"As expected, the JSE has opened down 5%. Stocks with big exposure to the UK are taking big heat. Brait is down 15%, Bidcorp down 10% and Steinhoff is down 10%. I bet you guys like Brian Joffe, John Gnodde and Marcus Jooste are salivating at the opportunities presenting themselves. So you should you, so should we"

To market to market to buy a fat pig Ouch! The Brits let us down. I must say I was shocked when I heard the news this morning. We all were in the office. I think it is a sad day for humanity as one of the former powers of the globe close themselves in. But I guess that is democracy, the people have the vote and every person's vote counts the same. From David Beckham to Jim Brown who lives off the doll and spends 60% of it on Carling beer and Greggs pork pies.

So what now? The scary thing for most is the knock on effects. French Nationalists are already calling for their own referendum. Frexit? The combined GDP of the Euro Zone is bigger than the US so this will impact everyone.

Unfortunately for us as a developing economy, we are considered risky. The Rand went from R14 to R15.17 to the dollar in no time. As I type this the Nikkei is down 8%, the Hang Send is down 4.4% and all futures point towards big pull backs. The market does not like uncertainty and this will create exactly that.

But all is not lost. From what I see on the box most European commentators whether it be French, German or Spanish feel that this will pull them together. You know the old saying, what doesn't kill you makes you stronger. And it is times like these where pulling together is crucial. Another old saying comes to mind, Ironically it came from Winston Churchill. "Never let a good crisis go to waste." There will be plenty of opportunities. Gaps to be taken. People are resilient, look at European history (Roman Empire, Napoleon, Both World Wars) and you will see that this is a mere flesh wound. Actually not even, maybe an infected blackhead on your nose.

People flow like water downstream (full of quotes today). Talented immigrants will go to Amsterdam, Berlin and Milan instead. Business opportunities that the UK miss out on will be filled by other hungry entrepreneurs. There is a huge amount of talent in Europe. Where Britain loses, others will gain.

I hope the UK position themselves as a business friendly financial hub, similar to Hong Kong. There are of course benefits of going it alone. How it will actually all work remains to be seen. But as usual we recommend you stick the course, ride the wave. This is the nature of the beast.

Linkfest, lap it up

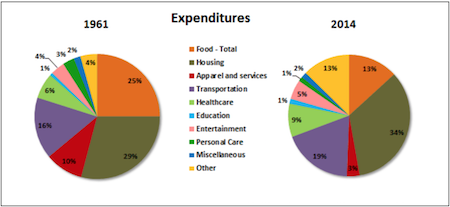

Interesting to see how the spending habits of the consumer has changed over the last 50 years. Thanks to technology advances and mass production, the cost of food has dropped significantly - 49 Years of Income and Home Values

Education is the next industry to have a major shake up. One thing that will push it there is that education will just get too expensive for very little return on the investment - Student Loan Delinquencies are Sky High. Recently I spoke to the head of HR at one of our banks, they were saying that people with degrees still need to go through substantial training, with the trend being; the higher the education achieved the harder they were to train because the candidates felt they "knew everything already".

The AEI blog always explores controversial topics, this one is right up there with sensitive topics - The great CEO-worker 'pay gap' is nothing but a union-built myth. The point made was that if the CEO was paid nothing and that cash was used to supplement rank and file employees, those employees would only receive a very marginal pay increase.

Home again, home again, jiggety-jog. As expected, the JSE has opened down 5%. Stocks with big exposure to the UK are taking big heat. Brait is down 15%, Bidcorp down 10% and Steinhoff is down 10%. I bet you guys like Brian Joffe, John Gnodde and Marcus Jooste are salivating at the opportunities presenting themselves. So you should you, so should we. God save our gracious Rand.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment