"Why is this the case? Are people suddenly going to stop buying iPhones, renewing their Microsoft Office 365 subscriptions, no more Amazon online orders and no more search (and by extension adverts)? No. Not at all."

To market to market to buy a fat pig Something different happened last night. The so called FANG stocks (Facebook, Amazon, Netflix and Google) came under pressure, the market sold off heavily in tech stocks and bought financials and some elements of healthcare again. There were three A's amongst the top losers in the markets last evening, Alphabet (Google holding company) sank 3.14 percent, Amazon gave back 3.82 percent, Apple ended the day down 2.79 percent and Microsoft (that starts with an M) also found themselves amongst the losers, down 2.44 percent by the time the session had ended.

Why is this the case? Are people suddenly going to stop buying iPhones, renewing their Microsoft Office 365 subscriptions, no more Amazon online orders and no more search (and by extension adverts)? No. Not at all. The winners column in the majors included Wells Fargo (up 7.58 percent), JP Morgan (up 4.64 percent) and Pfizer (4.27 percent better on the day). Err.... back to finance and home ownership and spending on pharma? Of course all of these things will still be consumed and used. The Dow Jones Industrial Average closed at a record high, up 1.17 percent to 18,807 points. The broader market S&P 500 added one fifth of a percent, the nerds of NASDAQ understandably (with these big moves mentioned above) was lower by 0.81 percent.

The perception out there, and this tries to explain the massive moves in the markets, is as follows. For many tech companies, their skills (and people who run these businesses) are imported, i.e. their workers are immigrants. And also, the feeling is that the Trump administration may well pick on some of the vocal CEO's (the companies that they run) in the campaign, people like Bezos from Amazon and of course Apple, who build their stuff far away.

In fairness to Apple, around two-thirds of their revenues come from outside the US. And the romance that exists between the current administration and Silicon Valley may not be the same. I am not too sure how that would impact their businesses, let us just say that Trump has less excitement for tech innovation (or so it seems) than Obama. There is a certain irony there, you would think that Republicans are always pro innovation and pro business. Yet .... Trump may not be that friendly to immigrant workers. I suspect that if this is the case, these businesses would open stronger hubs in Europe, in Asia. Many of these stocks recovered strongly off the lows, the NASDAQ rallied around a percent off the lows. Facebook was around four and a half percent off their lows. The realisation may well be that there may be some resentment there, Trump is made of teflon.

Trump appointments for all the top jobs to get the economy moving again are going to be interesting. The awkwardness of Obama and Trump in the meeting yesterday was plain to see. It is just a reminder that you can say stuff on Twitter and in political rally speeches, when it comes to meeting face to face, it is "different". Mind you, they both have to act more presidential. Trump has toned down the rhetoric in recent days, removing aggressive stances towards various ethnic groups.

And of course the opposite is true for financials and banks, the reason that they all caught a serious bid is that a) Treasuries sold off on the basis that the purse strings are going to be opened to fund infrastructure (the irony that the Republicans told the Democrats they were spending wildly) and b) that benefits banks who are holding these, higher rates means more income. Less regulation for banks, the breakup of Dodd-Frank (breaking up all the restrictions post the financial crisis) could be pending. We will have to wait and see what transpires. For now, the market seems to favour banks and pharma.

Locally markets were a mixed bunch, it depended where you were invested. The overall market added just over a percent on the day, financials were nearly down a percent though. Emerging market currencies were sold off sharply, the whole idea that yields in the US are going to improve (see above), money can go home and the "search for yield" might be nearing an end. We are going to be buffered by people repositioning ahead of what they anticipate is likely to happen. What transpires eventually, well, you should not second guess that, stay the course and make sure that you view this as a period of great patience in investing.

Company corner

Mediclinic reported numbers for their half year to end September. "Things" are taking a little longer with regards to integrating the Al Noor reverse listing. Not the listing itself, that has gone OK, rather the AL Noor operations into the existing Middle East businesses that Mediclinic had before they became a London listed business earlier this year. Excluding the Al Noor business, revenues grew by 11 percent, including, it was up 27 percent to 1.283 billion Pounds. Operating profits increased 10 percent. The big change in these results is that the weighted number of shares in issue grew to 737 million from 545 million. Earnings per share decreased 26 percent to 12.8 pence for the half. The dividend was hiked by 20 percent to 3.2 pence.

The breakdown of revenues are as follows: Hirslanden (Switzerland) contributes 47.7 percent, Southern Africans responsible for 28.3 percent and the bigger and newest business, the Middle East accounts for 23.8 percent of group revenue. Of course there is still the just shy of 30 percent stake in the UK listed hospitals business, Spire. In terms of underlying EBIDTA contributions, Switzerland stands head and shoulders above them all, as you would imagine, being a 51.8 percent contributor and saw good growth (currency translations - yes) of 18 percent. The South African business contributed 34 percent to EBIDTA and the Middle East business was the balance, 15.45 percent.

The Middle East operations were the problem in these numbers, it wasn't "unknown", the trading update was pretty clear that there were issues. The Middle Eastern countries reliant on oil exports for revenues have seen giant holes in budgets. This has impacted many businesses in the region. The Health Authorities in Abu Dhabi announced in June (effective 1 July) that Emiratis and expats using the Thiqa plan would now be responsible for co-payment of 80 percent at private institutions. At public institutions, 100 percent still.

Thiqa in Arabic means trust, the scheme itself is relatively new (established by the Crown Prince of Abu Dhabi in 2007), and offers health insurance for all the Emiratis and "those of similar status", I presume that means expats with high skills and long dated work permits. Daman, which is the The National Health Insurance Company, manages this on behalf of the Abu Dhabi government. There are around 1.4 million Emiratis in the UAE, the rest of the significant population (around 6 million in the UAE) is made up of expat workers.

So, the funding of the services is under scrutiny, the recent budget saw a cut of just over one percent in that region, the UAE. The government depends on half of their revenue collection on oil exports, with the prices having been very volatile, the good times are over for the time being. Sovereign Wealth funds often plug the gaps during periods of stress, like this, and infrastructure plans no doubt will be curtailed. So there are general stresses in the area in terms of the ability to a) afford private healthcare and b) fund the 20 percent co-payment out of your own pocket. So you can see why this has impacted on the business of Mediclinic. Added to the rise in co-payments, there have been Doctor vacancies and integration issues, as well as delayed opening of various facilities. All around, more than a few problems in the Middle East.

Not only has it been tough going in the Middle East, here in Southern Africa underlying earnings decreased by 5 percent. Financing costs increased. The group still plans to invest heavily in their network, 285 million Pounds in the coming financial year, most of which (44 percent) will be in Switzerland. 29 percent here in Southern Africa and then the balance, 27 percent in the Middle East. So the company will continue to forge ahead in a tough operating environment. With regards to the share price, the double whammy of the weak environment has been exacerbated by a weak Pound. In part that means earnings from their foreign operations should be higher, it does mean that in their secondary listing (here in Johannesburg), the share price has weighed heavy.

We like the theme a lot, and whilst growth seems to have disappeared for the time being, this is a great opportunity to acquire the same business at a much cheaper price. We are long term very confident that they will work through the issues that they will face both at a regulatory level (everywhere for healthcare) and with regards to offering the same quality care on a relative basis. If you think that private healthcare is facing headwinds as a result of consumers being under pressure, can you imagine what governments are facing?

Healthcare and in particular hospital stays are very emotive issues, when you throw in cost, it becomes a bigger issue. Cost. And people do not skimp there. We maintain our buy recommendation, the stock is trading at a 52 week low and thus far we have been very wrong, the business is superb and the big shareholder (Remgro) may well be in a position to further the expansion, if the right acquisition arises. I suspect there won't be any of that for a while, they will continue to integrate the Middle East business and watch the regulatory changes both here in South Africa, and Switzerland.

Alibaba's 3Q numbers for the quarter ending on the 30 September. The Chinese internet company showed strong top line and bottom line growth.

Onto the numbers, revenue surged 55% (YoY) to $5.14 billion with strong growth coming from their smaller divisions. The media and entertainment division saw revenue up 302% to $541 million and the cloud computing division surged 130% to $224 million. The meat of the business, online retail was up 41% to $4.3 billion.

All the smaller divisions are still loss making as they spend money to grow their customer base as quickly as possible. The cloud computing division lost $58 million and the media and entertainment division lost around $330 million. The media and entertainment division is their Youku Tudou asset which they purchased last year for $4.4 billion dollars. Youku Tudou is the leading Chinese television internet company, picture Netflix meets Youtube. The loss in the division is due to investment in content creation.

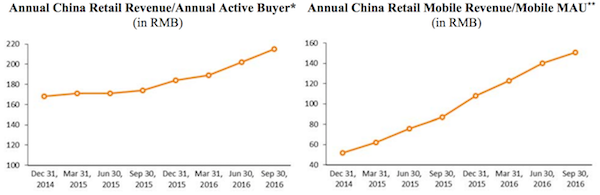

The core of the business is still the ecommerce platforms, where they had user growth of 30% YoY of mobile MAU to 450 million people and annual active buyer growth of 14% YoY to 439 million people. Coupled with the strong user growth there has been good growth in average spending per user.

Their International commerce retail business grew by 178% to a relatively small $201 million in revenue. This is an area where there is huge growth potential, especially as they establish international logistics channels. For now though they are focusing on the Chinese home market which is still relatively young.

Currently the stock trades on a P/E of around 48 times, so not cheap. Going forward the analyst community is expecting big things, with a forward P/E of 23. Our preferred stock in the ecommerce space has been Amazon.com given their main operations being in the US and having a much simpler organisation structure. The e-commerce space is a sector that must form part of your portfolio.

Linkfest, lap it up

Bringing down travel times, will help spur more economic growth - The audacious plan to bring back supersonic flight - and change air travel forever. The challenge is to keep costs down, noise down and emissions down.

Have you ever wondered how a particular wine can cost a whole lot more, relative to the taste? Wine farming is a lifestyle, not a business, or have I got that completely wrong. This line cracks me up: "In the experiment, subjects said they preferred what was presented as a $90 wine over that presented as a $10 wine, even when what the researchers poured them was actually from the exact same bottle." Read the whole article - What Wine Snobs Get Wrong.

The Indian PM is taking some large notes out of circulation, gone are 500 and 1000 Rupee notes. To put that into perspective, 1000 Rupees is 14.92 Dollars. Why? Loads of fake notes used for illegal activities, it was cited by the government. Poor planning in a massive country meant this has happened - ATMs go dry soon after opening; queues continue at banks.

It is Armistice Day, the end of World War One was signed into effect on this day at 11am in a railway carriage 98 years ago. There are a whole lot of 11's there. It is also singles day in China today, Alibaba (see above) benefits hugely from sales today, Chinese consumers may spend as much as 20 billion Dollars today, the biggest spending splurge by any segment of humanity. For some Friday fun, Google Facts Twitter account tweeted the following:

Home again, home again, jiggety-jog. Woolworths have released a very muted trading updated that if you strip out inflation, looks poor, the price is down sharply at the start. Not good at all, a warmer than anticipated winter (the same for all retailers I guess) means short term pain here.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment