"I think all you need to know is that the company has managed to attract new investors (they say so), across all territories. Most of the debt is in Euro's, some in Rand and some in Aussie."

To market to market to buy a fat pig Dow 18 thousand. Again. The first time that the Dow Jones Industrial Average closed through that mark was December 23 in 2014. You don't need to be a genius to figure out that we have pretty much trended sideways since then. The all time high was reached intraday 19 May 2015, at 18351.36 points we are still around two percent adrift from that mark. Close, a year and a few weeks on. At the closing level of 18005 last evening (and some change), it is easy enough to say that we have been in a market flux for some time.

That said, it doesn't mean that there weren't opportunities along the way, the rolling 52 week low is 15370.33 points. If you were suckered into selling either late last August, or in the first half of February, you have done yourself NO favours. Part of our job will always be acting like shock absorbers when the train is tricky. The number of times I have said "don't sell" outnumbers the number of times I have said "sell" by a very wide margin.

As a result of this both nowhere and everywhere move, I was reflecting on the stocks that we used to own, either that we sold late, or that did well after we had sold them. We used to own SABMiller over ten years ago, we also held Anglo, GoldFields and Harmony at some point too, mostly all the commodity exposure was through BHP Billiton. Netcare, PPC, AVI and even Edgars at various stages. Standard Bank and African Bank (that went to the wall), we also owned Impala (emissions controls were going to clean the world), Sasol and of course MTN has been one we have owned since the beginning.

We also owned Massmart widely. As well as Liberty International, that no longer exists in the current format. Selling and buying these stocks at different times in their respective cycles have meant that we have missed out on some upside and equally avoided steep losses by having sold timeously, seemingly late at the time. Timing is very tough in equity markets, hindsight is an exact science. How many times have you heard, I should have, and I knew I should have. We all fall for that rookie investor mistake.

Most of the stocks that we have owned for the last half a decade have been the regulars that appear in client portfolios, Aspen, Naspers, Richemont, Discovery, Steinhoff and Woolies, as well as several others. You can check them out on the website. The reflection was nothing more than whilst "things" change, often they stay the same. I have seen countless times that often the only stock that people want to speak about is the one that shows up negative in the profit and loss column. And human behaviour conditions us to believe that perhaps this is a bad company somehow, whereas a stock that soars and immediately we are led to believe that the company is excellent, well run, consumers are receptive to their products, it is seemingly just "a good one". Again, a rookie mistake that all investors make at some time.

The irony, and it is very difficult to process this common sense approach, is that the lower the stock price, the happier an investor should feel. Provided that the thesis remains intact and that the company is set to meet your expectations. Often a company may feel priced at a level that seems perpetually expensive, you make the mistake of waiting for that stock price to come lower, as it does not check all of your boxes at that point in time. And many times you may simply have to pay up for quality.

I was looking across the depth and breadth of our US stocks and checking the current PEG ratios. A PEG ratio is simply the Price to Earnings (per share) divided by the expected growth. You can draw it out a little more by testing longer dated back earnings and growth rates, relative to the expected growth rates. Most measures I see take expected price to earnings ratio and divided by expected growth. What this measure does is quite simply determine at this moment in time if one stock is "priced right" versus their growth prospects. The most expensive of the stocks that we follow is Facebook, yet it has the lowest PEG ratio, very close to 1 in fact.

In a relatively new company, like Facebook, perhaps the PEG is not the best ratio to use. Equally, different industries use different metrics to value them, cash flows and return of equity are traditional, well tried and tested metrics that apply across all industries. Every now and again you come across companies like Apple that hoards large sums of cash and is seemingly "lazy" at deploying it, and then you come across companies like Amazon that invests in their business like crazy and must be an accountants nightmare. There can be no perfect metric for determining what price you should or must pay for all companies at any given point in time, which is why we don't like generalising, i.e. How is Mr. Market today, or next week, or for the year. Rather, each company should be investigated on their own merits at the price today. And apply all metrics and ratios you may think are applicable. After all, we are all really taking and making calculated assumptions about the future.

You know where the Dow Jones ended last evening, the broader market S&P 500 is closer to the all time high, up one-third of a percent to end 2119 by the close. 13 odd points away from the all time high. And only up 3.7 percent year to date. Did you know that the Dow Jones Industrial Average took 20 years to get from 9 to 18 thousand points. It hardly sounds like plain sailing to me now, does it? In that time there were two huge noticeable drawdowns, I understand where the caution comes from. We also did a 50 year check back, there was a period in the late 60's, through to the early 1980's (January 1966 to July 1982 to be exact) where the Dow Jones went from 7333 points to 1966 points. Jeepers, that sounds ugly! From there, below 2000 points, all the way through to 16 thousand points and December 1999, it was pretty much plain sailing (the big blip of 1987 aside).

The nerds of NASDAQ closed up one-quarter of a percent to nearly squeak into the green for the year. That is right, notwithstanding the recent rally from the February lows, tech stocks are not in the green for the year. Google is down four and a half percent year to date. Facebook is up 13 percent. Apple is down 6 percent year to date. Microsoft is down by a little more than Apple, jeepers, why don't we see the anxiety about plateauing growth there? Even as Microsoft is much more expensive than Apple.

Quickly, on the local front here, stocks fell away in the afternoon. Fitch kept our rating effectively the same. The Rand strengthened. And this was strange, as the shock and horror of first quarter South African GDP was released. I thought to myself, we are in June this year. We are nearly half-way through the year people. So the market has basically baked this into the cake. So whilst there was a little surprise and a sell down of financials and ZA inc. stocks, most of it is there and known. We have seen company numbers, from the likes of Omnia yesterday, to know that mining and agriculture are struggling. We know that, tell us something new. I think that a bigger and longer take of the South African economy of ten years is probably worth looking at, to see how we have morphed away from the traditionally associated South African economy to something newer. Perhaps we will look at it in the coming days, readers of the daily newsletter will know that we are company interested.

Company Corner

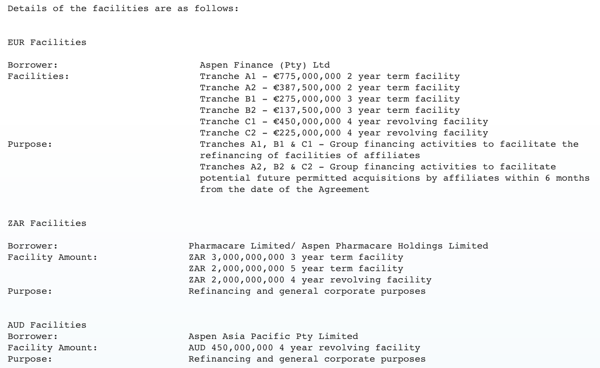

Two sets of news from Aspen yesterday and then this morning. First, the news came yesterday afternoon that the company had obtained funding facilities of 3 billion Euros. I will do a copy and paste of the announcement:

"The Facilities were structured across EUR, ZAR and AUD term and revolving credit facilities with tenors of 2 to 5 years. All facilities were consolidated into a single facility agreement ("the Agreement") with all creditors ranking pari-passu.

The initial launch size of EUR1.5bn for the EUR facilities was significantly oversubscribed (over 2x); allowing Aspen to upsize the EUR facilities to EUR2.25bn and still offer the EUR banks considerable scale-back."

Got it? I think all you need to know is that the company has managed to attract new investors (they say so), across all territories. Most of the debt is in Euro's, some in Rand and some in Aussie. They do lay it out in the SENS (image below), that this of for refinancing, raising money for future acquisitions and general corporate purposes.

And funny that the company points out: "Tranches A2, B2 & C2 - Group financing activities to facilitate potential future permitted acquisitions by affiliates within 6 months from the date of the Agreement" Why? A deal announced this morning. More like 6 minutes or 6 hours we said in the office.

Announcement this morning: "Aspen Holdings is pleased to announce that its wholly owned subsidiary, Aspen Global Incorporated ("AGI"), has signed an agreement with AstraZeneca AB and AstraZeneca UK ("AstraZeneca") whereby AGI will acquire the exclusive rights to commercialise AstraZeneca's global (excluding the USA) anaesthetics portfolio ("the Transaction")."

Price? 520 million Dollars for now and then double-digit percentage royalties on sales of the portfolio. As well as sales related payments of up to US$250 million based on sales in the 24 months following completion. I am copying and pasting a bit here, forgive me for that. The supply agreement lasts initially for ten years.

What are these anaesthetics? Copy and paste time again: "seven established medicines, namely Diprivan (general anaesthesia), EMLA (topical anaesthetic) and five local anaesthetics (Xylocaine/Xylocard/Xyloproct, Marcaine, Naropin, Carbocaine and Citanest) ("the Portfolio"). The products in the Portfolio are sold in more than one hundred countries worldwide including China, Japan, Australia and Brazil. These products generated revenue of US$ 592 million in the year ended 31 December 2015."

The market clearly likes this. Why? As Aspen points out: "Based on the terms of the agreements and Aspen's current cost of funding, Aspen's interest in the Portfolio would have generated a contribution to profit before tax of approximately US$100 million in the year ended 31 December 2015."

The stock is up 8 to 9 percent to begin with today. That is what Mr. Market thinks. We continue to accumulate the stock, this is clearly good news for shareholders.

Linkfest, lap it up

Opportunities are sometimes stumbled upon, driving an Uber means that you reach and talk to a diverse group of people who you would not ordinarily have done - He Sold His Business for $2 Billion. Now He's an Uber Driver. Huh?

There is no doubt that WhatsApp is huge, the question is where will they make money - WhatsApp Revenue Model And The Reasons Behind Facebook's 19 Billion Dollar Acquisition !. Having 1 billion people spend large amounts of time on the app means that there are many opportunities, the trick is to not drive people to other apps as revenue streams are introduced.

This graph shows why Apple makes the bulk of the profits in the smart phone industry. The price gap also highlights that the iPhone can be considered to be in a different league to other phones - The Smartphone Price Gap

You will find more statistics at Statista

I think this patent law is taken too far but it is the case nonetheless - Sweden Bans M&Ms in Chocolate Trademark Dispute

This is one of our favourite new websites, pictures are great for all ages - The World's Largest Factories. What we would give for a factory visit.

Home again, home again, jiggety-jog. Stocks are mixed at the start here, some up, some down. Asian markets all closed lower. The main news for the networks is that Mario Draghi is talking about buying European corporate debt. Stocks across Europe are lower on balance.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment