"There are lots of moving parts in these numbers, as there always are with Naspers. In order to keep abreast with an ever changing world, the company has to be constantly on the lookout for the next big trend in consumer entertainment, that is what they are, an entertainment and internet services business."

To market to market to buy a fat pig OK, so Fitch released their "rating" on South Africa. As we said, this is a rating on the credit worthiness and the ability to pay back the money over time. These are independent agencies advising bond buyers on whether or not they think that South Africa can, or can't afford over time to pay their creditors. If I bought a 10 year government debt instrument today, would they be able to return all my capital when the instrument matured and would they be able to pay me all the interest? It is as simple as that. If the rating sinks to non-investment grade, as per the actual definition, then this becomes the reality. So yes, it matters. There will of course always be investors that look for higher yields and are willing to take on the relative risks associated with your debt. As such, that is why in personal capacities that some financial institutions may give you the credit, others may not.

At the end of the session the Rand had weakened. Some of the Rand hedges caught a bid, the index closed the session up one quarter of a percent. Perhaps the positive Naspers lifted the broader market. Steinhoff and AB InBev also had a good day. On the losing front were the commodity stocks, the single commodity stocks like Amplats, AngloGold Ashanti and Sasol. Today the Rand has caught a bid, more to the point, the Dollar's momentum has been stopped in its tracks.

Over the hills and far away in New York, New York, in a shortened session that was influenced by pumpkin and turkey and ended early, stocks rose to records again. The Dow Jones added just over one-third of a percent, the broader market S&P 500 added nearly four-tenths and lastly the nerds of NASDAQ tacked on just a whisker over one-third of a percent. Energy stocks sank half a percent. There is the small matter of a meeting of the oil producers in order to test production levels. My view on this is simple, let the market take care of the market, your collusion will not address the price in the long run. In fact, if you keep an elevated price, the alternatives will be more widely adopted, that will be the consumer and the free market response.

Political ideologies are best kept to politicians and economists, yet it is the people that suffer from the missteps that do not work in practice. If I tell you that in a perfect world we should all be equally rich and enjoy the same things as one another, access to quality healthcare and education, you would think that is a very noble idea. And it is, in theory. What it does do however is ignore the human element, we are selfish and motivated to do the best by our family and friends. In other words, whilst again it is noble to think that we are born all equal, this is not the case with our genetic makeup. Some are physically stronger, some are mentally superior. Some are quicker on a track, some are quicker at math. If we were all born the same, with the same prospects, then in theory the idea of all being equal would of course work. Except this is not the case.

Capitalism is not the best idea we have, it excludes many people as they may not have the necessary skills to participate in a certain kind of democratic dog eat dog world. Not everyone thinks that capitalism is fair, and I certainly get it. You can be born into privilege and continue to live a superior life to someone that is born into poverty. However, given the same skills, the playing fields are equal and the cycles (both of them) can change. There is actually a saying in China, Japan and of course the US that uses different variations of the following. Here goes, which country is which?

"Rice paddies to rice paddies in three generations.

Wealth never survives three generations.

Shirtsleeves to shirtsleeves in three generations."

The last one in the US, the top one in Japan and the middle is China. What are these saying about and what is the meaning of these? Well, grand-dad/grand-mom works hard to build their own personal empire, sons and daughters work less hard with more resources and then the third generation squanders it all, as life is too easy. Abundance is everywhere. And this is capitalism, it rewards those further down the line from the point of wealth creation, generational wealth. They can choose to do with it what they want. Often first generation folks give away a lot of money, think of the giving pledge. There are a whole host of people on that list that you recognise. Yet .... there are no dictators, or communists ....

Which brings me to my point. This weekend marked the passing of Fidel Castro, a man that depending on which side of the aisle you sat, elicited a different reaction. A freedom fighter and revolutionary for one can be seen as an oppressor and greedy to others. For instance, Canadian Prime minister's tribute to Castro has "raised eyebrows" (Trudeau faces backlash after Castro tribute) and equally, so has Trump's statement, he called Castro a "brutal dictator who oppressed his own people for nearly six decades". Herewith an interesting Washington Post story - In wake of Castro's death, his legacy is debated.

I was expecting something like this from Mark Perry, a man who champions individuals and the best of capitalism, who noted this post from the Washington Post too - 13 facts that should be etched on Castro's tombstone and highlighted in every obituary. Makes you think, doesn't it? If you have to force people to comply by the barrel of a gun, then I am afraid that perhaps your methods need a re-work.

In almost all these instances, my rule of thumb is what would ordinary people do when faced with these choices? To live under the oppression or to find something else? All you need to do in this case is to look for which direction the unlawful migration was heading (which way is the boat going, which wall are the people jumping, which fence are they climbing under?), were people facing death while trying to get to freedom away from that place, or towards that place. That would answer your question, I think, about what individuals thought about the person and the place that they used to live.

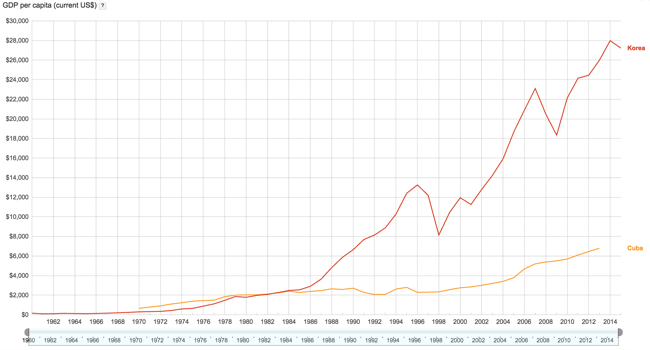

In closing, here is a graph of Socialism versus Capitalism, the economic prowess of South Korea versus Cuba over a 50 year period - GDP per capita (current US$). You be the judge as to whether the people "did better" or not.

Company corner

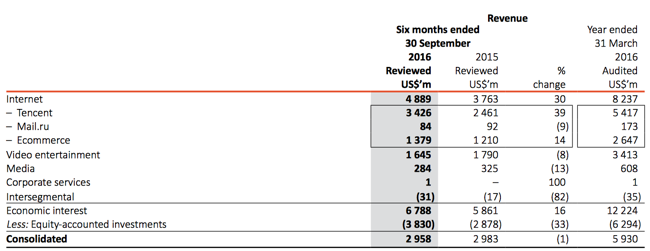

Naspers delivered results on Friday afternoon. First thing to remember is that back in April the company changed their reporting currency to Dollars, for the purposes of standardising across multiple geographies. As they point out in these results, revenues derived outside of the borders of our country represent 80 percent of total revenues, so it makes sense to report in US Dollars and not Rands anymore. This is a sign of the business continuing to mature and attract more customers across the globe, as we often say, you cannot carry your hopes on only 50 odd million customers, you need to attract all of them, all across the globe! As the release points out, costs for their ecommerce business are incurred in the local currency, as such the currency movements are "diffused", whereas in the video entertainment segment (TV and streaming) you earn local currencies, your costs are in Dollars. i.e. your subscribers are buying content in local currencies, you are paying Dollars for said content.

There are lots of moving parts in these numbers, as there always are with Naspers. In order to keep abreast with an ever changing world, the company has to be constantly on the lookout for the next big trend in consumer entertainment, that is what they are, an entertainment and internet services business. When one says internet business, immediately the normal reaction is one of confusion amongst investors. Yet many of Naspers' websites are simply service related tools in order to buy used goods, classifieds in order to get that product or simply to book that trip or obtain pricing comparisons. All they are, their various global websites, are enablers of the same thing we know (payments portals) for the same thing. They just take place on the internet, which is another method of doing the same things. I think that some people just miss this.

As the group states on their website: "We believe in the power of local backed by global scale and we look for opportunities to address big societal needs in markets where we see the greatest growth potential." Sounds pretty simple, right? OK, moving swiftly along ...... Herewith the interim results release to September 2016. On a segmented basis, herewith a table from the results:

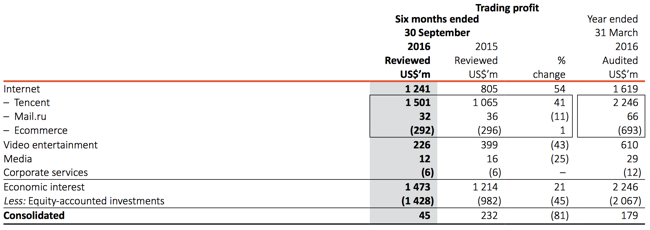

And then of course, you can have all the revenues in the world, you need to be profitable, herewith trading profits from the group:

It is fair then to say that the group is undergoing another metamorphosis. Entertainment and video (i.e. streaming) is taking up some serious monies, high spend in order to get the content that the customer needs and wants. The evolution of TV is going to be huge, and is ongoing.

So what do you get when you buy and own this business? You get insightful management who are in tune with global entertainment and global ecommerce trends. They will sell and buy assets that they perceive to be in segments that either are ex-growth or pre-growth. Ecommerce looks like a great business, operating in many non-english speaking countries as the dominant player. Interesting that the group points out that Flipkart in India is experiencing strong competition from Amazon, that is to be expected. That fellow Bezos says that he sees India as a huge opportunity. I suspect that all of the majors in India, provided that they have a fairly dominant market position, will do well. Flipkart and Amazon will both be "ok".

The prospects outlook is as follows: "In the second half of the financial year we hope to deliver revenue growth and scale to the more established ecommerce businesses. The group will continue to invest in long-term opportunities such as letgo, and seek further promising models within the internet segment. We expect to accelerate letgo's development spend to further strengthen its position in the US classifieds market. In African video entertainment, a tough environment at present, we aim to grow DTH customers by offering increased value and reducing costs to counter the impact of falling currencies. Earnings and cash flows in this segment will continue to be constrained in the foreseeable future."

In short, expect more of the same. Do not expect huge dividends from excessive cashflows. Expect the group to invest heavily in what they perceive the future to be. Expect them to sell some businesses that you may well like as an investment, expect them to buy businesses that have good growth prospects and look at face value as unprofitable (for now). Expect volatility. That said, we continue to recommend the company, and we expect the continued strong growth in revenues to translate to higher profitability. The sum of the parts valuation is important here. In our view, Naspers is undervalued and should be bought on weakness, that currently exists.

Linkfest, lap it up

Like anything that you read on the internet you should take some time to think about the validity of what is being said. The same goes for financial journalism; "does the journalist understand what they are writing?", "what time frames are being referred to in the article?" and "are the points being raised valid or just there to sell stories?" - NIRP. . .I Was Promised Negative Interest Rates from Main Stream Media and All I Got was Trump.

India scrapping their 2 biggest bank notes has meant that digital payment platforms user numbers are spiking - "A 7,000% increase" and other WTF numbers thrown up by digital payment firms post-demonetisation. A large number of people in India don't have bank accounts, so having access to digital payment platforms is a good thing.

Time will tell if poaching will have long term impacts on the DNA composition of elephants - Is Poaching Causing Elephants to Evolve Without Tusks?.

Home again, home again, jiggety-jog. Markets have started better here at the get-go. Markets across to the East are better, on balance. US futures are lower there too, perhaps a little period of excitement around the Donald has subsided a little, we shall see when the man actually gets to sit in power. Trump has had 34 thousand tweets since March 2009. There have been approximately 2800 days in-between the end of March 2009 and present day. Roughly 12 tweets a day. Interesting. Or one every two hours.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment