"As long as your thesis still holds true, you should continually be adding to the same companies. You wouldn't sell your house if your neighbour sold their plot of land or house at a discount relative to the last sale price, if anything, you would think about buying that asset. Why didn't I get a piece of the action?"

To market to market to buy a fat pig Stocks were a deep mixed bag here locally yesterday, mostly as a result of the much stronger Rand through the session. The Dollar rally ran out of steam, at least for the time being. The Business Insider chart of the day was the strength of the greenback relative to the rest of the majors, only the Pound Sterling (which was way weak at that point, to the Dollar ) has been stronger - The dollar has been on a tear since the election. So, rates in the US are likely to go higher, relative to these currencies. And that makes the Dollar more likely to attract the flows in the nearly decade long search for yield. Ever since rates were and have been driven lower across the globe, in most developed markets, the search for yield has been on. So expect the Dollar strength to be somewhat justified.

So why the stronger local currency? In part the favourable outcome to the two ratings agencies Friday, remember that Standard & Poor's give their feedback before the week is out. That could be the key one of the three agencies. Should you care? Yes, the interest bill that we all have to service on government debt impacts on all citizens. And visitors, I guess you charge them higher VAT in order to make it up. Although visitors can always come back with their VAT refunds, I am sure that the "participation rate" of VAT is not always what it could be. We must celebrate a stronger currency, that leads to lower imported inflation, and that definitely has an impact on the poorest of the poor, who have a far larger percentage of their spend on food.

OK, let us finish the market segment quickly, locally stocks as a collective slipped nearly a percent, financials were up just over nine-tenths of a percent, banks were up over three percent and mining stocks were down two and a half percent. General retailers were up nearly one and a half percent, industrials sank by exactly the same amount. There's it, as a famous local Youtube star says, a mixed bag. No DIY of any sort for you. MTNZ are embarking on an accelerated bookbuild to retire the debt associated with the scheme, and as such will sell 21 million shares in a rush. Someone is going to get a bargain, I guess that is the way that the deal is structured. It was unsurprising then to find the stock near the top of the list of losers. A list that you don't want to make, like ever. Stocks with a strong Rand hedge element sank sharply, Mediclinic, BHP, Old Mutual, Bidcorp and AB InBev found themselves on the wrong side of the thin red line.

Over to the other side were the banks and financials. Having a good time, Barclays Africa up 4 percent, RMBH up over three and three-quarters of a percent. Tiger Brands, since their recent results, have been on the charge, that stock touched an all time high earlier in the day. Over the last year the stock is up nearly 22 percent. Over ten years that is a pretty astonishing 231 percent, plus do not forget the very decent dividend flow. Another in the majors making a new 12 month high was Barloworld. So much for ZA inc stocks being out of favour and the wrong flavour.

Mind you ... general retail is down nearly 18 percent over the last 12 months, Industrials as a collective are down 12 percent plus over the last 12 months, financials are down 8 percent over the last year, it has been tough out there. The collective, the all share index, is down two and three-quarters of a percent in this time. Pharma is down 6 percent. Healthcare is down nearly 19 percent. So much for defensive. The only sector showing any signs of life is the resource sector, the resources 10 is up 27.66 percent over the last year. More on this in a bit.

Over the seas and far away in New York, New York, stocks sank, some suggested that perhaps the Trump off trades were starting to happen. Energy stocks sank the most as the OPEC drama continued. I for one am very tired of the correlation between stocks and the oil price, it is the one commodity that any single person using powered transportation uses day in and day out. According to CNet, Cyber Monday edged out Black Friday in total sales (Another Cyber Monday, another online sales record), as we reminded you last week though, singles day through the Alibaba platform is far bigger!

At the end of the session the Dow Industrials had shed around one-quarter of a percent, the nerds of NASDAQ gave up over half a percent, as did the broader market S&P 500. Amazon, Wells Fargo, Bank of America and some big energy stocks were losers, Alphabet (Google) was amongst the resource stocks (Vale and the like) in the winners column. Oil, Trump, the Fed? The Dollar? Hey, if that wasn't enough, remember that it is jobs Friday coming, the last real look for the Fed before they inevitably raise rates in just a few weeks from now. That would be some sort of relief, don't you think?

What is going on with equity markets globally, more to the point in a South African context? As you can imagine, we are fielding calls and emails (and WhatsApps) from concerned holders of equities. I can't think of many people who get excited about watching the value of their equity portfolios sink, unless they have plenty of resources to add at any given point. As we pointed out above in the moves on specific sectors, it has been a poor time to be invested in equity markets locally, unless of course you have held the line on the resource stocks. Mostly everywhere else it has been downright tough and a little disheartening. I do not like to compare one time to another in markets, I do not think it is fair. They didn't sell iPhones or Xbox's back then, nor were people posting selfies on Instagram or self destructing messages on Twitter or Facebook.

So whilst we try and find reasons for the re-rating of certain stocks, again it is tempting to draw on ones experiences in investing. And again find comfort in the fact that whilst share prices may be well off their all time highs, the underlying businesses (that produce the profits that reward shareholders) are in good shape. Obviously not all of them, I am pretty sure that the operating environment for Brait for instance could be a whole lot better. The unknowns of Brexit means that there is a fair amount of uncertainty associated with the stock.

Mediclinic is another stock that at face value looks like it has done extremely "badly" and in Rand returns it has. The price, since the rebasing and the new version of the London listing, has fallen dramatically in Rand terms. Remember that the company reversed into the Al Noor London listing, see - Mediclinic corp action. Since then, the stock in pounds is down 14 percent, most recently as a result of the tricky operating environment in the UAE, with healthcare benefits under pressure and quality staff hard to find, see - Mediclinic half year numbers - not going so well in UAE. In Rand terms, the stock is down around 30 percent.

So what to do? Nothing really. Investing is about time, learning when to react and when not to. Learning when just to hold the line in the face of very trying times and circumstances. As long as your thesis still holds true, you should continually be adding to the same companies. You wouldn't sell your house if your neighbour sold their plot of land or house at a discount relative to the last sale price, if anything, you would think about buying that asset. Why didn't I get a piece of the action? That should be the same reaction when dealing with your equities portfolio. Stand by for more on this in the coming days.

The Mannequin challenge. What is the point? I mean, are they raising money for some good cause? Nope, it is just a form of entertainment. In their hands, they have the tools to shoot (smartphone) and then upload (using 4G from your network or a wireless infrastructure, locally MTN, Vodacom, Cell C and Telkom) to their favourite platforms (Instagram, Twitter, Facebook, Youtube) for other people (friends or "friends") to see.

All this would not be possible without the huge infrastructural spend across the various tools available. Think about it, all these businesses, from the smartphone business that creates the cameras in order to take the crisp images, billions of Dollars of R&D have gone into that phone, the networks that spend billions of Rands in order to keep pace with the speeds that their customers want and need. And then last, if not least, all of the platforms have spent so much on server farms and software. Youtube is the largest streaming business in the world. Yet consumers demand more. They want quicker speeds, better cameras on their phones and easier to use platforms. All this requires spend, loads of it.

See the wiki entry try and explain it - Mannequin Challenge. I have got to hand it to the people of Cape Town, this one in Camps Bay is epic. Here is whole bunch of them from around the world - 13 of the best videos you need to see. So ..... the next time that you see one of these or partake in one of these, know that a mere decade ago this would have been nigh impossible to achieve with your phone and network back then. Perhaps the platforms, some of them at least, were there.

I found out something pretty amazing and strange. We all know that (the infamous, for obvious reasons) Guantanamo Bay is in Cuba, and we all (sort of) know the details of the lease agreement between the US and Cuba. It may have been a few tough days in the Cuban missile crisis to have been a US naval officer there, can you imagine? What I didn't know is that there is a McDonald's there. Equally strange is that the Cuban government, since Castros took power (Raul is still in charge), have only cashed a single lease check, in error apparently in the early days of the revolution.

Each check is for 4,085 Dollars a month in rent. For a little more than that, you can have this Nice clean style apartment in Central midtown near Javits. You would have to say that the deal is a bargain for the US and one of those strange historical agreements. When Fidel Castro was still in charge, he kept these checks in his drawer. Uncashed. That is 57 years and 10 months (nearly 11) of uncashed checks. So .... the USA has issued checks to the value of 2,834,990 million Dollars for 694 months of rental since the Cuban Revolution finished, 1 January 1959. And one has been cashed.

Now, according to Statista (Big Mac index - global prices for a Big Mac in July 2016, by country (in U.S. dollars)), a Big Mac in the US (close enough) costs 5.04 Dollars. So this amount owed is equal to 562,498 Big Macs. Or, a whole lot of Cuban cigar, like this Hoyo de Monterrey Hermosos No. 4 Anejados, costs 22.5 Dollars. For the money owed that is 126,000 cigars of this kind. Either way, it is just weird to think that all along, there has been a US presence deep in one of the last bastions of communism. The case of the single McDonald's and the uncashed checks.

Linkfest, lap it up

The tech industry is getting creative with how to reach the unbanked - No Credit History? No Problem. Lenders Are Looking at Your Phone Data. Once people know what metrics the fin-tech companies are looking for, you can expect behaviour changes, with perceived negative behaviour reserved for a second cell number.

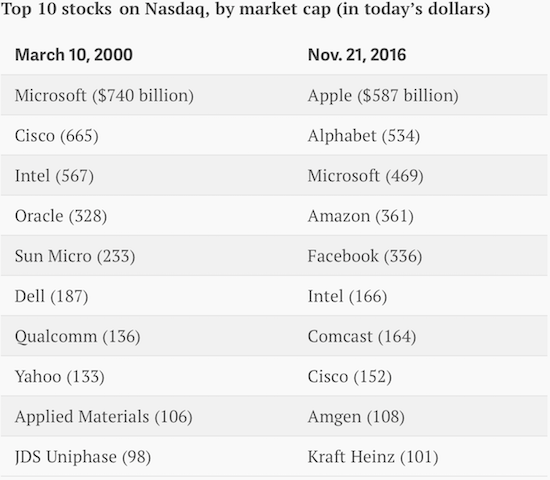

The Nasdaq is in record high territory but on an inflation adjusted metric we still have some time to go until we reach the highs of 2000 - Putting the post-Trump stock market rally in perspective.

I think we sometimes underestimate the power that a brand has in making us buy something or more importantly makes us continually come back and buy it again - Skateboarder Tony Hawk said he had to destroy his brand to learn its value. A strong brand is a moat against other competitors, which is one of the reasons that we like Tiger Brands. I used this brand growing up, I will use the brand now and my children will use it and so the cycle continues.

Home again, home again, jiggety-jog. We have opened slightly up. Currencies, politics, commodities, jobs numbers, interest rates. It's all happening here during the close off of 2016.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment