those of you who think that global travel is in the infancy of the new experience economy, this is definitely the investment for you. We like the theme, we really like the business as a long term investment, buy.

Linkfest, lap it up

Here is one area that machine learning is being practically used - Google's DeepMind trains AI to cut its energy bills by 40%. Great to see the technology already making a positive impact.

Having access to information is probably the most effective way to help people move up in the world and by extension having access to the internet is the easiest way to give people access to information. Facebook is working hard to bring free internet to parts of Africa and MTN has been involved in the initiative - Facebook's latest plan for cheaper and faster internet in Africa is off to a good start.

If you didn't understand what MTN was testing for Facebook, here is a more detailed explanation of the hardware that Facebook is developing - Now Facebook plans to eat the $500 billion telecom equipment market.

Given how quickly Tesla burns through cash as they ramp up car production and expand their supercharger network, it makes sense that Tesla is starting to charge for the use of the supercharger network - New Tesla buyers will have to pay to use Superchargers.

Home again, home again, jiggety-jog. Today all of the action will be dominated by US election speak, voting has already kicked off in the US. Markets across Asia are apparently "cautious" ahead of the US elections. Make no mistake here friends, today will be very tough to call, I am going to suggest that Clinton will win comfortably. We shall see, this time tomorrow or a little later.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment