"So there you have it. All the anxiety in the world won't change the minds of folks who are there to try and keep you on the fiscal straight and narrow. Call them financial advisors at a national level."

To market to market to buy a fat pig Today is the day that a ratings agency (or two) decide whether or not we are investment grade, or not. Whether or not we maintain the rating that is credit worthy or not is an event that you have no control over whatsoever. Pretty much like the selection of your favourite sporting team or where your favourite program is aired, although the second one becomes less of an issue nowadays with streaming TV.

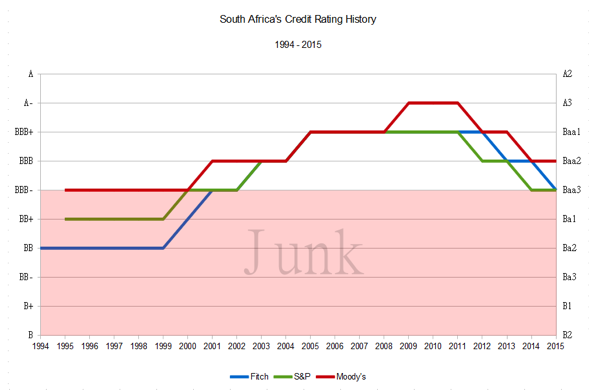

Don't get anxious about it, it won't change anything except the levels of your blood pressure or your irritability clock. I had read in recent days that we were rated junk before, and if we get rated junk again by all the agencies, it will not be the first time. Two images that I found via the inter webs, credit to businesstech and Protea media.

Firstly, our credit rating since democracy, from 1994 to 2015, notice how we emerged from "junk" status in 2002. Remember that? No, I am sure that you may not remember that, perhaps that wasn't the biggest thing in the world back then.

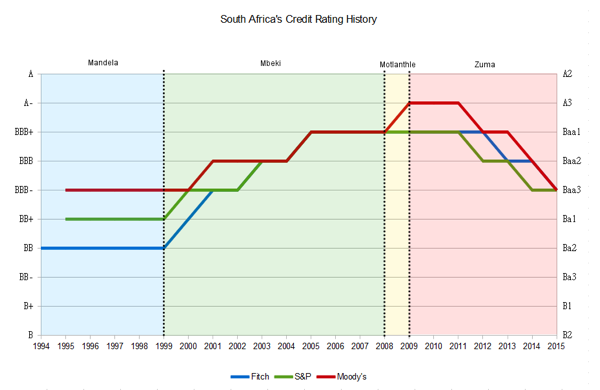

And then the respective presidents, in fairness to both the Mbeki and the Zuma era, they did coincide with global strength (and weakness) and equally excitement (and not) to emerging markets. Brazil possibly follows a similar type of pattern. Here below is ratings per ZA president:

So there you have it. All the anxiety in the world won't change the minds of folks who are there to try and keep you on the fiscal straight and narrow. Call them financial advisors at a national level. The definition of a Credit Ratings Agency is as follows, as per the biggest encyclopaedia in the world, Wikipedia:

"A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers."

A country is not a household. And then importantly, what are/is the role of the ratings agencies? Wiki has an answer for that too:

"By serving as information intermediaries, CRAs theoretically reduce information costs, increase the pool of potential borrowers, and promote liquid markets. These functions may increase the supply of available risk capital in the market and promote economic growth."

The cheaper your debt, the better for all citizens, it means infrastructure programs (roads, dams, basic services) can be rolled out more effectively, more schools and clinics can be built at a cheaper cost, the things that we all need and crave as a society. If your government acts like an irresponsible drunken uncle spending with gay abandon, there are consequences. As a citizen you get to decide whether or not you want that route, and it matters for ordinary citizens. Just know there is everything that you can do about the makeup of your portfolio and in which territory you are invested. So rather than vacillate, be active. The end, OK?

Company Corner

The news came yesterday that Naspers had invested a 60 million Dollar stake in Udemy. Udemy describes themselves on their About Us sections as "We're the world's online learning marketplace, where 10 million+ students are taking courses in everything from programming to yoga to photography-and much, much more. Each of our 40,000+ courses is taught by an expert instructor, and every course is available on-demand, so students can learn at their own pace, on their own time, and on any device."

And then the official press release from the company - Naspers Invests $60 Million in Udemy to Expand Global Reach. As you can see, this follows an announcement from three weeks back - Naspers Announces Investment in Brainly - Its First in Education Technology.

This is something that has been on my mind for a while now, the fact that my growing children will some day need a tertiary education. Or will they in the sense that it has existed for decades? No, for hundreds of years we go to a formal place and sit at a desk and an expert tells us how it is. I get the centre of excellence thing, if you go to one tertiary institute over another, surely that reflects better on your ability to obtain a superior job to another. These online platforms, or Mooc (massive open online course) as they are called, bring together experts from all quarters.

I keep telling a particular mum to not stress about the future and where her kids are likely to go to university, the world will be different in ten years time I tell her. And it seems that this trend is starting to gain momentum. The fact that we do things the same way in the internet era is a little strange to me. It really is. I know that the resources available to university students are more plentiful than at any other time in history, the idea that you HAVE to be in the same place doing it the same old way is a stumbling block, for me at least. The cost would be lowered dramatically and it would free up a lot more time for all concerned, allowing for maximum flexibility.

The only tools you would need would be an internet connection, and a laptop, perhaps a pair of earphones. And voila, you can go to "school". Through these two funding rounds, 15 million Dollars with Brainly and a more sizeable 60 million Dollars with Udemy, Naspers have just "dropped" 75 million Dollars, or in ZA terms, 1.168 billion Rand. For comparisons sakes, Stefanutti Stocks, the construction company, has a market capitalisation of 771 million Rand. Naspers could have bought this construction company with what looks like small change.

I like this, I really do. And whilst I think it is still very early days in terms of the acceptability of multiple courses and online learning platforms. I guess then everyone could do worse than subscribe to the Malcolm Gladwell ten thousand hours rule in the "Outliers" book. To achieve world class skills, in any field, you need ten thousand hours of practicing in the correct manner. Now if you are working an 8 hour day and only work during working days, you get to just short of 2100 hours a year. So just short of five years of practice day in and day out will make you an expert on something. Perhaps not all levels of expertise need 10 thousand hours.

I just think that this new foray represents some long dated thinking, as Naspers often do, they take that view. I like this, and although it represents such a small part of their now 1 trillion Rand market capitalisation, it signals intent to shake things up a little. For the sake of our children and their children, this is really an important moment in the history of how we learn. Time to shake things up a little.

Linkfest, lap it up

If you want to understand the oil market over the last decade here are a number of graphs showing global production, demand and how efficiency in cars has improved - Trends in oil supply and demand.

Low oil prices are not good for the sales of small or hybrid cars, last year SUV's had the largest sales segment in Europe - OPEC's Cheap Oil Strategy Lures Drivers Back Into Gas Guzzlers. As South Africans we are not feeling much of this lower oil prices thanks to a much weaker Rand and due to there being large fuel taxes and levies.

This is a long article but interesting read into the world of oil trading. All I can say is I am glad that I don't operate in an industry where the lines between right and wrong are so blurry - Inside Vitol: How the World's Largest Oil Trader Makes Billions.

The final result of the wave machine looks awesome and I am sure it will prompt more people to get into surfing. No need for a long swim out to the backline to catch waves anymore - Greatest Surfer Of All Time Looks To Transform Surfing With Launch Of Solar Powered Man-Made Wave Machine

Home again, home again, jiggety-jog. Apart from being some sort of huge moment in our history, I see that Bloomberg had a feature on our economy earlier, so it is a biggish deal. In the bigger picture it will be non-farm payrolls today. Tune into your favourite business news channel at 14:30 to see all of the excitement about the most important meeting since the last one.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment