"Combining comfortable clothes with an athletic element allow you to work out and then walk around afterwards without feeling exposed. Or just hanging around in athletic gear, even if you are doing nothing athletic during the day. All the big manufacturers of athletic apparel and footwear have as much of a bias towards fashion as they do to functionality."

To market to market to buy a fat pig Huh? I kept asking the fellows in the office whether or not there was a concrete reason why stocks globally were moving so much higher. The reasons given were relief rally, oversold and bargain hunters, and then some of the usual trader talk along the lines of short squeeze this and dead cat bounce that. The origin of the term, dead cat bounce apparently traces its roots to the Far East, two FT journalists quoted a broker who used the analogy. And then it stuck. Now I thought cats were supposed to land on their feet, for starters and secondly, being very good climbers, they wouldn't fall in the first place. What do I know, I am more of a dog person myself. I love the more loyal and slightly dimmer dog, what can I say!

I see in some market reports that a sense of calm has returned. Are you kidding me? British politics looks more polarised and splintered than ever. What matters in those developed economies and societies is that the bureaucratic functions still seem to work well. As many often point out, until recently Italy had more governments than fans had time for managers, yet society still worked. The first Prime Minister of Italy post the second world war held the post no less than 7 times in a 7 year period. For Berlusconi it was four times! Since 2000 it has been relatively stable, with "only" six prime ministers, including Berlusconi twice.

Another major event capturing the news reels this morning, Twitter and all the associated communication platforms is the horrible events at the airport in Turkey. It is just a matter of time before all airports start screening people differently before they arrive any where near the airport terminal. Or, perhaps there can be stronger security outside. I get the sense that sadly we have become desensitised to these very important events, the lives of over 100 people impacted immediately and thousands others indirectly. Perhaps all of us. We live in a world where people will end their own lives and take others with them to strike fear into the hearts of others. I for one can't understand extremists.

Stocks are all up again across the globe. Part of the reason is the fragmented political environment in the UK and that the EU has not received anything formal yet. i.e. Whilst the people had voted to exit, it is actually the politicians who have to formally approach the European Parliament and European Union and start the process. And seeing as the leadership of Labour, old Jeremy Corbyn basically is persona non grata in his own political movement (and the leadership of the ruling party is currently vacant), who exactly is going to negotiate this exit? For now, nobody. There may well be an election in the UK as early as October, that could in essence be another referendum. In the meantime, there are around 6 million people with Irish heritage (including England football captain Wayne Rooney) and many of them are scrambling to become Irish citizens. To stay European, you know!

So what should you continue to do? Nothing. Still nothing. When the dust settles we will have a clearer idea of what to do. Selling in panic is never a good idea. In fact, history will show you that it is a VERY BAD idea. SMH, now I am reading headlines that all asset classes are benefiting from the uncertainty, the fact that there is this political void and seemingly inaction from all corners. Pfff .... the longer I do this, the more I realise that many quarters of the market is like the proverbial Jack Russell chasing their tail. That segment of the market provides us with the necessary liquidity that we so crave however.

Company corner

Nike. This is a company that has just been doing it for a while now, both revenues and profits have been growing sharply, leading to a big earnings multiple expansion and with that a rapidly appreciating share price. Share holders have become used to the idea that the stock has just grown as global and in particular, North American sales have consistently been above expectations. In fact, if you visit the Investor Relations landing page of their website, there is Cristiano Ronaldo running away from the crumbling defence, some figurines exploding. And in bold letters there, it states that Nike is a growth company.

We all know that Athleisure is a "thing". Combining comfortable clothes with an athletic element allow you to work out and then walk around afterwards without feeling exposed. Or just hanging around in athletic gear, even if you are doing nothing athletic during the day. All the big manufacturers of athletic apparel and footwear have as much of a bias towards fashion as they do to functionality. I simply have to recall the old poly shorts and your beat up running shirt to know that fast forward a couple of decades and even the socks are seen as highly important fashion items, as well as being darn comfortable and of course most important, functional. Whether or not, as a casual runner, my times have improved much with all the gear is another matter entirely.

Research from Morgan Stanley (via this - The Rise of Athleisure suggests that as a category (athleisure), the market is now 270 billion Dollars per annum globally and is set to grow around 30 percent before the decade is out. There is still plenty of wriggle room for all providers, inside of the majors competition to Nike have emerged, most especially with Under Armour. Strong personalities such as Steph Curry and Andy Murray, as well as Jordan Spieth, and some other well known US athletes, like Tom Brady. Highlighting the move to all sports and casual wear is that both Misty Copeland (an extremely talented ballerina) and Giselle Bundchen are featured as Under Armour sponsored athletes. Bundchen's husband, Gridiron legend Tom Brady is also sponsored by Under Armour. First husband and wife team? In terms of teams, only Spurs (Harry Kane's team) are one of the big sponsorships.

This is a piece about Nike, not about Under Armour. In order to show how competitive it has been, that is why we spent a little time discussing a competitor. Herewith the fourth quarter and full years results 2016 released last evening. At face value the metrics all look pretty decent. I suspect there were two things that everyone focused on, one was that whilst quarterly earnings were a slim beat, the sinking in that earnings were actually flat on the comparative quarter meant that the recent share price weakness was probably justified. In other words, if you are going to own a growth company, be sure that it is a growth company.

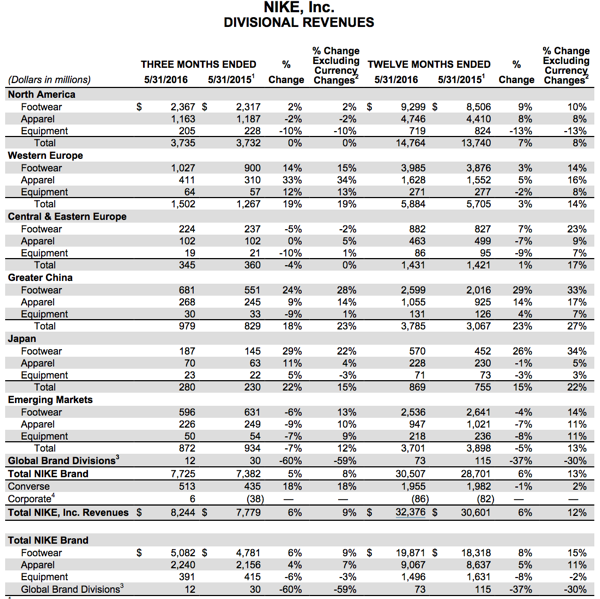

As the company pointed out (see the table below), North American apparel sales were 2 percent lower when measured against the corresponding quarter, 8 percent higher over the year. Total sales (see at the bottom of the table) in North America make up 45.6 percent of group sales. And if those are "sluggish" as the WSJ points out (Nike Reports Sluggish North American Sales), then does the growth tag still hold true? First, here is the long and detailed table of Nike sales across all regions of the world -

I suspect that one can answer the question about growth by pointing to the Chinese region, sales are only 11.7 percent of total sales. In order to determine whether or not the company is a "growth" business, let us throw back to the 2010 annual report. Total sales were 19 billion Dollars, they are now over 32 billion. Greater China sales back then were 1.74 billion Dollars, they are more than double now at 3.785 billion Dollars. In some parts of the world, and in particular a huge market shifting one (the next growth engine in China is largely consumer based) like China, the company is still growing like gangbusters.

I know this is pretty long, I want to however highlight why I think that the future is exceptionally bright for the whole industry and this specific company. The chief Mark Parker (not related to Spiderman) spoke about global sport participation, a move to mobile and importantly, the ability to customise your shoes and clothing, personalised "stuff".

"Participation is increasing all over the world ..... people are leading healthier, more active lives. At the same time, the rise in sport culture is bringing fitness and style together, profoundly influencing what we all wear every day. It's clear: our amplify category offense is a model that works. We're growing the business across the entire lifestyle of sports - from performance to sportswear.

And in retail ..... our industry is in the early stages of unprecedented transformation. Mobile innovation and personal services are dominating the landscape. That's why we invest in integrating digital and physical retail seamlessly, giving our consumers better access to the products they want ..... and why we're working even closer with our best wholesale partners who share our vision for the future of retail.

Manufacturing, too, is undergoing its own revolution. We're rethinking the fundamentals across our business - in how we make products ..... how fast we deliver them ..... and what kind of impact they leave behind. With other innovators like FLEX or HP, we're deploying projects across our source base to reduce costs and delivery time, improve quality, explore customization and enhance performance."

In conclusion, the stock has taken a hammering this year, it is down at 51 Dollars pre market, and now trades on a 23.6x historic multiple, which is possibly at this juncture a fair reflection. We do however believe that the growth will return, the thesis is well intact and this may prove to be a wonderful opportunity to acquire the market leader at a much cheaper price. Across all territories, future orders still look strong, nearly 20 percent up in mainland China. We maintain our buy rating on the company.

Linkfest, lap it up

Another company that takes advantage of the sharing economy is now worth not billions but 10s of billions - Airbnb is raising a new round of funding that would value the company at $30 billion.

Here is an idea of how widespread the company is in major US cities.

You will find more statistics at Statista

Sticking with billion dollar tech companies, here is a list of companies that started in garages - These Billion Dollar Companies Were All Started in Garages.

The latest news from the biggest private tech company - You Can Soon Book a Hot Air Balloon Through Uber.

Home again, home again, jiggety-jog. As mentioned earlier in the message, stocks are all higher across the globe. The Pound is bouncing off the worst levels, that snarky remark from Nigel Farage that the Euro was "crashing" or some such other way of putting it riled me a little. He would do worse to go and have a look at the 17 year graph of Sterling, the time that he has been a member of the European Parliament. When Farage arrived, it was around 1.55 to the US Dollar, now it is 1.33. Seeing as the Euro was basically accepted at around the same time (1999), the levels to the Dollar have gone from 1.05 (back then) to around 1.10 now. Nigel, update your reality, OK?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment