"We have interim numbers out of Brait on Wednesday. These numbers were probably more highly anticipated than usual thanks to the fall out from Brexit and Brait having major assets in the UK. Given that Brait is an investment company, the figure that people want to see is the NAV number that management feel is a fair representation of the value of their assets. "

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig Stocks and all the major indices across the seas and far away closed better on the day, the Dow Jones up nearly one-fifth of a percent, the nerds of NASDAQ added three-quarters of a percent, technology stocks that were hurt last week and earlier this week are getting it back, whilst the broader market S&P 500 nearly managed to squeak out a half a percent gain. Would you believe that the broader market is reaching for the all time high, a mere one-quarter of a percent away now. And as good old Eddy Elfenbein said in his weekly letter, most major investment houses suggested that a Trump victory would strike disaster into the markets, volatility abound. That was all true for the first 18 hours and then ..... WRONG. Since the acceptance speech, there have been a few incidents, on the whole the new presidency is looking to be .... errrrr ..... more presidential?

Trump has met the old president and it seemed a little frosty (they had said some mean things about each other), Trump has met Shinzo Abe (they both have great hair) and Nigel Farage (not sure what, other than bigotry that they have in common). And markets have in the most part rallied. Bonds have sold off, that has possibly been the one thing that has kept us all guessing. Although, as I am reminded often enough, bond gals and guys shouldn't talk stocks, stocks guys and gals shouldn't talk fixed income. Unless of course you invest in both and need the steady income.

Quick check on the action from the street. There were results the night prior from Cisco that looked OK, the outlook looked cloudy. Funny that, in a world that is about the cloud, increasingly so. Walmart delivered quarterly revenues of 118 billion Dollars, that is nearly 1.3 billion Dollars a day, the outlook was also cloudy and "not as good as the market expected". Listen in and lean in (like Sheryl Sandberg does, anyone read that book, recommended?), a weeks worth of sales at Walmart is almost equivalent to the entire economic output from Madagascar in a single year. A fortnight worth of sales, the size of Afghanistan annual GDP. A month? The DRC.

The size of this company (Walmart) is just mind boggling, whether they will reach one trillion Dollars worth of sales first, or the fast growing Amazon will get there remains to be seen. Amazon is still around 1 quarter of Walmart in terms of sales, so there is a lot of very heavy lifting on that businesses part before they come even close. The market thinks that is likely to happen, Amazon (with loads of different businesses) has a market cap of 373 billion Dollars, Walmart has a market cap of 216 billion Dollars.

The other "big news" that isn't that big in market cap, and may change the world at some stage, is that both the shareholders of Tesla and Solarcity (sans Musk) approved the deal. Solarcity shareholders will receive 0.110 Tesla shares for each Solarcity one that they own. Timelines? Well, here goes - Tesla's Acquisition of SolarCity Receives Shareholder Approval: "With SolarCity's shareholders also having approved the acquisition, the transaction will be completed in the coming days. We would like to thank our shareholders for continuing to support our vision for the future. We look forward to showing the world what Tesla and SolarCity can achieve together." Done.

And then the most powerful woman in the world was at it again last evening. Not Ellen, not Oprah and not Michelle Obama. Or Angela Merkel. Nope, it is Janet Yellen. The Fed chair confirmed that she would stay on to the end of her term, she wouldn't be stepping down any time soon. She was being asked questions by a joint Congressional committee about the state of the US economy. That is right, you want to know what the little guy on the street thinks, ask the Fed chair. She knows

Back where the sun shines and there is not enough solar to go around yet somehow we must build nuclear power stations, markets had a ripping day. On or off the grid argument I guess, in a country where the economic policy must have the awesomeness of the guiding hand of the state/government, that is another argument all together. Can the state do better? The answer is probably always no, humans in their personal capacity always do better. Perhaps the answer is for us to always view ourselves as individuals who work as such (for ourselves) and enter into contracts with the organisations and companies in that way. View yourself as a tool supplying valuable services to the business. Rather than working for a company, work with a company. That may shake things up a little. The All Share rallied 1.23 percent by the close, back comfortably above 50 thousand points. Resource stocks were the leaders, up over one and three-quarters of a percent. Good work chaps.

Company corner

We have interim numbers out of Brait on Wednesday. These numbers were probably more highly anticipated than usual thanks to the fall out from Brexit and Brait having major assets in the UK. Given that Brait is an investment company, the figure that people want to see is the NAV number that management feel is a fair representation of the value of their assets.

At the close of the period the NAV number came in at R105.06, which is down 23% from the R136.27 NAV number reported for their full year numbers ending in March. A big part of the drop in value is due to the weaker Pound, going from R21.21 (exchange rate at full year reporting) to R17.82 (exchange rate at current 6 month numbers) coupled with a lower earnings multiple being given to the New Look asset by management. Here is a quick overview of the underlying businesses.

New Look is 30 % of NAV, which has the bulk of its business in the UK. Like for like sales in the UK were down 8.8% (ouch), compared to international sales being up 16.5% and 3rd party online sales up 21.5%. For the current period 17 new stores were opened in China and for the next 6 months another 40 stores are planned to be opened. Good news for the group is that UK retail sales out yesterday were much higher than expectations, up 7.6% YoY, hopefully some of that strength filters down to New Look sales.

Their asset that we are probably most familiar with here in RSA, is Virgin Active which contribute 26% to the NAV. The asset looks strong with Revenue up 6%, EBITDA up 12% but probably more important, EBITDA margins expanding 1 percentage point to 21.2%. Over the next 6 months, they plan to add 8 clubs globally, 6 in South Africa, 1 in Thailand and 1 in Singapore.

The Premier Foods asset had good EBITDA growth of 36% YoY for the period and contributes 22% to the NAV. Iceland Food which is 12% of NAV had a slight drop in like for like sales over the year but are investing heavily in e-tail, which should pay dividends in the future.

Remember that Brait are also in the process of moving their residency to the UK and will then list on the LSE probably in the first half of next year. Given that and their asset locations, what happens to the Pound (and UK in general) is going to have a large bearing on the share price performance. The risk in Brait lies in their rather large high yield debt sitting in each of their underlying businesses. With high leverage, when things are going well they go very well, but when there is a large interest bill due periodically a miss-step can lead to profits being wiped out very quickly.

You can't bet against the Brait management team and Christo Wiese in the background. All their assets have entrenched market shares in their respective markets and New Looks expansion into China looks to be going well. All in all, the share price is going to be thrown around by the Pound in the short term but over the longer term the group will become more international and the value of their underlying assets should grow.

Linkfest, lap it up

The numbers for last weeks singles day are rather staggering - Singles' Day Sales Scorecard: A Day In China Now Bigger Than A Year In Brazil. The amazing thing about those sales is that 82% were placed using a mobile site, something that the rest of the world is still playing catch up on.

Behavioural economics, do you like that subset of economics? I do, it is pretty much my favourite. As this article asks - Does Prospect Theory explain Trump and Brexit votes? "The slogans "Make America great again" and "Take back control" clearly refer to the lost grandeur of the past. This sets the reference point as a lost state that was much better than the current one."

Thanks Byron for this link! Remember the show Friends? That is so old that the jeans all look bad. Ross (my least favourite) and Joey (my favourite) and the rest of the gang. They still get 20 million bucks each a year. Why? They still earn 2 percent per annum each as a results of 1 billion Dollars of syndication revenue. Which is why ..... Amazon and Netflix are paying so much to lock down the world's best talent

Whoa! This is bound to shake things up a little in our office, we love running around here. Running is the Worst Way to Get Fit. Hmmmmm .... more gym work for the boys?

And then another one that is bound to not make you that happy. Or happy. Depending on whether you believe this or not - If You Want to Be Happy, Quit Facebook?

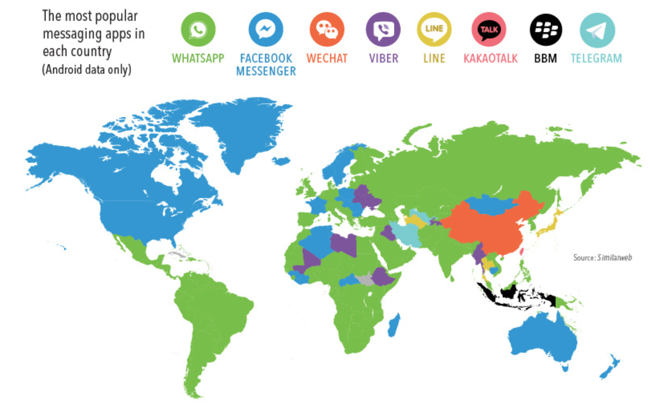

Staying with Facebook, and who uses what app where around the world, Paul drew us to the attention of this infographic - The Evolution of Instant Messaging. From an MIT time sharing system in 1961 to present day. So who uses what, the biggest in each country, great map?

Home again, home again, jiggety-jog. Stocks across Asia are mixed. Shanghai is down, Hong Kong is up (Tencent is up a smidgen) and Japanese stocks are up over half a percent. US futures are flat, it has been a pretty spectacular two weeks in terms of the pricing action. Dischem list today. Retail clients got zero shares. I will visit the Dischem and see whether or not the staff or the people who shop in the stores care as much as South African Twitter finance suggests.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment