"The reason why there is this fixation with the Fed is that everyone wants to know if someone can point the way. This is not a new phenomenon. The Fed in the modern era has been very influential in the stock market. Sayings on Wall Street like "don't fight the Fed", made famous in part by Martin Zweig, could apply today as they did back then. Whether or not the Fed should be the be-all and end-all, of your market analysis that is another question entirely."

To market to market to buy a fat pig Janet Yellen this and that. I get it that the last one was a prepared Fed speech, the one from two nights back titled: Current Conditions and the Outlook for the U.S. Economy. What I do not get is how that many people, who are compensated for their performance, hang on every word that the Fed says. Clients pay you to make up your own mind, to watch the incoming data. Again, I get it, we are equity people, the debt markets are far more sizeable than equities by quite some margin. The fact that the Federal Reserve (and all central banks for that matter) have embarked on unusual programs and never before seen methodologies, with consequences only being speculated on.

And that I think is part of the reason why this equities market rally, back from the dead at the end of 2008 and back from the market bottom in March 2009 has been questioned. Time and time again. As a result of central bank intervention, terms like free money, helicopter money, loose fiscal policy and the list goes on were thrown around on a daily basis for years and years. I for one did not experience easier conditions as a consumer, and I am pretty sure that globally credit scoring became harder, more difficult for consumers to get the easy credit that they got before.

And for banks, even though conditions were favourable at first, all sorts of added attachments after the binge years weighed down (and continue to do so) profitability and risk taking. Many people who are market commentators and watchers, and strategists and traders and, and, and, would have seen these added regulations add non-revenue generating people and trim risk taking jobs. I know I used too many ands there, my English teacher would have thrown the Concise Oxford Dictionary at me. No, only kidding, my English department at school were borderline lefty hippies, that carried an enormous amount of passion for their subject. They all had beards (the men), the ladies wore strange outdated hippie type clothes. Yes, they were different and influential, they were passionate and exuberant.

The reason why there is this fixation with the Fed is that everyone wants to know if someone can point the way. This is not a new phenomenon. The Fed in the modern era has been very influential in the stock market. Sayings on Wall Street like "don't fight the Fed", made famous in part by Martin Zweig, could apply today as they did back then. Whether or not the Fed should be the be-all and end-all, of your market analysis that is another question entirely. We don't buy Nike, or Starbucks, or Woolworths or Bidcorp for that matter based on a speech by Janet Yellen, and neither should you. We hope to own these same stocks through interest rate cycles and through business cycles. In fact, if the environment gets harder in which to operate in, it is the higher quality business that will ultimately gain market share from their less able market competitors. Don't own the Fed, own companies.

That said, we have to accept the fact that when a Fed official of importance says one thing or another, the market is going to act accordingly. Whether I think it is sensible or not. The debate still rages on the unusual measures taken by central banks, and history will judge whether or not it was the right thing to have done, to intervene in the same way. All I can say is that in this day and age it is far more sensible than the alternative, see this set of images to try and explain the Great Depression - Life and Times During the Great Depression.

Did the "purists" really want to see long queues at soup kitchens and 25 percent unemployment? Would failing financial institutions help humanity? Would crashing asset prices help stabilise matters and encourage a recovery? Would falling revenue collections help the social programs intended to help the most vulnerable in society? Would the era of the falling prices (see related infographics - The World's Most Famous Case of Deflation) encourage greater production? Was the Fed too easy leading up to the Great Depression? Perhaps as a great student of the Great Depression, Fed governor Ben Bernanke was the right person at the right time.

Whilst Central Banks and their policies may be unwelcome for some segments of society (who ironically would be "OK" in a meltdown), I for one was grateful for the intervention. The patching up of the ship to stick it back on an uneven keel meant that we had learnt from our mistakes, and excuse me for saying this, sounds like evolution to me. We live and learn.

Scoreboard check: In Jozi stocks closed higher, off their mid afternoon swoon, we ended 0.58 percent better at the bell. Perhaps it was a baby boks better second half performance. An improving Rand lent itself "nicely" to some local insurers and ZA inc companies. The opposite of course for the dual listed stocks, in particular those with a UK flavour. We have seen Discovery suffer from that. Across the oceans and far away, in New York, New York, stocks as a collective were mixed. Sagging at the end of the session, the Dow Jones ended up one-tenth of a percent, whilst the broader market S&P 500 added a fraction more than that.

The nerds of NASDAQ fell around one-eighth of a percent, there was some particularly heavy selling in some specific pharma stocks, both Biogen (down over 12 percent) and Valeant (down 14 and a half percent) fell for different reasons. Biogen as a result of a specific therapy, opicinumab, failed to clear the phase 2 clinical trials. It was expected that the Multiple Sclerosis drug was going to be a big pipeline drug for the company, back to the drawing board!

Valeant cut guidance sharply, even on that basis the stock still looks dirt cheap, Mr. Market may be very scared of all the skeletons in that closet however. It didn't look like it warranted that much of a sell off, what do I know! And with Ms. Rodham making history, securing the nomination of the Democratic Party (throw in the towel Bernie!), she would as president take aim at the "price gougers". In my heart I believe that scientists who go into research and development, and who get nearly blank checks to develop therapies that advance humanity, are the pieces that drive the industry. Not the likes of Martin Shkreli, the man who represents everything wrong about the industry.

Linkfest, lap it up

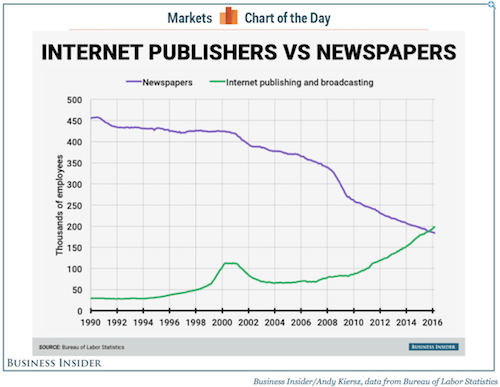

The jobs market now reflects the reality that people are moving online and away from print - This chart shows the generational shift that's taking place in media

A sharing economy results in a more efficient use of resources which on a macro level creates value for people in the economy - EU throws support behind 'sharing economy' firms like Uber, Airbnb. Change always has winners and losers but the sharing economy will arrive globally at some point.

I don't agree with medling too much with pricing because there are always unintended consequences. Increasing prices generally leads to unregulated black markets springing up - Alcohol lobby fights minimum pricing Scottish legal precedent. Setting a minimum price for alcohol shows the negative light that governments view alcohol in, this is what the potential impact could be "a floor of 40p a unit could mean 50,000 fewer crimes a year and 900 fewer alcohol-related deaths a year by the end of the decade."

This is news from last week but is worth noting due to many countries drinking more tea than coffee (South Africa being one of them) - AB InBev, Starbucks Join Forces on Tea Distribution.

Home again, home again, jiggety-jog. The Proteas made good on a very hard pitch. I like the look of that Shamsi fellow, I have been following his career for a while now. None of that, stocks only here chaps and chapettes. Across Asia, it is mixed, Shanghai a smidgen higher, Japan a whole lot higher and Hong Kong just a little up. US futures are up just a little, whilst over in Europe they have separate problems, German Bunds are trading at an all time low yield. And the ECB balance sheet is likely to hit a record. If that is your thing, to worry about central banks and their participation in the fixed income market, then there you go.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment