"To add to her pot are the small matters of the Job Market Is Getting Stronger, Not Weaker and Janet Yellen's Inflation Problem. In the bigger picture this is immaterial to the continued holding and ownership of the businesses that we hold for clients. Sure, it is disruptive for equity markets, it comes with the territory!"

To market to market to buy a fat pig Another day, another set of fears around the looming Brexit vote. A week and a day away now, that 23rd of June, it really cannot come fast enough now. That doesn't mean that there wasn't action in other places, there certainly was. However with increasingly hazy looking polls and too many I don't knows, the usual is happening. Sell and then ask questions later. German ten year government bond yields went negative. So that means that for the pleasure of owning sovereign bonds in Germany, the continents biggest economy, you get to pay them interest too. Wow, that sounds incredibly dumb, what do I know though, right? Twitter had their own fun with "make it do" xyz again, and came up with this gem.

Read the Bloomberg coverage to understand why this is happening - German Bunds Reach New Milestone as Yield Declines Below Zero.

Locally in the trenches it was a market that sold off by over two percent, all across the board, financials, industrials and resources, there was no place to hide. It seems that, to paraphrase many a trader type, we are at a stage where the foxhole may be the best place to hide for a while. Amongst the majors, inside of the ALSI 40 there wasn't a single spot of green on the screen, it was a complete red-spread. After an astonishing run, MTN gave back some ground, there was a presentation of their Nigerian business that I was trying to make sense of.

More importantly for them, the central bank of that country is set to announce easing rules for the whole lock stock and barrel - CBN to release flexible exchange rate policy today. Obviously the short term implications are not that desirable, it is the right thing to do in the long run though. A free floated exchange rate is the way forward, even if it hurts, ask the Argentinians, who now have a free floating currency. It certainly hurts, it all equalises in the long run. Tell that to the Chinese central bank and their authorities! Not me, thanks.

There was other significant news in the city founded on gold, at least from a stock exchange release, the company in question resides in Cape Town. Pick n Pay stores and Pick n Pay Holdings, the holding company controlled by the founder, the Ackerman family, is set to unwind the structure that has existed for quite some time now. Pick n Pay Holdings, or Pikwik as the market calls is, will unbundle all of the Pick n Pay stores shares, of which it owns 52.8 percent.

The Ackerman family own through their vehicle, the Ackerman Investment Holdings company, nearly 50 percent of Pikwik, giving them effective control of the stores business. Fear not for the family and their control, after the Pick n Pay stores shares are unbundled to shareholders and the shell will delist, it doesn't mean the family are ready to give up that control. No. A new class of B shares, unlisted, will be created by the company in order to give the controlling family the same control, through a different structure.

Simplification, one vehicle, one set of costs and the family will still maintain the control, I am not too sure that the last part is the most important in the modern age. Mind you, we have seen the various structures put together recently, Google and Facebook with their founding shareholders spring to mind, those businesses, with all due respect to one of Mzansi's finest, are a little more tech intensive, and perhaps require a different kind of vision. I do hear that the founder and need we say again, one of our finest, still goes into work every single day, perhaps I am wrong now. The circular goes out next week, it is expected to take a couple of months to completion. Pikwik, which was the cheaper entry to stores, shot up over 13 percent, whilst stores sank a little, down 2 percent on the day. Our only food retailer, which is also a clothing retailer, is Woolworths, we prefer that business.

The other significant news on the day was PPC's results. The stock was hit hard. They will have to raise significant pots of money, between 3-4 billion Rand. Bearing in mind that the market capitalisation of the business by close of business was 5.46 billion Rand. Down at 9 Rand a share (off 7 percent and some more on the day), the discount is possibly going to be pretty deep, it may well be a case of 1 to 1. And if someone is going to take the view that with plants in two of the most populous countries on the continent, the DRC and Ethiopia, as well as businesses in Tanzania, Zimbabwe and locally, a very long dated approach may well yield positive results. It is difficult to say when and how long, it may take half a decade before the results filter through.

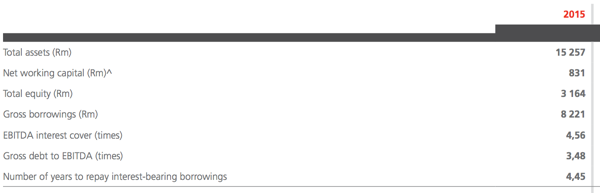

I was checking the annual report of PPC yesterday, the company lists total assets and gross borrowings, see the image below. Total assets far exceed a mountain of debt, the duration of the debt is not that favourable -

A company that has had a proud history of paying dividends is passing here, and perhaps likely to do so for the next 18 months or so. It is another reminder of the cyclicality of it all, a company with significant assets, and post such a recapitalisation of this nature it may well look "good" again. The cycles are long and deep, weaker commodity prices mean that many of the continents countries reliant on higher prices are facing budgetary pressures. Which leaves little wriggle room for infrastructure development. I think that if the PIC wanted to stand up and recapitalise the business in a big way, they have the time frames and the deepest pockets in order to be counted. We will wait and see what transpires here. It is not a stock we own, we have not for a long time now.

Over the seas and far away, across the oceans and into the Northern Hemisphere summer, stocks in New York, New York closed lower, significantly off the lows though. If that is any consolation to the bulls. The nerds of NASDAQ were the best performers of the majors, down 0.1 percent, whilst the blue chip index, the Dow Industrial Average closed off one-third of a percent. The broader market S&P 500 was somewhere in-between those two. Today of course the focus will be on the Fed, the most important woman in the world (hopefully not for long, if you know what I mean) delivers her state of the economy along with the outlook for rates, more importantly. That is right, we are on Fed-watch again, and it ain't Roger!

To add to her pot are the small matters of the Job Market Is Getting Stronger, Not Weaker and Janet Yellen's Inflation Problem. In the bigger picture this is immaterial to the continued holding and ownership of the businesses that we hold for clients. Sure, it is disruptive for equity markets, it comes with the territory! And if that wasn't enough for the Fed smorgasbord, then the small matter of US Retail Sales Up A Solid 0.5% In May all point to a continued recovery.

Linkfest, lap it up

This headline from the BusinessInsider is self explanatory and feeds into the health and wellness investment theme that we like so much - The fitness world is experiencing a seismic shift that should terrify retailers. Big winners, Nike and their peers, Under Armour, Lululemon and the like. Big losers, old casual attire folks.

A few more useful snippets about Apple from their WWDC Monday evening, a good summary for those who didn't get a chance already - Apple's 7 Most Immediately Useful New OS Features. Photos, the size of those get in the way!!!

The reason to buy Nike is due to the growth coming out of China. (Yes, growth and China were used in the same sentence) - Nike's Success Will Continue In China

Human innovation is the reason why we don't still live in caves. It is great to see the solutions that people come up with, in this case communities built their own glaciers during winter so that they would have water for their crops when things warmed up - India's Desert Farmers Are Saving Themselves With Artificial Glaciers.

Home again, home again, jiggety-jog. Looking at the markets already open in the East, most have bucked the red trend that we have seen over the last few days. It is not often that you see the market as a collective down over 2%, so lets hope that we have some green on the screen today. On the news front we have local retail sales out at 14:30. Then the big news for the current 45 day cycle, the FED have their interest rate decision out at 20:00 our time. The markets are currently pricing a close to 0% chance of a rate increase tonight. Expect some currency volatility on the decision and then some more based on the tone used in her speech. As a long term investor though just sit back, relax and watch all the reactions and emotions playing out in the trading arena.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment