"I feel that the company is in a space that will continue to see massive growth. GDP percentage spend in healthcare in the US is expected to continue the upward trajectory. They have many more territories in which to operate and are one of the real quality operators globally. Non-U.S. revenue represents only 11 percent of Cerner total revenue. The bookings and backlogs are huge,"

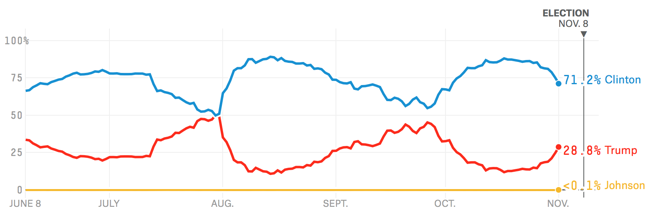

To market to market to buy a fat pig With the possibility of a Trump victory in the US elections closer than last week thanks to the new FBI email investigation against the other more desirable candidate, Mr. Market shuddered and really didn't like what they saw. How is this possible? Well, those are polls. For what it is worth, in the prediction markets, Clinton still holds a very strong chance, far stronger than Trump, check it out (thanks Paul for the link): Who will win the presidency? As of this morning, Trump's chances of winning, according to this measure is only 28.8 percent. Which is actually higher than Lloyd Christmas ever marrying Mary Samsonite. I wonder about polls, I suspect that everyone feels a little burnt post Brexit and the polls, elections in the UK too. Here goes, the chances thing from FiveThirtyEight:

The story overnight on Wall Street is that with the race tightening and the predictions market itself seeing a closer battle (this hardly seems close, does it?), safe haven assets are catching a bid over traditionally riskier assets. i.e. Japanese Yen, US Treasuries and the Dollar are in, equities I am afraid you are the weakest link. And the Mexican Peso, which has also been some sort of barometer for the US election is at a two month low. This morning Asian markets find themselves at a 7 week low. Never-mind earnings sports lovers, never-mind that the World Series Baseball is tied at three games apiece, never-mind that "City" (the blue team from Manchester) managed to pull one over Barca last evening, never-mind that OPEC may not be able to pull off a supply agreement, stocks are all about the US elections right now. We just have to live with it.

Session end, the Dow Jones Industrial closed 0.58 percent lower, the worst levels since mid September (that is not such a long time ago), the broader market S&P 500 lost 0.68 percent, and the nerds of NASDAQ just a smidgen more than that. Energy was the only major sector that ended in the green, with Chevron and Royal Dutch Shell (up nearly 5 percent) being winners there. Apple and Pfizer were noticeable losers, the maker of wonderful devices (that is Apple) is seeing heat from the investor community in China and also may be dropping the price of Apple Music. I guess to attract more and more people. I use Apple Music exclusively and think that the product is amazing. Pfizer, that stock was lower after after their results, the market may see a nearly four percent yield, the growth, well, that appears to be missing for the time being.

Back home, where the heat is still being turned up on the weather front and in the courts (all rather complicated) stocks produced a winning day. Resources post the Chinese PMI number were the drivers on the day, it was still a pretty broad based rally. AngloGold and Amplats were monster winners on the session, Shoprite and Woolworths were at the other end of that stick! Most of the moves on the day were higher, winners outpaced the losers 2 to 1, more or less. Jeepers, in all the years of writing this, that may well be the first time that I have ever said that. Repeat, this is not a market blog. A small factoid, did you know that the market capitalization of Steinhoff is nearly double that of Old Mutual? Bet you didn't! The market cap of Standard Bank is also double that of Nedbank, did you know that? And to think that the two entities could be one, if it wasn't for the pesky regulators. Ha-ha! And Aspen is half the size of Anglo American, in market cap. So there you have it.

Company corner

Cerner, the IT healthcare services company, reported numbers and issued guidance for the coming quarter. For shareholders who are not looking to add to their positions, I am afraid the guidance and the numbers themselves fell short of expectations. Obviously the market was looking for more, the stock was down around 6 percent post the market close, i.e. in the aftermarket. What does this business do exactly? This is a business that uses current technology to make healthcare systems easier to use.

Eliminating paper and human error, making the entire ecosystem digital from the time you enter the ambulance to the time you are discharged, Cerner can be part of the process. For the better. The company offers solutions to all size healthcare providers to make lives easier for all concerned. Safety of patients, being able to serve those same said patients with high quality care and eliminating wasteful expenditure along the way, making the business more profitable (and by extension more resources elsewhere) means that everyone gets what they are looking for.

The company manufactures software that reduces human error, essentially. By working together with the healthcare staff and administration, they eliminate incorrect procedures and help the healthcare professionals keep a clean sheet means less litigation (yes, true story) and most importantly, the best outcome for the patient and their loved ones. And by using the internet (the cloud) the resources are able to be best utilized at the healthcare facility. i.e. if patient X needs Y and pronto, the pharmacy is already issuing the prescription that the doctor ordered, and the delivery would happen soonest. And therapy X would be facilitated and hey presto, all parties would save time and be kept notified of the progress of the patient. Neat, hey? Think sharing of clinical trials too.

The company is innovative, is licensed in around 25 facilities across the globe, in 30 countries. As per the annual report, they do business in "hospitals, physician practices, laboratories, ambulatory centers, behavioral health centers, cardiac facilities, radiology clinics, surgery centers, extended care facilities, retail pharmacies, and employer sites."

Their strength also lies in their ability to crunch the data being generated. In the 2015 Annual report the chief, Neal Patterson said: "In 2012, digital health care generated an estimated 500 petabytes of data worldwide. By 2020, that number is expected to grow to 25,000 petabytes. The only missing ingredient, then, has been a systematic way to analyze the data and make it actionable in providers' workflows. Fortunately, as we saw this situation developing in the early part of this decade, we knew a good health IT systems company that could take care of the problem."

And then in his closing segment of the CEO's letter in the 2015 annual report, Patterson continues, pointing to the whole prevention is better than cure theme that is currently taking hold: "The next era in health care is a shift toward prediction and prevention, personalized engagement and new types of interactions that are both continuous and contextual. Because Cerner invests in the future, we continue to arrive at the right place and time with systems that address real needs in health care."

Onto results for the third quarter of the previous financial year. Revenues were lower on the comparable period, a tough comp as the previous year had grown by 44 percent, 10 percent lower than the comparable at 1.434 billion Dollars, and unfortunately this was below guidance. Revenue guidance for the next quarter is 1.225 to 1.3 billion Dollars, also below what Mr. Market was looking for. Adjusted diluted earnings per share clocked 59 cents, below Mr. Market consensus of 60 cents. Guidance for the next quarter was 60 to 62 cents worth of earnings, also below the market consensus.

That is exactly why the stock was "downgraded" by Mr. Market, down 6 percent as we said earlier. The early guidance for 2017 looks OK to me, revenues for next year at the midpoint (between top and bottom) expected to be 11 percent better than revenues for this year and adjusted diluted earnings per share to be in the region of 2.50 to 2.70 Dollars. That means that at the indicated opening share price, the stock should trade forward on 20.9 times. I guess with revenue growth lower than before, the market has adjusted away from growth to a more "manageable" multiple.

I feel that the company is in a space that will continue to see massive growth. GDP percentage spend in healthcare in the US is expected to continue the upward trajectory. They have many more territories in which to operate and are one of the real quality operators globally. Non-U.S. revenue represents only 11 percent of Cerner total revenue. The bookings and backlogs are huge, the company has an enormous amount of work to do and could surprise always to the upside, this time around they disappointed their own high standards. We continue to hold the stock of what is a fine business, and ride out the current weakness.

Linkfest, lap it up

As sales of sugary drinks fall, product developers are coming up with new variants to try keep customers and lure old ones back - Coke Ginger designed to tempt health-conscious Australians with new infusion. Does ginger flavored coke sound more healthy to you? Would you drink it?

The key market that Amazon wants to break into is the grocery business. It is a huge part of peoples monthly budgets and it is a regular spend, unlike buying books or TVs - Affordable, Quick Delivery Is Key for Online Grocery Sales. The key to this market is speed of delivery which is where all the billions spent on distribution centers will come to the fore.

Is this competition at its finest?. New products normally come to market at a premium because of little competition. Then as the competition rises the price falls until the product becomes a commodity and sells for little more than the production cost - Your brilliant Kickstarter idea could be on sale in China before you've even finished funding it.

Home again, home again, jiggety-jog. Disaster struck this week, in the form of the opening hour of JSE trade being in a vacuum. In other words, daylight savings in the modern world means that we "lose" a hour of trade as JSE volumes are down due to clocks in Europe and the UK being turned back an hour. A reduction of energy usage was supposed to be the main reason, plus also encouraging late night summers and athletic participation. Surely in the modern world, with heating and cooling and flexi-hours, it makes more sense to keep your time?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment