"Given how integral battery packs are to solar power and vice versa, the merger makes sense on that level. You would be able to get energy from the sun, store it on your Tesla power wall and then charge your car when you get home, none of this using electricity generated from coal fired power stations to run your 'clean' electric vehicle."

To market to market to buy a fat pig Taking the focus off of Brexit/ Bremain was Janet Yellen speaking on Capital Hill to congress, no major market moving statements though. So the current roadmap still reads one, maybe none, rate hikes this year. Going back to the end of 2008 when interest rates were dramatically slashed, no one would have forecast that between then and now there would only be one 25 basis point hike in rates. Before now it was unthinkable that interest rates would be so low for so long and that some bonds now have negative yields. Trying to forecast the future is nigh on impossible. The US markets were marginally green yesterday, the DOW up 0.1% and the S&P 500 up 0.3%.

The JSE All Share closed down 0.15% yesterday, pulled down by resource stocks, Harmony and Amplats both down around 7%. The oil price is back above $50 a barrel after US data showed that reserves are decreasing instead of increasing, which indicates the supply glut is coming to an end. Also on the oil front BHP Billiton Takes Steps to Boost Oil Output, where they are now tapping wells that were previously drilled but unprofitable at the depths of $30 a barrel of oil. If oil stays above $50 a barrel new wells will be drilled, highlighting why oil is going to struggle to get much higher than $50 a barrel for the foreseeable future. The introduction of shale oil allows companies to drill and start operating a new well in weeks, compared to older technology where it took months to get a new well off the ground. Conclusion, supply can keep pace with demand.

Company corner

There will be big movements on the 'renewable energy' stock front today, thanks to Elon Musk. Waking up this morning we were greeted with the news that Tesla Makes Offer to Acquire SolarCity Given the huge cash burn rate of both companies, this will be a pure script deal. The current proposal is:

"Subject to completing due diligence, we propose an exchange ratio of 0.122x to 0.131x shares of Tesla common stock for each share of SolarCity common stock. This proposal represents a value of $26.50 to $28.50 per share, or a premium of approximately 21% to 30% over the closing price of SolarCity shares, based on today's closing price of SolarCity shares and the 5-day volume weighted average price of Tesla shares."

Given how integral battery packs are to solar power and vice versa, the merger makes sense on that level. You would be able to get energy from the sun, store it on your Tesla power wall and then charge your car when you get home, none of this using electricity generated from coal fired power stations to run your 'clean' electric vehicle. The other advantage is that it makes it easier for Musk to keep an eye on both companies with the creation of what Seeking Alpha called the "ultimate alternative energy conglomeration".

Why has the Tesla share price dropped 12% on the news?. Solar City does not make money selling solar panels, they make money off the financing of the solar panels, which is risky due to most of the loans having 20 year pay back periods. Also Solar City like Tesla, is currently loss making so the need to raise cash going forward will need to be stepped up. All in all Tesla buying Solar City increases the risk factor of the company but also increases the potential for up side.

The big news out yesterday on a tech front was from Facebook. Their Instagram app reached the mile stone of 500 million monthly active users (MAU), the more impressive number is that they now have 300 million people using the app daily. The user growth has been amazing since Facebook bought the app for $1 billion back in 2012, the app only had around 30 million MAU back then. Mark Zuckerberg's vision for the potential of the app was amazing, people back then could not understand how an app could be worth that much. The great thing about the app is that it is easy to use and people seem to connect better with images. For Facebook having such a 'sticky base' that is growing quickly means strong revenue streams from the app. In the last set of results, Instagram had over 200 000 businesses advertising on the platform and the estimation from analysts is that revenues will be around $1.2 billion this year.

Staying on the tech front, Tencent to Acquire Majority Stake in Supercell from SoftBank for U$D 8.6 billion. In total Tencent will own 84% of the company, valuing it at $10.2 billion. Pre-tax profits last year for Supercell were $960 million meaning Tencent paid a low double digit multiple for the company, time will tell if this was a good purchase. The huge risk here is that their current stable of games become old and they don't come up with new games to keep the user numbers and revenues up, currently there are over 100 million people a day who play supercell games.

I don't fully understand the gaming culture and the numbers of people who watch gamers game. If I consider how many people think I am mad watching a full day or two of test cricket I can understand how one persons entertainment is not the same as another. Here is a video watched 3.6 million times of clans playing on iPads battling each other, Clan War Finals: Sweden 1 Star vs. Glory China I, the game has a strong following.

The line in the announcement that stood out to me was:

"In parallel to the transaction, Tencent and Supercell have entered into marketing and publishing arrangements regarding the distribution of games developed by Supercell in China."

This allows Supercell to have access to Tencents distribution network and access to their huge user base. Tencent will get new content to push to their users and increase revenues. Win-win for both companies (and Naspers).

Linkfest, lap it up

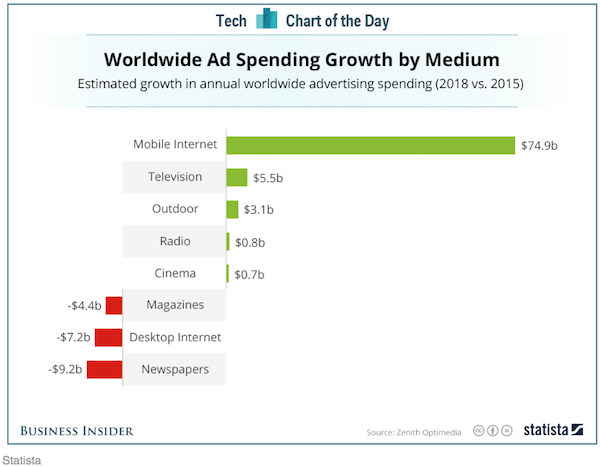

Why are Facebook and Alphabet worth so much? - The next gold rush: mobile advertising. It is because they are dominant players in the advertising space on mobile devices.

There are always many moving parts when it comes to markets and demand & supply. On the supply side of oil there have been a number of disruptions which when resolved could add a further cap on oil prices - This chart breaks down the crazy amount of oil production disruptions in 2016

This seems like a novel idea with some good intentions, where the idea is to create incentives that make management more long term in thinking and so too investors. Increased regulation will ultimately mean that trading costs increase though - A group from Silicon Valley has a serious plan for creating a totally new US stock exchange.

Home again, home again, jiggety-jog. Our market is well in the green this morning, with retail doing even better with a lower than expected CPI figure out. Our yoy CPI came in at 6.1% compared to the expectation of 6.4%, still out of the SARB required band but heading in the right direction. Hopefully this means no interest rate hike at the next meeting.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment