"You may really (really) not like the man. You may really think that he is a bag of wind. You may think that the electorate have lost their marbles. There are many reasons for the vote having gone in the direction that it has, a segment (pretty big one) feeling left out. And that is the American way, ebbs and flows in thinking at the fringes, those are the people who decide the direction, not necessarily the core who are committed forever. And if the establishment needs a bit of a shakeup, perhaps a man with an attitude and a self belief may unblock the drains of DC."

To market to market to buy a fat pig Call it the Trump bump. Markets were first trumped and then turned around sharply as the spot market opened in the US. As for the predictor industry and the polling folks, well, a YUGE (the Trump huge) WRONG. And for believing them, wrong to me too. And regardless of what I think about the fellow, there is absolutely nothing that any of us can do to change the outcome. You cannot change politics, interest rates. In fact, equity markets are a place where you have little control most of the time. Weighing machine in the long run, voting machine in the short run.

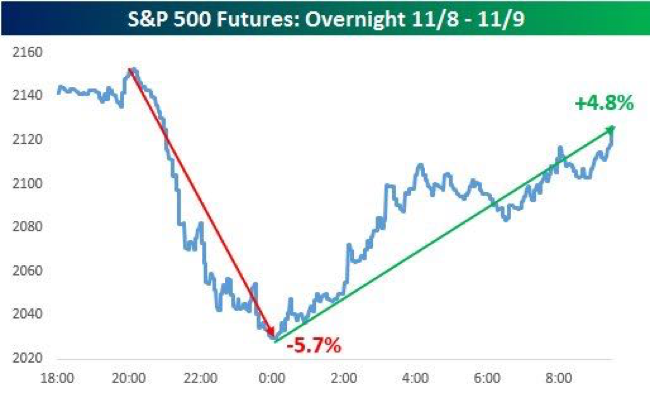

See this pretty violent u-turn of the US futures below, the announcement that Trump was "in" sent the index into a tailspin. Courtesy of the inter-webs. The reconciliatory speech and a commitment to building (YUGE) infrastructure and being pro business started seeing a market recovery. And then in the spot market, stocks ended the day far higher. It was YUGE. If you took a position one way or another in anticipation of something, well, then you were fired.

By the time the spot market finished trading, stocks were up sharply. Both the nerds of NASDAQ and the broader market S&P 500 ended at a variation of Nelson, up 1.11 percent apiece. The Dow Industrial Average ended the session 1.4 percent better. And whilst half of the people were weeping, one of the best traders around told us that he bet 1 billion bucks (real ones) going long the market. See this Bloomberg piece - Icahn Left Trump Victory Party to Bet $1 Billion on Stocks.

Again, whether we like the fellow as a person, the speech promised (in the usual style) YUGE things with lots of amazing people, of which of course there are many, and it is going to be amazing. I wonder, if like Dr. Seuss, Trump could pen a speech of his own, would he be able to only use 100 words, including the usual superlatives? That speech set the tone for the rest of the day. Sectors that rallied sharply were financials and healthcare, as well as industrial stocks that expect an uptick in infrastructure spend.

Cramer in his Mad Money daily made some good points about these stock groupings - Cramer explains the puzzling Trump rally in plain English. Firstly ..... healthcare. In Pharma specifically ok, there were some shorts built into the market and negative sentiment on the basis that the House and the White House there would pushback drug prices, currently.

Now, with a Republican controlled everything, repatriation of overseas funds in a potential tax holiday, or an overhaul of the tax code may lead to more deal related activity for big pharma. And also, less regulation equals more ability to be flexible. So, stocks in that sector were up sharply. Amongst the majors we saw JNJ up 2.79 percent, Pfizer up 7.07, Merck up 6.07 percent and Amgen up 5.76 percent. The list pretty much goes on, and healthcare stocks have now been on a tear since the beginning of the week. Pharma specifically is having a bad year, as a collective in the share price department, the recent moves are YUGELY encouraging.

What about financials and banks? Cramer explains that YUGE infrastructure spend = more borrowing, something that the Donald has never been afraid of. Of course you have to convince both the House and the Senate, with a Republican control (did we mention everything) and backing, the infrastructure rebuild would be a go ahead. And a decent enough plan would mean a slight tick up in borrowing costs, longer dated of course. And that is good for the banks and financials. JP Morgan jumped 4.6 percent, Wells Fargo added 5.38 percent on the day. Bank of America was up 5.71 percent, Citi posted a 3.37 percent gain. And of course, lest we forget, a Republican controlled everything means less regulation for financials and banks.

You may really (really) not like the man. You may really think that he is a bag of wind. You may think that the electorate have lost their marbles. There are many reasons for the vote having gone in the direction that it has, a segment (pretty big one) feeling left out. And that is the American way, ebbs and flows in thinking at the fringes, those are the people who decide the direction, not necessarily the core who are committed forever. And if the establishment needs a bit of a shakeup, perhaps a man with an attitude and a self belief may unblock the drains of DC.

We will see, I am all guessing that as equity holders of businesses, we can get our own back. Everything about the fellow may induce all sorts of (negative) reactions, if he is good for galvanising politics and if he is good for business, that creates good long term tangible results. And equity returns, long term equity returns ought to be positive. Let us not give him too much credit, either way it may have induced a "thank god it is over" rally. It is what it is.

Locally stocks ended a volatile session just over half a percent to the good. The Rand was all over the map, and in the end closed about flat. Resources soared (infrastructure spend), industrials sagged a little. There were several of the majors that sank to 12 month lows, including Steinhoff, British American Tobacco, Capital & Counties, as well as Woolies and Old Mutual. Many recovered from their worst levels, busting higher later in the session. AB InBev also registered a new 12 month (and I guess all time) low. From the time it became apparent that Trump may win, to the time that it became apparent that he will win, the Rand went from 13.18 to the US Dollar to 13.80, inside of 6 hours of trade. This morning we are back at 13.46, for a reference point. Glencore, Anglo and BHP Billiton rallied to 12 month highs. Equally Nedbank.

So, the same applies here, if you sold as a result of being spooked, you were wrong. I had several calls with a number of committed investors yesterday, we all agreed to do very little. In other words, we decided that doing anything, selling, was a costly exercise and doing nothing was the best thing to do. Often the collective at the fringes, what Cramer referred to futures Pyjama crowd, do crazy and wild things. Do not be the crazy Jack Russel that chases their tail.

Linkfest, lap it up

Work and life balance is something that has been getting more attention. Companies want to get the most out of their employees, research is showing that being over worked means that employers get unproductive workers, which is worse than having a healthy leave policy - The average American worker takes less vacation time than a medieval peasant

Apple may make the bulk of the profits in the smartphone industry, they do not sell the most phones though - The Smartphone Market Is Not a Two-Horse Race

You will find more statistics at Statista

Given how fast paced life is for most people, we often miss the bigger picture and how far society has come over the last 100 - 150 years. Which sounds like a long time but when you think that most people today will live around 90 years, it doesn't look that long anymore - Some Things That Haven't Been Around Very Long

Home again, home again, jiggety-jog. Back to the earnings grind here, Disney tonight and everyone is watching the ESPN numbers closely (how many subscribers will they lose), politics is over for the most part. That storm yesterday in Jozi and the surrounds was pretty wicked. Lives lost, pretty darn hectic. Cars lost, insurance claims, that sort of thing, and of course damage to precious infrastructure. Anglo American Platinum suggests that earnings will likely be at least 20 percent higher than the last full financial year, remembering that we are a full two months out from their year end. Recovering nicely off a low base, that ought to lend a helping hand. Results themselves? Next year February. That is right sports lovers, we are so close to the end of the year. Today, 11 November, is day 315 of the current year. 51 days to the end of the year!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment