"Humans are great inventors, they are also great inhibitors, humans that is. If you do not make these therapies, or incentivise people to search for these therapies, then you are unlikely to ever get them made. There are those motivated by science and invention, there are those who are motivated by profits, there are those who are motivated by believing that societies best needs to be taken into consideration"

To market to market to buy a fat pig The Rand caught a serious bid yesterday, mostly as a result of political meddling coming undone at the edges. It all looks rather amateur, even to the untrained eye. Surely in a country where graft impacts on poor people, you have better things to do than read reams about pension law and early retirement? We (and by we, I mean South Africa) also recorded a trade surplus in September, economists had expected a deficit, that may have seen the Rand catch a bid too. Perhaps these are the green shoots that the minister of finance is talking about, greater exports. He will put on a brave face, and perhaps the ratings agencies will be at bay for another 6 or so months. Meddling. The less politicians do, the better. Oh, and does Shaun Abrahams look more like Gru from Despicable Me or Chester Messing, the puppet fellow?

Democracy trumps central planning, each and every time. Letting individuals carry on and doing what they do in an orderly fashion, keeping to a set of guidelines is something humans do. Even in North Korea there is a flourishing informal market (I call it real market, where real people set real prices for real goods, some people call it a black market) that sells all sorts of electronics. This segment of the market accounts for nearly 30 percent of their entire economy according to some estimates. The more freedoms people have, the more they want, it is a natural thing.

Session end, stocks locally had slipped 0.41 percent overall, some sharp moves in specific sectors though masked what looked like a mild day at face value. Local ZA inc. stocks, banks, financials and retailers caught a serious bid, FirstRand rallied 4.82 percent, RMBH was up 4.42 percent, whilst Shoprite (up 4.19 percent) moved northwards on news related to the retirement of their chief and a trading update. Perhaps this clears the way for the younger fellows at Steinhoff and Shoprite to commit to the master plan, a tie up of epic proportions. Emerging markets, established markets, good quality, good price. A truly global force to be reckoned with.

On the other side of the table, deep in the red, were the likes of AB InBev (secondary listing in Jozi, Mexico, and an ADR in New York) and Richemont, big Rand hedge businesses that reflect an offshore price (Listed in Brussels and Zurich respectively) in local units. i.e. part of the reason why some Rand share prices have performed poorly since the Brexit vote is as a direct result of the Pound having been rubbished. It has been just over four months since the Brexit vote. And in that time, the Pound has weakened by nearly 24 percent to the Rand.

So, for ease of math, a 10 Pound share price would now equal 164.84 Rand, whereas the day before Brexit (23 June this year), the same 10 Pound share price would have been 212.04 Rand. And added to that, the same ten Pound share price now attracts a market discount, as a result of the economic uncertainties that face the United Kingdom who would now face more trade barriers. Potentially. These are unknowns. So that 10 Pound share price would now be 8 Pounds, on the same earnings, a lower valuation. What we have learnt overnight is that the Bank of England chief, the dashing Mark Carney, will stay on until 2019. That is a bit of a relief and he will now stay on and bring some stability. Or so it seems.

So, back to that comparison of the 10 Pound share price pre-Brexit to a 8 Pound post Brexit and heightened uncertainty scenario. 8 Pounds at the current level equals 131.84 Rand. What we are dealing with, in terms of our UK exposure is a drop in value in Pound terms, exacerbated by the weakening Pound to all other currencies. What I think is likely to happen is that recent good news (i.e. not so bad news) is likely to be replaced by inflationary concerns and growth doldrums.

For the time being the Brexit doomsayers look wrong. Except for the Marmite thing. I suspect that whilst the outlook is patchy, I have asked the question several times, if you lived in an economy that was patchy (for example China or Russia), would you rather own a flat in Moscow, Shanghai or London? Which country do you think has the best property ownership laws protecting buyers? Just saying. We have no idea what the outcome of the Brexit referendum is likely to be, and for the time being, anything with a British flavour is being treated like boiled potatoes and Bubble and Squeak. Leftovers and not the main course.

Over the seas and far away (from us) in New York, New York and in a time zone that we still know well, there was some deal related activity that needed fleshing out. Whilst politicians have been nearly swallowing giant feet, markets and confidence have been patchy. Some stocks have continually caught a bid and have stayed at elevated levels, others have fallen flat on their backside. I guess that is why one tries to have as balanced a portfolio as possible. No two businesses are the same, inside of the collective that makes up the market the evolution is slow (like growing trees) and suddenly you turn around and the market composition isn't what you remember. That aside, and we have covered that multiple times in this never ending series of "newsletters", everyone refers to the market as one homogenous beast. Asking how the market is, is the same question as do you think it will rain today, or how do you expect the Proteas to do come Thursday in Perth?

Stocks on Wall Street lost a little ground, the Dow Jones Industrial Average sank 0.1 percent, whilst the S&P 500 fell a fraction, down one quarter of a point (0.01 percent). The nerds of NASDAQ fell double that, down 0.02 percent. So hardly a day to speak much about, other than an oil and gas services deal between the GE division and Baker Hughes (the folks that release the weekly rig count). Amongst the winners on the day was Amazon, recovering lost ground post their (what I thought were good) results from last week. The opposite end of that spectrum was Alphabet, that stock lost ground. I think that both these businesses have great prospects.

Company corner

Amgen reported their numbers post the market close last Thursday evening. The stock was completely smoked. By Friday close of trade the stock had lost nearly ten percent, the worst single day loss for 14 years. Why? Was there anything fundamentally wrong with the numbers? At face value the results and guidance looked decent enough. There have been several concerns about their best sellers coming under volume and price threats. Let us be clear when we are talking about these pharma businesses that one is able to invest in, there is a very fine line between the company dedicating in the teens of revenues for research and development (looking for new life changing therapies), billions of Dollars and then the cost to broader society, who essentially pays after the therapy has passed all the regulatory requirements.

Humans are great inventors, they are also great inhibitors, humans that is. If you do not make these therapies, or incentivise people to search for these therapies, then you are unlikely to ever get them made. There are those motivated by science and invention, there are those who are motivated by profits, there are those who are motivated by believing that societies best needs to be taken into consideration. What history has shown us is that the market is normally the best leveler. If the therapies are too expensive, they won't sell. That said, what is a life worth? Much more than you will ever know, having lost my mother to a dreaded disease, I can see that there is no money in the world that could have saved her, eventually. Yet that didn't stop the family from trying whatever they could. See, a fine balance, and it is impossible to be objective.

OK, so let us have a look at the spread of therapies that Amgen have, Byron did a great job for all of us, he stuck it in a spreadsheet. It is a little too big to stick in here, follow the link to get the "larger image" - Sales update

Amgen has attracted a lot of heat after this reporting period, we view this as a huge opportunity to be able to acquire what is a well placed business, with a solid pipeline at a much cheaper price. The stock is trading near a year-to-date low. With a yield rapidly approaching three percent at current levels, a 14 historic multiple, we still feel major conviction on this business and by extension the share price. Buy.

Linkfest, lap it up

Elon Musk, revealed Tesla's latest product in their alternate energy product line - No One Saw Tesla's Solar Roof Coming. The roof tiles are designed to look exactly the same (or better) as current roof tiles. Part of the launch was the release of their Powerwall 2, which is a lot more powerful and more cost effective. What is the point of driving an electric car if the power used to power it is made from coal? The solution is to have a complete solar system at home.

Here is the video of the launch - Elon Musk unveils Solar Roof

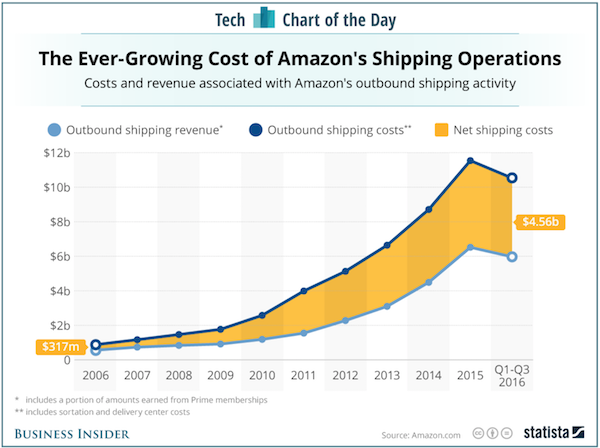

To be the best online retail store, Amazon invests huge amounts of money in their distribution centres. Costs of shipping is a big sucker of cash - Enjoying that Prime membership comes at a big cost to Amazon. That is a huge short fall, would you call the expense an investment in future customers?

Another great blog from A Wealth of Common sense. As investors, too much focus on price action leads us to make irrational investment decisions - The Frog-in-a-Pot Theory of Investing.

"High prices attract buyers, low prices attract sellers."

Home again, home again, jiggety-jog. Stocks are higher here, a better Asia as a result of better Chinese PMI. Sigh. It is what it is. Facebook numbers tomorrow evening, that is fun and exciting!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment